Dividend notes: a B+ for this selection - BME, BOY, BMY

31/05/23: I review the latest results from B&M European Value Retail, Bodycote and Bloomsbury Publishing.

Today I'm looking at results and trading updates from three (very different) companies that all have names beginning with B...

Companies covered:

- B&M European Value Retail (LON:BME) - solid results from this this value retailer, which now claims to have established a new post-pandemic baseline for future growth. I have a positive view on the shares.

- Bodycote (LON:BOY) - 2023 guidance is unchanged, despite a strong start to the year. Management warns of macro uncertainty. Long-serving CEO has decided to retire.

- Bloomsbury Publishing (LON:BMY) - a quick look at a strong set of results from the publisher of Harry Potter (and much else). With the shares down 16% from record highs last year, is there an opportunity here?

This is a review of the latest results from UK dividend shares that are in my investable universe and may appear in my screening results.

B & M European Value Retail (BME)

"We expect to grow sales and profits in FY24, despite economic uncertainty."

A solid set of numbers sent shares in value retailer B&M up by 5% this morning.

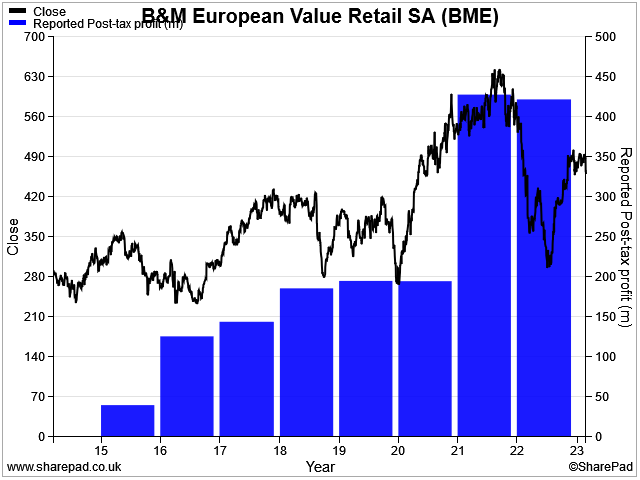

I've admired the progress of this well-run business since its 2014 IPO. B&M is now adjusting to post-pandemic life, having received an exceptional boost to profits during the Covid years, but I think the shares remain worth considering.

Today's results cover the 52 weeks to 25 March 2023. Chief executive Alex Russo believes this period "can be viewed as the Group's new underlying revenue and profit base level from which we grow from".

To put this in context, sales of £4,983m were 31% ahead of pre-pandemic levels, while operating profit of £479m was 44% above the £333m achieved in FY20.

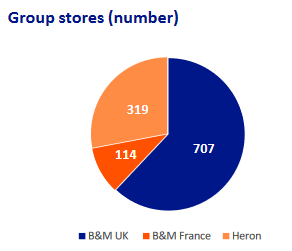

The group now operates 1,140 stores in the UK and France, compared to 1,050 at the end of March 2020.

FY23 results summary: profits and the ordinary dividend fell last year, as cost pressures mounted and sales growth slowed compared to the pandemic years. But cash generation improved as stock levels fell, and the business looks in decent health to me.

- Revenue up 6.6% to £4,983m

- Pre-tax profit down 17% to £436m

- Free cash flow of £430m (FY22: £164m)

- Earnings per share down 17.6% to 34.7p

- Ordinary dividend down 11.5% to 14.6p per share

- Special dividend of 20p per share (FY22: 25p per share)

- Net debt exc. lease liabilities fell to £724m (FY22: £790m)

Against a backdrop of double-digit inflation, sales growth of 6.6% suggests a modest fall in volumes, in my view. Especially as new stores were opened last year.

Management don't comment on volumes and only say that like-for-like growth was positive in all businesses last year, including inflation and mix effects.

However, performance seems to have varied across the group.

B&M UK: the core UK business accounts for 80% of sales, but seems to have seen a modest decline in volumes last year as shopping patterns returned to normal:

- H1 LFL -3.9%

- H1 LFL +5.1%

- Full-year LFL sales +0.7%

Other divisions: Heron Foods (a discount grocer specialising in frozen/chilled/ambient branded goods) and B&M France account for c.11% and c.9% of group sales, respectively.

Both of these smaller businesses reported revenue growth of c.20% last year, including the impact of new store openings which resulted in c.5% increases to average sales area.

These numbers suggest to me that both Heron and France saw modest LFL volume growth, in addition to inflation-linked price increases.

Profitability: cost inflation and slowing sales growth put some presure on profit margins last year. But B&M's business model remained far more profitable than that of UK supermarkets.

My sums suggest the following figures, based on last year's reported profits:

- Operating margin: 10.8% (FY22: 13.1%)

- Return on capital employed: 19.0% (FY22: 21.2%)

- Return on equity: 47.5% (FY22: 57.1%)

Dividend cut: a dividend cut is always disappointing, but B&M makes its dividend policy clear in today's results.

"an ordinary dividend pay-out ratio of between 30 to 40% of net income on a normalised tax basis"

Surplus cash is used in the following order of priority:

- the rollout of new stores with a strong payback profile;

- ordinary dividend to shareholders;

- mergers & acquisition opportunities;

- returns of surplus cash to shareholders.

I prefer this discplined and transparent approach to the opaque fudges sometimes employed by companies when balancing dividends and growth investment.

Strategy: more generally, B&M's clear and disciplined strategy is one of the things I like about this business. The commentary in today's results seems reassuring to me - I've extracted some of the main points:

- Competitive positioning alongside Aldi and Lidl (Limited Assortment Discounters, or LADs) - B&M's branded offer is complementary to their own-lable focus. Where co-located, B&M stores "tend to trade exceptionally well". Said to be true in France and UK.

- In general merchandise, made an effort to improve quality as well as price positioning in recent years. I can agree with this to some extent. I bought some garden furniture during pandemic that's lasting well and was very good value.

- Newer stores tend to be larger and often have a garden centre area. The company's previously stated target of 950 UK stores (FY23: 707) is said to be "conservative", but even so represent a 35% increase on current estate. The implication is that core UK sales could rise by more than 35% over time, due to new openings.

Management: B&M was founded in 1978, but the company's transformation from minor retailer to FTSE 100 company really started when it was acquired by Simon and Bobby Arora in 2004. At that time, B&M had just 21 stores.

I think it's fair to say that much of the success of the business is down to skilled and consistent management.

Simon Arora was chief executive for 19 years, but stood down last year. Should shareholders be worried about a loss of direction?

My impression from today's results is that current CEO Alex Russo seems a fairly safe pair of hands. He's an experienced retail executive and worked with Simon Arora for two years as CFO, prior to taking charge.

In some ways, I'm more concerned about the prospect of Bobby Arora stepping down. He's not a board member, but is the group's trading director. In other words, he's ultimately responsible for all purchasing and supply chain management.

B&M's stock is a clever mix of everyday groceries and household products, mixed with seasonal ranges that change regularly.

I think it's fair to say that Bobby Arora's ability to choose, source, and stock the right items at the right time – and the right price – has played a big role in B&M's growth. I'd hope that he's built up a team that can take over this role, but I still see a degree of key person risk here.

Outlook: CEO Russo expects to report like-for-like sales growth from existing stores in FY24.

New store openings are expected to continue, with plans for c.30 new B&M UK stores, c.10 B&M France stores and c.20 Heron Food stores.

Further special dividends may be possible:

"in the absence of acquisitions opportunities for batches of stores, we will look to return excess cash to shareholders at the appropriate time"

In the first 9 weeks of FY24, B&M UK LFL sales have run at 8.3%.

Full-year adjusted EBITDA is expected to be ahead of FY23 levels.

Broker forecasts ahead of today's results suggested a further 5% fall in adjusted earnings this year, to 35.1p per share. That puts B&M on a forecast P/E of 14, with a prospective yield of 4%.

My view: B&M's performance last year seems acceptable to me in the circumstances. I think the group's profitability and cash generation are impressive. I can see continued growth potential for the business in the UK and France.

An estimated run-rate of c.£350m for free cash flow would give the shares a free cash flow yield of c.7%. This looks potentially attractive to me, as does the stock's ordinary dividend yield of c.4%.

I think it's reasonable to assume that FY24 will be a low point for B&M (assuming that FY23 wasn't the low point). For me, the shares could be worth considering at current levels.

Bodycote (BOY)

"Guidance for the full year remains unchanged"

FTSE 250 firm Bodycote is an industrial heat treatment specialist. Its services improve the strength and corrosion resistance of metal parts such as aircraft landing gear and engine components.

Key market sectors include aerospace, defence and automotive manufacturers.

Today's update covers the first four months of 2023.

I looked at Bodycote in an in-depth piece for Stockopedia in early November 2022 and concluded that the shares look potentially attractive. The stock has risen since then, so I'm interested to see if trading so far this year supports a continued positive view.

Trading highlights: revenue rose by 22.1% to £281m during the four-month period, but this figure was boosted by currency effects and energy price surcharges applied to customer invoices.

Excluding these factors, the company says that revenue growth at constant currency was +9.5%. Still a respectable performance.

Energy surcharges are said to have declined steadily, in line with broader energy price trends.

"Guidance for the full year remains unchanged."

Trading performance was positive across all key market sectors, but some potential risks were noted:

- Aerospace & Defence (revenue +9.4% exc. surcharges): growth led by civil aerospace (revenue +11% exc. surcharges) as OEM customers ramp up build rates to clear the backlog of aircraft orders. But supply chain risks remain a challenge for "several of our customers"

- Automotive (revenue +8.8% exc. surcharges): stronger performance against a weak comparative last year. Supply chain issues have largely cleared but the outlook remains "sensitive to the macro environment and consumer spending"

- General industrial (revenue +9.9% exc. surcharges): slower growth in some sectors offset by "very strong growth in Oil & Gas during Q1 driven by specific project related activity". Also "good demand" from medical markets.

Outlook: management remain confident of full-year guidance but recognise "near-term macroeconomic uncertainties". The company continues to expect volumes to grow ahead of its underlying markets, suggesting market share gains.

Profit margins are expected to improve as cost surcharges moderate.

Looking further ahead, "the Board remains confident in the Group's prospects for continued profitable growth".

Broker forecasts for 2023 suggests adjusted earnings could rise by 6% to 45.3p per share this year. That would put the stock on a forecast P/E of 14, with a 3.4% dividend yield covered twice by earnings.

CEO change: Bodycote's long-serving chief executive, Stephen Harris, has decided to retire next year. Harris has been in the role since 2009.

The decision to retire seems logical enough, but I'm always conscious that successful CEOs tend to have good timing. Is this as good as it's going to get, for a while?

My view: Bodycote is essentially an outsourcer. By serving multiple customers, its facilities can run at high levels of scale and utilisation compared to manufacturers' in-house facilities.

This aspect of the business is key to understanding the growth opportunity – management believe that more of this work will be outsourced in the future.

Today's trading statements reads pretty much as I would expect. The business has started the year well, but there's not yet sufficient confidence to justify upgraded guidance.

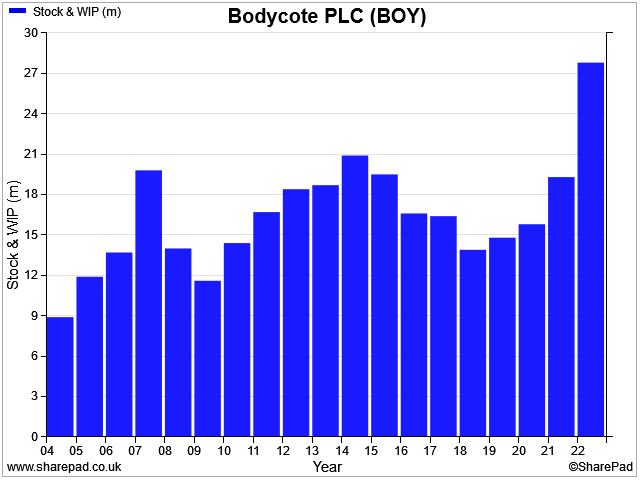

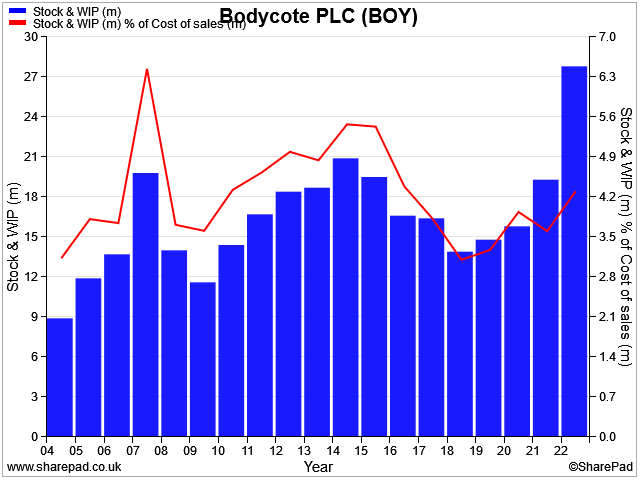

One possible indicator of a looming industrial slowdown is a build-up of unsold stock. When I checked Bodycote's balance sheet inventories, I was initially a little concerned about how elevated they appeared to be at the end of last year:

However, when I compared inventories with cost of sales, I didn't see a repeat of the spike that heralded profit slumps in 2008 and 2015:

While I'm still cautious, I think it's possible that much of the increase in balance sheet inventory value last year reflected the higher cost of inventories - raw materials and energy use.

If the outlook for the global economy turns out to be better than expected, then Bodycote could outperform from here.

Personally, I'm not optimistic enough to believe this. I think that it's sensible to price in some downside risk at the moment.

On balance, I think Bodycote's share price is probably up with events at current levels.

Bloomsbury Publishing (BMY)

"Record sales and profit ahead of recently upgraded expectations. Final dividend up 10%."

Bloomsbury is best known as the publisher of Harry Potter books. The first was published 26 years ago, astonishingly. But the company (and its shareholders) are always keen to remind us that the group also has a sizeable non-consumer business. Fair enough.

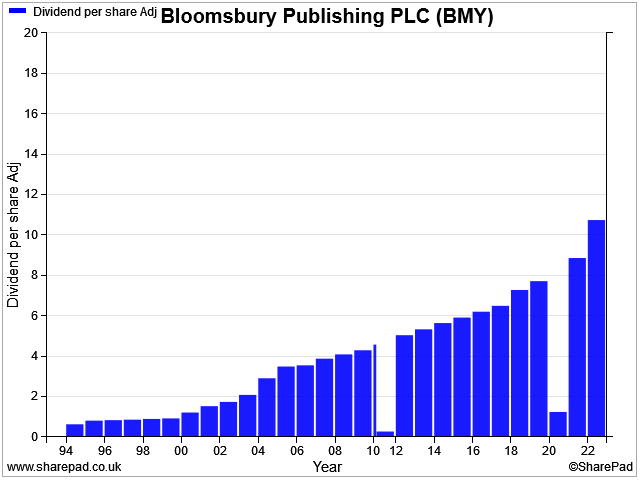

This business has certainly performed well in recent years. Bloomsbury now has an (almost) unbroken dividend growth record stretching back 28 years:

Today's results were said to be ahead of expectations, but they left the share price unmoved. Let's take a look at why this might be.

Financial highlights: chief executive Nigel Newton says that "readers are turning to books" in these challenging economic times. The group's latest numbers show a decent level of growth last year:

- Revenue up 15% to £264.1m

- Organic revenue (exc. acquisitions) up 9% to £231.6m

- Pre-tax profit up 15% to £25.4m

- Earnings per share up 21% to 24.5p

- Dividend up 10% to 10.3p per share

- Net cash up 25% to £51.5m (FY22: £41.2m)

Profitability was broadly unchanged from last year (my calculations):

- Operating margin: 9.7% (FY22: 9.7%)

- Return on capital employed: 13.4% (FY22: 12.3%)

Free cash flow fell last year, due to a big increase in inventories and other unfavourable working capital movements. But I don't see any serious concerns here:

- Free cash flow: £15.7m (FY22: £25.1m)

Trading highlights: the business is divided into two main segments, consumer and non-consumer (academic/professional publishing).

Consumer revenue rose by 12% to £166.7m, generating a pre-tax profit of £17.8m. Of this, children's books generated 65% of sales and 97% of profit.

Sales of children's author Sarah J. Maas' titles rose by 51% last year. Harry Potter was also said to have delivered a "strong" performance.

Adult books were barely profitable, generating just £0.6m of pre-tax profit on £57.8m of sales.

Non-consumer revenue rose by 19% to £97.4m, generating a pre-tax profit of £8.2m.

According to CEO Nigel Newton, this growth was driven by the Bloomsbury Digital Resources (BDR) unit. BDR owns and acquires academic and professional titles that generate repeat revenue at attractive margins.

The key to success in these markets is owning titles with captive audiences who must make regular repeat purchases.

Revenue from academic and professional titles rose by 28% to £75.7m last year (FY22: £59.3m). However, prior-year acquisitions are said to have contributed £21.5m of revenue. This represents 36% of prior year revenue, so seems to imply that organic sales may have fallen last year, unless I'm missing something.

Within this, BDR generated revenue of £27.2m, a 41% increase. The company says that this included 18% organic revenue growth, with the remainder coming from acquisitions.

The non-consumer business amortised nearly £5m of acquired intangible assets last year. This suggests to me that some of these acquired assets may need continued investment to prevent a decline in performance.

Outlook: trading so far in 2023/24 has been in line with consensus expectations. These are specified as revenue of £272.1m and adjusted pre-tax profit of £32.2m.

Based on this outlook, sales and profit growth is expected to be about 3.5% this year.

This subdued outlook doesn't entirely seem to reflect the company's narrative that "readers are turning to books", but it might explain why Bloomsbury's share price has fallen by nearly 20% from the record highs seen last year.

My view: in broad terms, I think this is a good business. But I can't escape the feeling that Bloomsbury is still heavily reliant on profits from Harry Potter. While the non-consumer business is growing steadily, my feeling is that a lot of growth is being driven by acquisition spending.

I also note that more than 10% of revenue (£68.9m) came from a single customer last year. A similar performance was reported in FY22. I don't know who this is or how much profit it represents, but such concentration often carries an element of risk.

I admit that I've only taken a fairly cursory look at Bloomsbury. There's more to unpack here and I may be missing some key elements. It would be interesting to spend some more time on this, and I may do so at some point.

However, my initial conclusion is that Bloomsbury's share price is probably up with events at current levels.

Disclaimer: This is a personal blog and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.