Dividend notes: contrasting approaches - PETS, AJB, HILS, IHP

I review results from AJ Bell, Pets at Home, IntegraFin and Hill & Smith.

In this edition of dividend notes I've looked at results from two investment platforms with contrasting approaches to their clients' cash.

I also consider the latest numbers from two FTSE 250 business which appear in my dividend screening results.

Companies covered:

- Pets at Home Group (LON:PETS) - a decent business, but the outlook looks a little weak to me and the valuation seems up with events. I'm not tempted at this time.

- AJ Bell (LON:AJB) - a very strong set of numbers, with H1 pre-tax profit up by 61%. Interest income on client cash balances is driving the gains, although customer numbers also rose by 7%. A quality business, in my view.

- Hill & Smith (LON:HILS) - profit guidance for the current year has been upgraded. This engineering group looks like a quality business to me, although I'm slightly concerned by the long-running CEO vacancy.

- IntegraFin Holdings (LON:IHP) - a stable set of numbers from this adviser platform, which enjoys 40% operating margins. Clients benefit from pass-through interest rates on cash.

This is a review of the latest results from UK dividend shares that are in my investable universe and may appear in my screening results.

Dividend notes is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

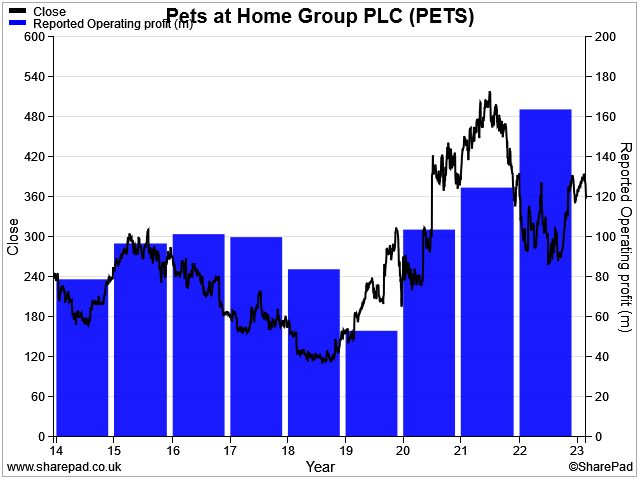

Pets at Home (PETS)

"We attained a market share of 24%, taking 5-year gains to c600bps, as we continue to grow our share of the growing UK petcare market."

Pets at Home is not a business I've paid that much attention too, but perhaps I should have done. The group's focus on providing a total petcare service has proved successful as pet ownership has boomed.

Pets at Home now captures £24 of every £100 spent on pet care in the UK, up from £18 in 2018. This gives PETS a similar market share to Tesco in groceries (27%).

Pets at Home's recent full-year results cover the 12 months to 31 March 2023 and show continued progress.

Group revenue rose by 6.6% to £1,404m, with like-for-like revenue up by 7.9%.

Pre-tax profit fell by 17.7% to £122.5m. Management says this was due to the cost of setting up a new distribution centre and the sale of the group's specialist business in FY22. On an underlying basis, pre-tax profit rose by 4.8% to £136.4m.

PETS is divided into two divisions, Retail and Vet Group.

Retail: this business generates about 90% of revenue faced cost headwinds last year. Although retail sales rose by 6.6% to £1,278.7m, retail profit fell by 2.5% to £98.8m, on an underlying pre-tax basis. That implies a margin of 7.7% (FY22: 8.4%).

Vets: unsurprisingly, pricing power appears to be much stronger in the vet division. This is one area where Amazon and supermarkets can't compete.

Revenue from the vet business rose by 13.3% to £122.8m, while underlying pre-tax profit rose by 18.3% to £50.9m. That gives a margin of 41.5%, up from 39.8% last year.

Profitability: Scrolling down to the statutory accounts, my sums suggest an operating margin of 9.7% for the whole group, with a return on capital employed of 9.3%.

These don't seem bad numbers to me for a business of this kind, and highlight the benefit of the group's higher-margin vet offering.

Cash flow: the group's operating cash flow was broadly flat last year at £251.2m (FY22: £248.1m). Free cash flow rose slightly to £98m (FY22: £95m), but this included the benefit of £22m of lease incentives (i.e. rent rebates).

Excluding these, PETS' free cash flow would have fallen to £76m last year due a £20m increase in capital expenditure, which rose to £75.7m. Presumably this reflects spending on the new distribution centre. Now this is open, the company expects its logistics-related costs to fall as it consolidates its delivery operations.

Year-end net cash was £54.7m (excluding £421.4m of lease liabilities).

Dividend: PETS' dividend rose by 8.5% to 12.8p per share last year, giving a trailing yield of 3.7%.

Outlook: strong momentum from last year is said to have continued into the first few weeks of the new financial year. However, cost inflation remains a source of pressure.

Management expect FY24 revenue to rise by c.7%, and "are comfortable" with consensus forecasts for underlying per-tax profit of c.£136m. That profit figure is unchanged from £136.4m in FY23, so PETS appears to be expecting a reduction in profit margins this year (higher sales vs flat profits).

Broker forecasts suggest adjusted earnings could fall by 9% to 20.8p per share this year (I always assume broker eps estimates are calculated on the same basis as company-adjusted earnings). This prices the shares at 17 times forecast earnings.

My view: I think this is quite a decent business, but I'm not sure it has all of the quality attributes I'm looking for. Prior to this week's results, PETS shares scored just 46/100 in my quality dividend screen.

The shares also seem quite fully valued to me, given the weaker outlook this year. I'll continue to monitor results, but I think there could be better opportunities elsewhere.

AJ Bell (AJB)

"Another period of growth for the platform business, with customer numbers up by 7% in the first half to 455,008"

DIY investment platform AJ Bell has put out a strong set of half-year results.

- Revenue rose by 37% to £103.6m

- Pre-tax profit climbed 61% to £41.9m

- Pre-tax margin of 40.4% (HY22: 34.6%)

- Interim dividend up 26% to 3.5p

- Customer numbers up 7% to 455,008

- Platform assets under administration (AUA) up 7% to £68.6bn, including net inflows of £2.0bn.

- Customer retention rate unchanged at 95.5%

You may wonder about the rapid growth in revenue and profit, given that private investor activity has become more subdued over the last year. The answer (mostly) is that like its larger rival Hargreaves Lansdown, AJ Bell is benefiting from a huge increase in interest income from cash held in client accounts.

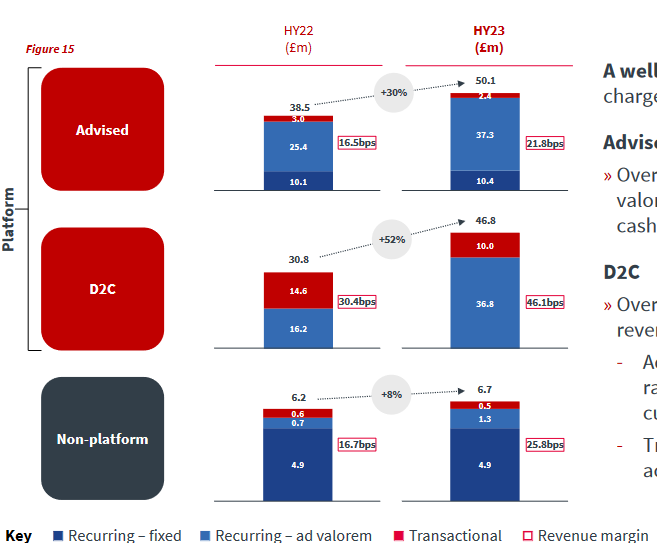

The company hasn't provided a detailed breakdown of cash interest income, but says that its revenue margin rose from 0.20% to 0.29% during the first half. Revenue margin represents the revenue as a percentage of assets under administration.

This chart from the half-year presentation makes it clear that the increase in revenue margin is derived from what the company annoyingly describes as ad valorem charges - in English, this means revenue derived as a percentage of AUA:

The company currently pays a maximum interest rate of 1.65% on cash balances in a Stocks and Shares ISA. Adviser clients do slightly better, receiving interest of between 1.66% and 2.32% on their cash, at the time of writing.

With the Bank of England rate at 4.5%, it's not hard to see why the company's net interest income has soared. The company just says that it pays "a market-competitive rate" on cash balances, but as we'll see further down, some rivals take a more transparent approach.

Outlook: chief executive Michael Summersgill expects cash balances to moderate during the second half of the year, as investors put some of their dry powder to work.

However, full-year revenue margins are expected to be "similar to those achieved in the first half", as higher interest rates offset lower cash balances.

Broker forecasts suggest earnings could rise by 32% to 15.0p per share this year. The dividend is expected to rise by 28% to 9.5p.

These estimates price the shares on 21 times forecast earnings with a 3% yield. That doesn't seem too expensive to me, for a cash-generative business with 40% profit margins.

My view: AJ Bell only floated on the London market in 2018, so it doesn't have the long listed track record I usually look for in a portfolio share.

However, I think this is a high-quality business that could deliver attractive long-term returns from current levels. It could be worth a closer look.

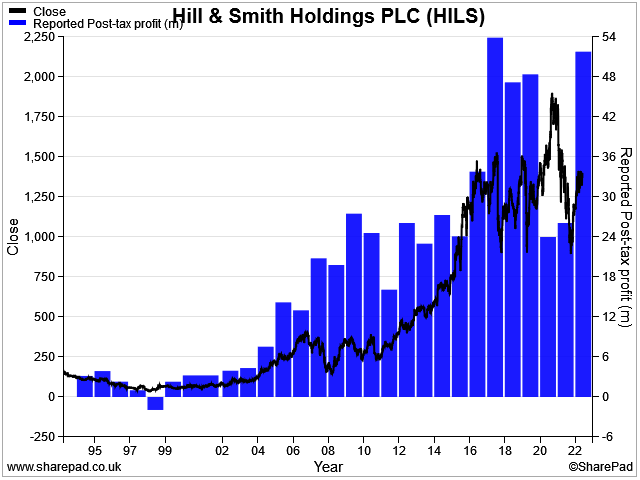

Hill & Smith (HILS)

"Strong start to the year ahead of expectations"

This FTSE 250 engineering business produces a wide range of (mostly) steel products used for transport infrastructure and other similar applications. For example, the company's products include structural steel for bridges, lighting columns, safety barriers and security fencing.

The business was originally founded as an ironworks in 1824, but has grown into an international group with operations in the UK, USA, India and Australia.

FY23 guidance upgraded: in this week's AGM trading update, management reported a strong start to the year.

Revenue rose by 18% (constant currency) during the four months to 30 April, with record revenue and profit from its Engineered Solutions and Galvanizing divisions.

Both of these strong performances seem to have been driven by strong US demand, including (I think) for energy-related infrastructure.

As a result, full-year operating profit is now expected to be ahead of the top end of expectations. Helpfully the company specifies this, citing a range of analyst forecasts from £105.2m-£110.2m.

This suggests the company expects operating profit to be above £110m this year. To put that in context, the comparable figure last year was £97.1m – so an increase of at least 13% is on the cards, probably a little more.

Bear in mind though that this is adjusted operating profit – reported operating profit was £20m last year, at £78.5m. A quick look suggests the underlying figure excludes amortisation and impairment charges – I'd probably use the reported figure to be prudent.

CEO vacancy update: the company also issued a directorate change notice advising the market that chairman Alan Giddins has formally assumed the role of executive chair for an expected period of 12-18 months. Giddins is a former investment banker and private equity executive who has chaired the board since 2017.

Hill & Smith's previous chief executive, Paul Simmons, stepped down in July 2022 "with immediate effect" and was placed on gardening leave. We don't know why he left in this manner, but perhaps the departure wasn't planned or entirely amicable.

The company has been hunting for a new chief exec since last July but has still not found one. The formal appointment of Giddins as executive chair seems to suggest that recruitment could take another year or more.

The problem seems to be that none of the applicants are measuring up to the company's standards:

"Since July 2022, the Board has undertaken an extensive search process that has identified many strong candidates who have been excited by the Group's prospects. However, the Board was not able to find a candidate that met its criteria at the current time."

I don't think there's anything amiss here. But the situation seems slightly unusual and I wonder if there is some kind of odd dynamic at work in the boardroom.

My view: Hill & Smith generates decent low-teens returns on capital employed and has always looked like a good quality business to me. Many of the company's products are sold into heavily-regulated sectors. This should make it harder for new entrants to compete and reduce the cyclicality of the business.

Share price and profits have moved steadily higher over the last 20 years:

Upgraded forecasts price the shares on 15 times forecast earnings, with a 2.6% dividend yield. That looks about right to me, but this is certainly a share I might consider buying in the next market sell off.

IntegraFin (IHP)

"Net inflows to the Transact platform were over 6% of opening period FUD and we now serve a record 228k clients, and 7.6k registered advisers."

This FTSE 250 firm floated in 2018 and provides platform services for financial advisers – it provides both an investment platform and an "adviser practice management solution".

The company says it had a 19% share* of adviser platform net inflows and a 9.7% share of UK adviser platform funds at the end of the half-year period.

*Corrected 27/05/23 - my original comment suggested IHP had a 19% share of UK adviser platform funds. This was incorrect.

Founder Michael Howard remains a non-exec and has a 9.7% shareholding.

Results summary: Client numbers rose by 4% to 228,000 during the six months to 31 March, compared the same period one year earlier. This supported a net inflow of £1.6bn.

At the end of the period, funds under direction (FUD) stood at £54bn. Average daily FUD was £52.6bn (HY22: £53.0bn).

Revenue for the half year was broadly flat at £66.5m (HY22: £67.0m), while pre-tax profit fell by 12% to £27.9m. This appears to reflect higher staff costs and the small drop in average FUD during the period.

If we compare these numbers to those for AJ Bell above, there's one glaring difference – IntegraFin does not appear to be benefiting from the interest on client cash in the way that AJ Bell and Hargreaves Lansdown are.

The results presentation confirmed why – IntegraFin says that interest earned on client cash (3.8% in April) is "fully paid onto clients". I would imagine this transparent approach is a useful marketing and client retention tool at the moment.

However, a comparison with AJ Bell suggests that IntegraFin is not necessarily cheaper, overall.

In its half-year presentation, IHP specifies a revenue yield (equivalent to AJ Bell's revenue margin) of 0.244%.

The equivalent figure for AJ Bell's adviser platform was 0.218% in H1, according to its interim results presentation.

IntegraFin appears to take a slightly bigger slice of client funds each year. So perhaps charges elsewhere are higher, offsetting the lack of interest income.

IntegraFin's half-year operating profit margin of 39% compares to a figure of 40.4% for AJ Bell and suggests a very attractive level of profitability, even in more subdued markets.

My sums suggest a trailing 12-month return on capital employed of 21% and a return on equity of 23.5% – both very attractive figures.

Outlook: broker forecasts suggest earnings could fall by 18% to 13.3p per share this year. Although a flat dividend would exceed the company's target 60% payout ratio, I suspect the dividend would be held at 10.2p in this scenario, given the group's £184m net cash position.

These estimate price the shares on 20 times forecast earnings, with a 3.8% yield.

My view: IntegraFin looks like a good quality business to me, with steady long-term growth potential.

The group is the third-largest adviser platform on the UK market, with a 10% share of funds under advice (AJ Bell is fifth).

My feeling is that IntegraFin shares look reasonably priced at current levels, albeit not cheap.

I've only taken a quick look at this business so far, but my initial impressions are positive. I may return to it in more depth over the coming weeks and months.

Disclaimer: This is a personal blog and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.