Dividend notes: renting space - IOM, SAFE

16/06/2023: I review results from cloud services provider Iomart and self-storage operator Safestore.

In this dividend note I'm looking at two quite different companies that both depend on renting out specialised space to their customers.

Companies covered:

- Iomart (LON:IOM) - this cloud services provider looks a decent business to me, but I'd like to see evidence that profitability is stabilising alongside organic (not acquisitive) growth.

- Safestore Holdings (LON:SAFE) - self-storage has been a booming business in recent years and Safestore doesn't look a bad option. But worsening operational metrics and macro risks mean I'm not tempted right now.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my view only and are not advice or recommendations.

Iomart (IOM)

"The first two months of the new financial year are in line with internal expectations, reporting revenues ahead of the equivalent prior period, with a mix of organic and acquisitive growth."

Cloud computing services group Iomart is a regular presence in my dividend screening results and has been listed on London's AIM market for more than 20 years.

Founder Angus MacSween stepped down from the CEO position in 2020 but still has a 15% shareholding, suggesting his eye remains on the business.

His replacement, Reece Donovan appears to be sharpening the group's commercial performance and increasing its focus on higher-growth managed services (versus higher-margin but slower growing self-managed infrastructure).

This week's final results delivered decent revenue growth, although profits fell again. However, the company's cash generation has caught my eye, so I've decided to take a closer look at the numbers.

Financial summary: these results cover the 12 months to 31 March 2023.

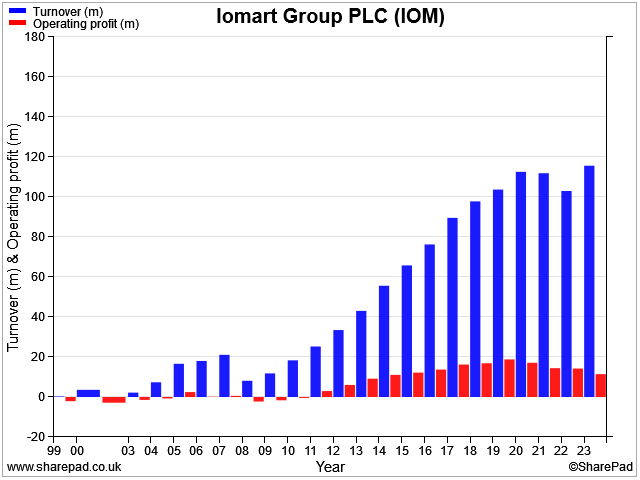

Revenue for the period rose by 12% to £115.6m. Breaking this down, Iomart says electricity costs rose by £7m and were passed onto the company's customers.

Stripping this out suggests that organic revenue growth was more modest at 5%. This doesn't t seem much given the level of inflation last year, but it's a welcome return to positive territory after two years' of revenue falls:

Pre-tax profit for the period fell by 30% to £8.5m. Excluding a one-off £0.8m relating to an error by the company's energy broker (!), the pre-tax profit would have fallen by 24% to £9.3m.

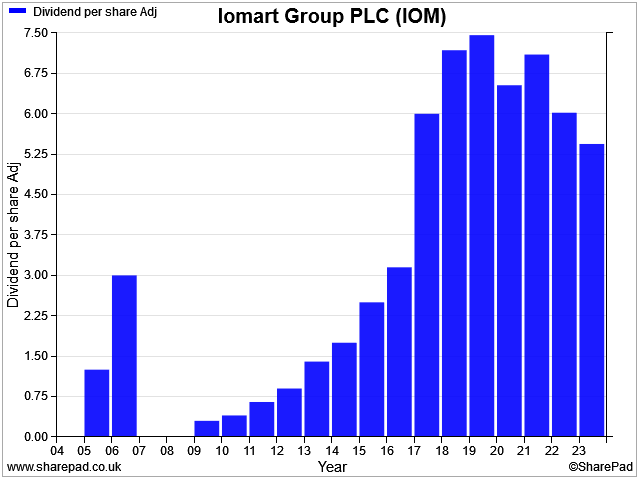

Adjusted earnings for the period were down 9% to 10.9p per share, but the more inclusive statutory earnings dropped 26% to 6.4p. This provided 1.8x earnings cover for the dividend, which was cut by 10% to 5.44p per share (FY22: 6.02p).

Broker finnCap believes this will be "the nadir of the dividend trajectory". Shareholders will certainly hope so. Iomart's dividend has now been cut by 27% from its pre-pandemic high of 7.5p per share:

Iomart's strong cash generation suggests to me that it may be fair to expect the payout to stabilise at this level, although not necessarily rise immediately.

Operating cash flow fell by 4.4% to £33.9m last year. From this, I estimate free cash flow of £16m, excluding a £10.3m acquisition. This measure of free cash flow gives a FCF yield of 8.8%, which seems quite affordable to me.

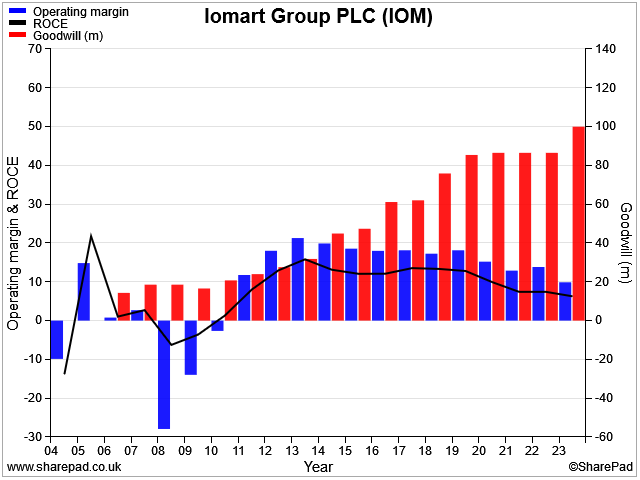

Net debt for the year fell slightly to £39.8m, representing 5.6x net profit – higher than I like to see. While net borrowings only equate to a comforting-sounding 1.1x EBITDA, I'm not sure we can ignore depreciation in a business of this kind – equipment must be upgraded and replaced regularly to maintain the level of performance and reliability that's expected by customers.

Depreciation charges totalled £16m last year, including £11m on data centre and computer equipment. Capex was c.£9m, highlighting the regular expense that's required.

Operating highlights: the group's operations are broken down into three core divisions. Reassuringly, all three generated revenue growth last year:

- iomart cloud managed services (revenue +15% to £64.1m): the group's flagship service, provides "fully managed, complex bespoke designs"

- Self-managed infrastructure (revenue +7% to £30.4m): provides dedicated, physical self-service servers for customers, hosted in the company's owned data centres

- Non-recurring revenue (revenue +32% to £9.4m): on-premise equipment, software reselling, consultancy projects. Seen as an entry-level proposition that can lead to the sale of higher-level services

Outlook: trading since the start of April is said to be inline with expectations, with revenue ahead of the comparable period.

Full-year expectations appear to be unchanged at this time, suggesting adjusted earnings will be flat this year at c.10.3p, with an unchanged dividend of 5.4p.

Those estimates put Iomart shares on a forecast P/E of 16 with a dividend yield of 3.3%.

My view: this looks like a reasonable business to me, but I'm a little concerned about the decline in profitability in recent years.

While operating margins still look reasonable to me, return on capital employed has fallen more sharply as acquisitions have piled goodwill onto the balance sheet:

I'd like to see some evidence of profitability stabilising and starting to improve. I think this is quite likely, as the company continues to deliver on its strategy.

On balance, I don't see anything much wrong here, but I don't think Iomart offers quite enough value and quality right now for me to consider this dividend share as a potential buy.

Safestore Holdings (SAFE)

"At present, Adjusted Diluted EPRA earnings per share for the full year is anticipated to be broadly in line with consensus."

Self-storage has been a structural growth market in recent years. The growth in the residential rental sector suggests to me that demand is likely to remain strong. However, supply has increased considerably too, as operators such as Safestore, Big Yellow and others have added new capacity.

The latest results from Safestore cover the six months to 30 April and suggest to me that a more cautious outlook may be justified, at least temporarily.

Financial summary: revenue rose by 8.9% to £110.1m and operating profit before property revaluation gains rose by 16.2% to £67.6m.

On an adjusted basis, EPRA earnings per share rose by 5.3% to 23.7p, in line with consensus forecasts for a full-year figure of 48.5p per share.

The interim dividend was increased by 5.3% to 9.9p, reflecting EPS growth.

However, while accounting earnings improved, free cash flow fell by 37% to £31.9m.

The slump in cash generation was partly due to higher finance costs, but mainly the result of a £19.8m working capital outflow. Management say this was "primarily associated with the settlement of employed related taxes" linked to the maturity of three- and five-year bonus schemes.

I haven't looked into these schemes, but if that was the tax bill, then presumably the value of the shares awarded must have been significant. Nice work if you can get it (update: the CEO and CFO appeared to have been awarded 3.5m nil-cost shares between them in December, worth c.£32m at today's share price)

Balance sheet: Safestore's loan-to-value ratio at the end of April was 25.3%, up slightly from 24.8% one year earlier. Interest cover was 10.8x (2022: 10.0x).

84% of drawn debt is said to be hedged, with an average interest rate of 2.77%. Weighted average maturity on drawn debt was 5.4 years at period end.

This all looks reasonably safe to me for now.

Operating metrics: the improvement in accounting profit was not entirely reflected in Safestore's operating metrics, in my view.

- Closing occupancy let: -1% to 6.124m sq ft

- Closing occupancy as a percentage of maximum lettable area: -4% to 76.7%

- Revenue per available square foot: -1% to £28.28

- Average storage rate (revenue/sq ft let): +4.1% to £30.58

These numbers suggest that occupancy fell on both an absolute and relative level. Although the company did achieve 4% revenue growth on the space that was let, falling occupancy suggests to me that further price increases may be difficult.

Outlook: enquiry levels in May are said to have been ahead of pre-pandemic levels but lower than last year. There's been some improvement in June and in continental Europe, enquiry levels have been ahead of last year.

For now, adjusted EPRA earnings per share for the full year are expected to be "broadly in line with consensus".

Consensus estimates I can see are for earnings of 48.5p per share this year, with a dividend of 30.9p. That puts Safestore on 18.5 forecast earnings, with a 3.4% yield.

However, I'd note that use of the word "broadly" is often seen as code for "slightly below".

My view: I don't see anything fundamentally wrong with this business. But with consumer spending under pressure, I think Safestore could find it hard to reverse its declining occupancy without holding back prices.

Rising finance and investment costs may mean that profits stay under pressure.

It's possible that demand will recover more quickly than I expect, but it's not something I'd bet on at the moment.

With Safestore shares trading at c.920p at pixel time, they're still at a slight premium to their EPRA net asset value of 909p.

Self-storage operators have operated at a premium to NAV in recent years to reflect their strong profitability and growth rates. But there's a risk to this business model, too – they must borrow long and rent short in order to make superior profits.

Tenants can come and go with minimal commitment, so self-storage operators could see occupancy fall more quickly than with other types of commercial property.

For now, I think Safestore's valuation are up with events. I'd want a cheaper entry point or a much stronger outlook before I'd consider this stock.

Disclaimer: This is a personal blog and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.