Dividend shares: can Aviva keep on delivering?

Aviva (LON:AV) shares now offer a 7% dividend yield and the prospect of steady growth. Is it time to buy this perennial underperformer?

Throughout my time as an investor, FTSE 100 dividend share Aviva (LON: AV) has been a popular pick for income with retail investors. This insurer is best known in its home market for offering products such as home, motor, travel and life insurance.

Sadly, Aviva has also gained a reputation for failing to deliver growth and cutting its dividend on a regular basis.

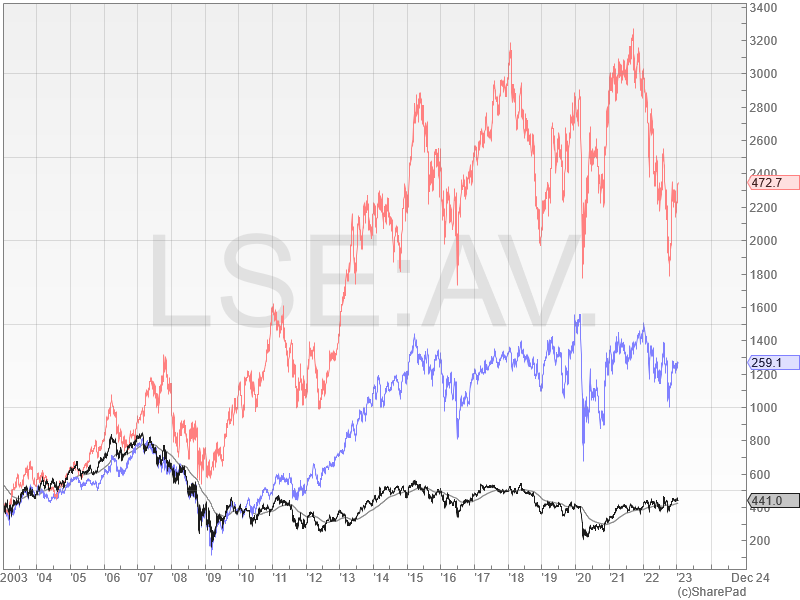

As a result, Aviva's share price today is pretty much unchanged from 20 years ago:

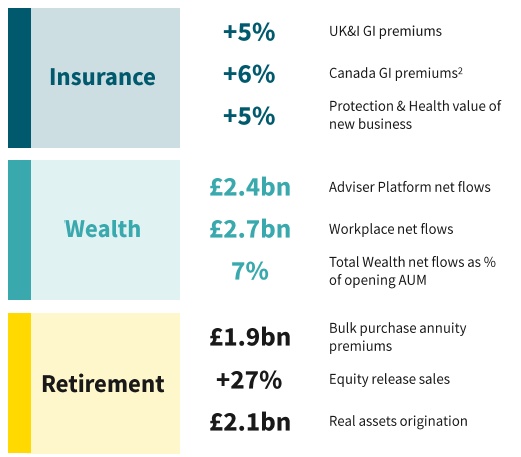

However, since CEO Amanda Blanc took charge in 2020, the business has been transformed. Ms Blanc has dramatically simplified the group and returned the its core operations to growth. These are the highlights from last year's half-year results:

Shareholders have also benefited from a rejuvenated dividend and £4.5bn of one-off cash returns. With a coherent strategy and a strengthened balance sheet, I think the current 7% dividend yield might represent a buying opportunity for income investors.

In this piece, I'll look at Aviva's track record and recent trading and consider whether this stock might be a suitable candidate for my quality dividend portfolio.

A 327-year history

According to Aviva's website, more than 750 companies have contributed to its heritage. This long and complicated story starts in 1696, when the Hand in Hand Fire Office was founded. This business provided fire insurance and firemen to its policyholders.

Fire protection, life insurance and annuities were the main lines of business for much of the first 300 years . The history of Aviva's predecessors is also in some ways the story of the British Empire and the Industrial Revolution. It's an interesting tale, which you can read about on the company's timeline.

The history of Aviva as we know it today can be traced back to 1997, when Norwich Union floated on the London Stock Exchange.

In 1998, Commercial Union and General Accident merged to form CGU.

In 2000, CGU merged with Norwich Union to create CGNU.

In 2002, the combined group was renamed Aviva.

Given such a long history, it's tempting to compare Aviva with venerable City names such as Schroders and portfolio stock Legal & General. However, I think a more apt comparison might be with BAE Systems.

The difference is that while Schroders and Legal & General have been a continous presence in their markets for well over 150 years, Aviva and BAE have not. They're modern corporate creations that have inherited the legacy of many older businesses.

I'd argue that Aviva – and to a lesser extent BAE – may lack the unified identity and clarity of purpose of successful older companies. This is only speculation on my part, but I think it could help explain why Aviva's performance has been disappointing when compared to its older peers.

New broom sweeps clean: My view on Aviva has rapidly improved since chief executive Amanda Blanc took charge in 2020.

In less than two years, she's raised £7.5bn by selling most of the group's overseas units and refocused the business on the UK, Ireland and Canada; core markets where Aviva has scale and a strong brand.

Early indications are that these core operations are now delivering a reasonable level of growth. In the meantime, shareholders have benefited from £4.5bn of one-off returns and a stabilised dividend.

Tentatively, I wonder if Amanda Blanc's actions have finally started to resolve the lingering lack of coherence within Aviva's operations, positioning the group to become what it should always have been – a reliable, slow-growing and high-yielding insurer.

Recent trading & dividend guidance

Aviva's most recent trading update covered the nine months to 30 September. Ms Blanc was in bullish form:

"We are on track to deliver our financial targets and trading momentum is building. Our dividend guidance remains unchanged and, as previously announced, we anticipate commencing additional returns of capital to shareholders with our 2022 full year results."

The headline figures from the group's nine-month results do seem to support a positive view:

- UK & Ireland life insurance: value of new business +46% to £466m

- General insurance (e.g. motor, home): gross written premium +10% to £7.2bn

- Wealth management net inflow of £7bn, compared to £7.3bn during the same period last year

- Pro-forma solvency coverage ratio of 215%, 35% above the target level of 180%. This is a complex regulatory measure, but the upshot for shareholders is that Aviva had £2.5bn of surplus capital at the end of September. Much of this is expected to be returned to shareholders in 2023.

The company is guiding for an ordinary dividend payout of 32.5p per share in 2023. That's equivalent to a 7.4% dividend yield at the time of writing.

If I can own stocks with an income like that, I don't need much capital growth to beat the long-term average annual total return from the UK market of c.8%.

Aviva is currently one of the highest-scoring financial stocks in my dividend screening results. Let's take a closer look at this rejuvenated business.

Aviva: crunching the numbers

Description: Aviva is a FTSE 100 insurance group offering a full range of life and general insurance, plus retirement and savings products. The Aviva Investors business provides asset management services for institutional clients.

| Aviva (LON: AV) |

Quality Dividend score: 72/100 | Forecast yield: 7.0% |

| Share price: 442p | Market cap: £12.5bn | All data at 17 January 2023 |

Latest accounts: 2022 half-year results and 2022 Q3 trading update

In the remainder of this review, I'll step through the different stages of my dividend screening system and explain whether I think Aviva could be a suitable addition to my quality dividend portfolio .

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Dividend culture: very good

My dividend culture score looks for a record of continuous dividend payments, regardless of any cuts.

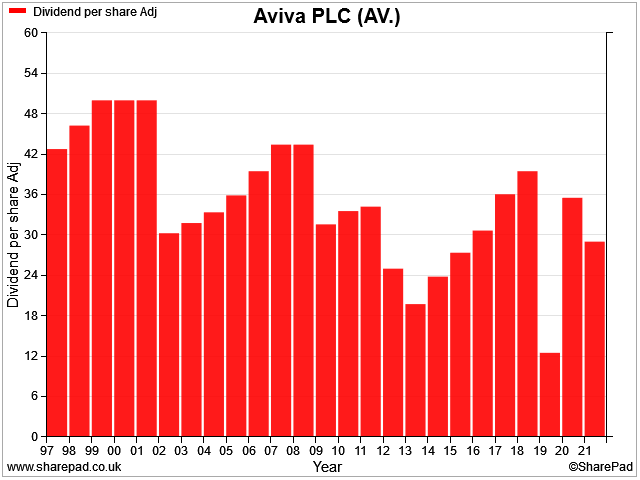

When we look at Aviva's dividend history in this way, we can see that the firm does appear to have a strong commitment to dividends:

Aviva and its immediate predecessors have not skipped a payout in 25 years, even during the pandemic and the financial crisis.

Aviva scores 5/5 for dividend culture in my screening system.

Dividend safety: much improved

As a quick reminder, the scoring rules I used for financial stocks are slightly different to those I use for non-financials. This is to reflect the slightly different metrics that I use for each type of business.

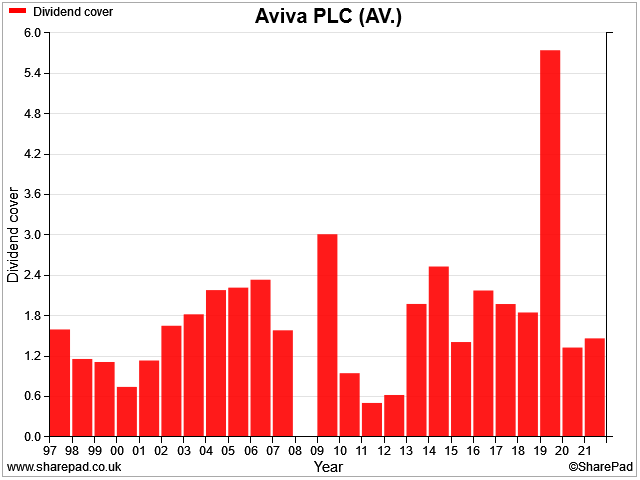

To score for dividend safety with financial stocks, I look at dividend cover by earnings. As earnings per share are essentially the 'return' part of return on equity, this ties in with my use of ROE to measure profitability.

Aviva's dividend cover has generally stayed in a range between 1.2x and 1.8x over the last 25 years. On the whole, that seems reasonable to me, for a large, mature insurer:

Cash generation: For non-financial stocks, I also look at dividend cover by free cash flow (FCF). However, a standard FCF calculation isn't generally very meaningful for financials, due to the way their accounts work.

What I do instead is to manually compare the dividend with an appropriate measure of cash generation. Insurers normally include a figure of this kind in their results.

For Aviva, the figure I want is reported as cash remittances. It represents surplus cash returned to the holding company (Aviva plc) by the group's operating subsidiaries. This is the money that's used to fund dividend payouts.

In this case, checking the accounts tells me that Aviva plc received cash remittances of £1.1bn during the first nine months of 2022, unchanged from 2021. For the full year of 2022, cash remittances are expected to exceed £1.66bn.

The expected 31p per share dividend for 2022 will cost around £870m, so I can see that this payout should be covered twice by cash remittances.

Aviva scores 5/5 for dividend safety in my screening system.

Dividend growth: a sorry tale

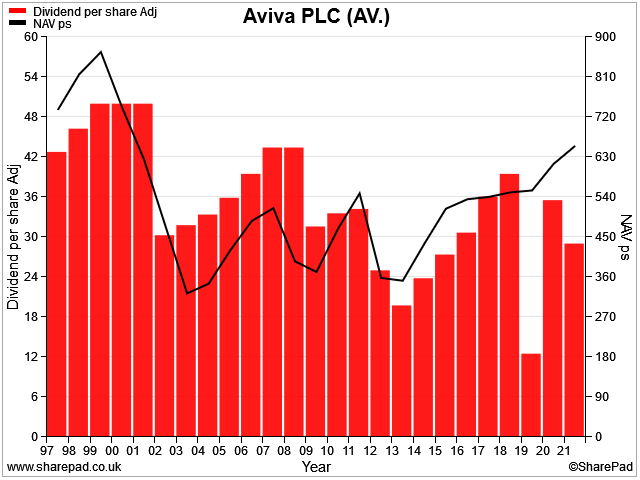

I've already mentioned Aviva's unfortunate track record of dividend cuts. You can see them again in the chart below. The red bars are dividends.

On top of this, I've overlaid a black line tracking the group's net asset value per share. Note how the NAVps line maps almost exactly the pattern of the dividend payouts.

Even without knowing about Aviva's past performance over this period, the falls in net asset value provide a strong clue about the necessity for dividend cuts. The business just wasnt't creating enough surplus value to maintain its previous levels of shareholder return.

This is why the share price today is still almost exactly the same as it was 20 years ago, in my view.

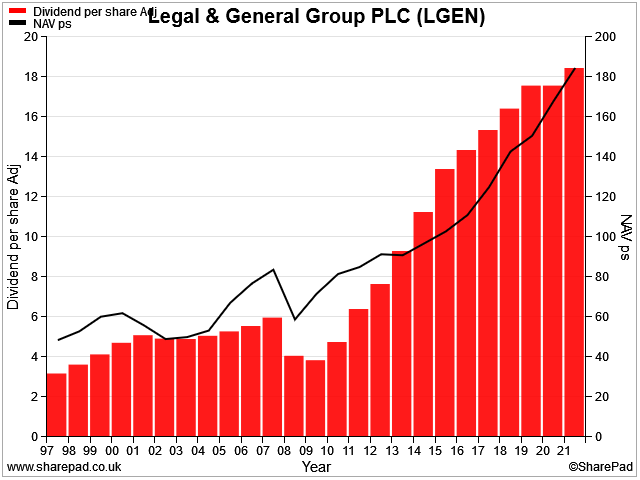

By way of contrast, here's the same chart for Legal & General, over the same time period:

This is why I use net asset value per share [book value] in several of my screening rules. I find that this measure provides a good snapshot of whether a business has created value for its shareholders over long periods.

It's very rare for my screening system to award a category score of zero to an otherwise high-scoring stock. But that's what's happened here. Aviva's most recent dividend cut has cancelled out the modest NAVps growth seen over the last five years, resulting in a zero score.

Aviva scores 0/5 for dividend growth in my screening system.

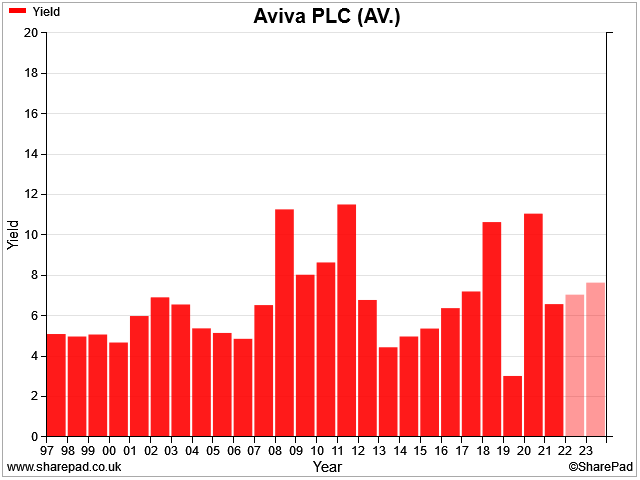

Dividend yield: high

Aviva has always been a fairly high-yielding stock. Of course, this is not entirely surprising, given the group's historic lack of growth.

Even so, the stock's current dividend yield appears to be at the upper end of its historic range currently, except for a few outlier years.

I think this could be a sign that the shares offer value at current levels, assuming trading remains stable.

Aviva scores 5/5 for dividend yield in my screening system.

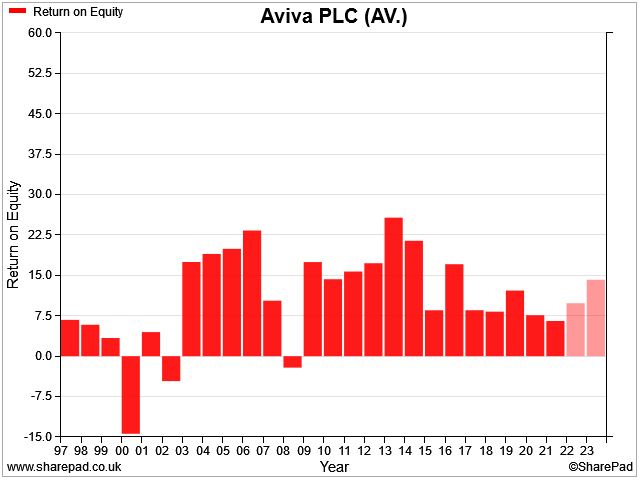

Profitability: improving

As I mentioned earlier, I use return on equity as my main measure of profitability for financials. This chart shows the group's return on equity since 1997:

Aviva clearly had a decent spell of profitability from around 2003 though to 2016. Things have gone downhill since then.

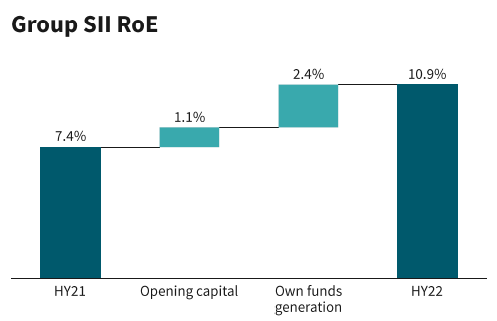

However, broker forecasts suggest that profitability should have improved last year. The group's half-year results support this view, showing a return to double-digit return on equity during the first half of last year:

I think the acid test will be whether Aviva can sustain double-digit ROE and reinvest some of it successfully in growth. This combination could create a significantly more valuable business in the future, but it's proven elusive in the past.

Aviva scores 3/5 for profitability in my screening system.

Conclusions: a turning point?

My quality dividend screen awards Aviva an overall score of 72/100 at the time of writing (January 2023).

In my view, Amanda Blanc has done pretty much everything right since taking control at Aviva. She now has the opportunity to create the kind of coherent, focused business that can deliver lasting shareholder value.

The group's results for the first nine months of 2022 certainly suggest a return to growth and improved profitability. Cash remittances have remained strong, too.

It's too soon to know whether Ms Blanc will be able to maintain this performance, but the situation definitely looks more promising to me than it has previously.

I wouldn't rule out owning Aviva shares in my model dividend portfolio at some point, although I've no current plans to invest.

Disclosure: Roland owns shares of Legal & General Group and General Accident preference shares (General Accident is a subsidiary of Aviva).

I look forward to your feedback and will be adding a comment facility to this site very shortly (!). In the meantime, you can always reach me on Twitter @rolandhead or by email.

Disclaimer: My comments represent my views only. I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.