Is NWF a dividend share to buy now?

I take a look at AIM-listed distribution specialist NWF Group (LON:NWF) and find plenty to like, including a 27-year dividend history.

Following my recent look at small-cap packaging group Macfarlane, I've been looking at another small cap dividend share that's been on my radar recently.

Distribution specialist NWF Group (LON:NWF) is a £100m AIM-listed business that supplies fuels, ambient groceries, and agricultural feed to customers around the UK.

Like Macfarlane, NWF belongs to a category of shares I describe as stealth multibaggers – seemingly dull companies that have actually delivered excellent results over many years.

NWF shares have doubled over the last 10 years – and have seven-bagged for investors who bought into the lows around the turn of the century:

Indeed, I wonder if NWF could be a business that might have attracted legendary fund manager Peter Lynch back in the day.

In his classic investing guide One Up on Wall Street, Lynch listed the characteristics he looks for in a perfect stock. NWF ticks many of these boxes:

- "It sounds dull" - NWF Group sounds dull and tells you nothing.

- "It does something dull" - delivering fuel, ambient groceries, and animal feed is not exciting, nor is it obviously a growth business

- "It does something disagreeable" & "there's something depressing about it" - diesel, heating oil, and "ruminant animal feed" are products most of us prefer to keep at arm's length, although they're not as offputting as – say – sewage or pest control.

- "It's a no-growth industry" - NWF's Fuels and Feeds businesses have seen volumes fall in recent years. In both cases, end markets seem mature, with growth likely to come from consolidation.

- "It's got a niche" - NWF's operations are not exactly niches as Lynch defined them – they do face some competitors. But NWF's operating segments are well defined and the company does have significant market share within them.

- "People have to keep buying it" - there may be seasonal variations in demand, but fundamentally, all of the products NWF supplies are routine, repeat purchases that cannot really be avoided.

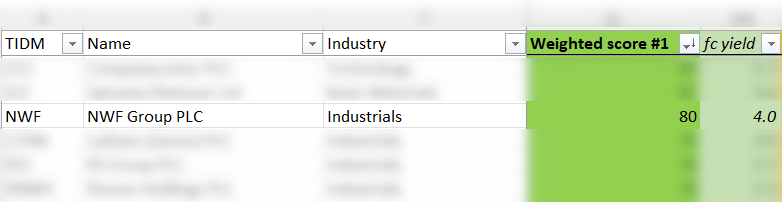

One further attraction for me is that NWF is currently one of the highest-scoring stocks in my dividend screening results, with a score of 80/100:

NWF is under the radar for many investors, but it has performed well for shareholders and has an excellent dividend record.

I've been wondering whether this business could be a suitable candidate for my quality dividend portfolio.

To find out more, I've run the stock through my dividend scoring system and taken a closer look at its operations. Here's what I found.

Table of contents

- History - 152 years of distribution

- Recent trading & outlook - in line with expectations?

- Crunching the numbers - how does NWF score in my screening system?

- Dividend culture - excellent

- Dividend safety - good

- Dividend growth - well supported

- Dividend yield - average?

- Valuation - could be cheap

- Profitability - hidden leverage?

- Fundamental health - good

- Conclusion - would I consider NWF for my dividend portfolio?

NWF Group: 1871-present

Nantwich-based NWF can trace its history back to 1871, when the Cheshire Farmers Supply Association Ltd was formed to serve the needs of local farmers.

The NWF moniker came into existence in 1958, when the firm changed its name to North Western Farmers Ltd following a double merger with two other regional farmers supply associations.

In 1988, the business became a limited company, NWF Ltd, replacing the co-operative structure that had been in place since 1918.

In 1995, NWF floated on London's AIM market, where it remains today. Since then, the company has continued to expand through a focus on consolidation, bolt-on acquisitions and careful capital allocation.

The group now has three established business lines, each with a clear identity and attractive scale:

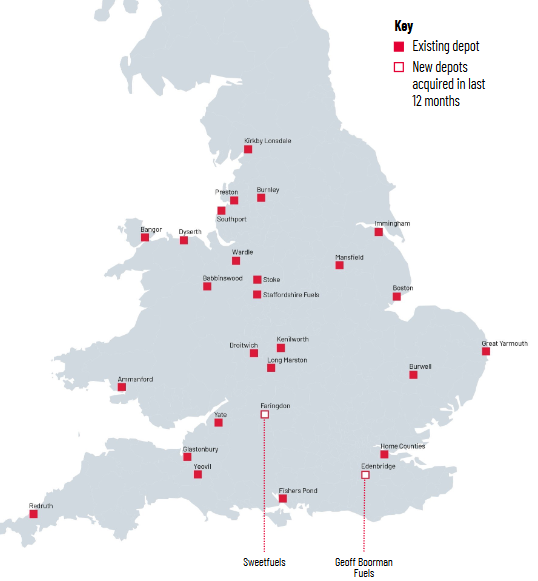

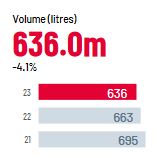

NWF Fuels: last year, this business supplied 636m litres of fuel from 27 depots to more than 100,000 customers across the UK. NWF Fuels' customer base is a mix of agricultural, commercial and residential (heating oil).

The fuels business has grown mainly by acting as a consolidator in a sector that remains very fragmented, with lots of small local operators.

Today, NWF says it's the third-largest fuel distributor in the UK. Even so, this position is equivalent to a market share of just 2%. "Over 150 smaller players" remain, many of whom are presumably potential acquisition targets for NWF.

Longer term, there's clearly some risk to this business from the energy transition. Over the coming decades, usage of oil-based fuels seems likely to decline, perhaps sharply.

Indeed, I wonder if this process has already started – NWF's volumes have fallen by around 10% over the last three years, despite some bolt-on acquisitions:

For now, I suspect NWF may be able to offset some declines through its role as a consolidator, which increases market share.

In addition, I would imagine that lorries and farm equipment are likely to remain fuelled by diesel for the foreseeable future. This may underpin the business for some time yet.

However, I think the residential part of the business could be more vulnerable. As an oil heating user myself, I intend to switch to a heat pump when my current boiler needs replacing.

Food: this division operates as Boughey Distribution. According to the Boughey website, NWF started this transport business in 1964. It's since grown to operate c.150 lorries and 1.1m sq feet of warehousing, with a specialism in consolidating ambient groceries.

Operating from sites in Nantwich and Crewe, Boughey collects and stores palletised ambient grocery products from suppliers and manufacturers. These are then consolidated into complete loads for delivery to supermarket distribution centres and other large retailers.

NWF says that the Food business works with all retailers [supermarkets] and cash and carry operators nationwide, and has an "active pipeline of customers looking to join us".

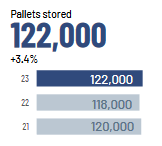

A new warehouse that opened in 2020 increased storage capacity to 135,000 pallets. This expansion was backed by customer contracts and has been fully utilised since then:

The company says it has "an ambitious five-year growth plan". According to the FY23 presentation, this may involve adding further warehouse space (backed by customer contracts), optimising the customer mix and providing value-added services such as e-fulfilment and repacking.

From what I have heard of this business, Boughey is well run and respected by both its staff and customers. The company recently won a local Employer of the Year award and says it has a waiting list of HGV drivers who would like to work for the firm.

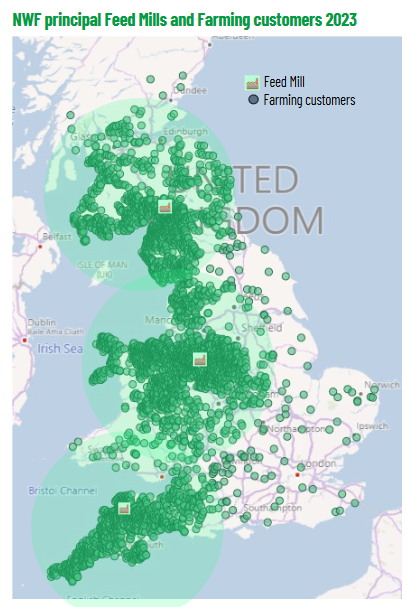

Feed: NWF supplies ruminant feed – primarily for dairy cows – to more than 4,100 farmers across the UK. Alongside this, the company offers a nutritional advice service that I'd imagine has a strong sales bias:

"over 55 trained nutritional advisors analysing forage and farmers’ objectives to deliver feed to optimise performance."

Providing the full range of feed and nutritional products for dairy farmers – opportunities for range extensions

Target 50 farmers for each nutritionist with up to 10,000 tonnes of feed per annum

NWF has its own feed mills and delivers direct to farmers. The company says it feeds one-in-six dairy cows in the UK.

This is essentially a commodity business, and NWF does take some price risk here on its inventories.

Feed costs and pricing can vary depending on market conditions, while demand also fluctuates depending on factors such as weather and farm-gate prices for milk.

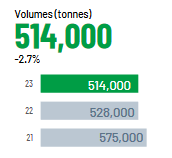

Feed volumes fell by 2.7% to 514,000 tonnes last year, which NWF blamed on "a mild autumn and a later transition to indoor housing for dairy herds". Volumes also declined in FY22:

Like the fuels business, I think it's fair to say that the UK market for ruminant feed is mature and is unlikely to grow significantly.

The company says falling volumes are linked to market conditions and the impact of Brexit. Apparently, farmers are not expanding their herds, even when milk prices are favourable.

NWF has sought to grow the Feeds business by acting as a consolidator in addition to seeking organic growth opportunities, such as "added value products" to optimise cows' diets. For example, it offers a range of "low emission feeds".

Recent trading & outlook

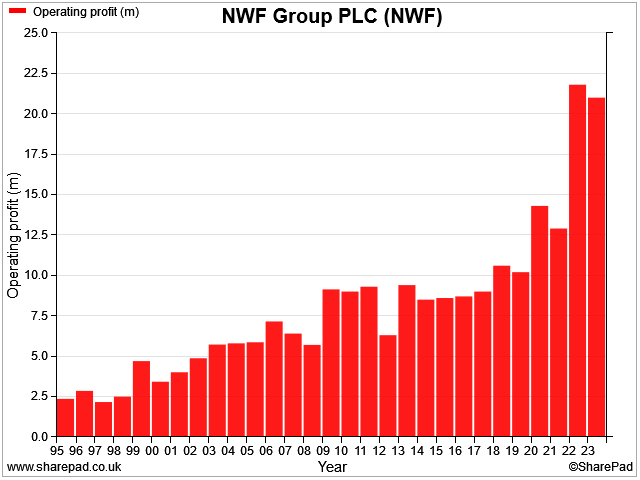

NWF enjoyed a period of record profits in 2022, as high energy prices and volatile market conditions worked in favour of suppliers such as NWF.

Market conditions are now normalising again and operating profit from Fuels fell by 25% last year (y/e 31 May). However, improved trading for the Food and Feed business offset this decline somewhat, leaving group operating profit down by around 4% at £21m last year.

Broker consensus forecasts suggest this process of normalisation will continue this year. Estimates on SharePad suggest NWF's operating profit could fall by around 20% to £16m in FY24. That would put the group's profits back on a pre-2022 trajectory.

CEO succession: chief executive Richard Whiting is retiring in March 2024, after fifteen years in charge. He's being replaced by finance director Chris Belsham, who has been with NWF since 2017.

Belsham obviously knows NWF well, but his background is quite different to that of Whiting. Whereas Whiting had experience in senior roles at industrial companies prior to joining NWF, Belsham's background was as a corporate finance specialist with "extensive mergers and acquisition" experience.

Fortunately, new CFO Katie Shortland does have plenty of infrastructure and industrial experience, with previous senior roles at FTSE 250 engineer Meggitt and Midland Expressway (M6 Toll operator).

Even so, I wonder whether the company's strategy may evolve under new leadership – perhaps through more aggressive use of acquisitions, or even, maybe, through a sale or partial disposal of the business.

Outlook: the first quarter of the company's financial year (June-Aug) is the quietest period of the year for NWF. But the company says that overall trading during these three months was in line with expectations.

Fuel volumes increased year-on-year with "expected normalisation of margins" reflecting more stable supply conditions. The acquisition of Geoff Boorman Fuels expanded the group's coverage in the South East.

In Food, trading was in line and unchanged from the prior year period. Storage volumes reached a peak of "just over 140,000 pallet spaces", with overflow capacity being used to make up the shortfall from capacity of 135,000 spaces.

The company is investigating opportunities to add a further warehouse.

In Feeds, volumes and margins were stable across the summer, relative to a more volatile period last year.

With the busier months of winter ahead, the company's overall outlook for the year remained unchanged. A trading update is expected later in December, ahead of the NWF's half-year results in the New Year.

NWF Group: crunching the numbers

Description: a distribution group specialising in consolidation in the UK fuel, grocery and agricultural feed markets.

| NWF Group (LON:NWF) | Quality Dividend score: 80/100 | Forecast yield: 4.0% |

| Share price: 207p | Market cap: £101m | All data at 08 December 2023 |

Latest accounts: final results for the year ended 31 May 2023 / trading update for three months to 1 September

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain whether I think NWF could be a suitable addition to my quality dividend portfolio.

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Dividend culture: excellent

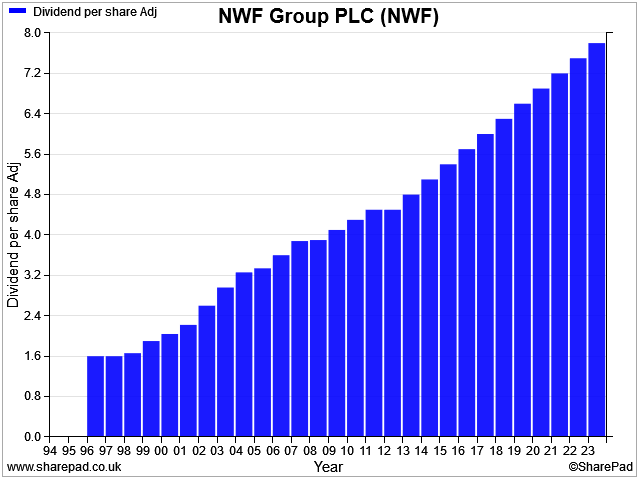

NWF's credentials as a stealth multibagger are supported by its excellent dividend record, in my view.

The company has paid a dividend every year since 1996, during which time its payout has quadrupled:

I score companies for their dividend culture based on the number of years of consecutive payouts. With an 27 years of dividends under its belt, my dividend screen awards NWF a perfect score.

NWF scores 5/5 for dividend culture in my screening system.

Dividend safety: good

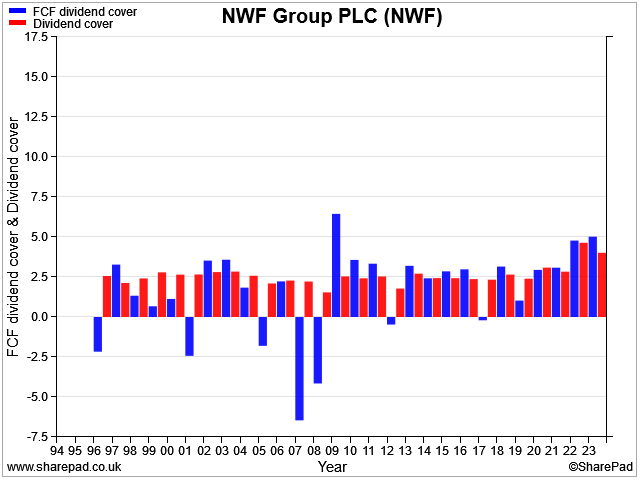

My screen scores dividends for safety by comparing the payout to earnings and free cash flow cover. This reflects the old market adage that revenue is vanity, profit is sanity, but cash flow is reality.

In this chart we can see that earnings cover for the dividend has been remarkably stable for most of NWF's listed life, at 2.0x-2.5x. Free cash flow cover has been more volatile, presumably reflecting spikes in capital expenditure, such as the 2019/20 construction of a new warehouse.

I think it's worth noting the increase in cover levels over the last couple of years. This reflects the exceptional profitability of the last couple of years. Management has prudently maintained the payout at a level that should remain affordable as profits return to more normal levels.

NWF scores 4/5 for dividend safety in my screening system.

Dividend growth: well supported

NWF's dividend has risen by an average of 4.9% per year since the company's first payout in 1996. That is a pretty good record, in my view.

This growth is nice to have and I am sure long-term shareholders are happy with the income they've received.

However, this growth rate does not necessarily tell me very much about whether the growth has been sustainable. This is an important factor for me. After all, no one wants to be ambushed with a shock pay cut.

To score stocks for dividend growth, I look at three metrics:

- dividend per share growth

- free cash flow per share growth

- net asset value per share growth

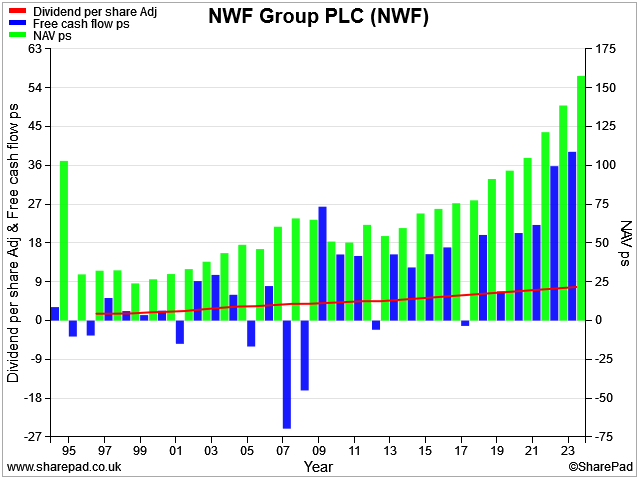

Here's a chart showing these three factors for NWF:

I admit that this chart isn't the easiest to read. But I hope that it shows that NWF's dividend growth has largely been mirrored by growth in its asset base and free cash flow.

Somewhat lumpy free cash flow means NWF doesn't earn a perfect score here. But I think the data support my view that dividend growth has been supported by a corresponding increase in NWF's capacity to pay dividends.

NWF scores 3.7/5 for dividend growth in my screening system.

Dividend yield: average

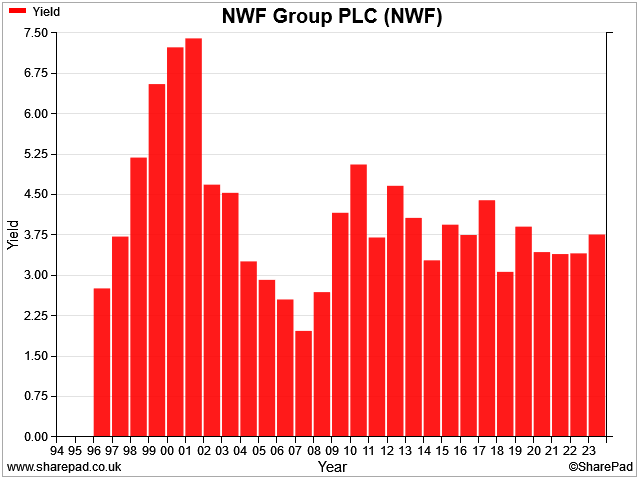

NWF's prudent dividend cover means it's not generally been a high-yielding stock. However, I think the yield has provided a useful guide to the valuation of the business over the years.

Right now, NWF's forecast yield of 4% is roughly in line with the long-term average for the business, according to SharePad.

Recent years have seen the dividend increased by about 4% per year, a rate that's expected to continue.

On this basis, an expected return calculation (dividend yield + dividend growth rate) suggests NWF stock could deliver a total return of about 8% per year, broadly in line with the long-term average from the UK stock market.

NWF scores 2.4/5 for dividend yield in my screening system.

Valuation: could be cheap

My comments above bring me to the subject of valuation. An expected return of 8% seems reasonable to me, but not extremely cheap.

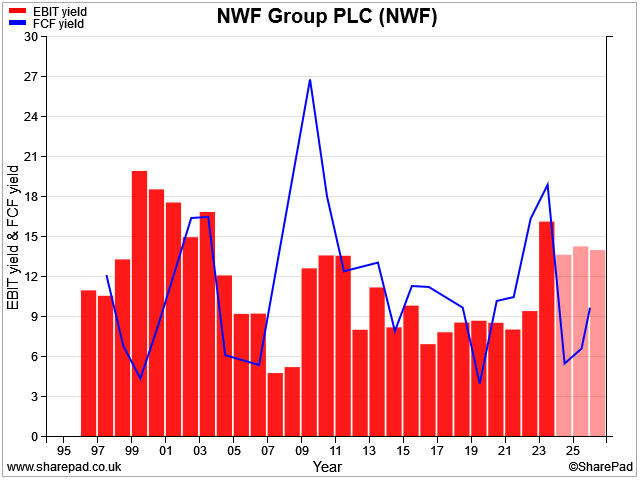

However, on other measures I think the shares look a little cheaper than this. My scoring system looks at a stock's trailing earnings yield (EBIT/EV) and free cash flow yield to gauge valuation.

On these backward-looking measures, NWF shares look extremely cheap. However, we've already seen that the company coming off a period of abnormally high profits.

To compensate for this, I've included SharePad's forecasts for EBIT and free cash flow yield in the chart below. I would argue that on the basis of this year's expected earnings, NWF shares could still be very reasonably priced:

An expected EBIT yield of 13% is well above the 8% level I use as a rule of thumb for value. Similarly, a free cash flow yield of 6% might also be reasonably attractive, providing a comfortable level of cover for the 4% dividend yield.

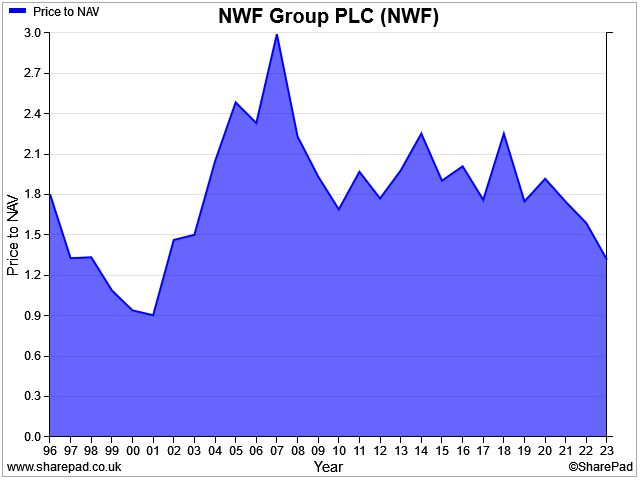

I'd also like to highlight one other measure of valuation that seems interesting to me. This isn't included in my scoring system, but NWF's price-to-NAV ratio is currently at its lowest level for 20 years. Assuming the group's profitability remains fairly stable, I think this could be a value signal:

NWF scores 5/5 for valuation in my screening system.

Profitability: hidden leverage?

In this section I want to look at NWF's profitability as a whole.

In addition, I want to consider the profitability of its individual operating segments and look at how these low-margin businesses are able to generate attractive returns for shareholders.

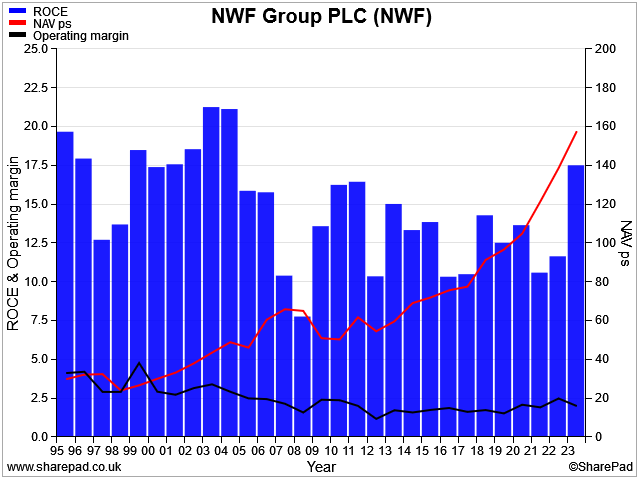

Let's start with the big picture, which is what I use in my dividend scoring system. For this, I use two metrics, return on capital employed and net asset value per share growth.

I don't use operating margin in my scoring, but I've included it above to reiterate an important point about this business – it's very low margin.

Low margins are fairly typical of distributors, due to the pass-through nature of much of their revenue. For example, NWF buys fuel in bulk and then resells it, with a small margin added on.

Well-run distributors can generate decent returns by managing working capital carefully and making good use of supplier credit (effectively free debt). I believe that's the case here.

What the accounts show, however, is that NWF's profitability is heavily skewed to the Fuels division:

| FY23 | Fuels | Food | Feeds | Group |

| Revenue | £757.2m | £70.9m | £225.8m | £1,053.9m |

| Op profit | £12.9m | £4.2m | £3.9m | £21.0m |

| Op margin | 1.7% | 5.9% | 1.7% | 2.0% |

| Pre-tax return on segment assets | 12.7% | 8.4% | 7.9% | 10.4% |

| Pre-tax return on net seg. assets | 54.0% | 15.7% | 15.9% | 27.6% |

Source: FY23 segmental results

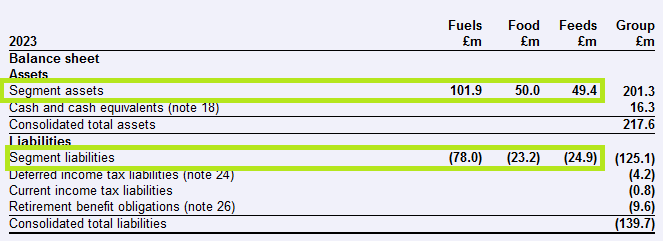

The Fuels business is the most profitable, measured by return on segment assets. However, this profitability is magnified to an impressive 54% when we look at net segment assets.

What lies behind this is – in effect – a high level of gearing in the Fuels business. Liabilities (mainly money owed to suppliers) represented almost 77% of segment assets at the end of last year.

This is a much higher level of liabilities than in the other two divisions:

In reality, I suspect NWF Fuels operates with rapid inventory turnover and collects payment for fuels from customers before it has to pay its suppliers. This means that today's sales are used to pay for earlier orders.

This negative working capital model is used by supermarkets and some other businesses, too – it's effectively a form of free credit and can work well. The only risk is if trading worsens suddenly, when a cash crunch can occur.

The attraction of this business model is that it allows NWF to generate after-tax returns on equity of 15%-20%, despite operating a low-margin business with no current bank borrowings.

If this sounds like a negative comment, it isn't really. I think this is a very well run operation. But I think it's worth understanding the difference between NWF's business model and that of a company that can generate high returns without any form of leverage.

NWF scores 4/5 for profitability in my screening system.

Fundamental health: good

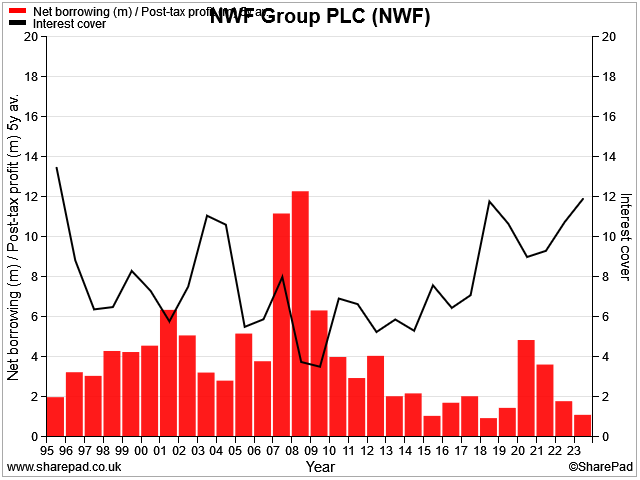

My fundamental health score looks at leverage and interest cover in order to gauge whether a company might have too much debt – or might have problems servicing that debt.

NWF reported a net cash position of £16.3m, excluding lease liabilities at the end of May. Even including these obligations, net debt was only £13.5m, which looks very comfortable to me relative to the group's net profit of £14.9m.

We've already seen that the group has generally produced good levels of free cash flow, so I do not expect any serious problems here. Even so, here's how the chart looks:

Interestingly, the positive value for interest cover (EBIT/net interest paid) tells us that NWF did use borrowing facilities at some point last year. The cash flow statement shows £1.4m of interest paid, of which £0.8m related to bank loans and overdrafts (the remainder related to IFRS 16 lease accounting).

There's no mention of interest received, which suggests to me that NWF's year end of 31 May is probably when the group's cash position is at its strongest each year.

By this time, peak winter trading has passed and NWF has collected cash from its fuel and feed customers. At the same time, the company is able to reduce its stock levels for the summer months, generating a cash surplus.

However, I don't see anything to worry about here. In my view, NWF is in good financial health. I do not have any concerns about the group's balance sheet.

NWF scores 4/5 for fundamental health in my screening system.

Conclusion: a good business

My quality dividend system awards NWF an overall score of 80/100 at the time of writing (December 2023).

As always on this website, my comments and analysis are made as much for my own understanding as anything else. The stocks I write about here are within my investable universe, even if I don't currently own them in my dividend portfolio.

I went into this review with a favourable opinion of NWF, but I haven't previously looked at the business in this much depth.

Having done so, my view is still very positive – I think this is a good business at a reasonable price. But I think I am probably a little more aware about some of the potential weaknesses of this business.

Here's a summary of some of the pros and cons I can see with NWF.

Pros:

- Long and successful track record of incremental growth through a consolidation model

- Clearly-defined business model with good market share

- Food business may provide further significant growth opportunities

- Long-term management culture

- Good cash generation and an impressive dividend history

Cons:

- The Fuels and Feed divisions have seen volumes decline over the last three years. Both operate in mature or perhaps declining sectors and are dependent on consolidation for growth

- There are no obvious synergies between the group's three divisions, except perhaps some procurement benefits; I wonder if this business could eventually be broken up and sold

- Change of leadership after 15 years introduces some succession risk

My view: on the whole, I think NWF shares look fairly valued at current levels. I wouldn't rule out the possibility that the stock could get cheaper in the short term. But on balance, I think there's a good chance I would get an acceptable return from buying the shares at current levels (c.200p).

I would consider owning NWF shares in my portfolio, but at present there's too much overlap with another of my dividend stocks for me to consider a purchase.

However, I will continue to follow NWF with interest.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.