Portfolio shares: Is Legal & General's 7% dividend yield too cheap to ignore?

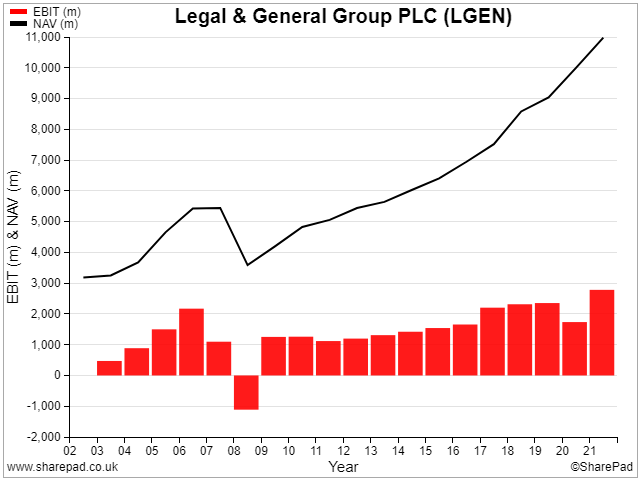

This week I'm looking at a 186-year old FTSE 100 business that has generated double-digit returns on equity and consistent growth in recent years.

The company in question is Legal & General Group (LON: LGEN), one of the UK's largest asset managers and insurers. L&G had £1.4tn of assets under management at the end of last year and is a big player in the retirement market.

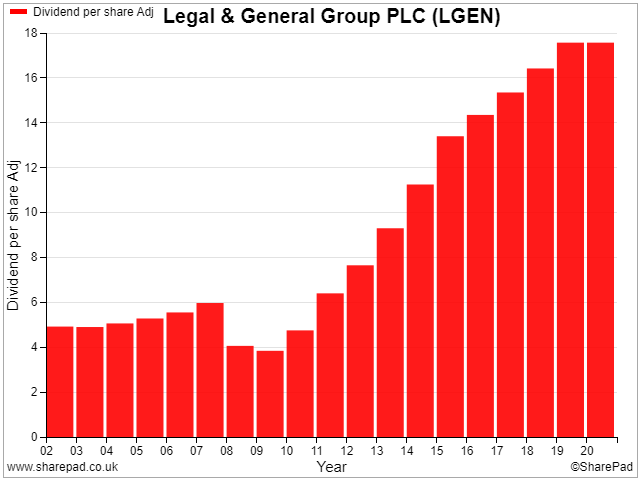

However, despite a seemingly impressive track record, Legal & General is relatively unloved by UK investors. The shares trade on just eight times forecast earnings, with a dividend yield of over 7%.

That's more than 2% higher than the yield on offer from most of the big UK banks, despite their dismal record since the 2008 financial crisis.

I'm a fan of Legal & General and see the stock as a good income investment. The dividend was maintained (albeit cut) through the 2008 financial crisis. It was paid as usual in 2020, when many insurers withheld their payouts.