2021 Quality Dividend portfolio review

Welcome back - and a belated Happy New Year to all readers.

A detailed stock review is in the pipeline, but I'd like to start 2022 with a portfolio review. I'm going to take a somewhat alternative approach to this, as I don't yet have a full year of figures for my Quality Dividend model portfolio (although my personal portfolio, which is largely invested in the same stocks, has been running in a similar way for some years).

Instead, I want to look at the overall shape and characteristics of this portfolio. I'm going to focus on two areas which I think are likely to define the model portfolio's future performance:

- Sector allocation

- Financial characteristics

Quality Dividend portfolio: financial characteristics

In the excitement and interest of stock picking, it's sometimes easy to lose focus on the importance of building a quality portfolio. The success of individual stock picks is obviously important, but the results they deliver in aggregate is ultimately the measure of success.

To measure this, one technique I've found useful is borrowed from Terry Smith's Fundsmith reporting. Smith averages the key financial metrics for all the stocks in a portfolio. The portfolio then appears as if it's a single business.

I've become a fan of this approach, which I think can be quite revealing. I've done the same calculations for my Quality Dividend model portfolio. Here's how it looks:

| No. of stocks | Median mkt cap | TTM ROCE | TTM EBIT yield | TTM FCF yield | TTM div yield | 5yr avg div growth | Forecast div yield | Net debt/5yr avg net profit |

| 20 | £3.2bn | 20.6% | 8.7% | 6.7% | 4.1% | 8.3% | 4.4% | -0.2 |

Data source: SharePad/author analysis.

What does this tell me?

The median size of the companies in my portfolio is £3.2bn - squarely in mid-cap territory. History suggests this could offer a good mix of growth and income, over time.

On average, these companies generated a return on capital employed of 20.6% over the last 12 months. That's well above the wider market average, which I believe is 8%-10%.

The trailing free cash flow yield of my portfolio companies collectively is 6.7%, which seems attractive to me in these low yield times.

More importantly, this free cash flow covers the portfolio's trailing dividend yield of 4.1% by 1.6 times. This suggests to me that my portfolio companies are not overdistributing dividends. Instead, they are keeping some cash back for debt reduction and growth investments. That's what I want to see in a long-term investment.

Next, we can see that my model portfolio companies have delivered average dividend growth of 8.3% per year over the last five years.

This growth figure is slightly ahead of the 7.3% annual dividend growth implied by the portfolio's current forecast dividend yield of 4.4%. This suggests to me that dividend forecasts for the current year look fairly reasonable, assuming no unexpected disruptions.

Finally, aggregate leverage appears to be pretty light. I'm not a fan of heavily geared businesses, as they increase the downside risk for equity holders. The model portfolio contains a number of non-financial businesses with net cash. The remainder are modestly geared, with one exception.

If my model portfolio was a single stock, I think it would look like a profitable, cash-generative, and growing business. I'm pretty sure I'd want to own it.

Of course, this does not mean that the individual stocks in my model portfolio are slam-dunk buys. Averages can be used to mask a multitude of sins. For example, cash cows with limited growth potential might be masking over-valued growth stocks with poor cash generation.

There's always a risk. But I'm pretty comfortable with the overall profile of my model portfolio. It shows all the characteristics I'm looking for in my personal investments.

Sector allocation

"Diversification is a protection against ignorance. It makes very little sense for those who know what they are doing".

This Warren Buffett quote is often cited by investors as a reason to concentrate their portfolio in their best ideas.

It's certainly true that Buffett made a lot of money from a few investments in his early years as an investor. But even he doesn't do this so much anymore. Mr Buffett's investments at Berkshire Hathaway look quite diversified to me, covering sectors including financials, utilities, tech, consumer goods and industrials.

A concentrated approach can work very well. However, I think the real problem here is that survivorship bias can give us a false perception of how risky it is to own just a few stocks.

We all know about the big winners, but concentrated investors who fail tend to disappear off the radar.

To use a crude analogy, there are far more actors waiting tables in Hollywood than there are at the Oscars each year.

I admire people who can commit totally to one idea and risk everything, but I've never been one of them. I don't know what the future holds. And I won't necessarily be able to spot internal problems at my companies before they blow up.

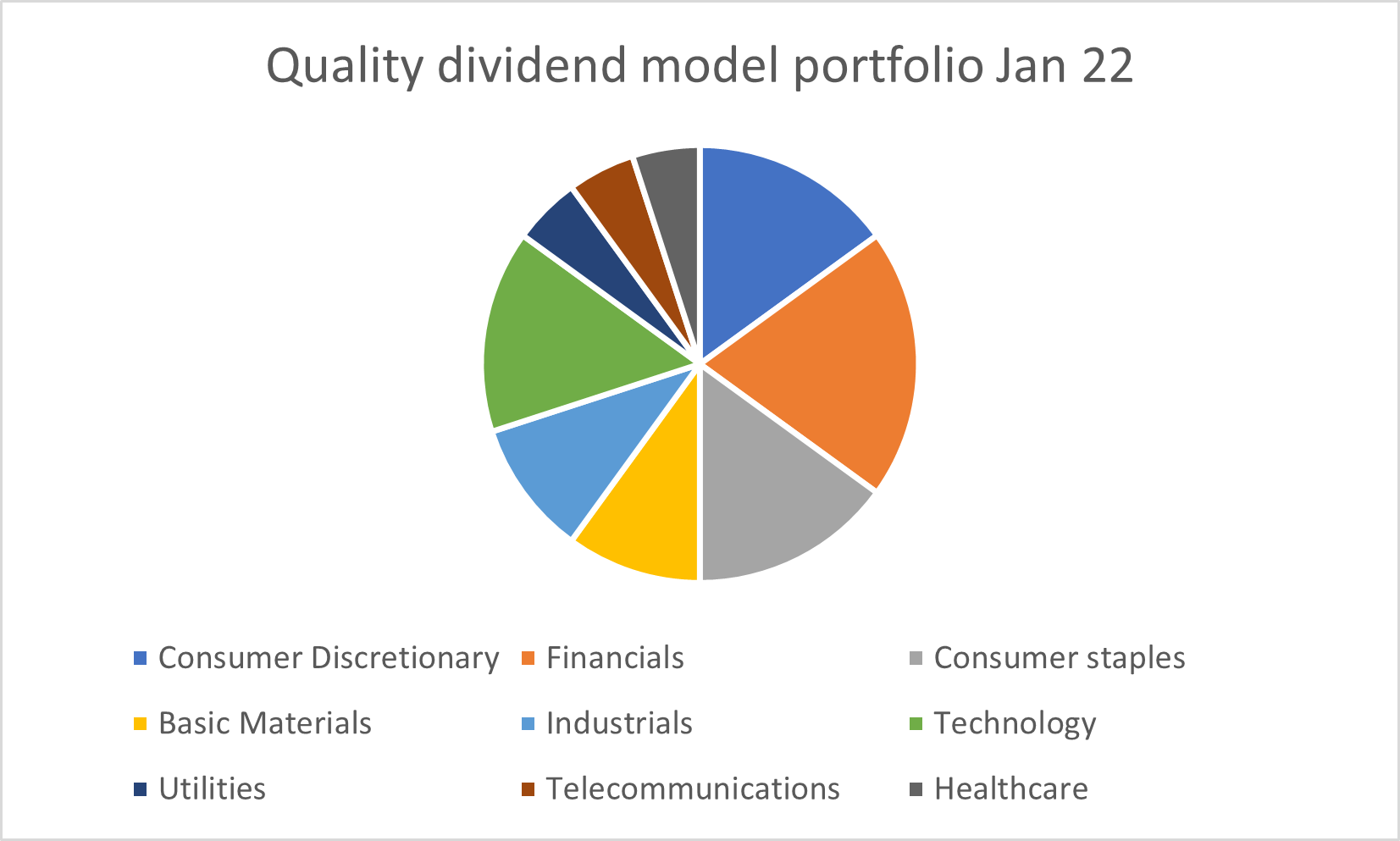

For this reason, I've constructed my model portfolio with quite deliberate sector diversification. I'll write about this in more detail in the future. But in short, I use the 10 main economic sectors as a starting point and aim to select stocks from each.

However, I'm not going to buy shares in companies which score badly in my system just to tick a box. For this reason, the model portfolio currently includes stocks from eight different sectors. I suspect this may be a realistic maximum, if I'm to avoid buying shares without much conviction.

I'm quite happy with this situation. Circling back to Mr Buffett, I think what the Sage really meant was that adding more companies to a portfolio doesn't automatically make it safer. Long-term portfolio safety comes from paying a reasonable price for shares in good companies. Anything else is just speculating.

My model portfolio currently contains 20 stocks. I don't intend to exceed this limit, but I may let the size fall slightly over time, if I feel it's appropriate.

Here's how the portfolio looks in terms of sector allocation at the start of 2022:

I'll dig into these selections and explain my portfolio trading rules in more detail in the coming weeks and months.

For now, thanks for reading - and good luck in the markets in 2022.

Roland

Disclaimer: This is a personal blog. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.