2025 dividend portfolio review: rising income wasn't enough

My model dividend portfolio delivered income growth ahead of inflation in 2025, but this didn't translate into capital gains. In this update I review progress and summarise my plan for the year ahead.

Welcome to my quality dividend portfolio review for 2025.

As a quick reminder, the portfolio documented on this website is a model portfolio that largely mirrors my main personal portfolio.

My primary goals for the model portfolio are:

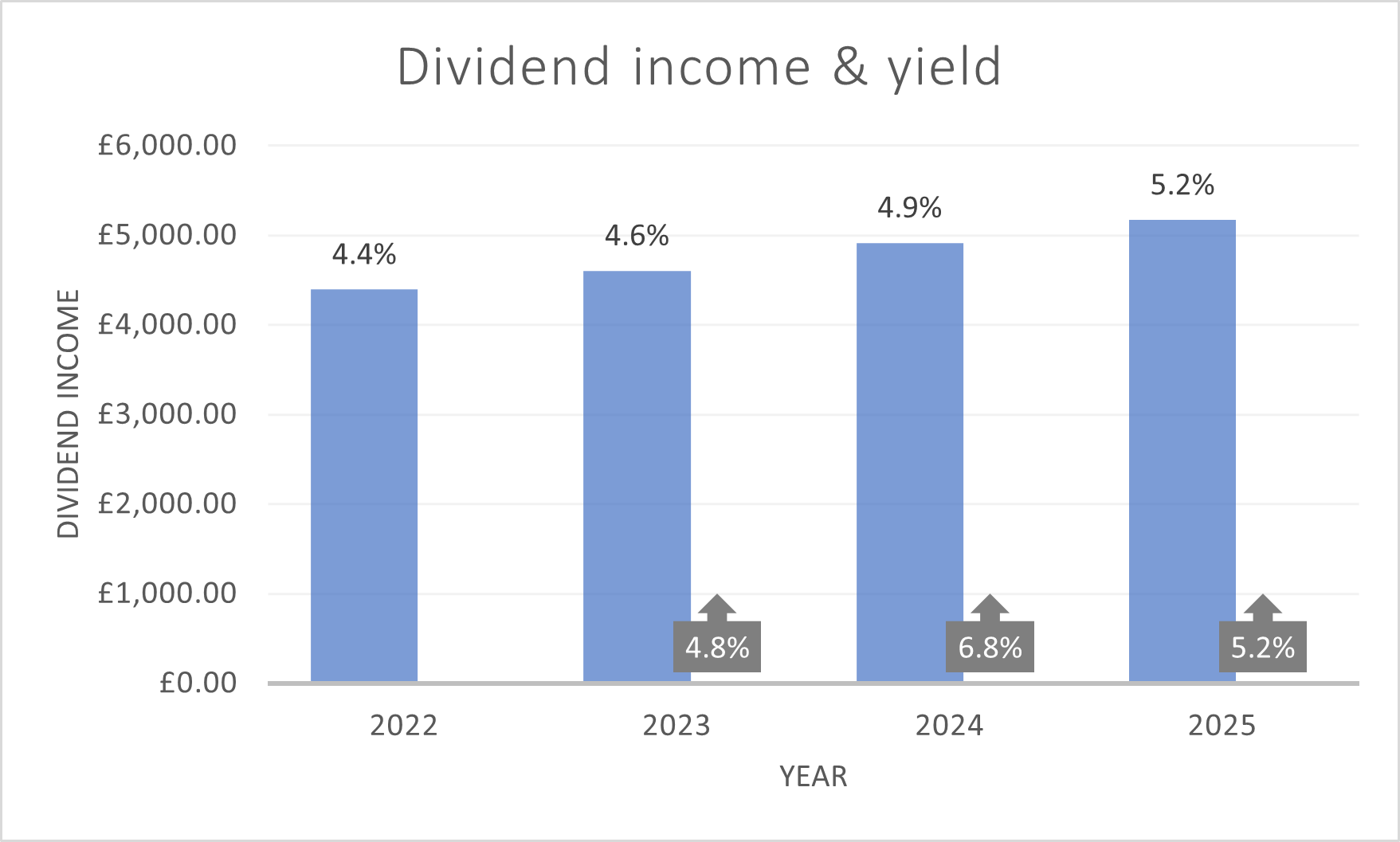

- Provide a dividend yield greater than the FTSE 100;

- Provide inflation-beating income growth.

Underlying this strategy is the theory that steady income growth should lead to corresponding share price growth over longer periods, as stocks re-rate to maintain stable yields. In theory at least, this should mean enjoying useful capital gains over time, while also receiving a rising income.

I'm happy to report that the portfolio met its income goals in 2025:

Unfortunately, the hoped-for capital gains did not materialise. I'll discuss this shortly. Given the strength of the UK market last year, this is especially disappointing.

In the remainder of this review, I'll take a closer look at the portfolio's performance in 2025, summarise the year's trades and review my plans for managing the portfolio over the coming years. I'll also update my record of the portfolio's key financial metrics.

- Q4/2025 performance review

- Portfolio changes in 2025

- Position weightings

- Key financial metrics for the portfolio

- Final thoughts

2025 performance review

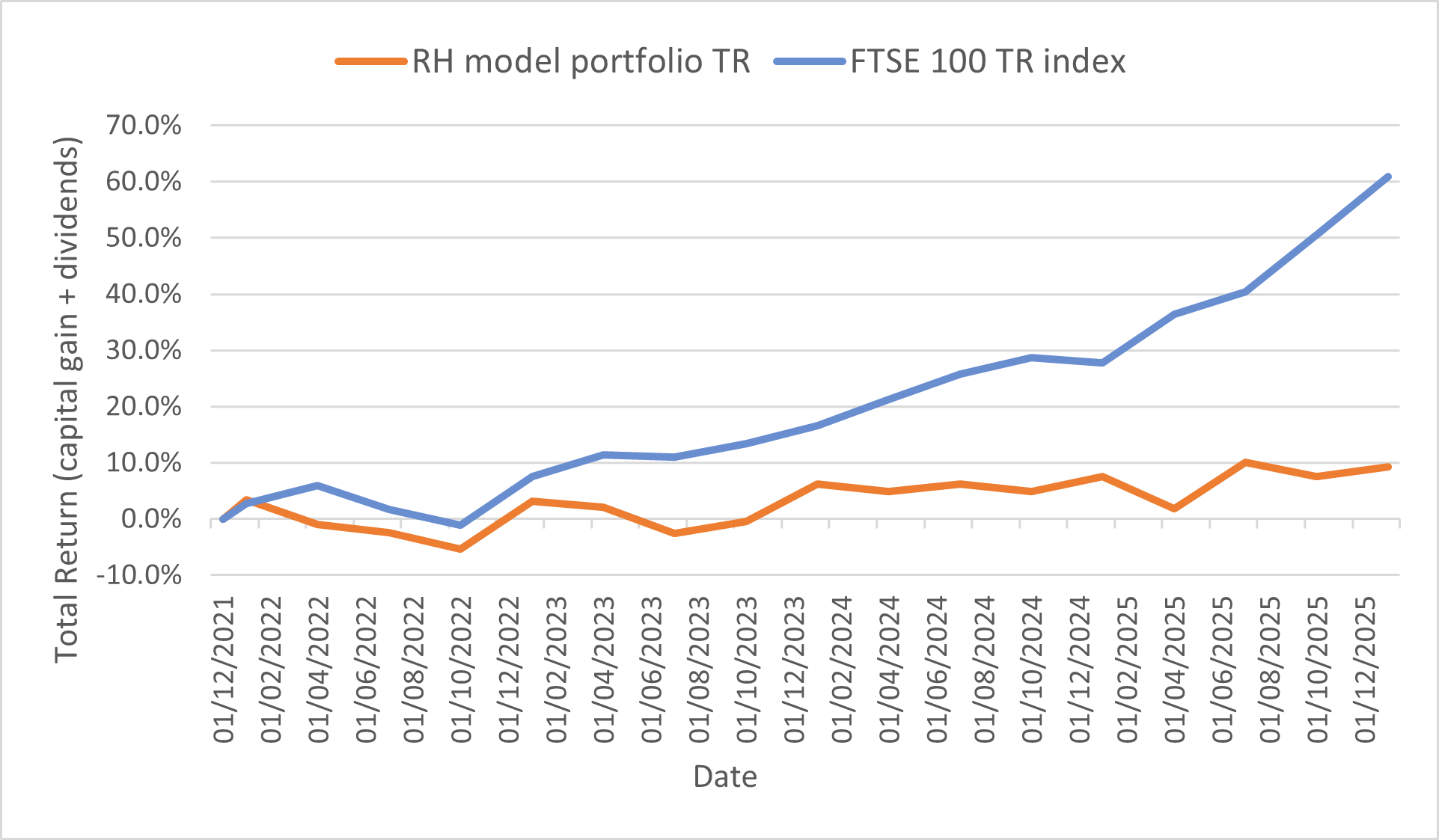

Here's how the portfolio's performance panned out at the end of the quarter, measured on a total return basis (share price movements + dividend income):

2025 performance:

- RH model portfolio total return: 1.5%

- FTSE 100 Total Return index: 25.8%

The chart below gives a broader view on the model portfolio's performance since its inception in December 2021. It's undeniably disappointing; the portfolio underperformed cash last year, during a period when the FTSE 100 delivered a 20%+ return:

My model portfolio is focused on delivering a rising and reliable income. But capital gains are also needed in order to achieve a satisfactory long-term total return.

The model portfolio has fallen woefully short in this regard, delivering a total return of just 9.2% since inception in December 2021 (2.2% annualised). This compares to a 60.8% for total return for the FTSE 100 (12.3% annualised).

As I discussed in my Q3 review, I believe the lack of capital growth is largely due to losses that have resulted from opening new positions at the wrong time, in too large a size.

For this reason, I've altered my approach so that I start new positions with a smaller weighting than previously, only increasing them as they deliver on expectations.

Alongside this, I've introduced added some new momentum rules to my scoring system which I hope will help to highlight stocks where the outlook is positive and improving

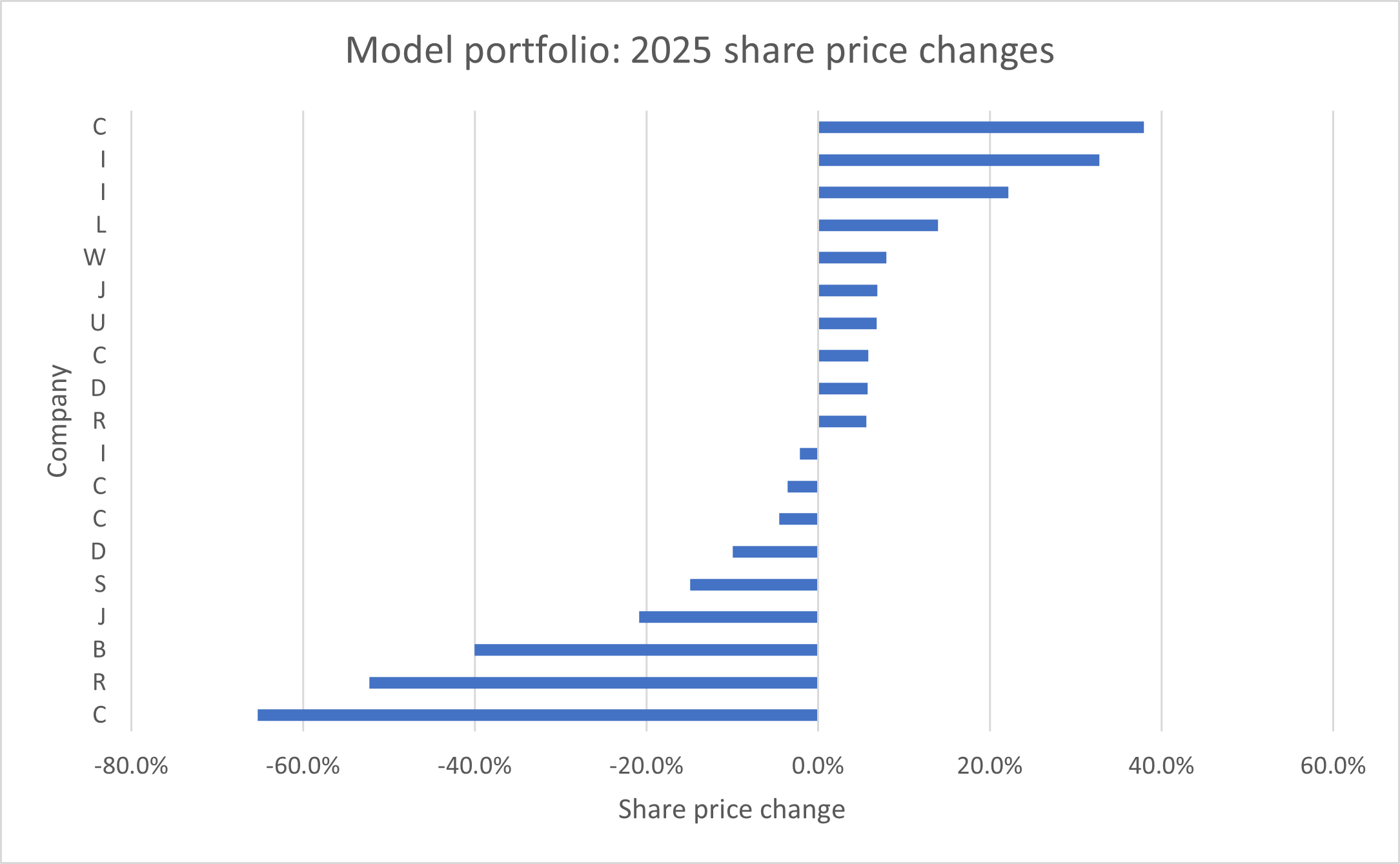

This chart showing 2025 share price movements across the portfolio highlights this point again. While there were some respectable gains that could have supported a positive overall result, there was a painful drag from three big losers:

I plan to follow my amended approach in 2026 to see if it delivers an improved result. If not, I may need to consider a more drastic change of strategy.

It's painful to realise that if I'd invested in a FTSE 100 tracker in December 2021 and done nothing since, my portfolio could be worth c.50% more than it is today.

Portfolio changes in 2025

Portfolio changes were relatively limited last year, with one stock leaving the portfolio and no new additions.

- I sold concrete floor levelling specialist Somero Enterprises at the start of October, as discussed in my September update. In short, I concluded the company's competitive advantages and growth potential were less compelling than they might have been in the past:

"I fundamentally misunderstood the exceptional market conditions Somero was benefiting from when I originally purchased this business – management now admits that a significant amount of demand was pulled forward during the 21/22 warehouse boom, thus contributing to weaker sales currently."

... the new CEO has indicated a potential change of strategy as he pursues new lines of growth. I can't really fault his logic, but the company's commentary on current market conditions doesn't seem that encouraging to me and I note there are not yet any broker forecasts for 2026.

As a result of the Somero sale and accumulated dividend income throughout the year, the portfolio's cash weighting had reached 12% by early October – before even adding fourth quarter dividend income.

While I like to have some cash, this was too much. To put some of this cash to work, I made a series of seven top ups at the end of December. I summarised my thinking behind each purchase in this update:

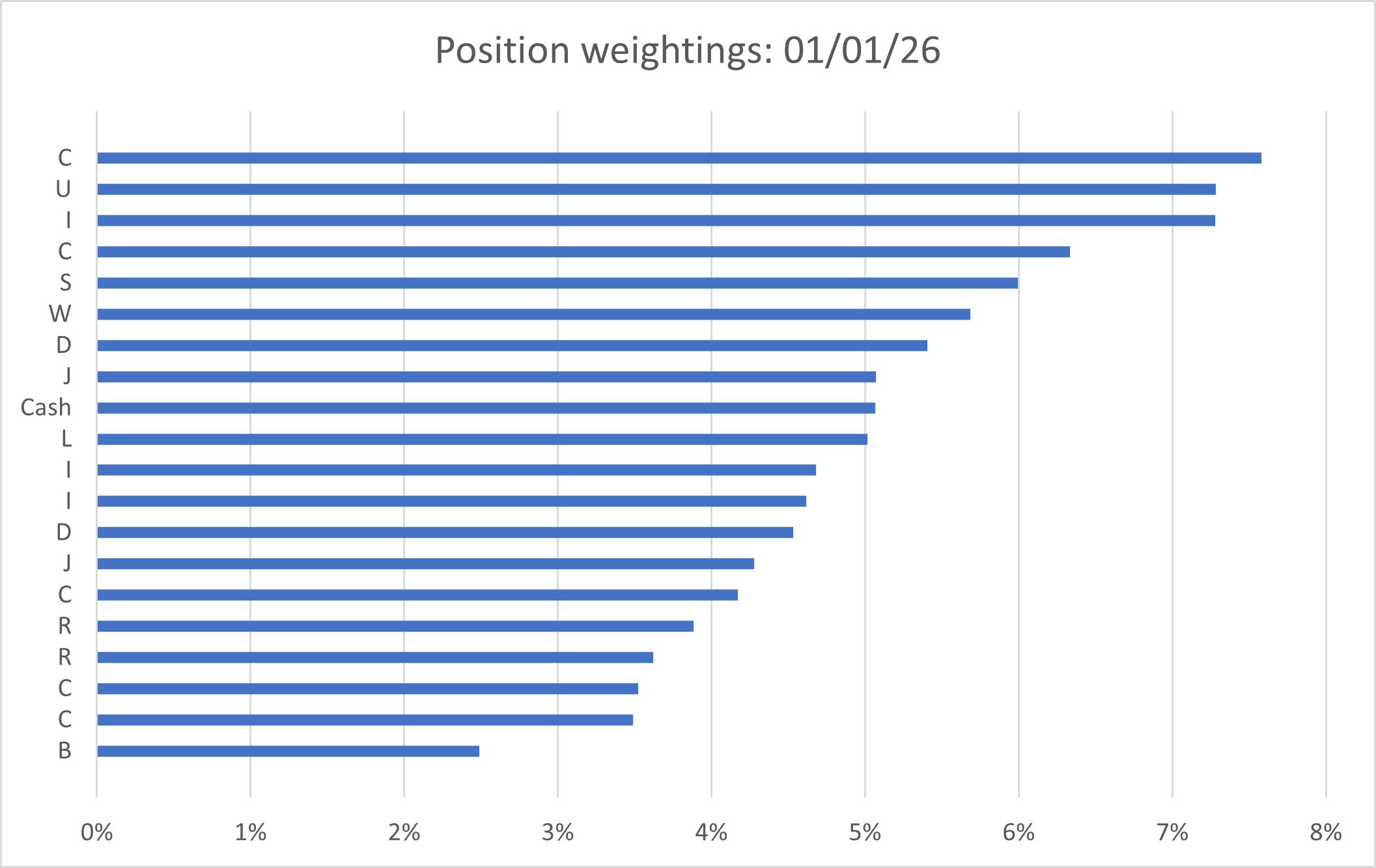

Position weightings

Here's a snapshot of how the model portfolio looked at the end of the quarter (paid subscribers can see this chart with company names on my portfolio page):

As mentioned above, I sold the Somero Enterprises in October. This means the portfolio now has 19 stocks.

My target is to maintain the portfolio at 20 stocks, although there's some flexibility about this. I'm likely to add a 20th company this year but am not in a desperate rush to do so. I'm hoping to review some potential ideas in some new share reviews in the coming months.

Portfolio: key financial metrics

In the final section of each quarterly review I take a look at the portfolio as if it was a single stock. I think it's useful to view the portfolio in this way to ensure that it still has the aggregate characteristics I'm looking for, such as strong profitability and good cash generation.

Of course, averages can mask a multitude of company-specific issues. This approach will not protect against that, but I still think it's a useful way to track broad changes in the quality and valuation of the portfolio over time.

Here's how the model portfolio looked at the end of December 2025:

| Period end | 31 Dec 21 | 31 Dec 22 | 31 Dec 23 | 31 Dec 24 | 31 Dec 25 |

| Median mkt cap | £3,200m | £2,300m | £1,700m | £983m | £1,230m |

| TTM ROCE | 20.6% | 22.2% | 21.0% | 22.5% | 20.2% |

| TTM EBIT yield | 8.7% | 9.4% | 11.3% | 11.0% | 8.7% |

| TTM FCF yield | 6.7% | 7.0% | 7.1% | 8.0% | 6.4% |

| Net debt/5yr avg net profit | -0.2x | 0.3x | 0.2x | -0.3x | 0.0x |

| TTM div yield* | 4.1% | 4.5% | 5.3% | 5.4% | 5.1% |

| 5yr avg div grth | 8.3% | 7.6% | 6.3% | 6.3% | 5.0% |

| fc div yield* | 4.4% | 5.0% | 5.2% | 5.4% | 5.3% |

| No. yrs div paid | 24 | 21 | 24 | 24 | 26 |

Scroll L-R (Data source: SharePad/company accounts. Some adjustments were needed. *Dividend yields were weighted to reflect position size from 2025 onwards. Prior to this they were simply averaged.)

In Q3, I commented on the gradual decline in the median size of the companies in the portfolio. I'm pleased to see this started to rise again last year. While I am agnostic on market cap, my feeling is that the optimum position for my strategy is to have a balanced mix of small, mid-sized and larger companies.

Looking at the table above, the average return on capital from the companies in the portfolio remained high, suggesting that collectively, they remain good quality businesses.

Valuation metrics (EBIT yield and FCF yield) remain at levels I'd see as decent value, but are notably lower (i.e. more expensive) than one year ago.

Fortunately, my portfolio companies haven't succumbed to the temptation of borrrowed cash. In aggregate, they had a broadly neutral net cash/debt position at the end of 2025.

The portfolio's forecast dividend yield of 5.3% is in line with past performance and comfortably ahead of the FTSE 100's expected 3%-4% yield in 2026.

My companies have also maintained their strong record of unbroken dividend payouts. On average, my stocks have paid unbroken dividends for the last 26 years (although this may have included some cuts).

Final thoughts

My quality dividend strategy was always intended to be a long-term approach that relies partly on compounding of companies' reinvested earnings and mean reversion of yields to deliver capital gains.

Periods of underperformance were inevitable, as with any strategy. But there's no doubt that total return performance has been disappointing so far, despite the progressive income the portfolio has generated.

Being a stockpicking investor requires a certain level of inherent optimism. Otherwise it would be illogical to choose to own individual stocks.

Naturally I am hoping performance will improve in 2026, with consistent application of the strategy. But I know there is no guarantee of this.

I will continue to document progress over the coming year.

As always, thank you for reading – and good luck in the markets in 2026!

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.