August 2022 dividend portfolio news

I review August's results and news from my quality dividend model portfolio.

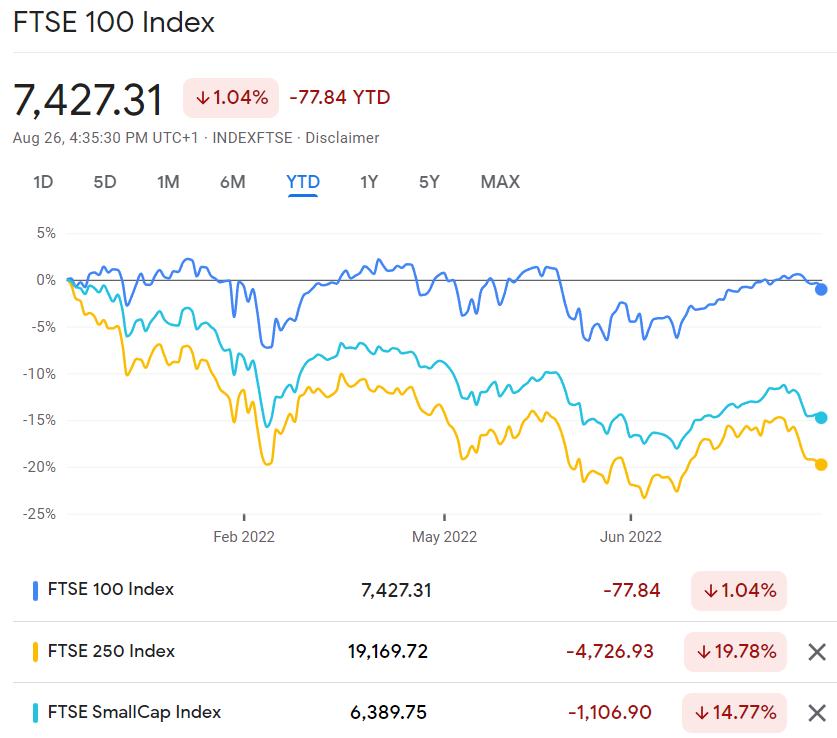

The FTSE 100 looks likely to end August up by around 1%. Smaller cap indices have continued to lag the big caps, echoing the trend seen so far this year.

My quality dividend model portfolio has an average market cap of around £1.6bn, so is weighted towards the FTSE 250. The contents of this monthly update reflect this mix. In August, I had one FTSE 100 stock report results, two FTSE 250 members and one small cap.

The largest two of these were Legal & General and Direct Line Insurance. The other two were member-only stocks, details of which are only available to subscribers. I'd strongly recommend this – you'll get full access to my model dividend portfolio and all portfolio share reports.

The model dividend portfolio contains the same shares I own myself.

Disclosure: unless otherwise specified, Roland owns all the shares discussed in this article.

For an explanation of my Quality Dividend score, see here.

Legal & General

Description: FTSE 100 asset management, retirement, and life insurance group. Click here for an archive of past posts.

| Legal & General (LON: LGEN) | Quality Dividend score: 91/100 | Forecast yield: 7.6% |

| Share price: 256p | Market cap: £15.3bn | All data at 27 August 2022 |

RNS release: L&G half-year results 2022

"We've made a good start to the year, with operating profit and EPS up 8%, cash and capital generation up double digits, DPS up 5% and a return on equity of 21%."

Legal & General is currently the highest-ranking financial stock in my screening results. The stock's valuation has remained stubbornly modest in recent years, despite the group continuing to deliver high returns on equity and strong cash generation.

This year's half-year results continue the theme. The group reported £4.4bn of new pension business (H1 2021: £3.1bn), while the investment management division saw £65.6bn of net inflows (H1 2021: £27.4bn).

These helped to lift operating profit by 8% to £1,160m. Capital generation rose by 14% to £0.9bn. As a result, L&G's regulatory Solvency II coverage ratio increased to an ample 212% (H1 2021: 182%).

Group profitability remained excellent, with a half-year return on equity of 21.3%.

With an economic slowdown now seemingly almost certain, management were also keen to highlight the quality of L&G's bond portfolio.

According to the firm, 99% of the group's £73.2bn annuity bond portfolio is investment grade. The company has not had a default for the last 13 years and its £2.7bn credit provision remains unused.

During the first half of the year, 100% of scheduled cash flows were received from the group's direct investments (i.e. alternative assets, such as property and renewable energy).

This is all very reassuring, but I think it's probably fair to say that it's too soon to see much impact on good quality investment grade assets. The next 12-18 months may be a more severe test.

However, given Legal & General's large scale and 180-year track record of investing in long-term assets, I'm inclined to think the shares should be a fairly safe place for my cash.

Dividend: The interim dividend was increased by 5% to 5.44p per share. That's consistent with forecasts for a full-year payout of 19.4p per share, which would give a 7.6% yield.

Outlook: Legal & General remains on track to deliver the five-year plan set out in November 2020. From a shareholder perspective, the company expects to increase dividend coverage by growing earnings and capital generation faster than the payout.

With a forward yield of 7.6%, I'd expect that the guided "low to mid-single digit" dividend growth should be enough to deliver 10%+ annual returns from the stock.

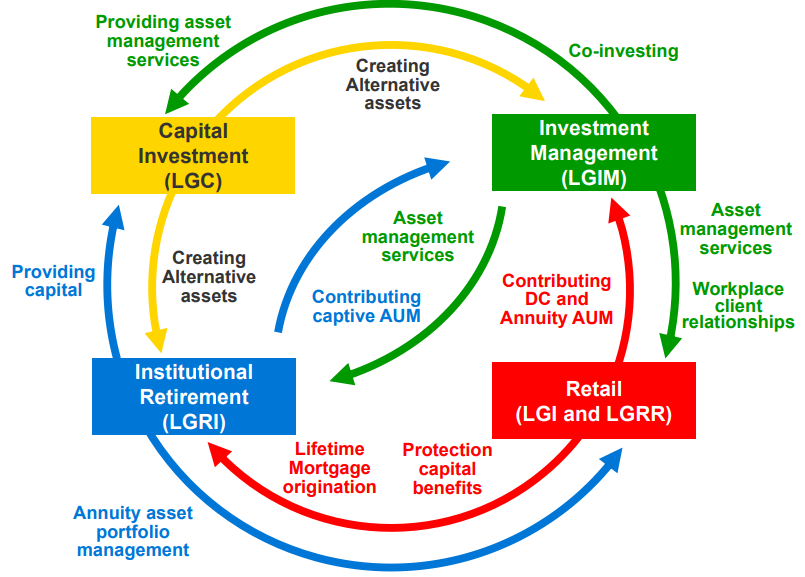

My view: Rising interest rates and rampant inflation are presenting less experienced investors with a whole new world. But Legal & General has survived many such challenges before and I believe the group's integrated model should continue to perform well.

Legal & General's long-term focus and large scale make it a comparative rarity in the UK market. I'm very happy to continue holding the shares, and believe they're attractively valued at current levels.

Direct Line Insurance

Description: A FTSE 100 company that's one of the UK's largest motor, home and commercial insurers. Click here for an archive of past posts.

| Direct Line Insurance (LON: DLG) | Quality Dividend score: 65/100 | Forecast yield: 9.9% |

| Share price: 207p | Market cap: £2.7bn | All data at 27 August 2022 |

RNS release: Half-Year Report 2022

"... uniquely complex motor market conditions during the first half, due to significant regulatory changes, heightened claims inflation and macroeconomic uncertainty, have challenged our short-term profitability."

I covered Direct Line's recent profit warning and updated guidance in my July review, which you can read here. August's half-year results did not add a great deal to the picture, except to flesh out some of the numbers.

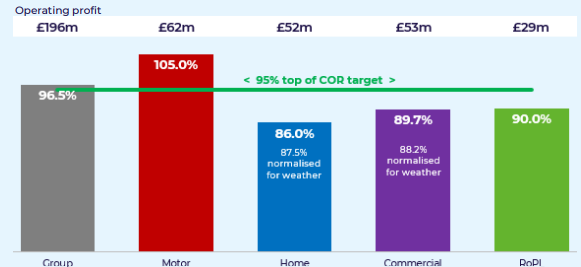

Gross written premium for the half year fell by 2.1% to £1,523m, while operating profit dropped 47% to £195.5m. The group's combined operating ratio rose from 84.2% in H1 2021 to 96.5%.

Annualised return on tangible equity fell by 12.3% to 17.8% (H1 2021: 30.1%). On a statutory basis including intangibles, I calculate a trailing 12-month return on equity of 10% – some way below the group's historic average of c.15%.

This slide from the analyst presentation made it clear where the problem lay. Direct Line's motor insurance business made an underwriting loss in H1, as claims costs exceeded premium income:

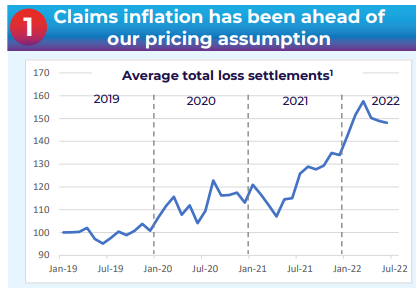

Here's why. According to the company, motor insurance claims costs have risen by around 50% since the start of 2019:

CEO Penny James admits that claims costs have risen faster than the company expected, but she believes that the cost advantages of its in-house repair network and new pricing models will help to recover this lost margin. James also says that Direct Line (and others) are continuing to push price rises into the market.

Dividend: The interim dividend was left unchanged at 7.6p per share. Assuming the full-year payout also remains unchanged, this gives Direct Line shares a prospective yield of almost 10%.

This payout isn't expected to be covered by earnings, but if performance improves in 2023 as expected, I think that shareholders may avoid a dividend cut.

Outlook: The company expects the 2022 full-year combined operating ratio to be 96%-98%, normalised for weather. This ratio is expected to improve to "around 95%" in 2023 and to return to a target range of 93%-95% over the medium term.

The company's ongoing target of achieving at least a 15% return on tangible equity is unchanged.

Direct Line's underwriting profitability is clearly going to be marginal this year. However, the group's Solvency ratio of 152% remains adequate and I think Direct Line, like L&G, should start to benefit from higher interest rates as we enter next year.

My view: It would be naïve for me to ignore the risk of a dividend cut here. However, I believe Direct Line remains a good business that's doing all the right things.

Most UK motor insurers have reported similar headwinds in recent months. The main concern seems to be how soon discipline will return to the wider market. If cheap capital remains available to support undisciplined underwriting, insurers like Admiral and Direct Line could face a period of sub-par returns or shrinkage.

I'm still comfortable holding Direct Line in the model portfolio and my own holdings.

The remainder of this post is only available to (free) members. Please sign up to read on – I'll never spam you and will generally email no more than once a week.