Quality UK dividend portfolio

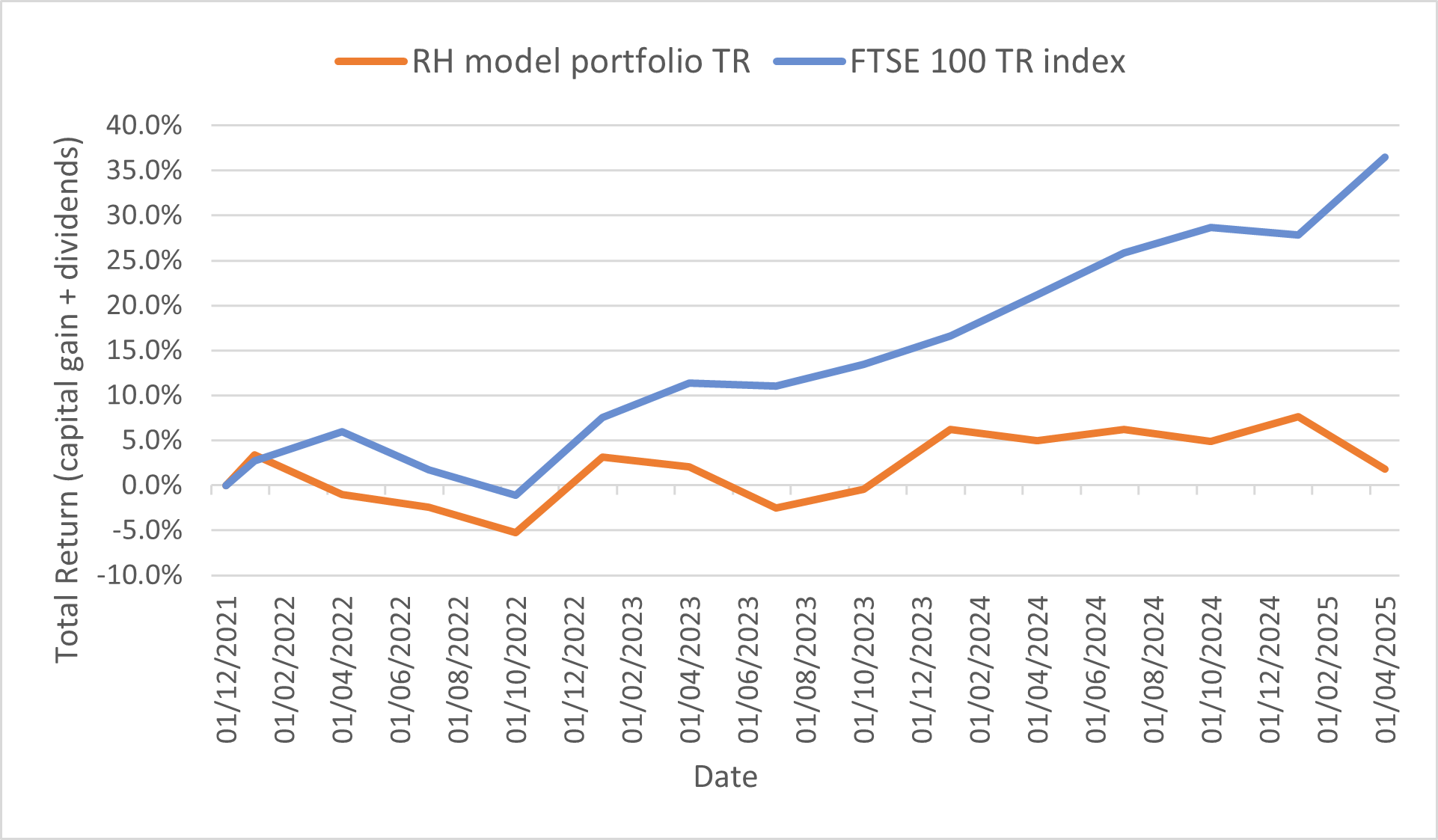

This page provides an overview of the shareholdings in my model dividend portfolio and its historic performance.

You can find all of my quarterly portfolio performance updates on my newsletter page.

Portfolio key stats:

- No. of companies: 20

- Median market cap: £853m

- 5yr average annual dividend growth: 7.4%

- Average number years dividend paid: 25

- 2024 portfolio average forecast dividend yield: 6.2%

- Portfolio average dividend screen score: 68/100

(Data as of 01/04/25)

For the avoidance of doubt, the portfolio documented on this site is a model (virtual) portfolio.

I own all of these shares in my personal portfolio, but real-world considerations mean that my personal portfolio is not exactly the same as the model portfolio. For example, I've owned many of these stocks since before I created this model portfolio, so my purchase prices and position sizing are different.

The stocks in this portfolio are selected from the results of my dividend screen, which scores each stock on a number of attributes. You can read about my screen here.

You can read more about my policy for selling shares and buying new ones for the model portfolio in this piece.

The portfolio is only available to subscribers.