Dividend notes: a fair price for quality? DPLM, BBOX

I review the latest updates from FTSE 250 industrial group Diploma and warehouse specialist Tritax Big Box REIT.

Welcome back to my dividend notes. Today I've covered two companies, both of which could of interest to me as income investments.

Companies covered:

- Diploma (LON:DPLM) - I'm a fan of this buy-and-build business, which is also a Fundsmith shareholding. Strong H1 trading has prompted management to inch up full-year guidance. Not cheap, but a quality stock, in my view.

- Tritax Big Box REIT (LON:BBOX) - One of the larger UK REITs, currently with a useful 5% yield. However, the logistics sector overheated during the pandemic and I think there's still some risk over financing costs and asset values.

This is a review of the latest results from UK dividend shares that are in my investable universe and may appear in my screening results.

Dividend notes is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

Diploma (DPLM)

"Strong first half, upgrading full year guidance"

Diploma is an industrial group operating in three sectors - controls, seals and life sciences (medical equipment). Customer sectors include healthcare, aerospace, defence and energy.

Interestingly, Diploma's history is in some ways similar to that of Spirent Communications, which I looked at in more depth over the weekend.

Both of these UK businesses were founded in the 1930s and have restructured to focus on higher-growth sectors over the last 20 years or so.

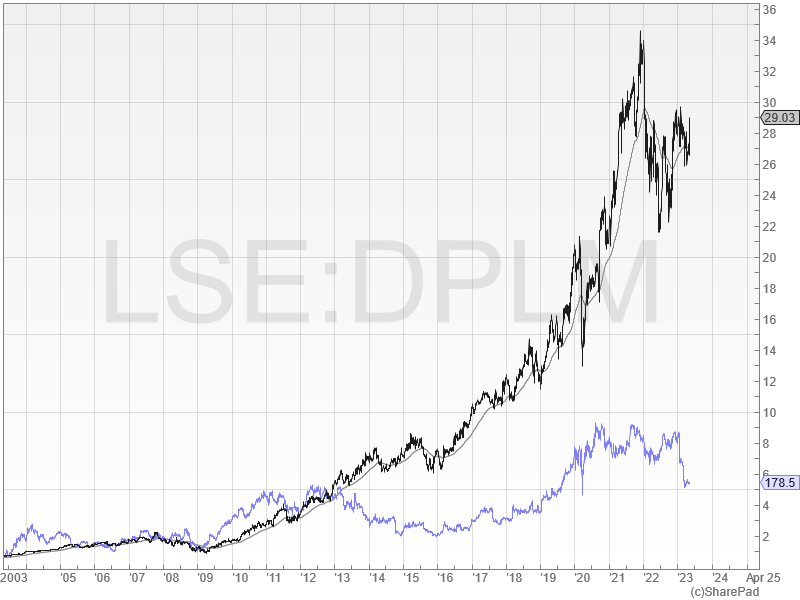

However, Diploma's more consistent growth has resulted in far superior shareholder returns. The stock has been a 39-bagger over the last 20 years:

In my view, Diploma is a high-quality business. I'd like to own the shares, but the firm's attractions are hardly a secret and the valuation has prevented me from buying in recent years – rightly or wrongly.

Today's half-year results cover the six months to 31 March 2023 and contain an upgrade to full-year profit guidance. However, the shares have only gained 2% at the time of writing, suggesting the good news was already in the price.

Let's take a look. I've also included a brief overview of the business below to help me build a reference point for when I next look at this stock.

Financial highlights: Revenue rose by 30% to £582.8m during the half year. Excluding the impact of acquisitions and foreign exchange, organic revenue was 10% higher.

Operating profit for the period rose by 59% to £92.5m, giving an operating margin of 15.8%. This was converted into £52.8m of free cash flow.

Adjusted earnings rose by 26% to 59.1p per share, while the interim dividend was lifted 10% to 16.5p per share.

Net debt fell to £154m with the benefit of £233m of cash generated from the recent placing (some was also used to fund an acquisition).

Operating summary: Diploma is continuing to diversify in order to drive growth and reduce its dependency on individual market sectors.

Controls (revenue +13% to £278.8m): the group's largest division generated 63% of operating profit during the first half and boasts 20%+ operating margins.

Products include wiring, connectors, control devices and other elements for "technically demanding applications". Key customers are aerospace, defence and energy.

About half of all controls revenue comes from Windy City Wire, which maintained double-digit sales growth in H1.

Seals (revenue +8% to £198.4m): the seals business supplies products that are typically used in heavy mobile machinery and fluid power products. In other words, expensive machines that can be immobilised for want of a replacement seal.

Diploma's customer offering is built around service quality as well as product quality, offering high stock availability and fast deliveries.

Seals generated 32% of operating profit at a margin of just under 15% in H1. Management report strong trading in North America, the UK and Australia.

Life sciences (revenue +4% to £105.6m): this business supplies a range of consumables and equipment to healthcare customers. It generated an operating profit of £16.7m at a margin of 15.8% during H1.

The company says growth is recovering after the pandemic caused a reduction in routine surgical and operating procedures. I've seen similar comments from other healthcare businesses, so don't have any reason to doubt this.

Management describe an "exciting outlook" as governments act to address healthcare backlogs and increase funding of capital projects.

Outlook: management say the second half has started positively, although they warn that last year's strong Q3 performance will make for a tough comparison.

Diploma has issued the following updated full-year financial guidance today:

- Organic revenue growth of c.7% with a further c.7% growth from acquisitions (previously "mid-single digit and c.6% respectively)

- Adjusted operating margin at c.19% (previously 18%-19%)

- Free cash flow conversion of 90%, reducing leverage to under 0.4x, excluding any further acquisitions

Acquisitions: Diploma is something of a buy-and-build story, making regular smallish acquisitions to diversify its products and gain market share. Since September 2022, the group has acquired eight businesses for a total of £98m.

The largest of these was Tennessee Industrial Electronics, for £76m. So we can see the remainder were fairly small and should be easily integrated.

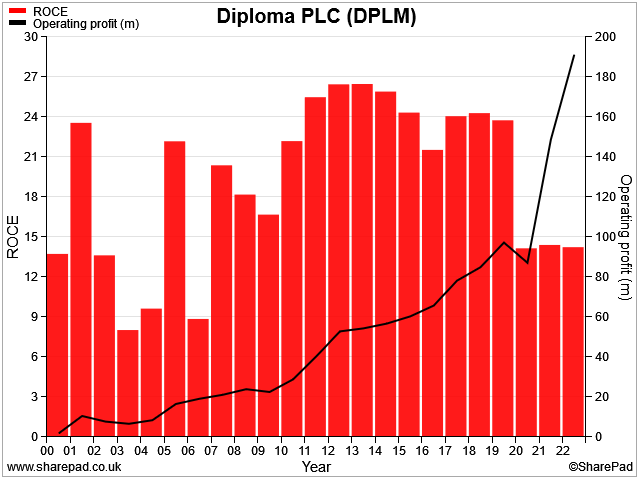

A quick inspection of the company's historic returns on capital and operating profit growth suggests to me that the majority of acquisitions have indeed added value. But I'd want to do more research into these numbers before considering a purchase:

My view: I'm attracted by Diploma's strong history of growth and high profitability and apparent track record of successful expansion.

The company's reported a return on average tangible capital employed (ROATCE) of 17.8% for the half year.

My more conservative and unadjusted measure of ROCE suggests a trailing 12-month (TTM) figure of 16.9% – still an attractive result.

In terms of valuation, I estimate a TTM EBIT yield of about 4.4% and a trailing free cash flow yield of just under 5%.

Current earnings forecasts suggest a P/E of about 25, with a dividend yield of c.2%.

These numbers are slightly above what I'd want to pay, especially as I'm looking for dividend income. But I see Diploma as a quality stock for which I would pay some premium.

These shares have traded as low as 2,090p over the last 12 months. If Diploma fell back towards that level again, I would certainly take a closer look.

Tritax Big Box REIT (BBOX)

"We continue to make positive progress delivering our strategy despite a more challenging economic backdrop."

The structure of most REITs means they're optimised for income and may be unlikely to deliver much capital growth. But I still have some interest in this sector as a potential source of reliable high yields.

Tritax Big Box is one of the larger UK REITs focusing on logistics property – warehouses. This is a sector that became somewhat overinflated during the pandemic, in my view.

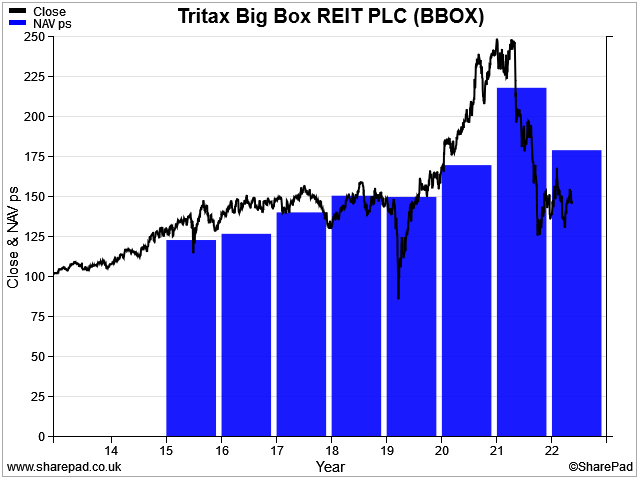

However, the BBOX share price has now returned to pre-pandemic levels, having fallen by 40% from its pre-pandemic highs.

With the stock now trading below its Dec '22 net asset value of 179.25p per share, is this £2.7bn REIT starting to offer value?

Trading update: today's covers the calendar year to date.

- Occupational demand said to remain healthy, with 6.6m square feet taken up in Q1, in line with a five-year average of 6.8m sq ft

- "Prime headline rents" have increased across all regions, typically by 2%-3%

- £150m of disposals so far this year, in line with Dec '22 valuations. An additional £100-£200m of sales targeted for 2023

- Recent acquisition of Junction 6 Industrial Park (near Birmingham) for £58.5m. This is an urban logistics estate, potentially a stronger market at present than out-of-town big box locations. This purchase was priced to give a net initial yield of 4.5%, with an opportunity to increase this to 6.7% as lease renewals become due over the next 2.5 years.

- Average remaining lease length to expiry is 12.4 years

Balance sheet/debt: REITs are essentially a financial structure created to arbitrage institutional funding costs with commercial rents and produce an income for shareholders.

The recent sharp rise in interest rates and the risk of an economic slowdown has changed the calculation, triggering a fall in commercial property values.

The financial metrics today appear healthy enough to me as they stand now:

- Debt fixed at an average rate of 2.6% with a five-year average maturity. Earliest refinancing December 2024

- Loan-to-value at end Q1 2023 of 30.0%

- 6%-8% yield on cost expected for new schemes currently under development

- £600m of available liquidity at end Q1 2023

For potential REIT investors like me, there are three key questions:

- will occupier demand and rental rates for the REIT's property portfolio remain stable?

- do property valuations have further to fall? (BBOX's NAV fell by -19% in 2022)

- what interest rates will BBOX have to pay when it refinances its current debts?

Together, these factors will determine whether the BBOX dividend remains safe.

My view: Right now, I'm not sure anyone really knows the answers to these questions. I don't, at least.

However, my feeling is that some of the better-quality REITs, with modern property and lowish LTV ratios are starting look potentially attractive.

I think Tritax Big Box could be a good example of this. If the company's current guidance and trading performance is sustainable, then my rough sums suggest that the current dividend could remain supportable.

In this case, I suspect the main risk might be that occupier demand falls below expectations over the next 12-18 months as fresh supply comes on the market.

The logistics property sector got quite overheated during the pandemic. This leaves me wary about the risk of a corresponding hangover as market conditions rebalance.

Even so, if I was looking for a pure income investment, I think that earning a 5% dividend yield on a portfolio of modern warehouse property might not be a terribly bad idea.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.