Is Spirent Communications a quality compounder?

FTSE 250 electronics group Spirent Communications (LON:SPT) has high margins and lots of cash. But is it a true quality stock?

My dividend portfolio is a mix of slower-growing high yielders and stocks with lower yields that I believe can deliver above-average long-term growth.

This week I'm looking at a company I hope could fit into the latter category – a possible quality compounder.

The company in question is FTSE 250 tech group Spirent Communications. This is a £1.1bn electronics and software business that provides test and assurance solutions for network operators.

Right now, Spirent's growth is being driven by the global rollout of 5G mobile, which the company describes as "the enduring driver"

Spirent's profits have risen by an average of around 20% per year since 2017. It's debt free and boasts double-digit profit margins.

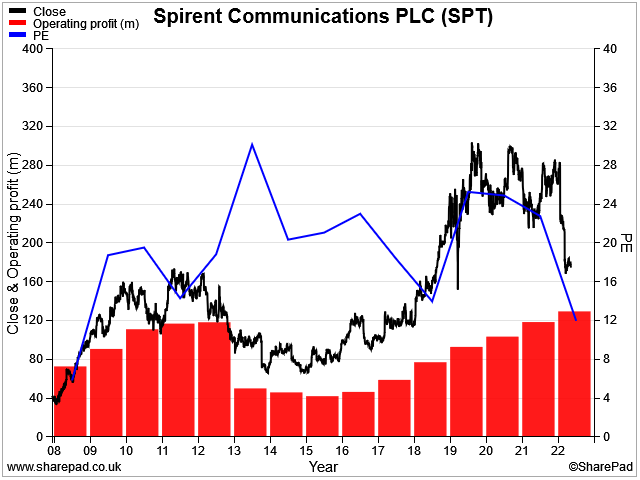

The company's record in recent years suggests to me that it could have decent compounding potential. But the shares have sold off hard since the start of this year, leaving Spirent's P/E ratio at its lowest level since 2008:

Spirent Communications is currently one of the higher-scoring stocks in my quality dividend share screen.

| Spirent Communications (LON:SPT) |

Quality Dividend score: 70/100 | Forecast yield: 3.5% |

| Share price: 179p | Market cap: £1.1bn | All data at 11 May 2023 |

The shares currently offer a dividend yield at the top end of the company's historic range. I'm wondering if this could be an opportunity for me to buy a quality stock at a reasonable price.

In this piece I'm going to consider whether Spirent Communications could be a suitable share to replace Direct Line Insurance in my quality dividend portfolio.

Before I start, just a quick note to share that I've expanded my coverage of dividend stocks recently in a new dividend notes format. This looks at newsflow from dividend shares I don't currently own, but which are in my investable universe and of interest to me.

I covered Spirent's Q1 update in my dividend notes on 4 May.

Over the last week, I've covered:

- Tue 9: warnings and uncertainty - Victrex, Direct Line Insurance and Marshalls

- Wed 10: no recession here - Custodian REIT, Compass Group and H&T Group

- Thurs 11: big spenders - Airtel Africa and Grainger

- Fri 12: underrated quality/full price - Macfarlane, RECI and Beazley

Let's move on and take a more in-depth look at Spirent Communications.

Table of contents

- History - few traces remain of the original business founded in 1936

- Business overview - making 5G networks hum

- Long-term performance - disappointing

- Quality niggles - signs of short-term thinking?

- Recent trading & 2023 outlook - a mixed picture

- Conclusion - not for me?

History

On paper, Spirent's history is a tale of British innovation and engineering that stretches back to 1936. In reality, not so much.

The company we see today is largely a product of multiple restructurings and M&A activity over the last 25 years.

The only real constant through the group's history is that it's always been involved in electronics. Here's a quick timeline to set the scene:

- 1936: Jack Bowthorpe founded Goodcliffe Electrical Supplies in London with £2,000. Goodcliffe's aim was to find and fill niches in the electric and electronic market – a strategy that continued until the 1990s.

- 1955: the group enjoyed success with wiring products for aircraft during WWII and expanded significantly. In 1955, Bowthorpe, as it was then called, listed on the London Stock Exchange.

- 1978: following Bowthorpe's death, Goodcliffe's first employee, Ray Parsons, became chairman. He led the firm on a journey to become a diversified conglomerate, albeit still with a focus on niche products.

- 1997: Bowthorpe had more than 100 subsidiary companies by the mid-90s, but in 1997 the group decided to change its strategy to focus on high-tech markets with strong growth potential. Communications test and assurance was identified as a likely market and a new round of acquisitions began. At the same time, the group began to sell some of its older subsidiaries.

- 2006: Bowthorpe renamed to Spirent in 2000 and then to Spirent Communications in 2006. At this stage the business reorganised into two core divisions, performance analysis and service assurance. A third, non-core division making motor controllers for electric vehicles remained until 2013, when it too was sold to US group Curtiss-Wright.

- 2013: the company "embarked on a fresh long-term growth strategy, reorganizing under new leadership". Investment was increased in product development, with R&D spend rising from c.$80m per year to over $100m according to SharePad data.

Business overview

Spirent's current business is divided into two divisions.

Lifecycle service assurance: the company says it is a "global leader" in lab-based testing solutions for 5G networks and Wi-Fi devices. Spirent's products are said to provide "actionable insights and automated troubleshooting to radically simplify turn-up and assurance of 5G networks and services, reducing time and cost."

So in short, this business is about providing hardware and software tools for network operators to setup and fine tune 5G networks to make them run as reliably as possible.

Networks & Security: this business is focused performance testing high-speed data networks and navigation satellite systems. The company says it's focused on opportunities in positioning, navigation and timing.

These are all increasingly important areas - modern computer systems are increasingly distributed (located in multiple places), location aware and operating in real time. This combination creates many challenges that didn't really exist 30 years ago.

Core & growth markets: the global rollout of 5G networks remains the key driver of Spirent's profits.

But the company is also targeting other complementary areas of technology such as edge computing, Open RAN and high-speed 800G Ethernet deployments.

One sector being targeted (and included in executive's bonus targets) is the hyperscaler market. This is a reference to large cloud service providers such as Amazon AWS and Google Cloud. This seems a logical choice to me, given the scale, complexity, and broad geographic footprint of these highly-networked operations.

Disappointing long-term performance

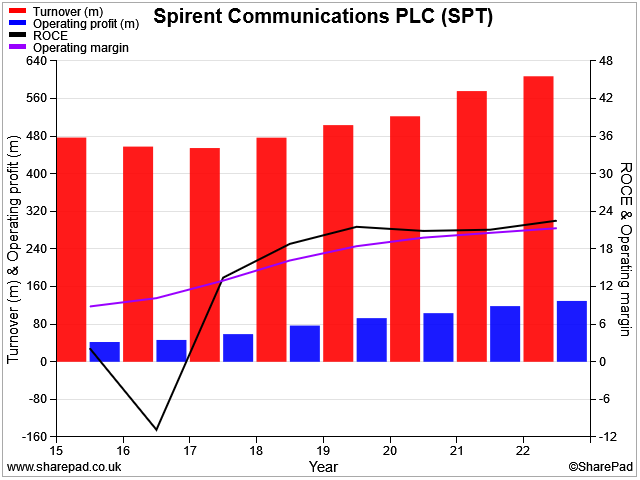

Spirent's performance since 2016 has been fairly impressive, in my view:

The company's focus on 5G tools seems to have paid off, with operating margins rising and return on capital employed topping 20%.

However, a true compounder needs to deliver over much longer timeframes. And here, Spirent disappoints.

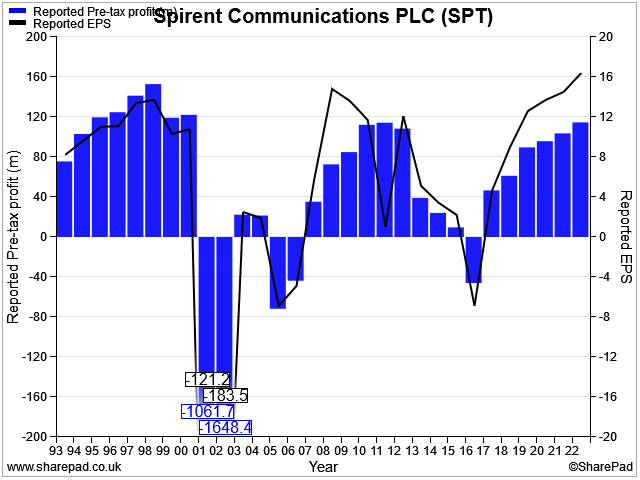

Looking back over Spirent's long-term performance as a listed company, what strikes me is that the company's strategy shifts in 1997, 2006 and 2013 were followed by multi-year slumps in profit:

Perhaps the company's management at these times rescued it from imminent problems that weren't apparent in its reported profits.

But what the chart tells me is that pre-tax profit today is lower than it was 25 years ago. I think that one way to interpret this chart would be to suggest that each time Spirent's management have had a bright new idea for growth, they've actually set the business back several years.

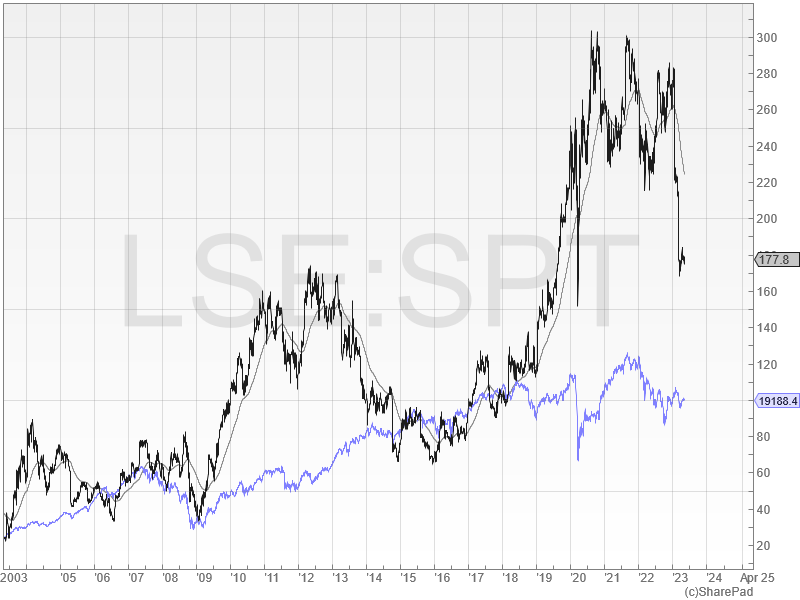

Having said that, anyone buying the shares in 2003 – after the TMT crash – could have done well over the last 20 years:

However, share price returns over the last decade – since the 2013 restructuring – have merely matched the FTSE 250, but with far greater volatility:

I wonder what this business might be worth today if it had stayed with its original strategy of focusing on niche electronics.

Quality niggles

In fairness, Spirent's current CEO, Eric Updyke, only took the reins in 2019 and was not responsible for the 2013 rejig.

I do also believe that the company's current strategy, if well executed, should have the potential for long-term profitable growth and market leadership.

However, my review of Spirent's board of directors did highlight a few other points I'd like to include here.

- The majority of board members appear to have big corporate backgrounds. In my opinion, there's a disappointing lack of entrepreneurial experience and heavyweight technical expertise.

- Mr Updyke collected total remuneration of £2.9m in 2022. That's nearly double the £1.6m pocketed by his predecessor Eric Hutchinson in 2019.

- In contrast to this, Updyke's Spirent shareholding totalled just 643k shares at the end of March 2023. I estimate this to be worth around £1.2m – less than six months' pay in 2022.

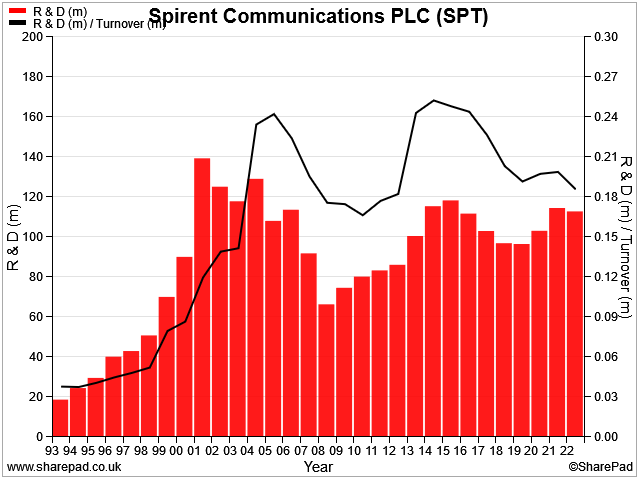

Question mark over R&D spending: I also wonder if the boardroom's corporate backgrounds account for Spirent's apparent reluctance to increase spending on research and development.

The chart below suggests that Spirent's R&D spending as a proportion of turnover peaked when the company announced strategy shifts (2006 and 2013) before declining steadily again.

Last year's reported R&D spend of $111m is lower (in real terms) than the $115m figure show in SharePad for 2014.

This doesn't seem ideal to me. After all, sales have risen by around 30% over the same period. Rust never sleeps...

On the other hand, R&D spending does seem to have increased since Mr Updyke took charge as CEO in 2019. The proportion of revenue spend on R&D – about 18% – is also reasonably high, I think.

Shareholders will certainly have to hope that a focus on short-term margins doesn't leave Spirent on the back foot again at some point in the coming years.

Recent trading & 2023 outlook

Spirent's share price fall prompted me to wonder whether there's an opportunity here for a long-term buyer like me to pick up the stock at an attractive level.

The company's 2022 results and recent Q1 update left me with a mixed view.

On the one hand, the group's financial performance was pretty strong last year.

Revenue rose by 5% to $607.5m, while pre-tax profit climbed 11% to $114.6m. Earnings per share rose by 12% to 16.5 cents, providing ample cover for the dividend of 7.57 cents per share.

Profitability remained strong, with an operating margin of 18.6% and return on capital employed of 21.9%.

Cash generation was also good. The group ended the year with net cash of $209.6m, an increase of 20% from 2021.

However, while the order book climbed 7% to $288m in 2022, order intake fell by 2% to $625.7m. This seems to suggest that there was no underlying growth in demand last year – or that Spirent failed to expand its market share.

Balance sheet & inventories: Spirent's balance sheet remained in good shape in 2022.

The group ended the period with net cash of almost $210m and a current ratio of more than 2x, suggesting very little risk of liquidity or solvency problems.

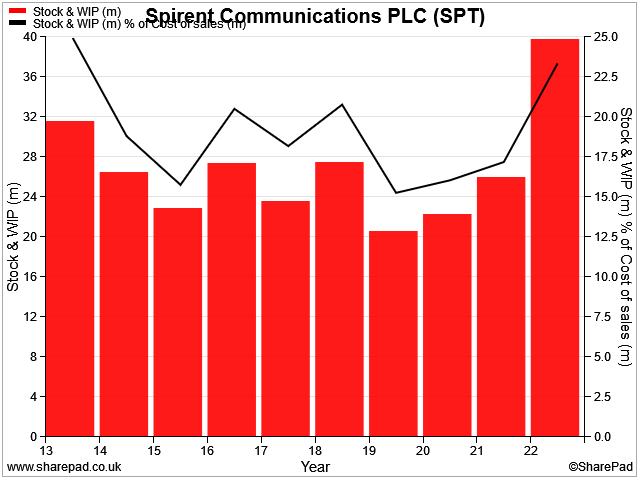

However, the inventory position did give me pause for thought, with stock levels rising sharply:

My sums suggest the average number of days required to turnover stock rose from 58 to 70 days in 2022. With sales expected to flatline in 2023, this build-up of unsold good does not seem ideal to me.

Rising inventories are a common warning sign of a cyclical slowdown.

Cash flow: one clear attraction of this business for me is its cash-generative nature. 2022 was no exception.

Spirent converted $112.7m of operating profit into $117.8m of operating cash flow last year, a conversion rate of 104%.

Free cash flow generation was also strong. My sums suggest a full-year FCF figure of $79.2m, a conversion rate of 79% from net profit. If I exclude $22.9m of share purchases for the employee share ownership trust, then free cash conversion rises to more than 100%.

In any case, the dividend was covered at least twice by last year's free cash flow. When combined with support from the net cash position, a dividend cut seems very unlikely to me.

Trading commentary & outlook: The outlook for 2023 seems more measured. Last year's sharp rise in inventories comes as the company reports some reluctance by customers to commit to new orders.

Management says that while customer budgets are "mostly intact", spending is now requiring "scrutiny at more senior levels". These comments suggest to me that Spirent's order intake could slow this year.

While the company left its full-year guidance unchanged in its Q1 update, CEO Eric Updyke warned us that:

"trading performance will be significantly more weighted to the second half of the year than usual".

In my experience, statements like this are often an early warning that full-year results will end up falling below expectations.

The company's current guidance is for "revenue to decline slightly" in 2022, with gross margins maintained.

Broker consensus forecasts have translated this outlook to suggest 2% to £595m this year, with earnings falling by over 15% to 15.5 cents per share.

The dividend is expected to be held flat at 7.6 cents per share.

These estimates price Spirent shares on 14 times forecast earnings, with a 3.4% yield. This does not seem too demanding to me, for a cash-rich business generating 20% returns on capital employed.

Conclusion: not for me

I don't often do this, but I'm going to draw this review to a close here. I've already decided that I'm not going to buy shares in Spirent for my dividend portfolio at this time.

The attraction of Spirent's 87-year history and recent trading performance is negated for me by its inconsistent strategy and shifting focus over the last 20 years.

I don't see any evidence of a successful long-term strategy and reliable shareholder value creation. Real quality compounders tend to have done the same thing for many decades, consistently building market share and brand equity.

Having reviewed Spirent's latest results, I also think there's a risk of more bad news in pipeline this year – although I admit this might already be priced in to the shares. This remains a very profitable business, after all.

I will keep an eye on Spirent's progress, but I think there are better choices elsewhere for me.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.