Dividend notes: bargain property stocks? GLE, GPE, WKP (12/07/23)

In this property-themed note, I look at recent updates from small cap MJ Gleeson and FTSE 250 firms Great Portland Estates and Workspace.

Welcome back to my dividend notes. In the absence of many interesting new updates from dividend-paying companies this week, I'm continuing to clear some backlog items from last week.

Today's notes are property themed, with updates from small-cap a housebuilder and two FTSE 250 commercial property REITs.

Companies covered:

- MJ Gleeson (LON:GLE) - a solid trading update from this small-cap housebuilder, which operates at the affordable end of the market. My initial impression ahead of the full-year results is that the shares could offer value.

- Great Portland Estates (LON:GPE) - this London commercial property landlord reports rising rents and strong occupancy. Although risks remain, I think the shares are probably too cheap at a 45% discount to NAV.

- Workspace (LON:WKP) - this flexible work space provider has a big portfolio across London and the south east. Trading nearly 50% below NAV the shares look potentially cheap. But I do have some concerns.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

MJ Gleeson (GLE)

"Purchasing a Gleeson home has become increasingly attractive to customers who would have previously bought a more expensive home"

This small cap housebuilder specialises in building affordable homes. Gleeson boasts that a couple earning the National Living Wage can afford to buy a home on any of the company's sites.

Gleeson's latest trading update covers the year to 30 June and reports completions of 1,723 homes last year, down from 2,000 the previous year. This included 115 homes sold under bulk sale agreements, presumably to rental landlords.

This total appears to have included "up to 66 homes" sold as part of a bulk deal to sell 288 homes to private equity group Carlyle. The remainder are due to be completed in the current financial year.

Order book: the bulk sales to Carlyle has helped to support reservation rates and Gleeson's order book.

The group is starting the year with an order book of 665 plots, compared to 618 at the end of FY22. This is a contrast to most of the big housebuilders, which are reporting shrinking order books at present.

However, Gleeson's numbers seem to suggest that at least 222 of these homes – one third – are due to be sold to Carlyle. This deal has clearly helped to offset a slump in sales to homeowners, but it's left Gleeson with some customer concentration risk.

Affordable positioning: Average selling prices rose by 11.3% to £186,200 last year. This figure reflects cost inflation, but also highlights the group's affordable positioning.

According to Nationwide, the UK national average house price was £262,239 at the end of June 2023.

Shift in buyer demographics: rising borrowing costs and the soaring cost of living suggest to me that Gleeson's offering could appeal to an expanded customer demographic at the moment. The company's latest trading update appears to confirm this.

The proportion of first-time buyers fell to 50% last year (FY22: 71%), but more than 20% of sales went to over 55s (FY22: 10%).

Outlook: the company acknowledges uncertainty but says that "land continues to be available at sensible prices". Management expect demand from "value-driven buyers" to help offset weaker demand from first-time buyers.

Full-year results are due in September.

My view

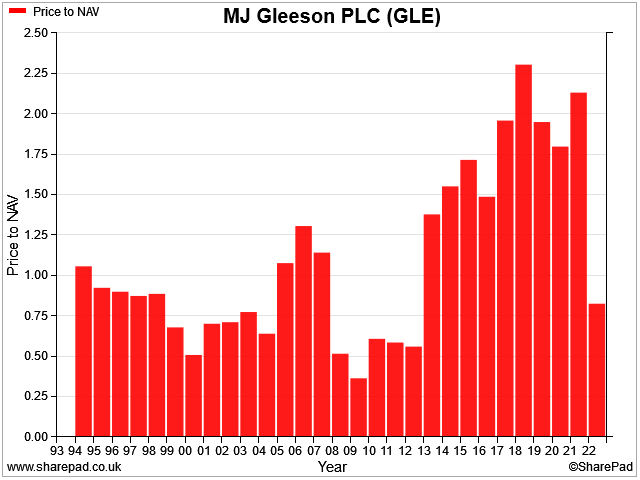

Gleeson's share price is down by 60% from its pre-pandemic highs. The stock trades at a c.20% discount to the firm's December 2022 book value of about 480p per share.

According to SharePad, this is the first time Gleeson shares have traded below book value since 2012. Although net asset value may fall in the full-year accounts, I see this as a potential indicator of value.

Gleeson's balance sheet looked okay to me in the interim results, but the company doesn't have the massive cash piles of some rivals. I look forward to taking a closer look at the accounts when the firm's full-year results are published in September.

In the meantime, my feeling is that this is a nice business, reasonably valued.

Although the 3.8% dividend yield is more modest than at some larger rivals, it looks well covered by earnings to me. I don't see any obvious reason for a near-term cut to the payout.

Great Portland Estates (GPE)

"we had another active quarter with £6.4 million of new leasing deals at rents 17% higher than the March 2023 ERV"

I've believed for a while that quality London property in good locations is starting to look cheap. FTSE 100 REITs British Land and Landsec both offer value, in my view (and big yields).

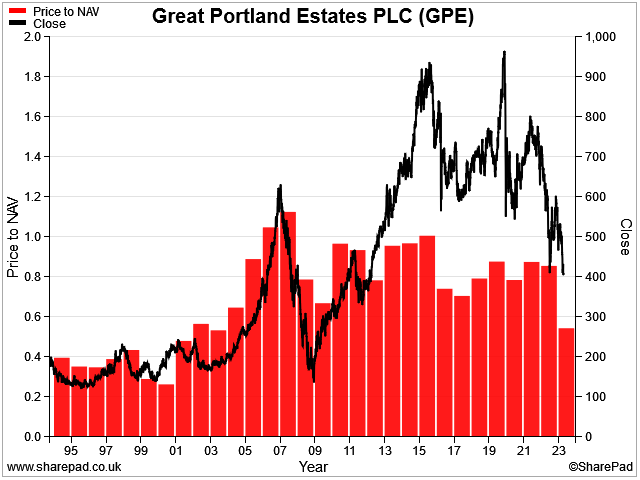

A more niche choice might be Great Portland Estates. This £1.0bn REIT currently trades 45% below its last-reported book value of 757p per share, despite reporting strong occupancy and rising rental rates.

GPE's portfolio is spread over a number of popular areas in Central London, including the West End and areas such as Shoreditch, Holborn and Whitechapel. Tenants include retailers, tech firms, and creative businesses.

In addition to offering traditional bare-building leases, GPE also offers fitted and fully-managed services, providing an added layer of value and flexibility.

This offering seems to have remained popular. The company says that new lettings during the second quarter were agreed at rents 17% higher than March rental estimates.

Void rates remain low, at 3.6%, and 99% of rent charged during the quarter was collected within seven working days.

Balance sheet: I think that refinancing risk is one factor that could differentiate investment returns from property stocks at the moment. Landlords at risk of being forced to refinance debt facilities quickly and at much higher costs may be worth avoiding, in my view.

GPE's balance sheet (based on March 2023 accounts) looks fairly low risk to me. The company reported a loan-to-value (LTV) ratio of 20% at the end of March, with an average debt cost of 3%. Of this, 97% was at fixed interest rates or hedged.

The average maturity on drawn debt was 6.4 years, suggesting very little near-term refinancing risk.

Outlook: results for the half-year to 30 September are due in November. Consensus forecasts suggest a dividend of 12.8p per share this year, giving a 3.1% yield – the highest level since 2010/11.

My view

I think this is a well-run business with a good quality property portfolio. It's not a high yielder, but historically, buying the shares at a discount to net asset value has generally been a profitable trade:

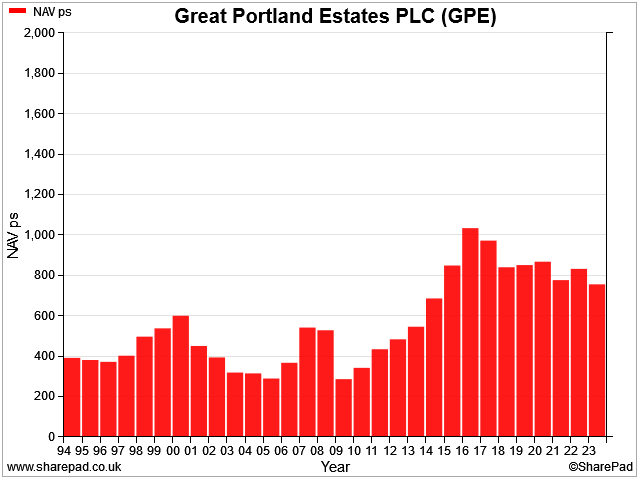

However, it's worth remembering that past performance isn't any guarantee of future returns. The group's record of value creation isn't clear cut, in my view, based on historical net asset value per share:

I'm interested to see how market conditions evolve for London-focused REITs over the coming 6-12 months.

My feeling is that there's value on offer among stocks such as GPE, with the caveat that this remains a cyclical situation with the potential for further unpleasant shocks.

Right now, my strategy here might be to buy a basket of my preferred commercial property REITs, rather than trying to pick an outright winner.

Workspace (WKP)

"Like-for-like occupancy stable at 89.2%"

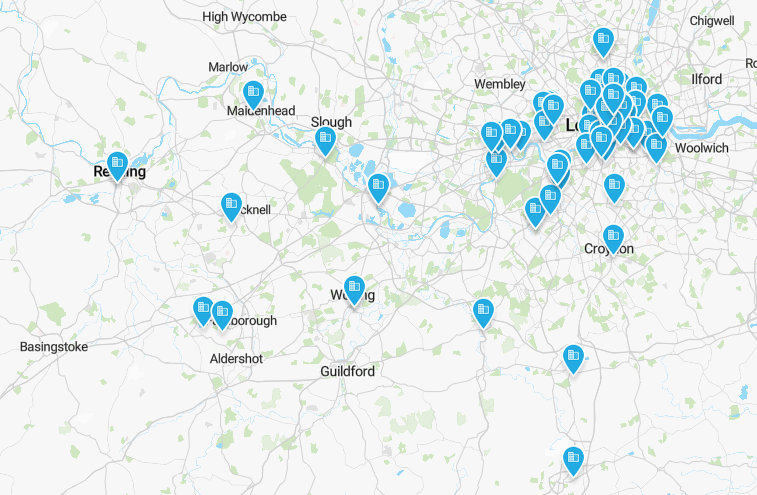

FTSE 250 REIT Workspace describes itself as London's leading owner and operator of flexible work space, primarily offices.

The company is hoping that changing post-pandemic working patterns will result in continued healthy demand for its serviced office sites.

Conversely, I would guess there's some risk that Workspace could fall victim to a broader glut of office space and be forced to cut prices to remain competitive.

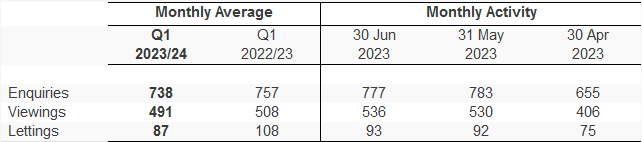

Trading update: performance during the quarter ended 30 June seems to have been broadly encouraging.

- Like-for-like (LFL) occupancy stable at 89.2%

- LFL rent per square foot up 3.3% to £41.73

- £83m of non-core disposals and £166m of available cash

- A pro-forma loan-to-value ratio of 31% (based on March 2023 valuations)

However, the company did see a modest reduction in enquiries, viewings and new lettings across the quarter, albeit with stronger performances in May and June:

Portfolio comments: chief executive Graham Clemett says that the firm's portfolio provides plenty of opportunity:

"Our extensive property portfolio across London provides us with a rich opportunity to upgrade and reposition our buildings to meet both the changing needs of our customers and higher environmental standards."

I think this is probably true, to some extent. But this statement also highlights some of my main concerns about this business:

- the office property market seems to be segmenting into well-located properties with high environmental ratings – and everything else. The costs of retro-fitting buildings to meet new environmental standards ahead of coming legislation can be high. This would be one area of Workspace's portfolio I'd want to research before considering an investment – how much spending will be needed?

- the company's properties appear to be spread fairly widely over London. Last year's acquisition of McKay Securities has added further properties in the south east. A number of these are still earmarked for disposal. I'd want to know a bit more about McKay's portfolio, too.

My view

Workspace reported a net asset value of 927p per share at the end of March 2023. At the time of writing, the shares are trading at 483p – a discount of nearly 50%.

A forecast dividend yield of more than 5% is an additional attraction.

Clearly, I think there could be value here.

However, one area I'd want to know more about is the expected cost of modernising Workspace's portfolio to meet new environmental standards. Is there a risk this could act as a drag on returns?

More generally, another risk with this type of business is so-called duration mismatch – in other words, tenants are often able to sign up for quite short leases, while the property owner may have secured longer-term financing on the property. If vacancy rates rise, this can lead to a shortage of cash to fund debt repayments.

I'd want to do more research on Workspace's debt and lease profiles. But my initial impression is that the company's balance sheet isn't quite as strong as that of Great Portland Estates.

Workspace's 31% LTV ratioo is significantly higher than that of GPE (20%).

Borrowing costs are higher, too. At the end of June, Workspace reported an average cost of debt of 4% (GPE: 3%).

Looking back at the March 2023 accounts, the average maturity on Workspace's drawn debt at that time was 4.4 years, compared to 6.4 years for GPE.

Comparing Workspace and Great Portland Estates isn't an exact apples-to-apples comparison. While overlapping, they have different business models and and they do not operate in all the same locations.

I plan to keep an eye on Workspace as the year unfolds. But my initial impression is that the forecast dividend yield of 5.5% may reflect a slightly higher level of risk than GPE's more modest 3.1% yield.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.