The Dividend Note - accomplished retailers + a mystifying problem - SMWH, GHH, BME (07/06/24)

I review updates from FTSE 350 dividend shares WH Smith and B&M, plus struggling AIM engineer Gooch & Housego. Do any of them offer opportunities for my income portfolio?

Welcome back to The Dividend Note, my weekly look at UK dividend shares I might be interested in adding to my portfolio.

This week I've taken a look at the latest results from FTSE 100 value retailer B&M and AIM-listed small cap engineer Gooch & Housego. One of them appears to be performing well, but the other has a problem that I don't fully understand.

Other updates of interest to me this week included WH Smith (SMWH), which reported sales up 5% during the 13 weeks to 1 June. I covered the travel retail specialist's half-year results in April and remain broadly positive on this business.

WH Smith's share price edged higher on the day of the update as the market digested a mixed performance.

While revenue rose by 9% in UK Travel, performance in North America looked weaker. WH Smith is currently expanding its US travel business aggressively with the goal of achieving a 20% market share.

However, like-for-like sales in North America travel were flat during the most recent quarter, and total sales were only 3% higher.

The company says it is applying its "forensic approach to retailing" to improve the performance of its US stores. I think this update highlights the risks as well as the opportunities of WH Smith's US rollout.

I suspect that the performance of the North American stores will improve over time. The company has proven expertise in travel retail.

However, I wonder if flat LFL sales might be a sign that the post-pandemic air travel surge in the US has now fully annualised.

Further growth could be more measured and may test the financial assumptions that lie behind the company's US growth spree. I commented on this in more depth in April. One to watch.

Companies covered:

These notes contain a review of my thoughts on recent results from UK dividend-paying companies that are of interest to me. In general, these are stocks that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- Gooch & Housego (LON:GHH) - I really want to like this photonics business, but problems in one of its three divisions mean that it's not investable for me at the moment without a better understanding of how (and when) these issues can be resolved.

- B&M European Value Retail (BME) - a solid set of results, although free cash flow was held back by higher tax and capex costs. I remain a fan of this well-run retailer, but I wonder about the company's decision to increase its long-term UK store target from 950 to 1,200.

Gooch & Housego (GHH)

"Full year expectations are unchanged; execution risks to H2 remain but have been reduced."

Interim results for six months to 31 March 2024 / Mkt cap: £143m

2023/24 forecast dividend yield: 2.4%

Gooch & Housego is a small-cap British engineering group that was founded in 1948. It's a photonics specialist – it makes high-specification optical and laser components for the aerospace and defence, industrial and life sciences markets.

The dividend yield here is a little low for me. But when I look at the company's half-year results in June 2023, I speculated that the business could be nearing a turning point and might offer value.

I felt Gooch & Housego might be the kind of high-quality, innovative business that could be a long-term compounder for me.

Unfortunately, this week's 23/24 half-year profits show flat revenue and a further profit slump.

Closer investigation the problems are largely restricted to one part of the business, Aerospace and Defence. I have to admit I'm surprised how bad things seem in this business, especially given the broader strength of demand in the defence sector at the moment.

I still think there could be a substantial turnaround opportunity here if management can overcome current problems. But I'm not sure I understand enough to make the call. Let's take a look.

23/24 half-year results summary: the company says it has put in place "important building blocks" to support the delivery of the group's strategic plans. This appears to include outsourcing a greater proportion of manufacturing.

Trading remained under pressure from "significant destocking" by many of the group's industrial (semiconductor) and medical laser customers.

This weakness was partially offset by an increase in revenue from the telecoms market. This mainly relates to the growing subsea data cable market, which is supporting demand for some of the firm's fibre optic modules.

The overall impact of these trends on G&H's financial results was decidedly negative:

- Revenue fell by 1.4% to £63.6m on a continuing operations basis (-5.3% constant currency)

- Adjusted pre-tax profit down 45% to £2.6m

- Reported pre-tax profit down 92% to £0.3m

- Adjusted earnings down 45% to 8.3p per share

- Interim dividend up 2% to 4.9p per share

These numbers give an adjusted operating margin for the period of just 6.0%. This is well below the double-digit level I'd expect from a business of this kind, on the assumption its products benefit from significant competitive advantages.

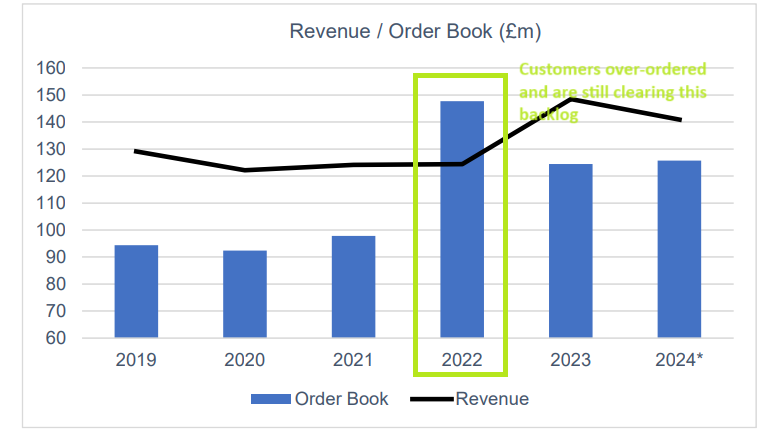

Outlook: there are signs of hope. Gooch & Housego says its customers in the industrial laser and semiconductor market have advised the company that they expect to pass through increased orders from "around the end of this calendar year". This should happen as these end users finally work through excess inventory accumulated previously:

These excess orders previously caused problems for Gooch & Housego as it struggled to fulfil them during the supply chain crisis. The company now says it has reduced its past due backlog by 70% over the last 18 months.

New orders are tracking slightly ahead of revenue and the order book for continuing operations was flat at £115.8m at the end of March (Sept 23: £115.3m).

Management says full-year expectations are unchanged and consensus forecasts have remained flat at 29.5p per share, with a 13.3p dividend. This prices the stock on 19 times FY24 forecast earnings, with a 2.4% yield.

Not a compelling valuation, given the low margins. But to really understand the group's performance, we need to look at the divisional results.

Segmental performance: the devil is in the details. This isn't just a story about a cyclical slowdown in industrial demand. Indeed, I would argue that element is less of a concern.

The real problem is harder for me to understand and appears to be more challenging for the company to fix.

To understand more, we need to look at divisional performance for the first half of this year.

Industrial: revenue fell by 13.1% to £31.7m, while adjusted operating profit fell 36.8% to £3.5m. This gave an adjusted operating margin of 10.5% (HY23: 15.0%).

These results aren't great but they're relatively easy to understand, I think. A fall in volumes as customers destock has resulted in reverse operating leverage (profits falling faster than sales). This happens when fixed costs are spread across lower volumes.

We've seen this in plenty of other industrial companies over the last year. All else being equal, I would expect this downturn to reverse over time.

Life Sciences: revenue fell by 3.4% to £15.3m, while adjusted operating profit was 2.9% lower, at £2.2m. In this case, margins were maintained at a healthy 14.7% (HY23: 14.6%).

The company says it's seen medical laser destocking, but also reports growth in some diagnostic categories following regulatory approval of new products.

A c.15% operating margin seems encouraging to me. I'm not too worried about this division, either.

Aerospace and Defence: this looks like a can of worms to me. Revenue rose by 35.8% to £16.6m in H1 from continuing operations. This translated into an increase of 19.6% on an organic constant currency basis. This should be good news.

Unfortunately, the A&D division is loss making, with an operating loss of £1.6m during the six months to 31 March 2024 (HY23: £1.9m). This is equivalent to a negative margin of 9.4% (HY23: 15.5%).

In other words, A&D lost £9.40 for every £100 of sales during H1.

For reference, A&D generated an operating loss of £2.3m in FY23 and £2.7m in FY22. So the trend is in the right direction. But this isn't a startup – how can such a well-established business be losing so much money on rising sales?

The answer isn't entirely clear to me from the results. Management simply say that "production yields and productivity are still below required levels".

"We still have much to do to improve production yields and generate acceptable returns in this part of the business but we are confident that our in house continuous improvement programmes, better use of our supply chain and the addition of more G&H content in to sub system and system offerings can generate acceptable returns for the Group from the A&D segment."

Management commentary makes reference to growth in demand for "super polished optical components used in ring laser gyros". The new business pipeline is said to be positive, driven by requirements resulting from the Ukraine conflict.

Apparently, the firm's products are also being used in the British Army's Challenger 3 (tank) upgrade programme.

Even so, A&D is currently a huge drag on the profitability of the group – without this business, I estimate the other two divisions would have generated an operating margin of c.10% in H1.

My view

These results contain pages of commentary about the company's strategic priorities and progress to date. But there's no clear guidance as to when the A&D business is expected to become profitable.

I have not done enough research to understand the history of the problems in the A&D division. But the lack of a clear target on profitability suggests to me that it may not happen in the next 12 months.

As things stand, this division is acting as a drag on the returns achieved by the wider group. I estimate ROCE at around 5% – which must be well below the group's cost of capital.

Given this, I would argue that it might have been better for the company to suspend its dividend and use the cash to reduce net bank debt, which rose to £22.2m during H1 (FY23: £20.9m)

I want to like Gooch & Housego. But without a much better understanding of the problems in the A&D division, I don't think it makes any sense for me to consider investing. I will remain on the sidelines for now.

B&M European Value Retail (BME)

"All fascias delivering volume growth through both positive like-for-like4 ("LFL") customer transaction numbers and new space growth"

Results for 53 weeks ended 25 March 2023 / Mkt cap: £5.0bn

2024/25 forecast dividend yield: 5.2%

I've covered this diversified discount retail several times before, most recently here (Nov 23).

I'm a fan of B&M's historic strong profitability, skilled management and good cash generation. I don't see too much in this set of results to change that view.

The company now operates under three fascias (trading names), B&M UK, B&M France and Heron Foods (a discount convenience format with a focus on frozen/ambient food – a kind of mini Iceland).

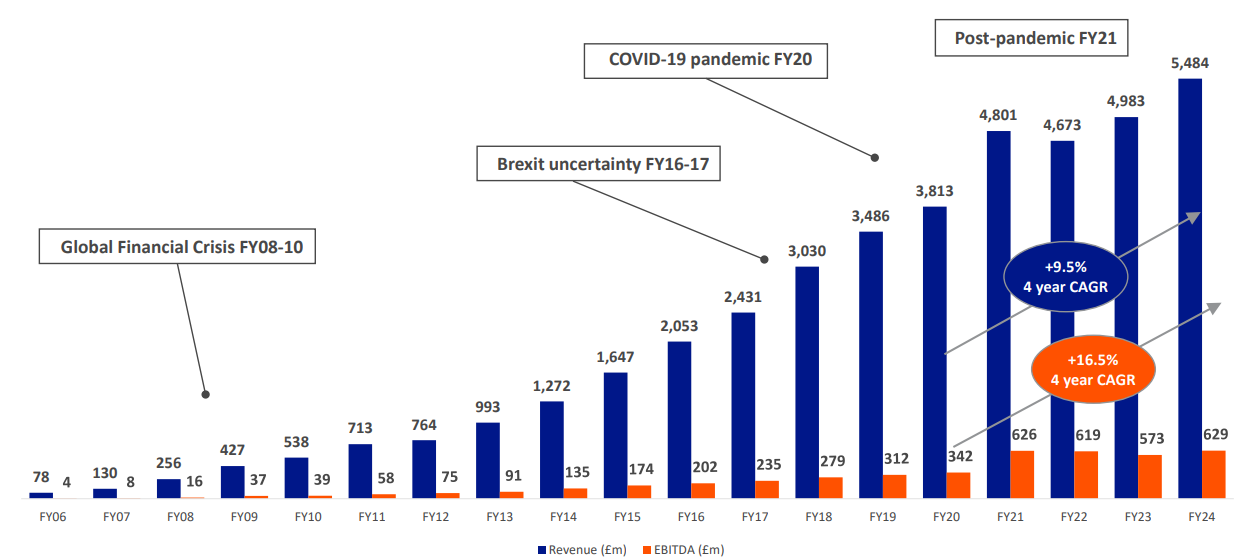

2023/24 results summary: B&M grew quickly during the pandemic but has maintained positive revenue growth since then, albeit profit growth has been less consistent as various cost headwinds have hit the business:

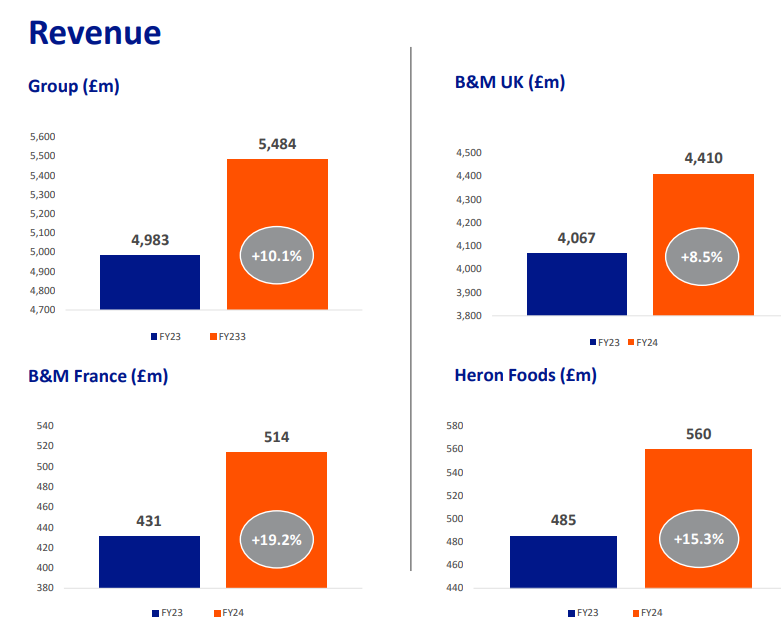

Group revenue rose by 10.1% to £5.5bn last year, or by 7.8% excluding the 53rd week.

The core UK business achieved like-for-like sales growth of 3.7%, supporting the company's claim of growth in transaction numbers and new space growth. Sales growth in the other divisions was stronger than this.

Pre-tax profit for the year rose by 14.1% to £498m, although a higher tax charge meant that reported earnings only rose by 5.2% to 36.5p per share.

Profitability remained good with an operating margin of 11.1% (FY23: 10.8%) and a return on capital employed of just over 19%, by my calculation. I've deducted lease costs from operating profit here, given that they are a sizeable cost for B&M.

Free cash flow for the year fell by 18% to £382m, due to higher tax and growth capex. New store opening costs rose from £33m to £59m last year.

Even so, cash generation remained sufficient to cover FY24 dividends declared of £348m. This performance gives an attractive trailing free cash flow yield of 7.7%.

This dividend total includes an ordinary dividend of 14.7p per share and a 20p special paid in January 2024. Together, they give a trailing dividend yield of 7.1%. B&M has a track record of paying regular special dividends.

Trading commentary: B&M opened 78 new stores last year (excluding closures), including 45 B&M stores in the UK.

CEO Alex Russo remains confident about the opportunities in the UK and the company has now increased its long-term target for the UK to "not less than 1,200 B&M UK stores". The previous UK target was 950 stores.

B&M currently has 741 UK stores, so this suggests the core UK estate could increase by 60% over time. This could be a significant growth opportunity, if the company can deliver this strategy profitably.

Russo says that he's confident of achieving cash payback in under 12 months on new stores. This seems plausible to me given the high returns on capital achieved by this business.

The company says its volume growth is currently "industry leading". Management say this is improving its relationships with both branded consumer goods firms and its suppliers in the Far East, where there is said to be excess capacity.

As a result, the company says it's achieving higher volumes through a broadly unchanged infrastructure. In turn, this is helping with cost control in the face of higher labour and energy costs.

B&M France saw sales rise by 19.2% to £514m last year and is benefiting from improved sales densities. CEO Russo believes the potential store count in France is "multiples" of the 124 stores currently in operation.

The adjusted operating margin of the French business rose to 9.5% last year (FY23: 8.8%), getting closer to the 12.4% achieved by B&M's UK stores.

Outlook: slightly disappointingly, the company didn't provide any explicit financial guidance for 2024/25.

Consensus forecasts suggest adjusted earnings could rise by 9.7% to 40.4p per share this year, supporting a total dividend of 25.5p.

These estimates put the stock on a forecast P/E of 12 with a 5.2% dividend yield.

My view

These results received a cautious reception and B&M's share price looks set to end the week down by more than 10% at the time of writing:

The lack of any financial guidance for 2024/25 is perhaps a little disappointing.

Forecasting the maximum number of stores a retail chain can support also seems to be as much of an art as a science. I'm not sure of the rationale behind this increase, which suggests the existing store estate could expand by more than 50%.

Although I think it's reasonable to suggest that B&M has more room to grow, anecdotally most of the small/medium towns in the area where I live already have a store. One larger town has two.

However, the group's focus on value and a diversified food/non-food mix plays well with the current economic pressures facing many shoppers. I expect this will remain true.

B&M shares certainly don't look expensive to me based on last year's results, especially given the strong profitability of the group relative to standard supermarkets.

On balance, I think B&M is probably reasonably priced at under 500p, although I might be tempted to wait for a price closer to 450p if I was thinking of buying the shares for my portfolio.

As always, thanks for reading – and please let me know what you think in the comments below.

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.