The Dividend Note - defensive quality - CCH, REL (16/02/24)

I take a look at full-year results from FTSE 100 dividend stocks Coca Cola HBC and Relx. Both of these are possible contenders for my portfolio, at the right price.

Welcome back to The Dividend Note. This is a weekly review of results from dividend stocks that look potentially interesting to me.

In this note I've covered two companies that score highly as quality defensives, in my view.

One of them benefits from an exclusive regional licence to supply some of the best-known consumer brands in the world. The other company has many of the attributes of a true quality compounder.

Companies covered:

- Coca Cola HBC (LON:CCH) - a solid set of numbers from this soft drinks group, which is a regional bottling agent for the Coca-Cola Co. I remain a fan and might consider buying the shares at current levels.

- Relx (LON:REL) - this high-quality business extended its track record of growth last year and boasts enviable profit margins and excellent cash generation. The shares look more expensive than ever to me, though.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Coca Cola HBC (CCH)

"We delivered volume growth, share gains, improved margins and record levels of free cash flow."

2023 full-year results / Mkt cap: £9.0bn

FY24 forecast dividend yield: 3.4%

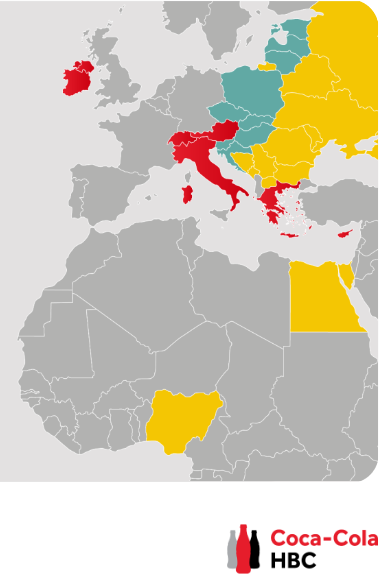

Switzerland-based Coca Cola HBC is one of the Coca-Cola Company's regional bottling agents. It has the exclusive right to supply Coca-Cola brands in its territories. These include parts of western, central, and eastern Europe, as well as some African markets:

I've written about this drinks business positively before (most recently here). I see it as a classic defensive stock that I could see myself owning at some point.

The main downside, I guess, is that CCH doesn't own any of its main brands. However, given that regional bottling companies like CCH are a core part of Coca-Cola's operating model, I'm not sure this is a major concern.

Let's take a look at Coca Cola HBC's 2023 numbers.

2023 results summary: Net sales revenue rose by 16.9% to €10,184m last year on an organic basis, which excludes the impact of currency rates, acquisitions and disposals.

This strong revenue growth was driven by an average price increase of 15% per unit case (5.678 litres), paired with a more modest 1.7% increase in organic volumes.

Excluding last year's €127m exceptional charge relating to the Ukraine-Russia war (CCH operates in both countries), operating profit for the year rose by 15% to €954m.

Operating highlights last year included the €180m acquisition of Finlandia Vodka from Jack Daniel's owner Brown-Forman, and the launch of Jack Daniel's & Coca-Cola in Poland, Ireland and Hungary.

Growth performance was not split evenly across the business, though. As this graphic shows, the core sparkling drinks category delivered a relatively staid performance, while energy and coffee performed delivered strong volume growth as these markets continue to expand:

CCH's profitability remained good, if not exceptional. My sums suggest an operating margin of 9.4% and a return on capital employed of 15.8%. Both are comparable to other soft drinks groups listed on the London market.

Excellent cash generation is another attraction of this business, for me. CCH converted an after-tax profit of €635.7m into free cash flow of €694.1m last year, by my calculations.

Net debt remained stable at around €1.6bn, which looks reasonable to me against annual profits of over €600m.

Dividend: a dividend of €0.93 per share has been proposed for the year, representing a 19.2% increase on the prior year. This gives a yield of 3.3%.

I estimate the cost of the payout to be around €341m, leaving it covered twice by free cash flow of €694m. That looks very sustainable to me.

Outlook: management warn of challenges from macro uncertainty in 2024, but expect to be able to deliver organic revenue growth of 6%-7% and comparable operating profit growth of 3%-9%, presumably depending on cost inflation and currency impacts.

Consensus forecasts suggest adjusted earnings may only rise by 2% to €2.12 per share this year, putting CCH on a forecast P/E of 13.

My view

I remain impressed with the strong cash generation and profitability of this business. I suspect it should be a reliable, defensive performer over time.

Possible downsides include lack of brand ownership and geographic exposure to troubled markets – Nigeria, Russia and Ukraine might be examples of this.

My sums suggest the stock is currently trading with an EBIT yield (EBIT/EV) of almost 8%, which looks reasonable value to me.

Although I would ideally like to buy CCH a little cheaper, I would not be totally against the idea of buying the shares at current levels.

Relx (REL)

"we expect another year of strong underlying growth in revenue and adjusted operating profit"

2023 full-year results / Mkt cap: £62.4bn

FY24 forecast dividend yield: 1.9%

I've not looked at Relx before on this site, but as a quality dividend investor, I probably should have done.

This FTSE 100 group is the business formerly known as Reed Elsevier. Historically it was an exhibition and specialist publishing group. Today the group has evolved into a more technology-driven business and divides its operations in four main segments:

- Risk (34% of revenue) - analytics and decision tools for financial services and government, primarily aimed at insurance and financial crime prevention, such as identity fraud.

- Scientific, technical & medical (33% of revenue) - academic journals, research databases, data analytics tools

- Legal (20% of revenue) - databases and research tools used by legal firms, academia and government

- Exhibitions (12% of revenue) - trade shows and supporting digital services to help companies reach new customers and suppliers, runs events in more than 20 countries

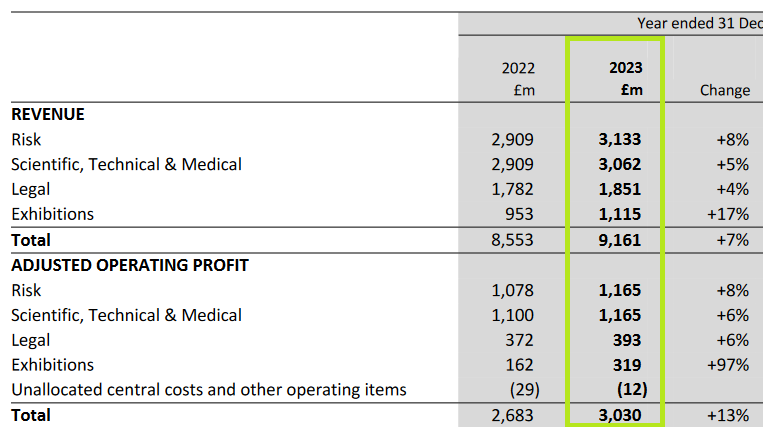

Relx's 2023 results showed decent progress. Revenue rose by 7% to £9,161m, while operating profit climbed 15% to £2,682m, supporting an impressive 29% operating margin and a return on capital employed (ROCE) of 28%.

The company reported a net profit attributable to shareholders of £1,781m and converted this into free cash flow of £1,940m before acquisitions (£130m), by my calculations.

This looks like an excellent performance to me, although the stock's free cash flow yield of 3.1% suggests to me that much of the good news is already in the price.

Dividend & share buyback: the full-year dividend has been lifted 8% to 58.8p per share and the company has launched a £1bn buyback for 2024, following last year's £800m share repurchase.

This dividend will cost about £1.1bn and gives Relx shares a yield of around 1.8%.

The stock's low dividend yield and free cash flow yield suggest to me that any investment here needs to be based on the assumption that growth will remain strong.

Segmental results: looking at Relx's segmental results for last year, it seems clear to me that the main drivers of profit growth are the Risk and Scientific, Technical & Medical divisions.

Risk and Scientific, Technical & Medical generated 76% of group operating profit last year at margins of 37% and 38% respectively. This is an outstanding level of profitability that suggests to me these operations have significant market share and competitive advantages.

In Risk, Relx singled out Financial Crime Compliance and digital Fraud & Identity solutions as key drivers of growth last year.

In Scientific, Technical & Medical, the company said that volume growth in academic publishing and the development of new value-add analytics tools were helping to support growth.

Margins in Legal were 21%, while exhibitions achieved 29%. While these are both respectable figures, these smaller, lower-margin divisions are not going to move the needle on group results as easily as the larger parts of the business.

Outlook: chief executive Eric Engstrom expects another year of strong underlying growth in revenue and operating profit.

Consensus forecasts suggest adjusted earnings could climb 7% to 122p per share this year, putting the stock on forward P/E of 27.

My view

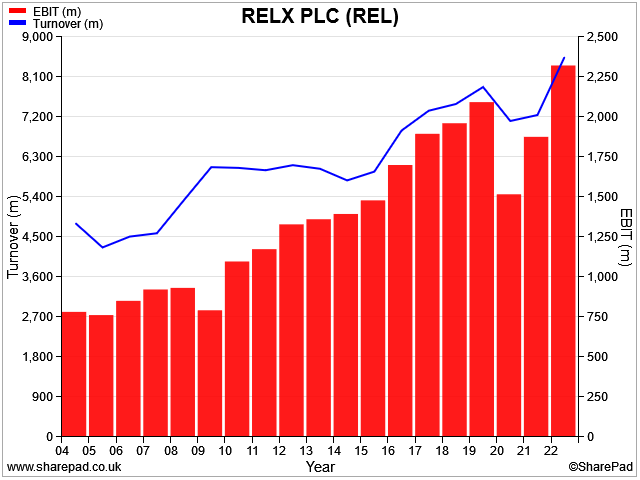

Relx certainly has an impressive track record of growth over the last 20 years, in my view. Operating profit has trebled over the period, equivalent to about 6.5% per year annualised:

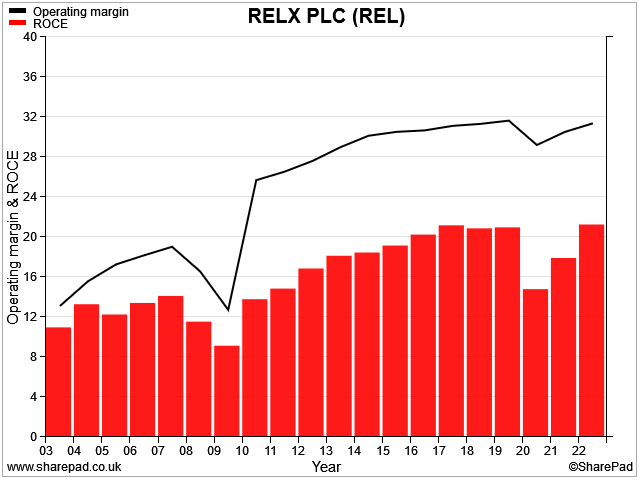

The profitability of the business has also trended higher over this time:

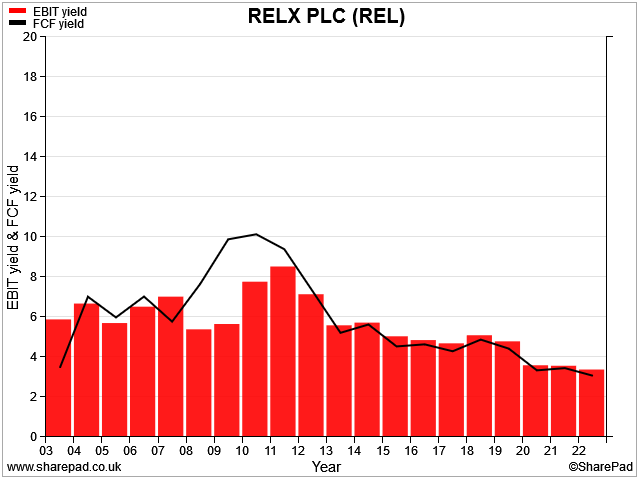

However, Relx's success is no secret. Based on my preferred metrics of free cash flow yield and EBIT yield, the shares are more expensive than at pretty much any time in their history:

What's a reasonable price to pay for a high-quality compounder, such as Relx appears to be?

For me, the price is a little too high and the dividend yield too low. But I think this could well be a case where paying a premium for quality delivers decent results over time.

I'm staying on the sidelines for now, but Relx is certainly a business I would be interested in owning if an opportunity arose.

For what it's worth, Relx scores a respectable 65/100 in my dividend screen at the time of writing, despite its low yield and strong valuation.

I don't make decisions based on my screen scores alone. But this result also tends to support my feeling that buying Relx shares at a full price could still give me more of the qualities I want in my dividend portfolio.

As always, please let me know what you think about the companies I've covered here in the comments below or my contacting me directly.

Roland Head

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.