Dividend notes: in a sweet spot - CCH, ROR, HILS (18/08/23)

I review recent half-year results from Coca-Cola HBC, valve actuator specialist Rotork and infrastructure group Hill & Smith.

In today's dividend notes I'm catching up with a defensive drinks business and looking at two engineering businesses that are benefiting from exposure to strong, growing markets.

Companies covered:

- Coca-Cola HBC (LON:CCH) - half-year results show stable margins and decent cash generation. I have some concerns about the continuing level of exposure to Russia, but otherwise remain positive about the defensive income qualities of this business.

- Rotork (LON:ROR) - solid half-year numbers with a sharp rise in order intake and profits for this specialist engineering firm. I'm impressed by strong profitability and the group's long-term track record.

- Hill & Smith (LON:HILS) - I like this infrastructure equipment business and admire recent progress, spurred by growing US demand. But I wonder how much of a premium I should pay for the shares.

Tip: to search for my previous coverage of a company, enter its ticker code into the search tool at the top of this page.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Coca-Cola HBC (CCH)

"We delivered a better-than-expected financial performance in the first half of 2023"

When I covered Coca-Cola HBC's half-year trading update in July, I promised to take a look at the firm's accounts in August.

To clarify, this business is one of Coca-Cola's regional bottling partners (HBC originally stood for Hellenic Bottling Company). CCH doesn't own the brands it sells, except in Russia. Of which more shortly.

Half-year financial highlights: Net sales revenue for the first half of the year rose by 19.3% to €5,021.5m, but volumes were only 4% higher, at 1,383.1m cases.

The increase in revenue reflects prices increases and "mix management". These measures led to a 21.2% increase in comparable operating profit, which rose to €557.3m (H1 2022: €462.5m).

The group's operating margin remained stable at 11.2% on a comparable basis, excluding impairment charges last year relating to the Russia-Ukraine war.

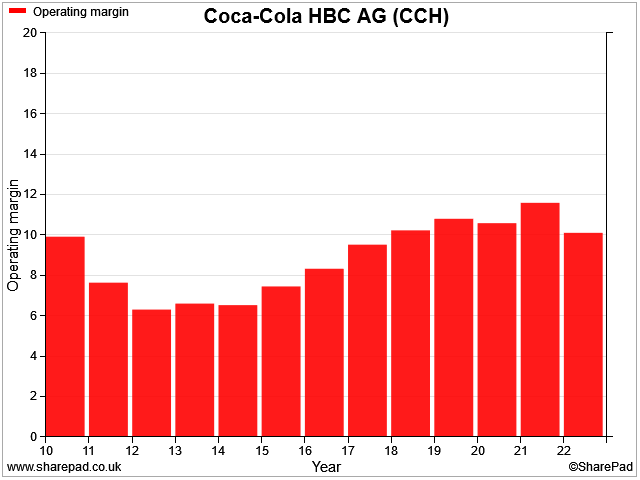

A group operating margin of 11% is slightly ahead of the average reported by the group since its 2013 IPO:

According to my sums, free cash flow fell by 19% to €249m during the half year (H1 2022: €305m). This weaker performance seems to have been caused by additional working capital outflows, so it may well reverse over the remainder of the year.

Cash generation in this business generally seems quite good to me. Net debt of €1.8bn looks manageable, if not minimal.

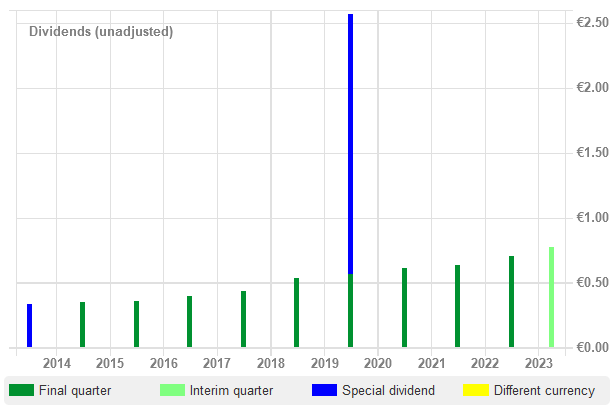

Dividend: CCH pays a single annual dividend, so there was no update on this year's payout in these results. However, the payout has trended steadily higher since the company's IPO:

The company's dividend culture may be linked to the needs of its two largest shareholders, the Coca-Cola Company and Kar-Tess Holding SA, who each control c.23% of CCH stock.

I believe Kar-Tess Holding SA represents the interests of the Levantis-David families, who owned CCH before it was floated.

Geographic split/Russia: the group's operations are divided into three geographical regions – established, developing and emerging. You can see a detailed breakdown here.

The real profit engine of the group are its emerging market operations, which include parts of central/Eastern Europe, Russia, Nigeria and Egypt.

Emerging markets generated €322m of CCH's adjusted EBIT during the first half of the year, or 57% of the group total.

Margins were higher too, at 13.4%, versus 10.1% in established markets and 6.5% in developing.

We don't know exactly how much of this comes from the group's operations in Russia, which now operate as a self-contained 'local brands' business called Multon Partners LLC.

However, the 2022 annual report shows €1,100m of external revenue attributed to Russia, or just over around 10% of the group total.

Given the superior profitability of the emering markets segment, I wonder if we can speculate that around 10% of profit still comes from Russia.

I don't know. But this factor may be worth considering for investors who have a view on exposure to Russia.

Outlook: management have become increasingly bullish this year. Like most other consumer businesses, CCH expects cost inflation to ease over the remainder of the year.

Cost increases are now expected to be limited to "high single digits" over the year as a whole, down from "low teens" previously.

However, profit guidance is unchanged. Operating profit is expected to rise by 9-12% in 2023, in line with previous guidance.

Broker forecasts suggest adjusted earnings of €1.90 per share this year, an 11% increase on 2022. That prices CCH shares on 14 times forecast earnings, with a prospective dividend yield of 3.3%.

My view

My sums suggest this business should return to delivering low-teens returns on capital employed this year, in line with past years.

The valuation also doesn't seem unreasonable to me. I estimate a trailing EBIT/EV yield of 8.5%. That's slightly above the 8% rule-of-thumb level I use as a sign of value.

On balance, I think this is a good business, with the kind of defensive qualities that could support a reliable long-term dividend income. However, I do have some reservations about the group's continuing exposure to Russia, which looks material to me.

I'd also hope for a slightly higher dividend yield as an entry point.

For now, this remains a business I'll watch with interest.

Rotork (ROR)

"Good first half, expectations for the full year unchanged"

Rotork is a £2.4bn FTSE 250 industrial group that designs and manufactures industrial flow control equipment.

Founded in 1957, the firm's core products are actuators – electric components that open and close fluid control valves remotely. Key market sectors include oil, gas, chemicals and utilities.

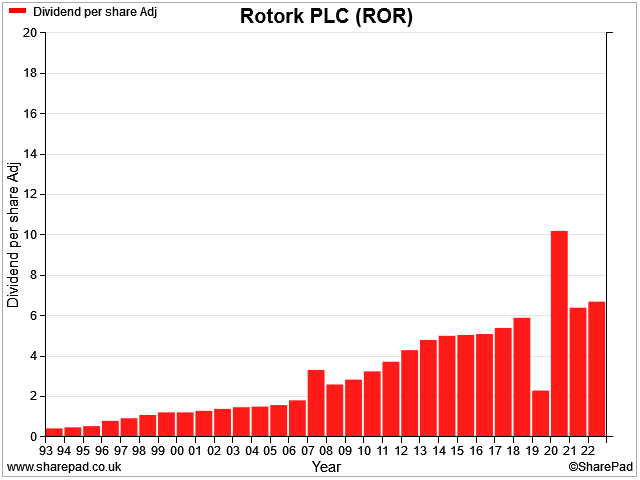

Despite its cyclical exposure, Rotork has an impressive dividend history:

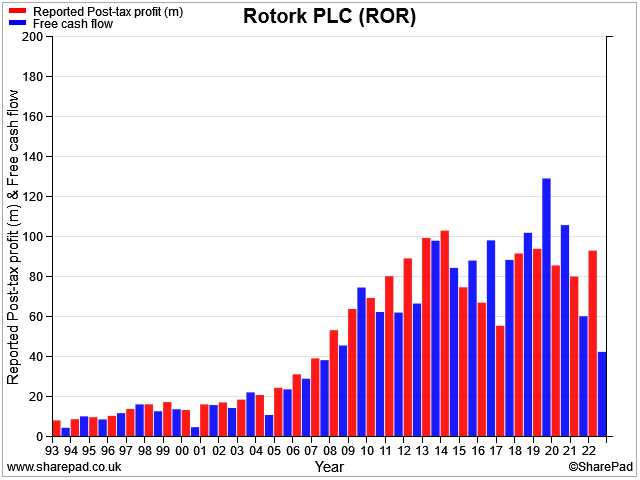

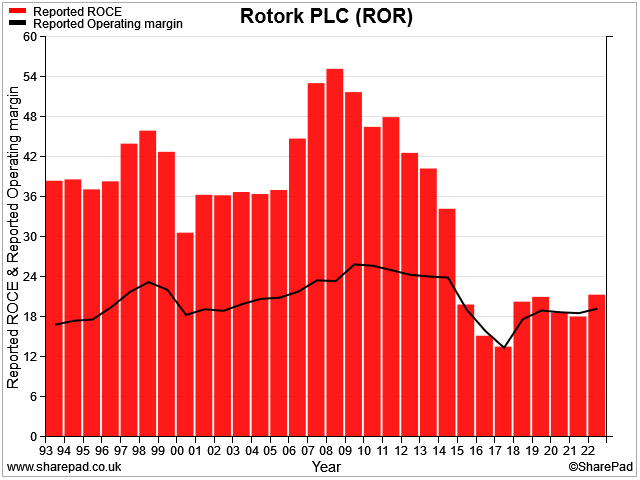

This payout has been supported by a consistent track record of excellent cash conversion from profits:

Profitability is also pretty impressive, in my view:

Rotork's historic share price performance shows the volatility you'd expect from exposure to capital-intensive and cyclical market sectors such as oil and gas. But the long-term share price trend has been very positive for investors who've invested during cyclical lows.

The shares have risen tenfold in 20 years:

The group's long track record and strong profitability suggests to me it has a sustainable competitive advantage in its core markets.

This could certainly be an industrial stock I'd be interested in owning, at the right price. Rotork's shares are already well down from last year's highs, but the recent half-year results suggest trading remains strong.

I've taken a look at the recent half-year results to see if an opportunity might be emerging here.

Half-year financial highlights: Rotork said its order intake rose by 11.9% to £386.9m during the first half of the year. Revenue rose by 19.5% to £334.7m, while pre-tax profit rose by 35% to £60.2m.

The group's operating margin improved to 17.7%, from 15.7% during H1 2022. However, last year's full-year margin of 19.3% suggests that the full-year result for 2023 may also be higher; Rotork's profits appear to be consistently weighted to the second half of the year.

My sums suggest the group has achieved a trailing 12-month return on capital employed of 23.8%, which is an improvement from the 20% achieved in calendar 2022.

Rotork ended the half year with net cash of £97.8m and an undrawn overdraft. This group has generally maintained a net cash balance in recent years, perhaps helping to explain why it has not needed to issue new shares for at least 30 years.

Dividend: the interim dividend was increased by 6.3% to 2.55p per share. Broker forecasts suggest a total payout of 7.1p per share this year, giving a prospective yield of 2.5%.

Outlook: chief executive Kiet Huynh says that supply chain problems have eased and customer demand in the oil and gas sector is higher than it's been since 2019.

Huynh sounds positive about the outlook for the remainder of the year:

"The outlook for all our divisions is positive and we entered the second half with a record order book. Whilst mindful of residual supply chain challenges, we anticipate delivering further progress in 2023 in line with expectations on an OCC basis."

Broker forecasts suggest adjusted earnings will rise by 15% to 14.6p per share this year. That puts Rotork on a forecast P/E of 19.

My view

I still need to learn a little more about this business. But my initial impressions are very positive.

My only concern – unsurprisingly – is over valuation. Market conditions seem strong at the moment and I wonder if Rotork's valuation reflects this.

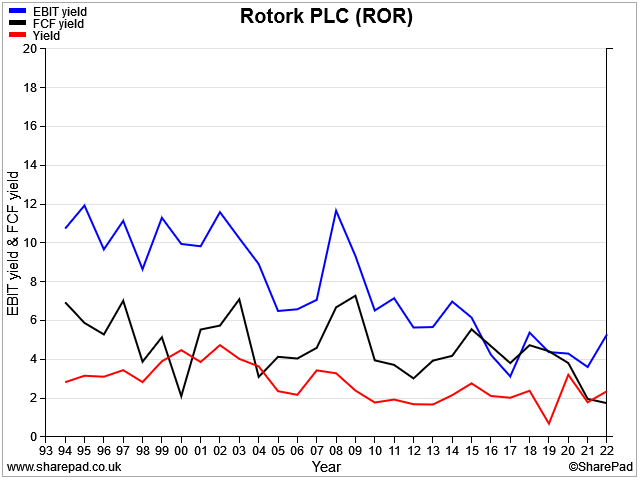

The group's forecast P/E of 19 is not especially high for such a profitable business, but I prefer to use a company's EBIT/EV and free cash flow yield as measures of valuation.

On this basis, Rotork shares look more expensive than they have for a while:

I'd hope to find a slightly better buying opportunity for Rotork. But this is certainly a business that I could see joining my model dividend portfolio at some point.

Hill & Smith (HILS)

"Hill & Smith is exceptionally well placed to benefit from US industrial expansion"

The US Inflation Reduction Act has triggered a surge in industrial spending in the USA. FTSE 250 infrastructure group Hill & Smith appears to be an early beneficiary of this largesse.

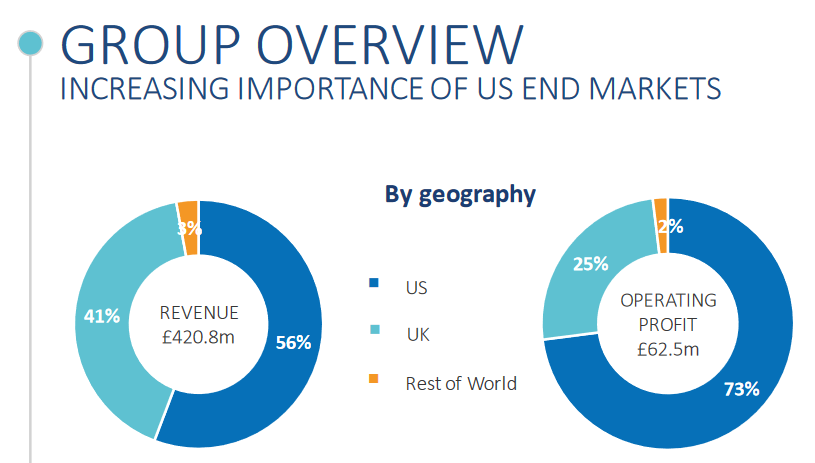

This 199-year-old business recently reported a surge in half-year profits and says it's now making almost three quarters of its profit in the US.

Hill & Smith started out as a West Midlands ironworks in 1824, producing products such as fencing and gates. Today it's product lines include structural steel, energy grid infrastructure, and road safety barriers.

Like Rotork (above), this business has a long track record of steady dividend and attractive profitability. But my feeling is that the infrastructure focus of this business could mean that it's less sensitive to cyclical swings than Rotork, which is heavily exposed to the oil and gas sector.

Half-year highlights: Hill & Smith's interim results triggered a surge in the share price and a further modest upgrade to full-year forecasts, following May's upgrade.

The company said that revenue from continuing operations rose by 20% to £420.8m, while pre-tax profit increased by 54% to £48.2m.

This increase supported an operating margin of 12.7%, up from 9.9% in H1 2022. My sums suggest a trailing 12-month return on capital employed of c.17%, up from 14.2% in 2022.

Acquisition boost: admittedly, this rapid profit growth was boosted by acquisitions and some currency tailwinds. The company acquired US firms Enduro Composites and Korns Galvanizing for a total cost of £38.5m in H1.

This follows the acquisition of roads firm National Signal during the second half of last year.

HILS says that these three firms contibuted £41m of revenue and £8m of operating profit in H1.

Stripping this out gives like-for-like revenue growth of 9%, with a 20% rise in underlying operating profit.

At first glance, these acquisitions look more reassuring and reasonably priced to me than BAE Systems' recent $5.5bn blockbuster deal, which I covered yesterday.

Dividend: HILS shareholders will see the interim dividend rise by 15% to 15p per share, on track for a full-year forecast payout of 38.9p. That's equivalent to a yield of 2.2% at current levels.

Outlook: full-year operating profit is now expected to be "modestly ahead" of market consensus.

Market estimates I can see on SharePad suggest operating profit of £116m in 2023.

Earnings per share forecasts suggest a 2023 figure of about 97p per share, valuing the firm on about 19 times forecast earnings.

My view

One idea I've seen put forward in recent months is that industrial markets in developed countries are going to enjoy a sustained increase in industrial spending.

Governments are using measures such as loan guarantees and subsidies to drive investment in energy infrastructure, reshoring manufacturing, and various other capital-intensive activities.

I'm not sure what the likely scale and impact of this will be for companies such as Hill & Smith. There seems to be the potential for significant growth. At the same time, competitive pressures could rise and inflation might remain an issue.

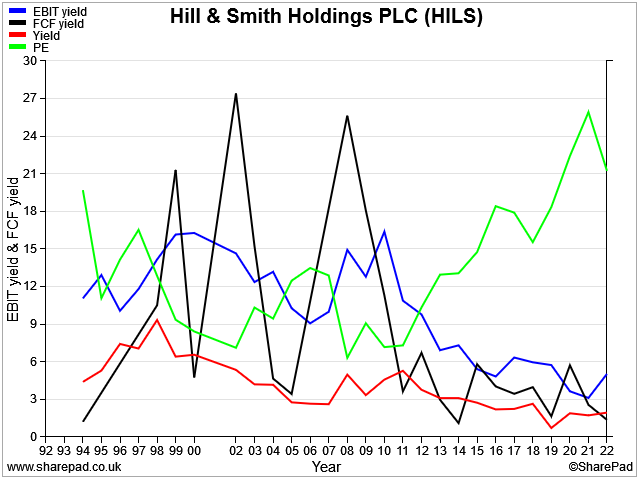

I mention this because – like Rotork – Hill & Smith looks expensive to me in a historical context:

This is a business I'd quite like to own, but I have some reservations about buying in at what appears to be a historically-expensive valuation.

On the other hand, if this business really is at the start of a period of strong expansion, the shares might easily grow into the current valuation.

My value bias means I'm likely to wait for an opportunity to buy this business when it's less popular. But I can see plenty to like at current levels too, and will continue to follow HILS's progress with interest.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.