Dividend notes: founder stocks with reliable dividends - HL, CHRT (19/07/23)

My founder theme continues with a look at a potentially revealing update from Hargreaves Lansdown and solid results from defence small-cap Cohort.

Welcome back to my dividend notes. Yesterday's founder theme continues today, with a look at two companies where co-founders retain c.20% shareholdings – and presumably – some influence.

Companies covered:

- Hargreaves Lansdown (LON:HL) - I question why HL has omitted its usual revenue update from this trading statement, but I continue to like this business as a potential income investment.

- Cohort (LON:CHRT) - strong results from this small-cap defence stock, despite the drag from one loss-making business. I'm encouraged and believe the valuation remains reasonable.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Hargreaves Lansdown (HL)

"We delivered net new business of £1.7 billion in the period, up 6% on the previous quarter."

DIY investment platform Hargreaves Lansdown is still out of favour with investors, but I've been bullish on this stock for a while.

I took an in-depth look at the company back in November to explain why.

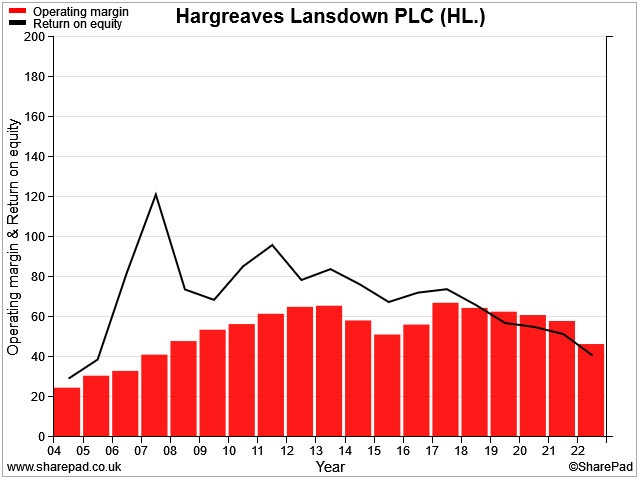

In short, I think the group's 40% market share and 40%+ operating margin mean that Hargreaves holds all the cards.

If the company loses its premier place in the market, then I think it will be mostly due to mismanagement.

Given the continued strong influence of co-founder Peter Hargreaves (20% shareholder), this seems unlikely to me.

Trading statement: today's update covers the three months to 30 June, which is the final quarter of the company's financial year.

Hargreaves saw net inflows of £1.7bn during the quarter, compared to £1.6bn during the third quarter. This took closing assets under administration up to £134bn.

Client numbers rose by 13,000 to 1,804,000, albeit this represented a significant drop in signups from 23,000 new clients in the previous quarter.

The only odd feature of today's trading statement was that it didn't include a quarterly revenue figure. All the previous quarterly updates I've looked at from HL have included revenue.

Naturally, this leads me to wonder whether revenue for the quarter was slightly weaker than might have been expected from such strong inflows.

My podcast colleague Bruce Packard often says that changes to companies' voluntary disclosures can be revealing. I wonder if this might be a (small) example of this.

Is revenue from client cash falling? One possible explanation for a shortfall in revenue might have been a decline in client cash. Recent results have shown clients holding a lot of cash in their investment accounts.

Hargreaves' pays some interest on client cash, but also keeps some for itself. This has been very lucrative in recent months.

The half-year results showed Hargreaves' net interest income rising to £125m for the six months to 31 December 2022. This was 10 times the equivalent figure of £12m for the same period one year earlier. This is what drove Hargreaves' 20% revenue growth in H1.

This kind of windfall rarely lasts forever. Interest rates on client cash appear to have improved slightly since I last looked but remain relatively miserly, in my opinion, especially on lower cash balances.

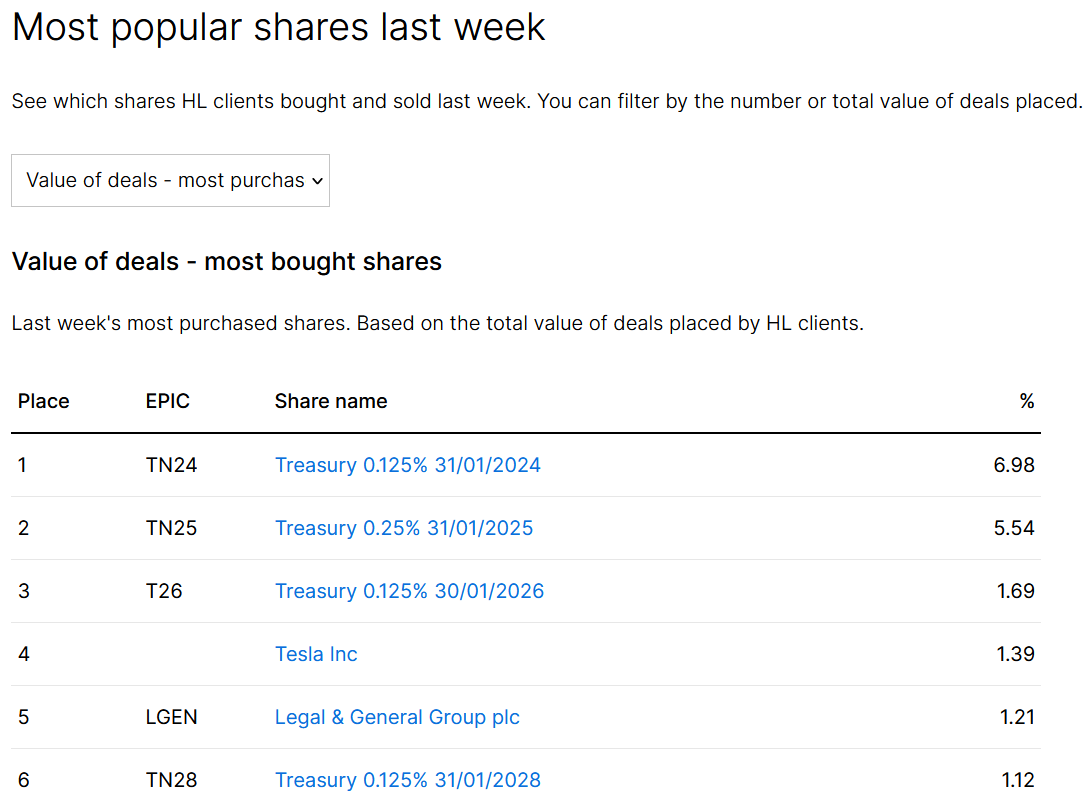

I wonder if clients have taken matters into their own hands and shifted more cash into investments offering low risk and full exposure to the 5% bank rate.

This theory appears to be supported by the latest results on Hargreaves' Top of the Stocks page of most popular trades. This currently shows that the most purchased assets by value right now are UK government bonds.

Scrolling down the full list, it seems that by value, nearly 20% of deals placed by HL clients last week were for UK government bonds. Until recently, I've never seen this.

I don't know much about gilts, but my understanding is that these ultra-safe bonds are generally offering a yield to maturity of 4%-5% at the moment, with very low costs.

This niggle aside, this quarterly statement looks fine to me. Client retention remains stable at around 92%, with asset retention down slightly to c.90% as "specific cohorts" of clients withdraw cash to fund living expenses.

Outlook: there's no update to full-year guidance in today's statement, suggesting that results should be in line with consensus forecasts.

These show adjusted earnings rising by 31% to 66.2p per share this year, supporting a 4% dividend increase to 41.3p.

At the time of writing, those estimates price the stock on 13.5 times earnings, with a 4.6% yield.

My view

Despite the sceptical tone of some of my comments, my view on this business is unchanged and remains positive.

I think it's reasonably priced, with all the advantages of a huge market share, high margins and significant customer inertia.

However, I also think that rival AJ Bell and adviser-focused platform IntegraFin look good at the moment. I discussed IntegraFin in more detail in yesterday's dividend notes and in this recent podcast.

Finally, for another view on Hargreaves Lansdown I'd recommend checking out former bank analyst Bruce Packard's comments in this recent podcast (free to listen). This was recorded shortly after Bruce bought HL shares for his own portfolio.

Cohort (CHRT)

"Dividend increased by 10%; the dividend has been increased every year since the Group's IPO in 2006."

A super-reliable dividend record is often a hallmark of a founder-led firm, in my experience. Owners often want a reliable cash return each year, in contrast to hired managers who may have other priorities.

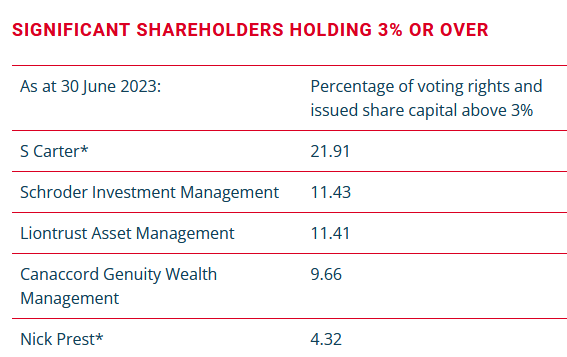

Cohort's co-founder Stanley Carter stood down as a director last year, but retains a 22% shareholding in this £185m group. The firm's other co-founder, Nick Prest, also has a material holding and remains chairman of the group:

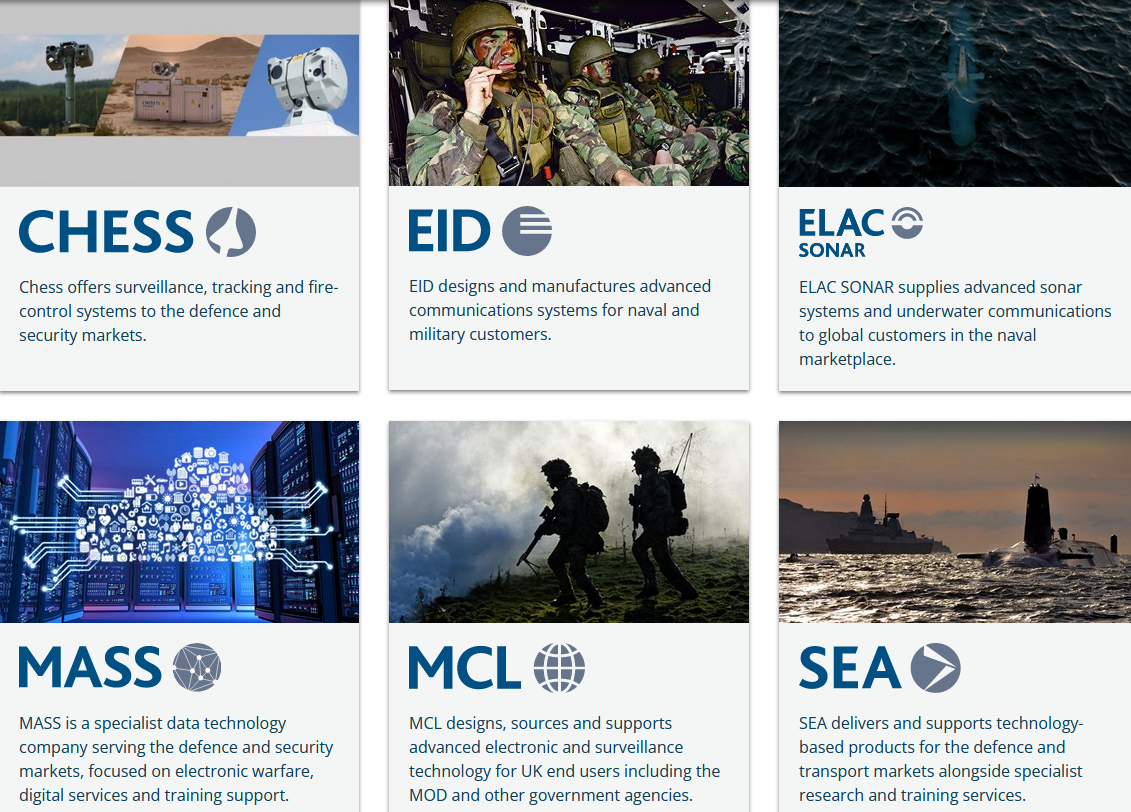

Cohort is a group of semi-autonomous defence businesses that operate under a central corporate umbrella. There's plenty of information on the company's website, so I won't repeat it here.

FY23 results - financial highlights: today's full-year results cover the 12 months to 30 April and look pretty strong to me, suggesting a significant step up in growth.

Revenue rose by 33% to £182.7m, supporting a 36% increase in pre-tax profit to £13.9m.

Order intake for the year rose by 19% to £220.9m, resulting in a year-end order book of £329.1m (FY22: £291m).

Net cash ended the year at £15.6m, up from £11m one year earlier.

The dividend will rise by 10% to 9.2p per share, maintaining Cohort's unbroken record of dividend growth since its 2006 IPO.

My sums suggest free cash flow of just under £10m, excluding acquisitions. That represents after-tax cash conversion of 88% and gives a free cash flow yield of about 5%.

Free cash flow is lower than last year, due mainly to working capital movements. I'm not concerned, given the overall improvement in the group's net cash position. Investing cash in the growing pipeline of orders makes sense at this stage.

Cohort's profitability seems solid, if not spectacular. I calculate a statutory operating margin of 8.4% and a return on capital employed of 12.3%.

Trading commentary: unsurprisingly, Cohort – like many other defence companies – is enjoying bountiful trading conditions. The company highlights particularly favourable trading in two of its divisions:

"Especially strong performance from within the Communications and Intelligence division, driven by significant uplift in UK MOD activity at MCL"

Also:

"Improved performance within Sensors and Effectors, with Chess delivering better operational performance."

However, the group's Portuguese electronics business, EID, has continued to perform poorly and operated at a loss last year:

"our Portuguese business, EID, which made a marginal trading loss, a result of continuing weak performance in Portugal due to continuing delays to new programmes, particularly with the Portuguese Navy. We now expect these orders to be placed in 2023/24."

EID's weak performance has been an issue for some time, but perhaps things will finally turnaround this year.

Today's results note that EID's managing director stepped down shortly after the year end. The company has put an interim MD in charge and has "commenced a process to determine the right way forward in the longer term".

Outlook: at a group level, Cohort's current order book underpins a record 80% (£140m) of forecast revenue for the current (23/24) financial year, with significant amounts secured for subsequent years.

Net cash is expected to decrease this year as a result of "planned capital expenditure and expansion in working capital", but Cohort expects to end the year with a net cash balance.

However, management say they've seen an "encouraging start" to the current financial year and that full-year expectations are unchanged.

The company says that it expects to achieve a "trading performance" ahead of the 2022/23 financial year, but broker forecasts don't make it clear how much increase is likely.

Today's results show adjusted earnings of 36.5p per share. Forecasts ahead of today's results also appeared to show earnings of about 36p per share for 2023/24.

Forecasts may edge higher, I guess. But I think it seems fair to assume growth will be lower this year than it was last year.

My view

Cohort shares are up by 10% as I write. This prices the shares on about 13.5 times forecast earnings, with a dividend yield of around 3%.

Today's results do not seem to show any nasty surprises and perhaps the poor performance of EID will finally be resolved this year. Or the business might be divested.

Overall, I think Cohort is an attractive business with the potential to be a rewarding long-term investment. I would quite like to see a higher level of profitability, but I think the rather average group-level figures mask much higher profitability in some of the group's operating businesses.

In terms of valuation, I think Cohort looks reasonably priced, with an EBIT/EV yield of 8% and a 5% free cash flow yield.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.