Dividend notes: investment platforms get cash boost - AJB, IHP (14/12/23)

I review recent results from FTSE 250 investment platforms AJ Bell and IntegraFin Holdings.

Welcome back to my dividend notes.

Today I'm looking at two quite different investment platform companies, AJ Bell and IntegraFin Holdings. Both of these firms are on my radar as dividend shares I might be interested in owning at the right price.

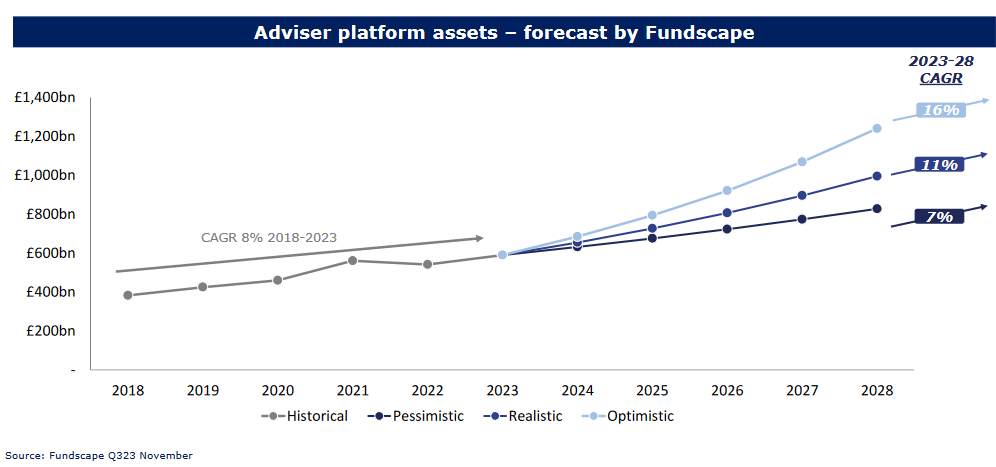

The UK investment platform sector is expected to continue growing over the coming years, as more people choose or need to take responsibility for their own retirement savings.

If the growth projections in this chart are vaguely correct, then I think there should be scope for leading platform advisor operators such as IntegraFin and AJ Bell to expand and gain market share over the coming years, despite growing competition.

Here are my thoughts on each company's recent full-year results.

Companies covered:

- AJ Bell (LON:AJB) - results from this FTSE 250 investment platform look solid to me and the company is taking proactive steps to forestall regulatory pressure on cash interest and fees. I think the shares could still be reasonably valued at current levels.

- IntegraFin Holdings (LON:IHP) - this adviser-only platform provides a truly independent service that allows IFAs to provide a whole-market offering to their clients. I like the business, although the competitive landscape seems to be getting tougher.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

AJ Bell (AJB)

"Record financial performance"

Final results y/e 30 September 2023 & pricing changes

Recent results from investment platform AJ Bell look broadly reassuring to me and showcase the excellent profitability and continued growth of this business.

Results highlights: AJ Bell's revenue rose by 33% to £218.2m last year, supporting a 50% rise in pre-tax profit to £87.7m. This translated into a pre-tax margin of 40.2% (FY22: 35.6%), reflecting an increased revenue margin of 0.298% (FY22: 0.226%).

This growth was driven in part by a 10% increase in assets under administration and a 12% increase in customer numbers to 476,532.

Net inflows of £4.2bn (FY22: £5.8bn) plus positive favourable market movements of £2.6bn lifted total assets under administration by 11% to £70.9bn.

Despite this positive performance, the elephant in the room was the increase in interest earned on clients' cash balances.

Interest on cash balances: AJ Bell says that "recurring ad valorem" fees (those based on account value) rose by 58% to £161.2m last year. This increase includes some retained interest income from customer cash balances – the company didn't disclose the exact amount of retained interest income.

Interest earned on customer cash has been a hot topic for a while. As largely expected, the FCA has now weighted in with a Dear CEO letter to platform bosses that was issued shortly after AJ Bell's results were published.

The main points in the letter seem to be that companies should be transparent about interest rates and the amount retained, and that interest retained should be proportionate to the costs of cash management.

The FCA also suggests that companies engaged in the 'double dipping' – retaining interest and charging their clients cash management fees – should cease this practice promptly. Fortunately, neither AJ Bell or Hargreaves Lansdown double dip, as far as I can see.

(According to an informative Liberum note on this subject that's available on Research Tree, the only sizeable platform engaged in double dipping is Quilter, which is now expected to change this practice. I've previously looked at Quilter here.)

I don't know if any regulatory changes will emerge from the FCA's interest in this area. But I don't think that AJ Bell is likely to suffer a serious impact. The company has already improved its disclosure relating to interest rates (here) and now pays more competitive rates than historically.

In addition to this, AJ Bell has already committed to a package of pricing changes. These were announced on the same day as the FCA letter was published.

The pricing changes will take effect from 1 April 2024 and will include a reduction in the standard share dealing fee, from £9.95 to £5.00, and an increase in the interest rates paid on large cash balances.

Profitability: notwithstanding my comments above, I think it's clear that retained interest on client cash played a significant role in boosting AJ Bell's profitability last year.

Despite a 26% increase in operating costs to £132m (FY22: £104.9m) – due to staff pay rises, recruitment and technology investment – AJ Bell's operating margin rose to 39.5% (FY22: 36.0%) last year.

My sums suggests a return on equity of 45.6% (FY22: 35.4%).

Management point out, rightly in my view, that if cash levels or interest rates fall, the group will be likely to see increased activity elsewhere. Even so, I suspect that this may be a peak level of profitability, at least for the near term.

Dividend: the total dividend for the year was increased by 46% to 10.75p per share. That represents 1.6x cover by earnings and gives the shares a 3.5% yield at the time of writing.

AJ Bell says this is the 19th consecutive year of dividend growth for the business. The company only floated in 2018, so slightly unusually this appears to include its time as a privately held business.

Outlook: chief executive Michael Summersgill expects short-term macroeconomic headwinds, but says he's confident of the longer-term opportunity for the business:

"our versatile platform offering enables us to continue delivering robust growth in these conditions and the long-term structural drivers of growth in the UK platform market remain strong."

Brokers appear to be taking a cautious view about the 2023/24 financial year. Consensus forecasts suggest earnings will be broadly flat this year. These estimates price AJB shares on a forecast P/E of 18 with a prospective dividend yield of 4.4% (another big increase to the payout is expected this year).

My view

As I've commented before, I think this is a good quality business. I don't see anything in AJ Bell's full-year results to change this view.

Although the shares aren't quite as cheap as they were a few weeks ago, the current share price still gives an EBIT yield of 7.9% and a prospective dividend yield of 4.4%.

AJ Bell's growth seems likely to slow, at least in the near term. Even so, I think the shares could offer value at current levels, given the strong profitability of this business.

IntegraFin (IHP)

"Record year end Transact investment platform funds under direction ('FUD') of £55.0bn."

Final results y/e 30 September 2023

IntegraFin shareholders (and clients) do not need to worry about interest on client cash balances. The platform has a longstanding policy of passing all interest earned on client cash directly through to its clients.

I should point out that this platform business serves financial advisers only – unlike AJ Bell, it does not have a direct-to-consumer offering. Even so, I like IntegraFin's interest rate policy for its simplicity and transparency.

Although it may be true that AJ Bell and Hargreaves Lansdown use retained interest income to subsidise some of their fees, the nature of such arrangements means that some clients are likely to benefit more than others from such subsidies. They also lack transparency.

As we'll see shortly, IntegraFin's interest policy does not seem to impact the overall profitability of the business. This suggests to me that clients (or their advisers) are happy to pay fees and receive offsetting interest income.

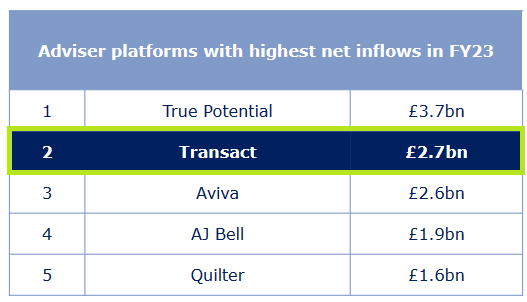

Results highlights: IntegraFin's funds under direction ended the year at a record level of £55.0bn (FY22: £50.1bn). This represents net inflows of £2.7bn during the year and positive market movements of £2.3bn.

Client numbers rose by 2.5% to 230,294, while the number of advisers registered on the platform climbed 1.9% to 7,683. Remember that these advisers do not typically have all of their client assets on IntegraFin's Transact platform – so funds under direction can potentially rise faster than client/adviser numbers, if advisers are impressed with IntegraFin's service.

Despite the growth in funds under direction, price cuts during the year meant that IntegraFin's revenue was broadly flat at £134.9m (FY22: £133.6m).

The group's underlying pre-tax profit fell by 4.3% to £63m, while underlying earnings fell by 6.7% to 15.2p.

I've used underlying profits rather than statutory profits here because IntegraFin's accounts have some unusual insurance-related items that cause big swings in reported profits. I'm comfortable these can be ignored for my purposes.

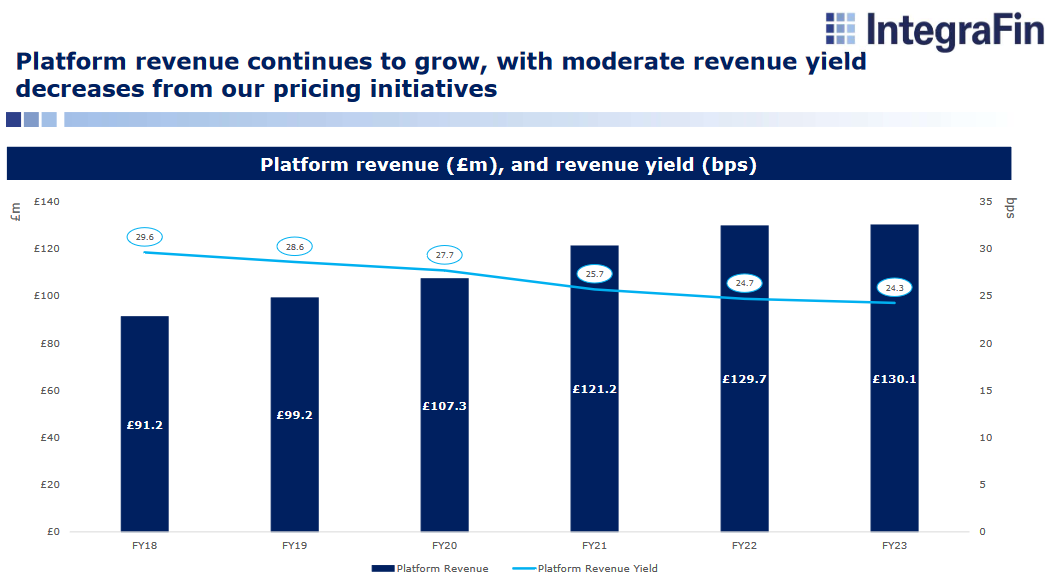

Profitability: IntegraFin's planned price cuts last year saw its revenue yield (the revenue earned as a proportion of client assets) fall to 0.243%. This continues a long-running downward trend:

I guess we might wonder how much further IntegraFin's pricing power is likely to be eroded by competitive pressures.

For contrast, AJ Bell's revenue margin on its advised platform was 0.182% last year – but AJ Bell retained a significant portion of interest earned on client cash, whereas IntegraFin passed it through in full.

For this reason, I'm not sure it's possible to make a direct comparison on fee levels without modelling various account scenarios.

Notwithstanding IntegraFin's falling revenue yield, the business remained extremely profitable last year, with an underlying pre-tax margin of 46.7%.

Dividend: the total dividend for the year was held flat at 10.2p per share, giving a yield of 3.5% at the time of writing.

IntegraFin is highly cash generative. The group's corporate cash balance was broadly flat at £178m at the end of last year, despite the £34m cost of the dividend. I don't see too much risk to this payout, even if earnings are subdued this year.

Outlook: some further reduction in profitability does seem to be a risk to me. The company's FY24 guidance suggests staff costs and regulatory/professional fees are expected to rise by around 12% over the coming year.

This seems to be largely driven by inflationary increases and investment in "platform digitalisation" – perhaps mirroring the technology spend and headcount increase AJ Bell reported for FY23.

As with AJ Bell, broker consensus forecasts for IntegraFin suggest earnings will be largely flat this year at 13.2p per share. That prices the stock on around 20 times forecast earnings with a c.3.5% dividend yield.

My view

IntegraFin may not seem immediately cheap, but I think this remains an interesting and potentially attractive business.

Like AJ Bell, it should continue to benefit from structural growth in the wealth management market. IntegraFin's more focused and transparent business model also appeals to me, although it's not clear to me whether it will be more or less vulnerable to competitive price pressure than AJ Bell.

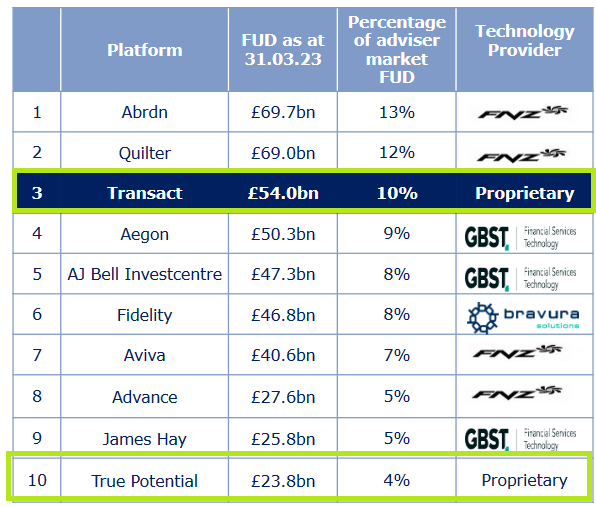

My feeling is that IntegraFin's focus on providing a truly independent platform on its own proprietary software is an attraction. The company says net inflows to Transact last year ranked it second in the top five adviser platforms:

However, I couldn't help noticing that the company at the top of the leaderboard above – True Potential – is the only other major adviser platform with its own proprietary technology:

Although True Potential's has less than half the FUD of IntegraFin, I wonder if this faster-growing business could become a serious competitior.

For now, IntegraFin is a business I'll continue to watch with interest. But I do have a favourable impression of this company – and like AJ Bell, this is a stock I could imagine owning.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.