Dividend notes: sleeper stocks? BNZL, MACF, QLT (30/08/23)

Two profit upgrades and a confident outlook: I review half-year results from Bunzl, Quilter and Macfarlane.

After enjoying a short but welcome respite from company newsflow, I'm catching up with a few results from August. These include:

- upgraded profit guidance from two FTSE 350 companies

- a possible 'sleeper' small-cap with a financial track record that's impressed me

Companies covered:

- Bunzl (LON:BNZL) - another solid set of results from this FTSE 100 distribution group. I can see much to like here, although the valuation looks about right to me at current levels.

- Macfarlane (LON:MACF) - this small-cap packaging business impresses me again with a strong set of half-year numbers and stable outlook.

- Quilter (LON:QLT) - this wealth manager has upgraded its 2023 profit guidance, but earnings are still expected to be below 2022 levels. I think the shares could offer value, but it's not my top pick in this unloved sector.

Tip: to search for my previous coverage of a company, enter its ticker code into the search tool at the top of this page.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Bunzl (BNZL)

"2023 outlook: adjusted operating profit guidance upgraded"

Bunzl has just upgraded its 2023 profit guidance for the second time in three months.

This FTSE 100 distributor flies below the radar for many investors, but has historically proven to be a far more successful investment than some popular stocks.

Bunzl operates in more than 30 countries, supplying customers with a vast range of not-for-resale items such as safety gear, cleaning products, and catering consumables.

I commented on Bunzl's June upgrade here. This week's half-year results show further fuss-free progress.

Half-year results summary: Bunzl's revenue rose by 4.5% to £5,906.8m during the first half of the year, although this increase fell to 0.6% at constant exchange rates.

A quick look at the group's geographic breakdown shows that operating profit rose in all regions, despite some volume weakness in certain markets. Cost inflation seems to be easing, but Bunzl appears to have been able to successfully push through inflation-linked price rises.

Pre-tax profit for the period rose by 6.9% to £317.1m, while half-year earnings were 6.9% higher, at 70.8p per share.

Free cash flow for the period rose by 21% to £286.3m, helped by "a substantial reduction in inventory".

Operating margin for the half year was 7.4% (H1 2022: 7.3%) and my sums suggest a trailing 12-month return on capital employed of around 15% – a solid figure that's slightly above the 14% average seen in recent years.

Bunzl acquired 12 companies during the period, in keeping with its normal growth strategy. These are almost always small bolt-on deals that can be integrated into Bunzl's global infrastructure and benefit from its purchasing power and distribution efficiencies.

One of the deals announced with the half-year results was the firm's first acquisition in Poland. The country was described by CEO Frank van Zanten as "a key target for expansion".

Dividend: the interim dividend was increased by 5.2% to 18,2p per share.

Broker forecasts suggest a full-year payout of 66p, giving a prospective yield of 2.3%.

Outlook: full-year profit guidance has been upgraded due to higher margin expectations:

"2023 outlook: adjusted operating profit guidance upgraded, driven by a meaningful increase in operating margin expectations"

Broker forecasts have been tweaked up very slightly. Consensus estimates I can see suggest earnings of 180p per share this year. That puts the stock on 16 times forecast earnings.

My view

I rate this as a quality business with good management. Despite a relatively low dividend yield, Bunzl shares also score quite highly in my dividend stock screening results.

At current levels the shares look fairly valued to me. I'd be open to owning Bunzl shares in my dividend portfolio, but would prefer to wait for a market sell-off to provide a higher yield (and higher expected total return).

Macfarlane (MACF)

"Profit before tax at £10.0m increased by 13%"

I last covered small-cap packaging group Macfarlane in May, when I noted that it "has been churning out steady growth for a number of years" and seemed "reasonably priced" to me.

I also said that the stock scored quite well in my dividend quality screen. That remains true today – Macfarlane's score of 72/100 has increased slightly since May.

The group's recent half-year results left full-year profit guidance unchanged and confirmed my view that this business is in good shape at the moment. Let's take a look.

Half-year results summary: Macfarlane's revenue rose by 2% to £141.6m during the six months to 30 June, while pre-tax profit rose by 13% to £10.0m.

Net debt improved slightly to £3.3m (Dec 22: £3.4m). Free cash flow before acquisitions rose to £15.5m (H1 2022: £0.8m) thanks mainly to a £9m reduction in inventories and outstanding receivables.

Profitability: the group's operating margin for the half year was 7.6%, while I estimate a trailing 12-month return on capital employed of 15.6%. These are decent figures for a business of this kind, in my view.

Trading: growth was split across the firm's two divisions, with operating profit from distribution activities up by 6% to £9.4m, and profits from the group's specialist manufacturing business up by 36% to £3.4m. Both figures are on an underlying basis.

Lower demand in some sectors was offset by several small acquisitions during the period and some new business wins.

Dividend: the interim dividend was lifted by 4% to 0.94p per share.

Broker forecasts suggest a payout of 3.6p per share this year, giving a prospective yield of 3.4%.

Outlook: full-year profit guidance was unchanged:

"Whilst we expect the second half of 2023 to remain challenging, our good progress in Europe, diverse customer base, strong new business momentum and effective management of pricing and costs mean that our profit expectations for the full year remain unchanged."

Broker forecasts suggest full-year earnings will rise by 19% to 11.8p per share this year. That prices Macfarlane on nine times forecast earnings, which doesn't seem excessive to me.

My view

I'm impressed by the continued growth of this business, although mindful that at least some of it is being contributed by acquisitions. Macfarlane's half-year results did not split out organic and acquisitive growth, so we're left guessing about the mix between the two.

Even so, I think the track record here is probably good enough to justify giving management the benefit of the doubt.

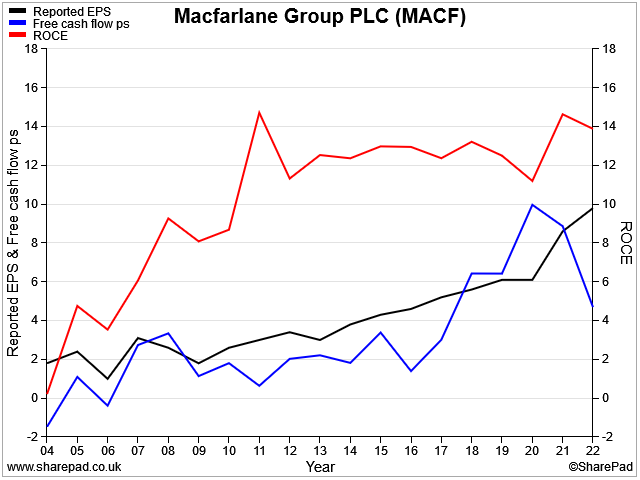

This chart shows growth in earnings and free cash flow (left scale) and return on capital employed (right scale). Earnings growth appears to have been consistently backed by cash conversion and solid profitability:

This business obviously remains vulnerable to wider economic conditions and could suffer in a serious recession.

Even so, I remain interested in Macfarlane and can see plenty to like at current levels.

Quilter (QLT)

"the adjusted profit out-turn for this year is expected to be meaningfully ahead of current market expectations, assuming broadly stable markets."

I've not looked at this wealth manager and investment platform before, but I have recently considered investment platform providers IntegraFin, Hargreaves Lansdown and AJ Bell.

Quilter is a wealth manager but also operates its own platform, so there's some overlap. Given this, I thought it might be interesting to take a look at Quilter's recent half-year numbers.

This business was spun out of Old Mutual in 2018 and is now a standalone business. Share price performance so far has been underwhelming, but the stock offers a 5%+ yield, which is higher than any of the rivals I mentioned above:

What does Quilter do? From what I can tell, Quilter is focused on wealthy investors who use financial advisers. It operates both under the Quilter brand and as a service provider to independent financial advisers.

The firm's operations are divided into two core segments, High Net Worth and Affluent.

This business isn't a direct rival to DIY-focused HL, but may compete for advisers' business with IntegraFin and AJ Bell. Both of these rival firms offer investment platforms specifically for financial advisers.

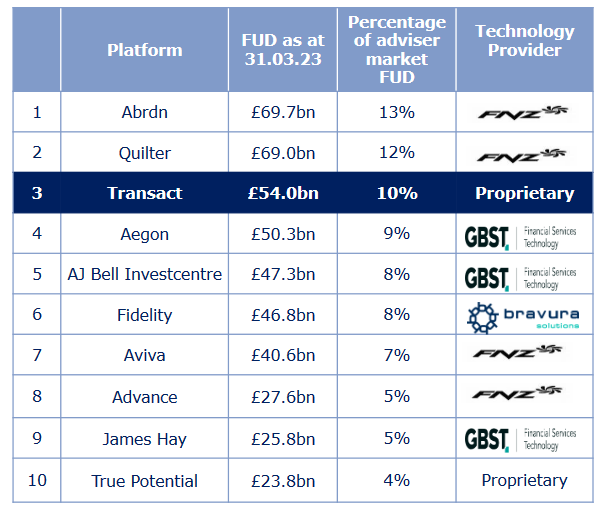

Quilter's platform has had about £70bn of assets under management or administration at the end of the half year, representing the Affluent customer segment.

The High Net Worth segment had a further c.£25bn under management or administration; presumably this isn't funnelled through the platform.

Total assets under direction are c.£100bn. This compares to £54bn on IntegraFin's platform and £47bn for AJ Bell's advised service at the end of H1.

Quilter's platform was ranked second in the UK by market share at the end of March, according to IntegraFin.

One big difference is that Quilter (and AJ Bell) use third-party software to power their platforms, whereas IntegraFin has its own proprietary solution. This could mean that differentiation relies more on marketing and less on functionality.

On this basis, IntegraFin's positioning as a pure-play, independent platform provider looks more attractive to me.

Half-year results summary: Quilter saw net inflows of £0.7bn during the half year, lifting AuMA to £98.3bn in the group's core business.

Adjusted pre-tax profit rose by 24.6% to £76m, while the group's operating margin improved from 20% to 24%.

Profits were boosted by the benefit of higher interest rates on client funds and "strong cost management".

There might be further scope for margin improvement, too. Quilter still appears to be rationalising and modernising its infrastructure in the wake of its split from OM five years ago.

The company has completed an initial £65m "optimisation" programme and is now moving into "simplification". This is expected to yield a £50m cost reduction from the 2022 cost base by 2025.

Fee margins: Quilter's group revenue margin for the half year was stable at 0.48%. Comparable half-year figures for AJ Bell and IntegraFin were 0.22% and 0.24% respectively.

Quilter's higher margins appear to be correlated to the wealth of its clients – high net worth clients generate around 0.7%, with affluent segment clients expected to be in the "low 40s bps".

Interestingly, the company says that "platform pricing initiative" – i.e. cutting fees – will lead to a decline in revenue margins over the next 18 months.

Dividend: shareholders will receive an interim dividend of 1.5p per share, consistent with forecast for a full-year payout of 4.6p per share. That gives Quilter shares a prospective yield of 5.2%.

Outlook: profits are expected to be lower in the second half of the year than in H1. This is due to the "repricing of our Platform" and an expected modest increase in costs.

Despite this, full-year adjusted profits are now expected to be "meaningfully ahead of current market expectations, assuming broadly stable markets".

The company doesn't quantify this guidance, but broker consensus estimates have risen by 15% to 7.4p per share over the last month. That prices the stock on around 12 times forecast earnings.

However, despite this recent upgrade, Quilter's earnings are still expected to be below their 2022 level of 7.9p per share.

My view

I don't see anything obvious to dislike here and I suspect Quilter's current valuation could be quite reasonable – this whole sector is out of favour at the moment.

However, a number of other larger firms are currently seeking to expand into wealth management at the moment. Quilter appears to be operating in a competitive market and I wonder how differentiated its offering really is.

I will also be interested to see how fee reductions affect the platform's revenue margins over the remainder of the year.

I would need to do more research to understand the company's market segments and positioning in more detail.

However, my initial impression is that I would be unlikely to choose Quilter over the other platforms I've considered previously.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.