The Dividend Note - is Direct Line a recovery buy? DLG, MACF, RSW (10/05/24)

I review this week's updates from Direct Line Insurance, engineer Renishaw, and packaging group Macfarlane and ask if buying opportunities are emerging.

I don't generally indulge in hindsight after I sell a stock. But this week I've been tempted to take a look at FTSE 250 share Direct Line Insurance, which was previously a member of my dividend portfolio.

I sold Direct Line after the company ran into problems at the end of 2022 and suspended its dividend. A recovery now seems to be underway and dividend payments have been restarted, albeit at a much lower level.

Should I have continued holding and taken more of an owner's approach? Perhaps.

I sold in part because of the dividend suspension, but also because I felt management had lost credibility and I was starting to question the direct-to-consumer model in an era of price comparison.

I've commented on some of these issues below in my review of the insurer's first-quarter update.

But more broadly, the experience has prompted me to think more carefully about when to sell and whether it might make more sense to accept a dividend suspension for a limited period – perhaps 12 months.

I'll comment more on this in the future. For now, let's move on and take a look at this week's dividend shares.

Companies covered:

These notes contain a review of my thoughts on recent results from UK dividend shares that are of interest to me. In general, these are dividend shares that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- Direct Line Insurance (LON:DLG) - operating performance and margins appear to be stabilising, but there's still a worrying customer exodus from the core motor insurance brands. If this can be halted, I think there's value here.

- Macfarlane Group (LON:MACF) - the packaging group warns of a slow start to the year but leaves guidance unchanged. I think management expectations are credible and would consider the recent drop as a potential entry point.

- Renishaw (LON:RSW) - a nine-month update from this specialist engineer suggests full-year profits will be at the lower end of guidance, with some pressure on margins. However, a recovery seems likely to me and I continue to admire Renishaw's quality metrics and track record. My sums suggest the stock could still offer long-term value at £40.

Direct Line Insurance (DLG)

"Claims trends and Motor margins continue to develop in line with our expectations"

Q1 2024 trading update / Mkt cap: £2.6bn

FY24 forecast dividend yield: 7.2%

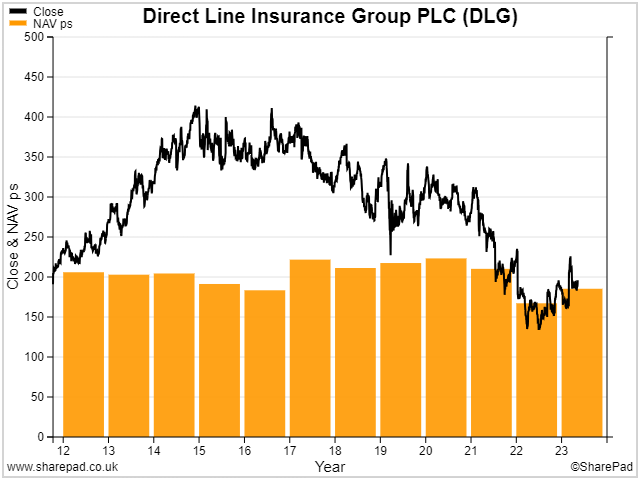

Direct Line was spun out of RBS (now NatWest Group) in 2012 and once appeared to have been a successful float. However, the shares dipped below their IPO price last year and are still only modestly higher today:

Anyone who has held DLG since the float has done somewhat better than this, thanks to a generous stream of dividends. According to SharePad, the shares have delivered a total return since IPO of around 150%, or 8% annualised.

Even so, Direct Line has been a disappointing performer relative to sector leader Admiral, which has delivered a 300% total return over the same period (an impressive 16% annualised).

Q1 trading summary: the headline numbers from this week's update appear promising at first glance.

- Gross written premium (GWP) up 10.7% to £892.2m

- Motor up 18.3% to £424.3m

- Home up 14.2% to £147.3m

- Commercial own brands up 14.9% to £71.7m

- Rescue down 1.9% to £63.5m

The company says motor claims costs were in line with expectations during the period, with "estimated written margins maintained above 10%".

Unfortunately, Direct Line is continuing to lose customers. The number of in-force policies fell by 1.8% (174k) to 9.3m in Q1, relative to the same period last year.

Most of these losses are coming in the core motor insurance business, as customers apparently find better renewal deals elsewhere. The number of individual customers taking Direct Line's own branded policies has fallen from 3.7m at the end of March 2023 to 3.2m at the end of Q1 this year.

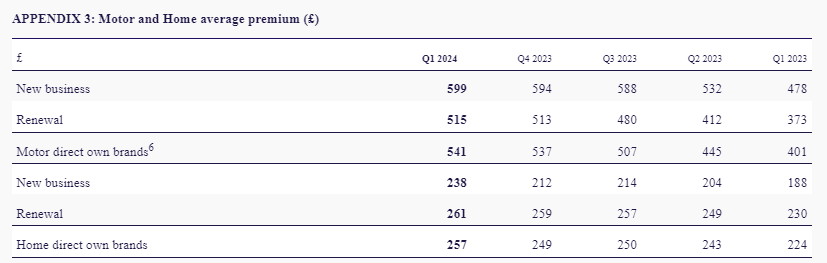

CEO Adam Winslow says this reflects "the continued repricing of the Motor book". This has seen Direct Line's average motor premium rise from £401 to £541 over the last year, albeit increases seem to have levelled out since Q4 2023:

Interestingly, Direct Line's average motor premiums are still below the Associated of British Insurers (ABI) average Q4 2023 premium of £627 (cited in Admiral's 2023 results presentation).

Direct Line's numbers are also below my estimate of £682 for Admiral's average 2023 motor premium (although this may not be accurate).

I don't know much about Direct Line's customer mix versus that of Admiral, or the wider market. But I wonder if it's a concern that Direct Line is seemingly pricing below the market average, but still losing customers.

One saving grace for the motor business was the addition of almost 700,000 Motability customers in September 2023. These are said to be contributing around £700m of gross written premium – c.£1,000 per vehicle.

The Motability contribution means that DLG's total motor customer numbers have risen from 3.7m to 4.1m over the last 12 months. But I'd still like to see evidence the performance of the group's core consumer brands is stabilising.

Outlook: new CEO Adam Winslow is confident he can achieve £100m of annualised cost savings by the end of 2025.

With this leader cost structure in place, he expects to be able to deliver a net insurance margin (normalised for weather) of 13% in 2026.

However, explicit 2024 guidance was limited to this comment:

"Claims trends and Motor margins continue to develop in line with our expectations"

No mention is made of GWP, overall margins or indeed profit. But City analysts – who tend to be better informed than private investors – appear to have cut their full-year forecasts following this week's update.

According to Stockopedia data, consensus earnings estimates for 2024 have fallen by 9.5% to 14.1p per share since Direct Line's Q1 update.

In fairness, Winslow only started work on 21 March 2024 – seven weeks ago. He has scheduled a Capital Markets Day for 10 July 2024 that should provide more information on both performance and strategy.

My view

Adam Winslow has joined Direct Line from Aviva, where he ran the group's UK & Ireland general insurance business.

The starting date of that appointment (May 2021) suggests to me he was one of Aviva CEO Amanda Blanc's appointments. Given the improvement in Aviva's performance since Ms Blanc took charge, I see this as a positive.

Winslow has also not wasted time in revamping senior management and has already appointed a new CFO, Jane Poole. Her previous role was as Winslow's CFO in Aviva's UK business. So presumably the two already have a good working relationship.

Would I consider buying back into Direct Line? Possibly. It remains one of the biggest players in the UK market and has several strong brands.

Historically this business generated a return on equity in low double digits. The shares currently trade close to their net asset value, for the first time since Direct Line's IPO.

If the business can generate a steady 10%-15% return on equity in the future, then buying the shares close to NAV (equity value) could deliver decent returns.

Subject to any revised guidance issued later this year, earnings are expected to be markedly higher next year. A FY25 dividend yield of 6%-7% doesn't seem unrealistic to me based on the current valuation.

Of course, past performance is no guarantee of future returns. Direct Line may now be structurally less profitable for reasons I don't understand.

I'll continue to watch with interest and will look forward to this summer's half-year results and CMD.

Macfarlane (MACF)

"the start of 2024 has been challenging with first quarter sales and profits below the same period in 2023"

AGM trading update / Mkt cap: £203m

FY24 forecast dividend yield : 3.0%

I last looked at small-cap packaging group Macfarlane in an in-depth share review in November. I was impressed at the time and continue to like this business, which is also one of the highest-scoring shares in my dividend screen results.

This week's AGM update warned of a challenging start to 2024, but left full-year guidance unchanged, triggering a mild sell off:

The company said that sales during the first quarter were 9.5% lower than the same period in 2023, due to "continued weak customer demand and price deflation".

First-quarter profits were also said to be lower, by an unspecified amount. However, the company said that benefits from "strong gross margins" and recent acquisitions had helped to dampen the impact of falling sales on profit.

Trading is expected to improve during the second half of the year, thanks to a mix of new business and sales recovery from existing customers. Cost control will remain a key focus.

Reassuringly, Macfarlane had a net cash position of £4.7m at the end of March, up from £0.5m at the end of December 2023.

Outlook: to be fair, Macfarlane warned in its 2023 results that the outlook for 2024 was likely to remain challenging. This update didn't seem particularly surprising to me.

I think the key thing is that full-year guidance was explicitly left unchanged. This appears to be supported by an updated note from house broker Shore Capital (available on Research Tree) showing unchanged 2024 forecast earnings of 12.4p per share.

I emphasise this because we've seen a trend of smaller companies recently slipping out profit warnings through updated broker notes, without making them explicit in an RNS. This has not happened here.

My view

Packaging is a cyclical business and it's quite obvious that there will be variation in demand sometimes, due to external conditions.

A second-half weighting to profits is often an early sign that a profit warning may be likely later in the year.

I can't rule out that risk here – clearly no one can be sure when demand will start to improve. But the latest UK economic does not seem that bad to me and I think Macfarlane has credible management and good record of disciplined operations.

On balance, I think Macfarlane shares look reasonably priced on 11 times earnings. The group has a solid track record of organic and bolt-on growth, with decent profitability. Cash generation is generally good and the net cash position is reassuring.

I remain interested in this business and would consider buying at current levels if a vacancy arose in my portfolio.

Renishaw (RSW)

"We have continued to deliver a solid performance in mixed market conditions"

Trading statement for nine months ended 31 Mar 24 / Mkt cap: £2.9bn

FY24 forecast dividend yield: 1.9%

Specialist engineering group Renishaw is often talked about as a bid target, perhaps in part because co-founders Sir David McMurty and John Deer actually put the company up for sale in 2021.

That came to nothing, but April saw more bid rumours making the rounds. These were followed by a statement from German industrial giant Siemens confirming that it is not planning to make an offer for Renishaw.

I suspect valuation is the sticking point with potential buyers, because the company's sensing and measurement technology is world class, as far as I can tell.

Last week Renishaw issued a trading update for the nine months to 31 March, ahead of a Capital Markets Day on 18 June 2024 and full-year results sometime in September.

9-month trading summary: Renishaw says that conditions in its end markets are "mixed" but figures for the most recent quarter seem to suggest some signs of recovery.

- Q3 revenue of £172.4m was 4% higher than the average of Q1 and Q2

- Updated full-year guidance implies Q4 revenue could rise further to between £177m and £197m

- The smaller analytical instruments and medical devices division has continued to deliver double-digit growth this year, with nine-month sales up 16% to £29.3m

Management say that additive manufacturing (3D printing) continued to deliver strong growth in the third quarter, while co-ordinate measuring machine and gauging systems also performed well.

There were also some "early signs" of recovery in demand for position encoders from semiconductor equipment builders.

However, demand for metrology sensors used in consumer electronics was weaker in Q3 than in H1.

Outlook: I always find it reassuring when a company is able to narrow its full-year guidance as the year progresses. Next does this and so too has Renishaw.

Management now expects to report revenue of £680m to £700m this year, with pre-tax profit of £122m to £135m.

This compares to February's guidance for revenue of £675m to £715m, with pre-tax profit of £122m to £147m.

Unfortunately this updated guidance does seem to imply that FY24 results may be at the bottom end of expectations.

Taking the mid-point from both sets of revenue and pre-tax profit guidance also appears to suggest that Renishaw's adjusted pre-tax margin may now be slightly lower than previously expected, at 18.6%, versus 19.4% in February.

I don't think this is really a profit warning, but this doesn't seem likely to be a standout year for Renishaw.

Consensus estimates now price the stock on 28 times FY24 earnings, falling to 23x FY25 earnings.

My view

I keep coming back to this innovative British engineering business even though the dividend yield is too low for me, at under 2%. Renishaw is a stock I'd like to own, but at what price?

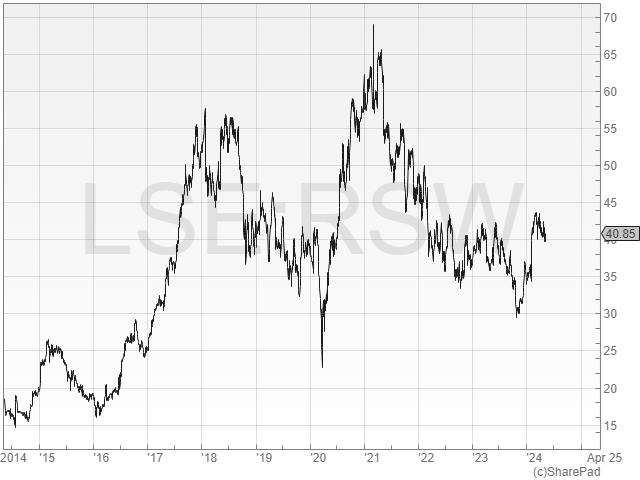

More decisive investors than I were able to pick up the shares at £30 in October 2023. On a long-term view, I suspect that could prove to have been a bargain price:

I'm less sure about buying at £40, which prices the stock with a FY24 forecast EBIT/EV yield of just 4.2% and a dividend yield of 1.9%.

Based on my target rate of return of at least 10%, I estimate that a £40 share price implies a sustainable growth rate of just over 8%. That doesn't seem entirely unreasonable to me, as the disruption from the pandemic recedes.

I suspect Renishaw may still be reasonably priced at current levels, but for now the shares will remain on my most-wanted list.

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.