Dividend notes (26/04/23): the road to recovery? ABF, WTB, GSK, PSN

This update reviews recent results from UK dividend shares Associated British Foods, Whitbread, GSK and Persimmon.

Welcome to the first of my dividend notes updates. This is intended to be a brief review of the latest results from UK dividend shares that are in my investable universe and are likely to appear in my screening results at some point.

This is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

Companies covered:

Associated British Foods

This FTSE 100 group is unusual for a whole range of reasons. It's family controlled and it's an old-fashioned conglomerate, owning a range of food and agricultural businesses in addition to the Primark clothing chain.

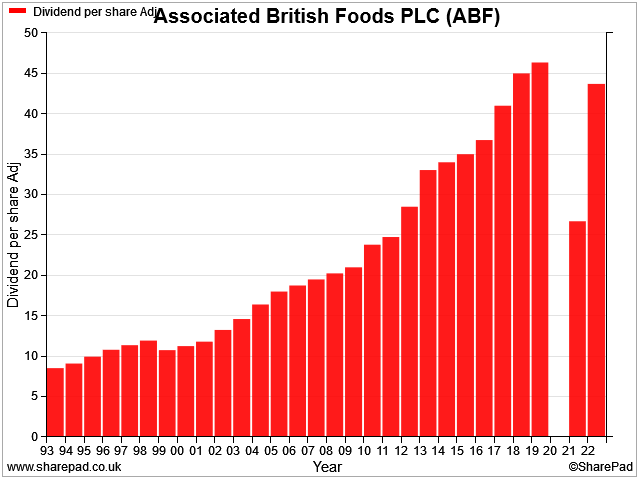

For dividend investors I think there's potentially a lot to like. Prior to the pandemic, ABF had not cut its dividend for more than 30 years. It navigated the pandemic without needing to raise funds the payout is expected to return to pre-pandemic levels this year.

Let's take a look at the latest numbers:

Results highlights: This week's interim results covered the 24 weeks ended 4 March 2023 (ABF has an unusual mid-September year end).

"Strong growth in group sales. Very good footfall and margin better than expected at Primark."

- Revenue: up 21% to £9,560m

- Operating profit: down 3% to £663m

- Net cash (exc. lease liabilities): £586m (Sept '22: £1,488m)

- Earnings per share: up 11% to 67p

- Interim dividend: up 3% to 14.2p per share

- TTM operating margin: 6.2%

- TTM return on capital employed (ROCE): 7.8%

ABF's half-year commentary struck a positive tone. But the numbers showed the impact of the company's decision to absorb some cost increases in Primark in order to keep prices competitive.

One notable change in the figures above was net cash, which fell by almost £900m during the half year. The company says this fall was driven by elevated inventories at Primark and the Illovo sugar business, plus some cost increases. Much of this outflow is expected to reverse in the second half, as inventories fall. I don't see this as a major concern, assuming full-year results reflect this guidance.

Outlook: The company says that full-year profits from its Food businesses are expected to be "modestly ahead" of last year. However, a poor UK sugar beet harvest means that profits from the AB Sugar division are expected to fall this year.

At Primark, management "remain cautious about the resilience of consumer spending". Product costs remain elevated although the company is starting to see savings on energy and shipping costs. Overall, Primark's adjusted operating margin is expected to be 8.3% this year, compared to 9.8% last year.

At a group level, expects its full-year adjusted earnings to be "broadly in line" with last year. Broker consensus forecasts suggest adjusted earnings of 130p per share this year, versus 131.1p last year.

My view: ABF's conglomerate model often means that stronger performance in one area is offset by weaker performance elsewhere. In my view, this is part of the appeal of this investment – this diversity tends to lead to more stable earnings and dividend performance over long periods.

The group's profitability is slightly below historic average levels at the moment, but I suspect this will improve over the next 12-18 months.

I estimate that ABF shares offer an EBIT yield of around 7% at current levels, based on trailing 12-month profits. In P/E terms, the stock is trading on 15 times forecast earnings, with a dividend yield of 2.3%.

At this level I'd say the shares are fairly valued, although not quite the bargain they might have been last year.

My positive view on ABF is unchanged. I think this is a well-run business with good long-term prospects.

Whitbread

Significant profit uplift to above pre-pandemic levels, driven by Premier Inn UK that continues to outperform the UK midscale and economy ('M&E') market.

This week's full-year results from the owner of Premier Inn cover the 52 weeks to 2 March 2023. This means they're the first set of results unaffected by Covid-19 for three years.

Inevitably, this means that comparisons made against last year's numbers look quite favourable.

To present a more neutral view, Whitbread has included comparison figures from the financial year which ended on 27 February 2020. I've used these FY20 comparators in the summary below:

- Revenue up 27% to £2,625m

- Adjusted pre-tax profit up 15% to £413m

- Adjusted earnings per share down 2% to 162.9p

- Net cash exc. leases £171m (FY20: net debt of £323m)

- Dividend per share: 74.2p (FY20: 32.7p - due to the cancellation of the final payout)

- Operating margin: 19.1%

- ROCE: 5.6% (company-adjusted ROCE: 10.5%)

The numbers seem solid enough to me. Management say that Premier Inn performed well last year and continued to gain market share in its target sectors of the UK market.

The group's return on capital is somewhat depressed by my statutory measure, but the company's adjusted metric presents a view that's more in line with medium-term guidance. Having taken a quick look at the adjustments, my feeling is that my estimate of real underlying ROCE would probably be somewhere between the two figures above.

One reason for surpressed returns maybe the ongoing investment in the group's German business. Whitbread is rolling out Premier Inn in Germany and now has 51 hotels open.

The German business generated a £50m pre-tax loss last year, but management are confident that over the long term, it will generate 10%-14% returns on the £1bn of capital that's been committed thus far.

The Germany hotel market is highly fragmented, like the UK market was 10-20 years ago. So there is potentially a significant opportunity for a well-positioned brand to take share, if Premier Inn can adapt its offering to suit German preferences.

Premier Inn UK: In the UK, Premier Inn occupancy rose to 82.7% last year, compared to 76.3% in the FY20 financial year.

Average revenue per available room was 27% higher, at £59.45, although I'm not sure this is very meaningful, given the impact of inflation.

Perhaps more interesting is that food and beverage sales have not yet returned to pre-pandemic levels. On a like-for-like basis, F&B was down 7% last year.

Outlook: the company says its confident in the outlook for FY24 but does not provide any fresh profit guidance. Broker consensus forecasts I can see suggest adjusted earnings of 148p per share for FY24, which seems to imply a 9% fall from the FY23 figures.

I'm not sure if this is correct – I'll keep an eye out for updated forecasts over the coming days.

The company does provide a useful insight into profit sensitivity to changes in sales, though:

- 1% change in UK accommodation sales = £15m impact on pre-tax profit

- 1% change in UK F&B sales = £4m impact on pre-tax profit

My view: At this point, my feeling is there's still some uncertainty about the likely path of profits this year.

However, I remain a fan of this business, which I see as well run and well positioned in its core UK market.

The balance sheet looks healthy to me, with a net cash position excluding leases and £4.6bn of tangible assets – the group holds the freehold for 54% of its hotels.

The shares now trade on around 20 times trailing earnings and yield 2.3%. My sums suggest an EBIT yield of 5%, which is below the level I'd normally look for in a new investment.

My feeling is that Whitbread shares are fully priced, given the uncertain outlook. But I don't think shareholders have anything much to worry about.

GSK

I published an in-depth review of FTSE 100 pharmaceutical GSK recently, when I asked if the newly-separated group is a quality dividend share.

This week's first-quarter results do not change my view that the company is most likely a steady dividend payer, but still needs to prove that it can deliver improved rates of growth and innovation.

Outlook: GSK reiterated its full-year guidance for 2023, which suggests adjusted earnings should rise by 12%-15%. The full-year dividend is expected to be 56.5p per share.

This guidance prices the stock on around 10x 2023 forecast earnings, with a 3.8% yield.

My view: The group's 2023 guidance has been left unchanged, but profits are expected to be weighted towards the second half of the year. My general impression was the the outlook was still a little uncertain.

I think GSK is probably reasonably valued at current levels and would not be a terrible thing to buy. But my view remains neutral for now.

Persimmon

Housebuilder Persimmon raised investor hopes on Wednesday that the worst of the housing slump might be over.

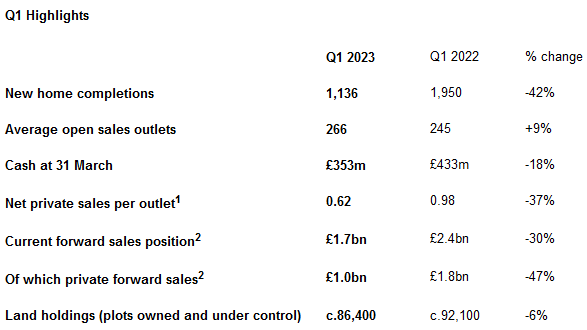

The FTSE 100 firm reported a 37% fall in new reservations during the first quarter, compared to the same period last year. But management said that if sales remained stable at current levels, they might be at the top end of expectations for this year.

If sales rates continue at the levels seen year to date, we would expect full year 2023 volumes to be toward the top end of the previously indicated range of 8,000 to 9,000 completions.

If this is to be achieved, Persimmon would need to deliver a sharp increase in completions for the remainder of the year. Q1 completions fell by 42% to just 1,136, which the company says reflects its reduced order book:

Most of Persimmon's peers have only reported results to the end of December 2022 so far, so it will be interesting to see if their results show the same pattern of reduced completions in Q1.

Outlook: the company says that the combined impact of build cost inflation and lower completions is having "a significant impact on the Group's profit margins".

Although Persimmon is managing to achieve "modest increase" in average selling prices, this is not enough to offset higher costs and lower volumes.

Broker forecasts for the year suggest adjusted earnings could fall by c.60% to 93p per share this year as a result. Dividend guidance for a minimum payout of 60p per share this year gives the stock a forecast yield of around 5%.

My view: I'm not sure I read Persimmon's Q1 update quite as bullishly as some other commentators. I think there could be a little more pain to come.

However, I am fairly bullish on housebuilders on a longer-term view. In my opinion, many of these shares look good value on a cyclical view at the moment.

Persimmon isn't my top choice in this sector, but I think the shares probably are reasonably priced at the moment.

I added a different UK housebuilder to my portfolio last year. You can read my September 2022 buy report on the company concerned here.

Disclaimer: This is a personal blog and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.