Dividend notes: quality dividends for my watch list - RSW, CHH (20/09/23)

I review recent results from engineer Renishaw (LON:RSW) and tableware manufacturer Churchill China (LON:CHH) and find plenty to like.

Welcome back to my dividend notes. In this post I'm looking at two companies that have issued results in the last week or so.

I think both of them could potentially be quality dividend stocks, so these comments are an initial marker to help me start tracking these firms in more depth.

Companies covered:

- Renishaw (LON:RSW) - a solid set of results from this specialist manufacturer, despite some weakness in the semiconductor sector. I'm impressed by the group's quality and long-term focus and believe the valuation could be coming down to a level that might be attractive.

- Churchill China (LON:CHH) - this venerable tableware manufacturer has survived the pandemic and retained its strong position supplying hospitality operators. Cyclical risks are a concern – volumes are down slightly – but I can see plenty to like.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Renishaw (RSW)

"We have seen a steady start to FY2024 and our order book remains solid."

This FTSE 250 engineering group specialises in precision measurement equipment and healthcare technology. It's also "a world leader" in additive manufacturing, better known as 3D printing.

Company information: I'm still learning about Renishaw's product range, but I think it's fair to say that the brief summary I've used above probably understates the breadth and sophistication of the group's offerings, which you can read more about here.

The business was founded by Sir David McMurty and John Deer in 1973. Both men remain on the board today as executive chairman and non-exec deputy chairman, respectively.

Collectively, the founders control almost 53% of Renishaw shares. This gives them a combined shareholding worth about £1.4bn at current prices.

Both are over 80 years old and are – perhaps – due for retirement. But when the pair put Renishaw up for sale in 2021, they failed to find a buyer able to satisfy all of their requirements. These included protecting local employment and the group's UK supplier base – effectively a barrier to cost-cutting or offshoring.

The shares traded at £69 when the sale attempt was announced and £50 when it was scrapped. Today they're changing hands for less than £37 – a level first seen in 2017 – despite continued profit growth.

I'm interested to see if this share price decline has opened up some value in what appears to be a high-quality business.

That's the background – let's take a look at Renishaw's results for the year to 30 June 2023, which have just been released.

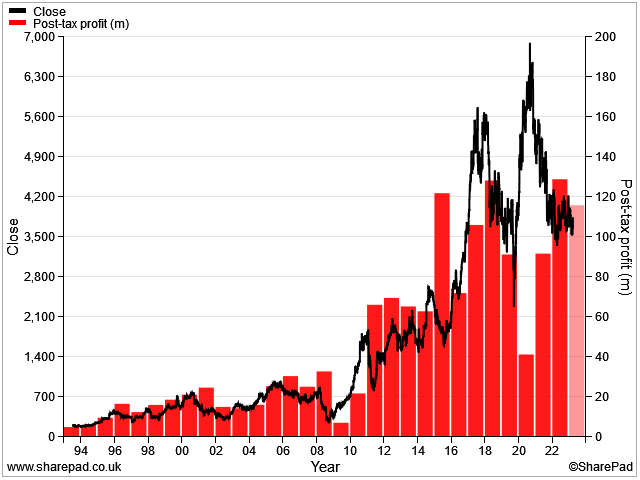

FY2023 highlights: Revenue rose by 3% to £688.6m last year, although this represented a 1% fall at constant exchange rates. Pre-tax profit for the half year was flat at £145m, while reported earnings were down 3% at 159.7p per share.

The group ended the year with net cash of £206m (FY22: £253m) following £74m of capital expenditure (FY22: £30.8m), including a new production facility in Wales.

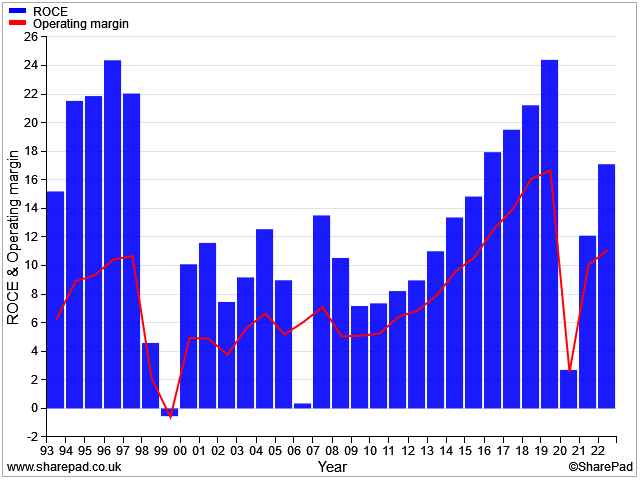

Profitability/cash flow: Renishaw's key quality metrics remained fairly strong last year, but were lower than in FY22 and – on the whole – slightly below medium-term average levels:

- Operating margin: 19.5% (FY22: 21.3%)

- Return on capital employed: 15.8% (FY22: 18.3%)

- Free cash flow: £14.6m (FY22: £84.3m)

I don't see this dip as a big concern; this is a cyclical business with exposure to some sectors that have slowed, notably semiconductors. By continuing to invest for growth, Renishaw should be well positioned for the next upturn.

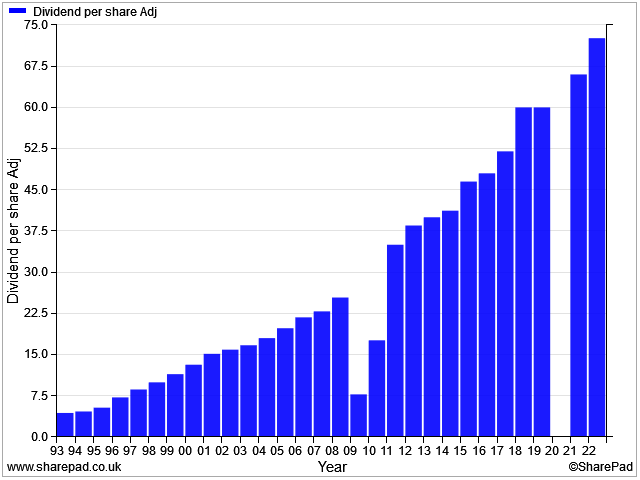

Dividend: the dividend was lifted 5% to 76.2p per share, giving a trailing yield of 2.1%.

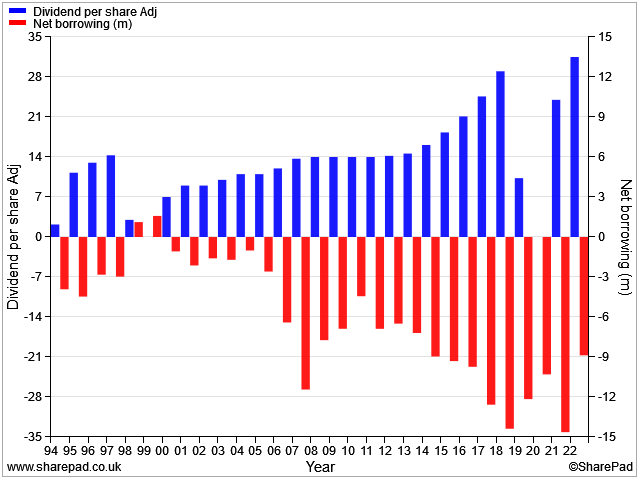

That's lower than I'd want. But this dividend increase extends a growth streak that stretches back at least 30 years and has only been interrupted twice – briefly – by the great financial crisis and the pandemic:

Trading commentary: management say the main weakness in last year's results was in the semiconductor sector, where there was weaker demand for optical encoders in the Asia Pacific region.

Elsewhere, there was "good growth" in sales of products such as the group's high-end 3D printing machines and "5-axis co-ordinate measuring machine (CMM) inspection systems".

Overall, sales from manufacturing technology product lines rose by 2% to £648.2m.

In the smaller healthcare business, revenue from analytical instruments and medical devices rose by 10% to £40.3m. This included record sales for spectroscopy products.

Outlook: chief executive Will Lee seems to expect more of the same in FY2024:

"We have seen a steady start to FY2024 and our order book remains solid. We continue to see positive trends for investment in low emission transportation, defence, additive manufacturing and robotics. Meanwhile, demand from semiconductor equipment suppliers for position encoders remains subdued."

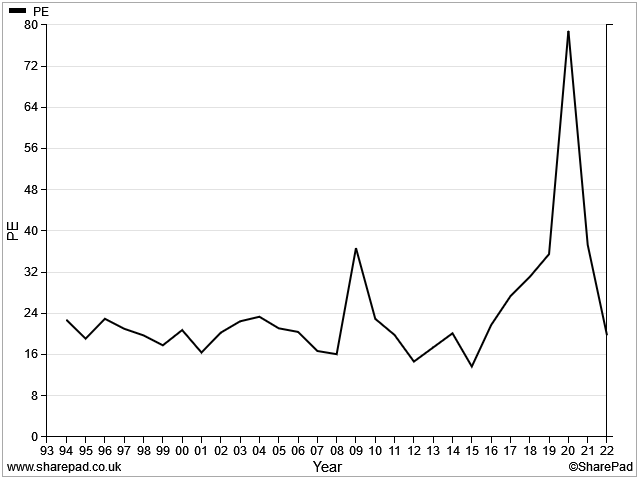

Broker forecasts ahead of these results suggested a modest improvement in earnings and the dividend over the coming year. These forecasts price the stock on 21 times forecast earnings, with a 2.2% yield.

That's well below the valuation seen in recent years, but is broadly in line with the longer-term average P/E for Renishaw, according to SharePad.

My view

My initial impression is that Renishaw is a high-quality British engineering company, with much to recommend it as a long-term investment.

The balance sheet looks extremely strong to me and the group's pension deficit has now been eliminated, with no more payments expected for the foreseeable future.

In valuation terms, the shares aren't obviously cheap, but the valuation is certainly far more reasonable than it's been for a number of years.

My sums suggest the stock is trading with a trailing EBIT/EV yield of around 5.5%. That's at the lower end of the range I'd look for, but it's not outrageous.

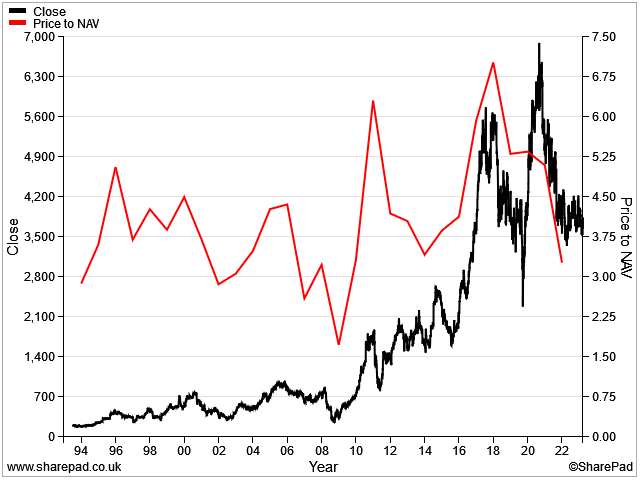

Renishaw's balance sheet is free of goodwill and intangibles and backed by plenty of owned assets, so this suggests another possible approach to valuation.

Historically, the shares have often performed well when their valuation has dropped to less than three times net asset value:

By my reckoning, 3x NAV would be equivalent to a share price of just under £35, based on these results. Although the near-term outlook remains uncertain, I think the shares could be interesting at this level on a long-term view.

However, one caveat to this is that Renishaw's return on equity has only averaged about 15% over the last couple of years. Buying a share at 3x NAV with a return on equity of 15% is equivalent to buying a return on equity of 5%.

To get a satisfactory return from £35, I think we'd still need to see an improvement in profitability (or a lower valuation).

Renishaw has certainly provided me with food for thought. I can see plenty to like here and have added the stock to my watch list.

Churchill China (CHH)

"despite some market headwinds the Group is in a good position to meet the Board's profit expectations for the full year."

Churchill China is another British manufacturer, specialising in tableware for the hospitality sector.

The pandemic and subsequent supply chain crisis caused some disruption, but the firm's recent interim results suggest to me that the business is steadily returning to normal.

Fortunately, Churchill's historic habit of maintaining a net cash balance sheet means that it's been able to negotiate this difficult period without any financial difficulty and has now returned to dividend growth, versus pre-pandemic levels.

H1 highlights: revenue for the half year rose by 6.3% to £44m, while operating profit rose by 39% to £4.9m due to a 3% improvement in margins as labour efficiency measures bedded in.

The company had recruitment problems last year and had to rely more heavily on inexperienced agency staff. As this situation normalises, productivity is improving and wastage is reducing.

Management say that revenue from the hospitality sector rose by 9.2%, despite some weakness in volumes "due to the general macro-economic climate". A focus on higher-margin value-added products is helping to offset this.

Net cash was £9.9m at the end of the period (FY22: £14.7m), reflecting an increase in stock levels to meet demand and support a return to normal service levels.

Operating margin for the half year was 10.2% (H1 2022: 9.6%), while my sums suggest a return on capital employed of 17.6% for the trailing 12 months.

While this business clearly has some cyclical exposure, I'm impressed by the average levels of profitability achieved over the last 30 years:

Dividend: the interim dividend has been increased by 4.8% to 11p per share. Broker forecasts suggest a payout of 36p (+14%) for the full year, which gives a prospective yield of 2.8%.

Outlook: the company expects to report further improvements in profitability and is hoping to move towards levels "that were evident prior to the pandemic".

However, management warn that rising interest rates "will naturally have an impact on consumer discretionary spend and therefore impact out markets".

Despite this, expectations for the full year are unchanged:

"Overall, the Group is in a good position to meet the Board's profit expectations for the full year."

Broker forecasts suggest earnings of 74p per share and a 36p dividend in 2023. This prices Churchill stock on about 18 times forecast earnings, with a 2.8% yield.

My view

Given this company's long history of above-average profitability and continued growth, I think a modest valuation premium may be justified.

The stock does not look overly expensive to me, based on the trailing EBIT/EV yield of 7.6% – considerably cheaper than Renishaw, above.

This business offers a simpler and easier to assess investment case than Renishaw, too, I think.

My only real reservation here is that the economic outlook could yet turn out to be weaker than expected. It's worth remembering that volumes fell during the first half of this year.

Further weakness could slow Churchill's recovery and leave the shares looking a little expensive at current levels.

Even so, I can see plenty to like here. I've added Churchill to my watch list as well.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.