Dividend notes: quality growth + beating expectations - EXPN, GEN, CGS (15/11/23)

I review updates from dividend shares Experian, Castings and Genuit and find (mostly) good news.

Welcome back to my dividend notes, where I record my thoughts on UK dividend shares from my investment universe.

Today I look at two more companies that expect to beat expectations this year, plus a FTSE 100 business that could be a classic quality compounder.

Companies covered:

- Experian (LON:EXPN) - a solid set of half-year results. Too expensive for me, but from a growth perspective I think the shares could still be fairly valued.

- Genuit (LON:GEN) - the company formerly known as Polypipe has upgraded full-year guidance slightly ahead of the year end, but the outlook for 2024 looks a little uncertain to me.

- Castings (LON:CGS) - a strong set of results from this foundry business, reflecting elevated demand from its core heavy truck customer base. Substantial net cash is available to fund growth and dividends; I think this is a good business.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Experian (EXPN)

"We grew in every region and across both B2B and Consumer Services"

Experian is known as a credit rating agency, but nowadays provides a broader range of information services for corporate and consumer clients all over the world.

Today's half-year results show the kind of steady progress I've come to expect from this business, which has many of the quality compounder attributes I look for in a long-term holding.

H1 results summary: Experian saw revenue rise by 5% to $3,424m during the half year, while operating profit rose by 56% to $799m.

Last year's H1 operating profit was depressed by a $152m goodwill impairment relating to the group's European markets. Excluding this, there was a 20% increase in underlying operating profit compared to H1 last year.

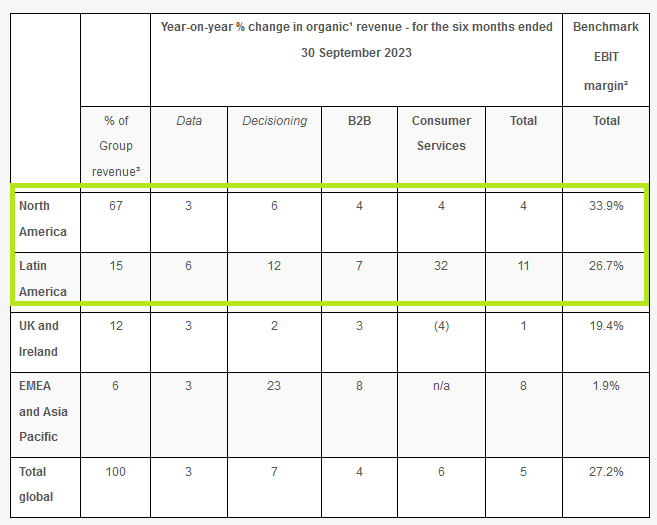

Europe appears to be subscale and something of a weak spot for Experian. As the chart below shows, North America and Latin America account for the vast majority of both growth and profit (due to higher margins):

Note these are the company's Benchmark EBIT margins, which exclude amortisation of acquired intangibles (c.$190m/yr)

Profitability/cash flow: my sums suggest Experian's free cash flow for the period was $319m (excluding acquisitions), down from $346m for the same period last year.

The reduction was largely due to a cash inflow of $192m into working capital. Excluding this, free cash flow would have shown a 90% conversion rate from reported profit of $572m.

I'm not sure why so much cash flowed into working capital – presumably to support investment in sales growth and new products.

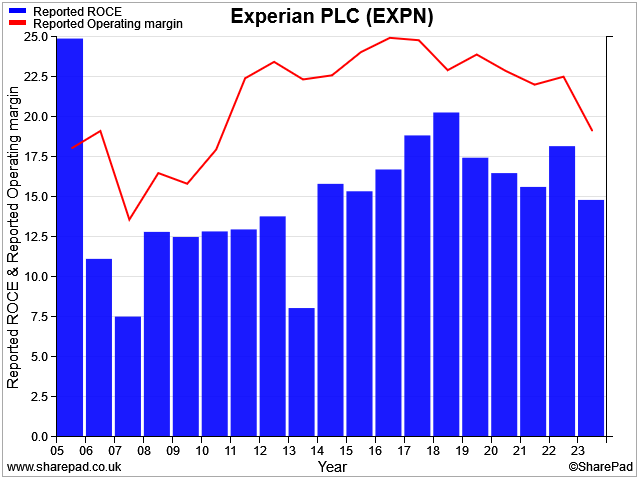

I prefer to look at statutory operating margin and returns on capital employed, as these include the company's sizeable amortisation charge on previous acquisitions. I view this as a real cost as it reflects past capital allocation decisions – so I want to see the returns on that spending.

Even on this conservative basis, Experian boasts a consistent and attractive record of profitability, in my view:

Dividend: the interim dividend has been increased by 6% to $0.18 per share, in line with forecasts for a full-year payout of $0.58 per share. This gives a paltry 1.7% yield at current levels.

Trading commentary: as shown in the table above, the group saw double-digit revenue growth in Latin America at attractive margins, with North America continuing to contribute the highest-margin revenue, albeit at a lower growth rate.

Organic revenue from consumer services rose by 6%, while B2B organic revenue was 4% higher. This was driven by "superior data, new product performance" and successful sales efforts, according to the firm.

Outlook: Experian's financial year ends on 31 March, so the current financial year is FY24. The company's guidance is for organic revenue growth of 4-6% and modest margin improvement – this sounds broadly like a continuation of the H1 results to me.

Broker consensus forecasts suggest adjusted earnings will rise by 7% this year, to $1.44 per share. That puts Experian on 23 times forecast earnings.

My view

I think this is an attractive business with many of the quality compounder elements I look for in a dividend growth stock.

It's a stock I'd like to own at the right price, but the valuation isn't really there for me at current levels. Experian's trailing EBIT/EV yield is under 4% at the moment and the dividend yield is under 2%.

Admittedly, this isn't the only way to look at this business. Consensus forecasts suggest earnings growth will run at 8% or more over the next couple of years. Dividend growth is expected to be similar.

On this basis, I think it's possible the shares could offer an expected total return of 8%-10% per year at current levels – potentially attractive.

Genuit (GEN)

"... profit marginally above market expectations"

Continuing yesterday's theme of guidance upgrades, Genuit (formerly known as Polypipe) has tweaked its 2023 guidance higher, with six weeks of the year left to go.

This business produces drainage and ventilation products used in residential and commercial buildings.

Management now expect to report full-year adjusted operating profit marginally ahead of consensus expectations. This is given as £89.7m, so I guess we can expect a figure slightly over £90m.

Depending on the scale of the adjustments required to achieve this figure – statutory operating profit last year was just £53m – this expected result suggests to me that Genuit shares might be quite reasonably valued.

The market was certainly impressed, sending the shares up by 10% on Wednesday morning. However, a look at the company's segmental breakdown for the first 10 months of the year suggests that revenue is still likely to fall this year:

- Group revenue 10 months to 31 October: £504m (2022: £527m) - the company says this is a 4.8% like-for-like reduction, driven by an 11% slump in volumes

- Sustainable Building Solutions: sales down 12.3% to £210m

- Water Management Solutions: sales flat at £149m

- Climate Management Solutions: sales up 5.3% to £139m

Cost cutting and "business simplification" is underway to improve the efficiency of operations and mitigate the impact of lower volumes. These are expected to deliver annualised savings totalling £15m.

Outlook: no guidance was provided for 2024 in this update, but chief executive Joe Vorih says he believes the company should be well positioned to realise higher margins when volumes "return to more normal levels".

My view

I don't see anything too much to worry about, but it does seem like the outlook for 2024 could be a little soft, at least in H1.

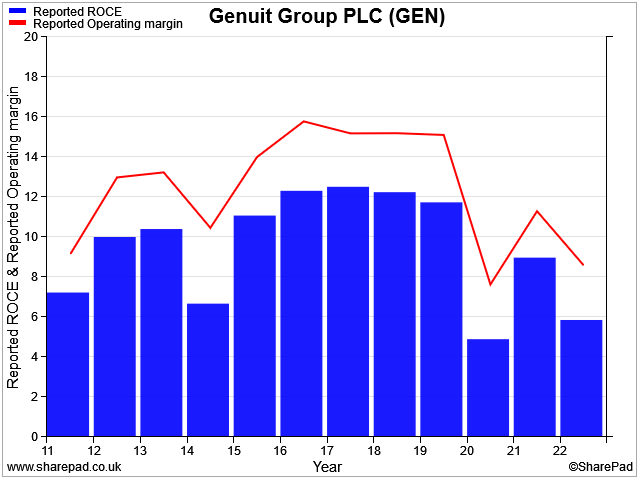

Genuit has achieved operating margins of 15% in the past, but not since the pandemic. Returns on capital employed have also fallen from c.12% to 6% over this period.

The dividend yield of 4% looks like it should be fairly safe to me, as this year's payout is expected to be covered 2x by adjusted earnings.

With the stock trading on a P/E of 12, I think Genuit could offer some upside from current levels. But on balance, I don't think the outlook is exciting enough to really interest me – I think there are more compelling choices elsewhere in the construction materials sector.

Castings (CGS)

"Management believes that the company will trade marginally ahead of market expectations."

This West Midlands engineering firm has a market cap of £168m and specialises in making cast iron engine parts for heavy trucks (80% of revenue). The business is also expanding into new areas such as trailer braking, trailer couplings, wind energy and rail.

Castings has been in business for more than 100 years and operates two foundries and a machining business in the UK. The group has been listed on the London market since 1986, I believe.

Long-time chairman Brian Cooke has just retired after a 63-year career with the business, but still has a 4.6% shareholding.

The firm's results typically make for pleasant reading as they are short, clear and do not rely on adjusted accounting metrics.

H1 results summary: Truck manufacturers were left with order backlogs last year when the semiconductor shortage forced them to slow down production. This affected Castings, too – but the firm's main customers now appear to have upped the pace in an effort to reduce their order books.

The company says that revenue for the half year to 30 September rose to £111.3m (H1 2022: £85.6m), with pre-tax profit up 37% to £10.3m.

Operating profit for the period was £9.6m, giving a margin of 8.6% – pre-tax profit was higher than operating profit due to £648k of interest income on the group's £31m net cash balance.

Cash generation was excellent, albeit boosted by some working capital outflows:

"The group maintains a very strong balance sheet with cash levels of £31.3 million. Free cash flow during the period was £8.5 million which was used to pay dividends totalling £12.4 million (including a supplementary dividend of £6.5 million)."

Cost inflation is said to have stabilised and deflation is being seen "in some areas". The company is continuing to pass on higher electricity costs to its customers, so there's no impact on profit.

- Foundry operations: output rose by 1.6% to 25,500 tonnes

- 62.1% of foundry output by weight was machined castings, compared to 57.4% last year. This is seen as a positive because these are valued-added products.

- Current demand is in excess of foundry capacity, so the company has temporarily outsourced some production to other foundries

- Looking further ahead, Castings has approved a new foundry production line at its existing William Lee site. This will cost around £17m and add up to 12,000 tonnes of additional foundry capacity, providing headroom for expansion into areas such as truck electrification, wind energy and the US market.

Dividend: an interim dividend of 4.13p per share has been declared, an increase of 7.6% on last year's interim payout of 3.84p per share.

Broker forecasts suggest a full-year payout of 17.8p per share, giving a prospective yield of 4.6%.

Outlook: demand for heavy truck parts is expected to remain strong:

"The long-term demand schedules continue to reflect the high build rates that the heavy truck OEMs require to satisfy their order books."

As a result, management expect the business will "trade marginally ahead of market expectations" this year.

Broker forecasts suggest earnings of 34p per share this year, pricing the stock on 11.5 times forecast earnings.

My view

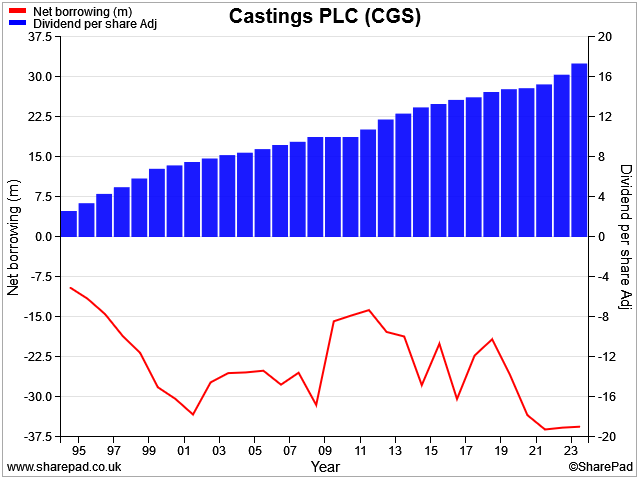

I think this is an excellent and well-run business. As far as I can see, Castings has maintained a net cash balance for at least 30 years and has never cut its dividend.

I suspect that the relatively capital-intensive nature of the business means that returns on capital employed and margins will always be relatively average. In recent years, ROCE has averaged around 9%.

However, the quality of execution and the strength of the group's balance sheet means that this is a stock I would consider buying, at the right price.

The obvious risk is that electrification or other technology changes will make the core heavy truck business reduntant, over time. The company acknowledges this and is expanding into new areas.

However, I think it's safe to assume that heavy trucks will be among the last forms of transport to be electrified or switched to lower-carbon fuels such as hydrogen.

In the meantime, I think Castings is doing all the right things. At current levels the shares are trading at around 1.3x their book value of c.300p per share. If the shares fell back towards the 300p level – as they did earlier this year – I'd probably view that as a buying opportunity.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.