Dividend notes: profit upgrades x3 - HILS, AZN, BME (14/11/23)

I take a look at AstraZeneca, B&M and Hill & Smith; all three companies have upgraded their profit guidance over the last week.

Welcome back to my dividend notes.

While it's certainly true that some UK-listed companies are having problems at the moment, many of them appear to be doing okay.

Today I'm looking at three quite different FTSE 350 companies that have all issued upgraded profit guidance over the last week.

Companies covered:

- Hill & Smith (LON:HILS) - a(nother) earnings upgrade from this infrastructure products group, which is benefiting from its US exposure. I rate this business highly.

- AstraZeneca (LON:AZN) - the FTSE 100 pharma group has edged up its forecasts for this year. Free cash flow seems to be improving, too, and could be poised for a big step up next year. A little too expensive for me, but I'm watching with interest.

- B&M European Value Retail (LON:BME) - a solid set of half-year results suggest to me that this business is continuing to perform well. The failure of Wilkos may have provided an opportunity for further market share gains.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Hill & Smith (HILS)

"we now expect FY23 operating profit to be slightly ahead of the top end of current analyst consensus"

This 200-year-old FTSE 250 business makes "sustainable infrastructure products and services". Many of these are products for use in heavily-regulated environments, such as road barriers, bridge supports, street lighting and so on.

Another upgrade: I've covered this business twice before this year, in May and August. On both occasions, the company upgraded its 2023 profit guidance slightly.

We're near the end of the year now, but Hill & Smith has just upgraded its 2023 guidance again. That's three upgrades this year, by my reckoning.

The company says that trading has been "strong" in its US business, which now accounts for nearly three-quarters of profit.

The company now expects operating profit to be slightly ahead of the consensus range, which is given as £116.0m-£118.6m. So I wonder if we can expect adjusted operating profit of c.£120m, or perhaps even a little more.

That would value the business with an EBIT/EV yield of just under 8%. I think that could be reasonable value, given that the company is also positive about the year ahead:

"Given the good trading performance, we now expect ... to start FY24 with positive momentum"

CEO vacancy: one slightly odd quirk about this business is that it seems to be having an unusual amount of difficulty recruiting a new chief executive.

The previous incumbent left in July 2022 "with immediate effect" and no explanation provided.

Since then, the company has failed to find a replacement, to the extent that the chairman was appointed executive chair earlier this year on a 12-18 month agreement.

As far as I can see, there's still no update on the search for a CEO.

My view

Despite the slightly mysterious absence of a CEO, I think this is a good quality business with many of the hallmarks of a long-term compounder.

The group's US operations leave it well-positioned to benefit from spending under the Inflation Reduction Act, while its focus on regulated and (mostly) less cyclical infrastructure also appeals to me.

In terms of valuation, I'd like to pay less than 17 times earnings and receive a yield higher than 2.3%. But in truth, I think the shares may not be all that expensive if the company can maintain its current momentum and profitability.

This is certainly a stock I would consider adding to my dividend portfolio if the right opportunity arose.

AstraZeneca (AZN)

"we have increased our full-year guidance"

Another company, another upgrade. FTSE 100 pharmaceutical group AstraZeneca increased its full-year guidance for 2023 in its third-quarter results, citing strong momentum in sales of non-Covid-19 medicines.

As I've commented before, earnings at the big pharma groups tend to be heavily adjusted. I also lack the medical knowledge needed for a meaningful understanding their products and end markets.

What I can do instead is to use free cash flow as a measure of progress. On this basis, AstraZeneca appears to be doing okay, with the promise of much more to come.

Free cash flow: AstraZeneca is one of a relatively small group of UK companies that publishes full quarterly accounts.

Using this information, I've calculated free cash flow for the first nine months of 2022 and 2023:

- Jan-Sept 2022: $3,470m

- Jan-Sept 2023: $3,898m

This year's result shows a 12% increase on the same period last year. It also appears to be in line with broker forecasts for 2023 free cash flow of $5,130m.

However, with a market cap of £158bn, this still leaves AZN stock with a forecast free cash flow yield of 2.6%, which is a bit pricey for me.

What's interesting is that broker forecasts suggest free cash flow will double to $10bn next year. That would increase the free cash flow yield to around 5%. It would also imply a much higher level of cash conversion from profits – something I look for.

Outlook: AstraZeneca now expects adjusted "core" earnings to increase by "low double-digit to low-teens percentage" this year, compared to "high single-digit to low double-digit" previously.

Broker forecasts don't seem to have changed much as a result, unless they're being slow to filter through to consensus numbers on SharePad and Stockopedia.

For what they're worth, current-year forecasts I can see price the shares on a forecast P/E of 17.5, with a 2.4% yield.

My view

For me, this remains one to watch. I don't really understand the industry or much of the detail of the company's operations. But I do get the impression AstraZeneca is firing on all cylinders and is starting to deliver on the promise of the investment we've seen in recent years.

The valuation is a little too rich for me at the moment, but I might consider AZN shares if the price provided a greater margin of safety.

B & M European Value Retail (BME)

"FY24 ... guidance is increased"

I've written positively about value retailer B&M on several previous occasions, most recently in May and then July.

The group's recent half-year results covered the six months to 23 September 2023 and continued to support my positive view of the business. Like the other two companies covered in these notes, B&M has recently upgraded its profit guidance for the current financial year.

H1 summary: B&M's sales rose by 104.% to £2,549m during the half year, while operating profit climbed 11% to £275m. That means operating margins were stable at just under 11% – a good result for a general retailer.

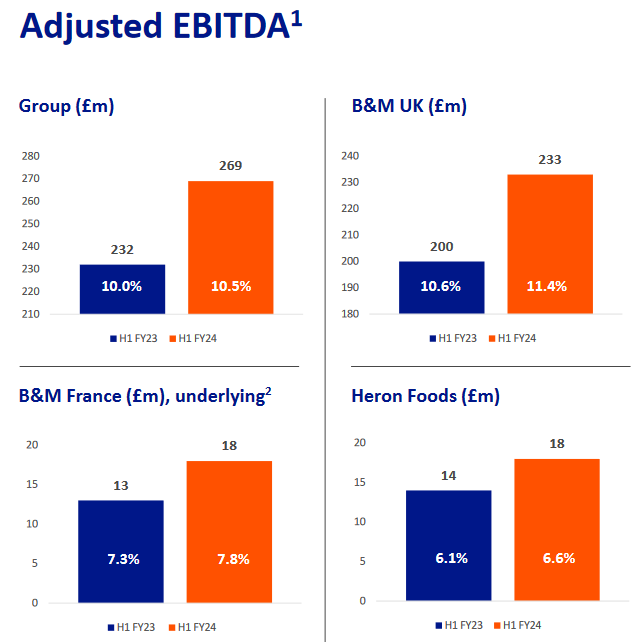

Profits (at least, adjusted EBITDA) rose in each of the group's three operating divisions compared to the same period last year:

Earnings per share rose by a more modest 4.2% to 16.3p per share, largely reflecting increased tax and finance charges.

My sums suggest free cash flow for the half year of £120m (H1 FY23: £168m). This fall reflects higher finance and tax costs, plus c.£120m cash inflow into working capital. This reverses a similar working capital outflow in the full-year results earlier this year.

B&M tends to stock up ahead of the festive season ("the Golden Quarter"), so I don't see anything to worry about here.

Returns on capital employed (ROCE) also remain high – one of the core attractions of this business for me. I estimate B&M's trailing 12-month ROCE is just under 20%. Not many large UK retailers can match this. It's leagues ahead of the single-digit ROCEs achieved by the big supermarkets.

Dividend: the interim dividend has increased by 2% to 5.1p per share. Broker forecasts suggest a full-year payout of c.20p, giving a prospective yield of 3.8%.

Expanded store opening programme: the company has increased its long-term store opening target.

The group now plans to open at least 1,200 B&M UK stores, up from a previous target of 950 stores set in FY17.

To put this in context, there are currently 707 B&M UK stores, according to the company's website. This suggests the UK store estate is expected to expand by a further 70% over the coming years.

It may be a coincidence. But B&M's decision to increase its UK store target appears to have come shortly after the recent failure of Wilkos, which had c.400 UK stores. The failed retailer's product ranges and customer demographic overlapped heavily with that of B&M.

The company's explanation for its increased growth target is simply that "move by consumers to discounters is a major trend ... set to continue over the long term".

In the UK, B&M says that its market share is just over 2%, "meaning there are many more years of growth ahead". I'm not quite sure how the company defines its UK market to derive a 2% share – the NIQ dataset referenced is only available on subscription.

However, my guess is that this market share relates to the company's core sectors of grocery, FMCG, and general merchandise – a pretty broad sweep of UK retail spend.

B&M now expects to open at least 125 new B&M UK stores over the next three years, adding 20% to its sales area. This will include some relocations, plus up to 51 Wilkos stores that are being purchased from the administrator.

New stores are also planned for the B&M France and Heron Foods fascias.

Outlook & current trading: management say that in the first six weeks of the Golden Quarter (October-December), B&M UK has achieved like-for-like sales growth of 1.6%. This performance has improved over the last three weeks to give an exit-rate LFL growth of 4.5%.

The company warns that it's trading against tough comparatives from last year and describes this as "a pleasing result against an uncertain and ever-changing economic background".

Although "this volatile background makes forecasting for the full year difficult", B&M's management are sufficiently confident to upgrade their full-year adjusted EBITDA guidance to £620m-£630m (previously "higher than FY23 [£573m]").

My view

I think B&M is a well-run business with a successful model that's likely to remain popular.

As I've discussed previously, I think there's a degree of key-person risk, but that appears to have been resolved for now.

The 9% upgrade to adjusted EBITDA guidance for this year is sizeable, but I think it's worth remembering that this is a heavily-adjusted measure of profit that excludes a lot of real costs.

Broker consensus forecasts have hardly budged following last week's upgrade. The language used in the outlook statement also suggests to me a fair degree of uncertainty about Christmas and trading next year.

Despite this, I think B&M should be fairly well positioned to ride out any softness and profit when conditions improve. If the group stays disciplined with its store openings and doesn't sacrifice profitability for growth, I think this business should continue to generate attractive value for its shareholders.

In my view, B&M shares are probably priced about right for now. But I'd take a closer look if they dropped below 500p again.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.