Dividend notes: reliable performers - RNWH, BVIC

I review half-year results from construction group Renew Holdings and FTSE 250 soft drinks stock Britvic. Do these dividend shares tick all of my boxes?

Two solid performers with very different business models have issued interim results today. Both firms score quite well in my dividend screen and are stocks I'd consider owning at the right price.

Companies covered:

- Renew Holdings (LON:RNWH) - a solid set of half-year results from this specialist construction group, showing strong returns and free cash flow. I'm impressed, but slightly outpriced at the moment.

- Britvic (LON:BVIC) - a good performance, with improved profit margins and a modest recovery in volumes during the second quarter. The shares look up with events to me at the moment, but I remain attracted to this business.

This is a review of the latest results from UK dividend shares that are in my investable universe and may appear in my screening results.

Dividend notes is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

Renew Holdings (RNWH)

Continued outperformance and strong organic growth; Board confident in its full year expectations

I mentioned this specialist infrastructure construction group in my recent in-depth review of Morgan Sindall (MGNS). While Renew's dividend yield is a little low for me at the moment, I've been impressed by the apparent quality and dividend track record of this business.

Renew Holdings also scores well in my dividend screening results, with a score of 76 out of a possible 100:

Today's half-year results cover the six months to 31 March 2023 and show further progress.

Financial highlights: Revenue for the half year rose by 13.9% to £471.8m, while pre-tax profit for the period was 20.9% higher at £26.3m. Free cash flow for the half year was £19.0m, giving a 95% cash conversion rate from after-tax profits of £20.0m.

Shareholders will receive an interim dividend of 6p, an increase of 5.8%.

Profitability and cash conversion are strengths of this business. While operating margins are relatively low – 5.7% for the half year – Renew's capital-light operations means it generates high returns on capital employed. I calculate a trailing 12-month ROCE of 32.3% from these results – an excellent figure.

Renew ended the half-year with net cash of £17m, excluding lease liabilities.

Operating highlights: the company's focus is on regulated markets with clear long-term spending commitments and multi-year contracts. Major markets include roads, rail, nuclear power and water.

During the half year, Renew secured new rail framework contracts with Wales & Western for the 2024-2029 regulatory control period (CP7) and continued to see good opportunities in highways and water.

Management also reported continued organic growth in the group's aviation business, which has a contract to provide electro-mechanical and civil engineering services at Manchester Airport.

In nuclear power, Renew contiues to operate on a number of long-term frameworks at Sellafield and has recently secured further positions.

The group has worked in UK civil nuclear facilities for 75 years and says that decommissioning spend at Sellafield could top £90bn over the next 120 years.

Renew is also aiming to develop relationships outside Sellafield and believes new opportunities could arise if the the UK builds new nuclear power stations as part of its net zero strategy.

Outlook: trading is said to have started well in the second half. Management remain confident that the full year will be in line with expectations.

Although inflationary headwinds continue, Renew says that its variable cost-plus contracts help mitigate cost pressures.

Broker consensus forecasts suggest earnings of 57.4p per share and a dividend of 18.2p this year. That prices the stock on 13 times forecast earnings, with a 2.5% yield.

My view: annualised free cash flow of c.£40m gives Renew shares a free cash flow yield of around 7%. That's not unattractive in my view, for a business that's also generating 30%+ returns on capital employed.

I continue to think Renew Holdings looks like a rare quality business in a sector that's known for low margins and mishaps.

The shares have rallied strongly since November and are currently trading at c.730p. However, the share price chart suggests regular bouts of volatility and the stock traded as low as 550p in October last year.

I wouldn't be surprised to see further opportunities to buy over the coming year. I'll continue to watch Renew with interest.

Britvic (BVIC)

"Consumer demand for our brands remains strong - Q2 volumes in growth"

This soft drinks group is well known for brands such as Robinsons, Fruit Shoot, J2O and Tango. It also produces PepsiCo brands such as Pepsi, 7UP and Lipton Ice Tea under licence in the UK.

Britvic is the largest supplier of branded still drinks in the UK and the second-largest supplier of carbonated branded drinks. In addition, Britvic has direct operations in France and Brazil and sells through franchises and exports into many other countries.

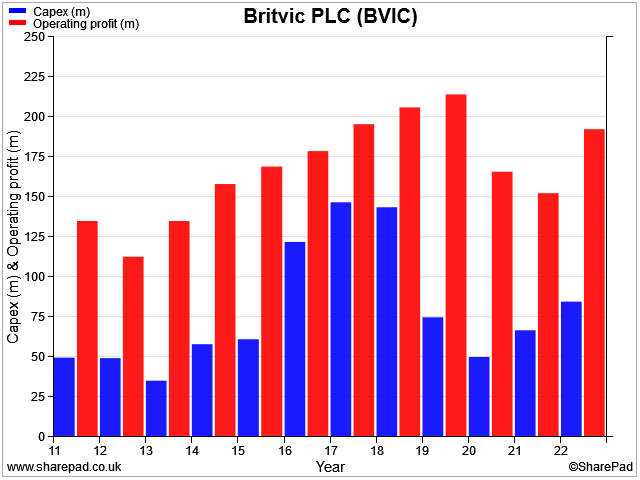

In the years directly before the pandemic, Britivic was going through a period of elevated capital expenditure to invest in its operations. The pandemic then hit, resulting in a big reduction in out-of-home sales.

Inflation has added extra pressures but in broad terms, I think the business is back to normal now and should be demonstrating its defensive qualities. Let's see if the firm's half-year results support this view.

Financial highlights: Britvic's latest accounts cover the six months to 31 March 2023. They suggest a decent start to the year, with increased sales and improved profit margins.

Revenue for the half year rose by 7.9% to £794m, while operating profit was up 21.5% to £80.7m. That equates to a margin of 10.2%, up from 9.3% during the same period last year.

Earnings rose by 22.3% to 21p per share, while the interim dividend was increased by 5.1% to 8.2p per share.

My sums suggest Britvic achieved a healthy return on capital employed of 17.6% over the last 12 months – an attractive performance.

Net financial debt adjusted for hedges rose to £593m, compared to £533.8m at the same point last year.

Some seasonality is normal in this business as Britvic builds inventories for the busy summer season. This cash outflow then unwinds during the second half of the year – net debt fell by £59m during H2 last year, for example.

However, management appears to expect the cash performance of the business to improve over the next 12 months. In addition to the 5% dividend increase, they've commences a further £75m share buyback to run over the next 12 months.

My sums suggest this buyback and the full-year dividend will cost at least £150m. That would exceed last year's free cash flow of £129m.

With leverage at 2.2x EBITDA, I would prefer to see shareholder returns running below free cash flow, to allow some room for debt reduction as well.

I don't think this is a dangerous situation, but Britvic is slightly more geared than I'd like to see.

Operating highlights: Price rises linked to inflation mean that most businesses are reporting rising revenue, even if volumes are falling.

Britvic does provide some clarity on this. The company says volumes fell modestly during the first half of the year, but rose by 0.6% during the second quarter.

This suggests to me that the company's decision to go early with price increases this year could pay off, as customers return to more normal buying habits during the summer season.

In brand terms, Pepsi MAX and Tango were said to be standout performers in H1. Robinsons products were relaunched to promote new flavour concentrate products.

Outlook: Britvic did not explicitly confirm that it expects to meet expectations this year, but in his outlook statement, chief executive Simon Litherland said he was confident of further progress "this year and into the future".

I think it's reasonable to interpret these results as being in line with forecasts, which suggests Britvic shares are currently trading on 16.5x forecast earnings, with a prospective dividend yield of 3.2%.

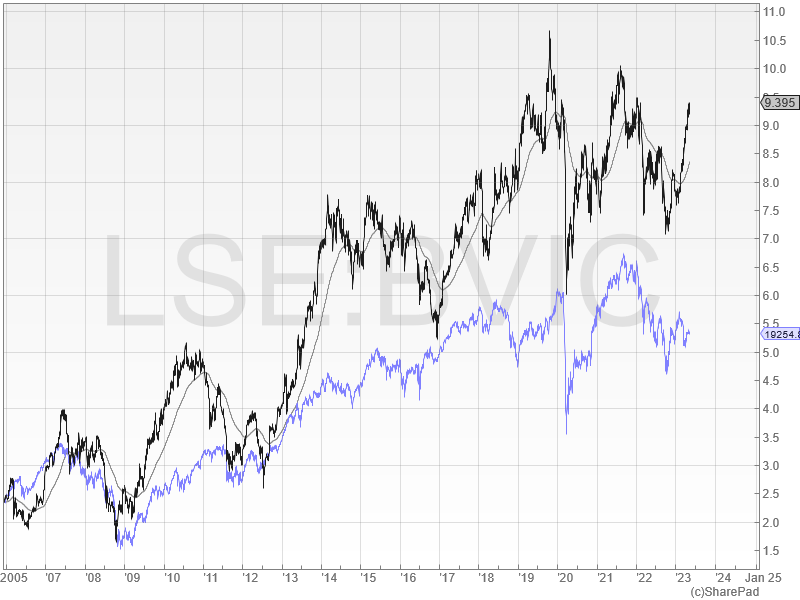

My view: Long-term shareholder returns at Britvic have been attractive, outperforming the FTSE 250 over the last 18 years.

In terms of valuation, last year's free cash flow of £129m gives the stock a free cash flow yield of 5.4%. That seems up with events to me, for a business whose operating profit has risen by an average of 5.8% per year over the last decade.

Looked at differently, Britvic's 10yr average dividend growth rate is 5%. Add this to the current yield of 3% and I get an expected total return of 8% per year. That's in line with the long-term average from the UK market.

I'd prefer to buy at a slightly lower valuation, given the single stock risk (versus the index) and Britvic's current leverage, which is slightly higher than I'd like to see.

Having said that, Britvic is certainly a stock I could see myself owning if a suitable opportunity arose.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.