Is Morgan Sindall a top dividend share to buy now?

FTSE 250 construction group Morgan Sindall (LON:MGNS) offers a near-6% yield. Does this dividend share offer a cyclical buying opportunity?

The company I'm going to look at today has generated a total return (inc. dividends) of 305% for its shareholders over the last 10 years.

On an annualised basis, that's an average annual return of 15% per year. That's roughly twice the long-term average return from the UK market.

These kind of returns are not what I'd normally expect from a construction and contracting business. This sector tends to have low margins and be somewhat accident prone.

However, I think that FTSE 250 group Morgan Sindall (LON: MGNS) could be a notable exception to this general rule. This founder-led construction and regeneration group operates in a range of UK markets and has an impressive record.

Morgan Sindall has trounced the FTSE 250 over the last decade:

The group's stock has also outperformed all of its listed competitors over the same period, except critical infrastructure specialist Renew Holdings, whose dividend yield is too low to interest me right now.

Morgan Sindall is currently one of the highest-scoring stocks in my quality dividend share screen and offers a tempting dividend yield of almost 6%.

In this piece I'm going to consider whether Morgan Sindall could be a suitable share to replace Direct Line Insurance in my quality dividend portfolio.

Table of contents

- History - an owner-managed firm

- Recent trading and outlook - stable but with economic headwinds

- Crunching the numbers - how does Morgan Sindall score in my screening system?

- Dividend culture - an 27-year record of shareholder payouts

- Dividend safety - I'm impressed by prudent levels of cover

- Dividend growth - sustainable but inconsistent

- Dividend yield - a cyclically high yield suggests a possible buying opportunity

- Valuation - good value unless profits are about to collapse

- Profitability - high returns and disciplined management

- Fundamental health - daily cash reports provide solid foundations

- Conclusions - my verdict

History: owner management

Morgan Sindall was formed in 1994 when Morgan Lovell merged with William Sindall. Current chief executive John Morgan co-founded Morgan Lovell in 1977 and has a 7.4% shareholding in MGNS.

The group is divided into five operating segments:

- Construction & Infrastructure (37% of profit) - public sector and commercial buildings, road, rail, energy and water infrastructure

- Fit Out (37% of profit) - office and education fit out

- Property Services (3.1% of profit) - social housing property repairs

- Partnership Housing (26.9% of profit) - social housing and mixed-tenure projects

- Urban Regeneration (13.6% of profit) - mixed-use projects

(Profits are quoted as a percentage of 2022 adjusted operating profit and exclude group costs and exceptional items)

I'm not going to get into too much depth here. There's plenty of information available on the group's website for anyone who wants to know more about the group's individual operating businesses.

Morgan Sindall says that its mix of operations creates a virtuous circle that can strengthen both profitability and growth:

This structure reminds me a little of the way that Legal and General (disc: I hold) uses interlinked businesses to generate additional value.

While I'm not convinced the synergies are so strong in this business, Morgan Sindall does seem to have a strong financial record.

My previous research on this business has also led me to believe that it is very well managed, with excellent financial controls and bidding discipline – essential in this sector.

I don't think it's any coincidence that John Morgan and finance boss Steve Crummett have worked together in their current roles since 2013.

Recent trading and outlook

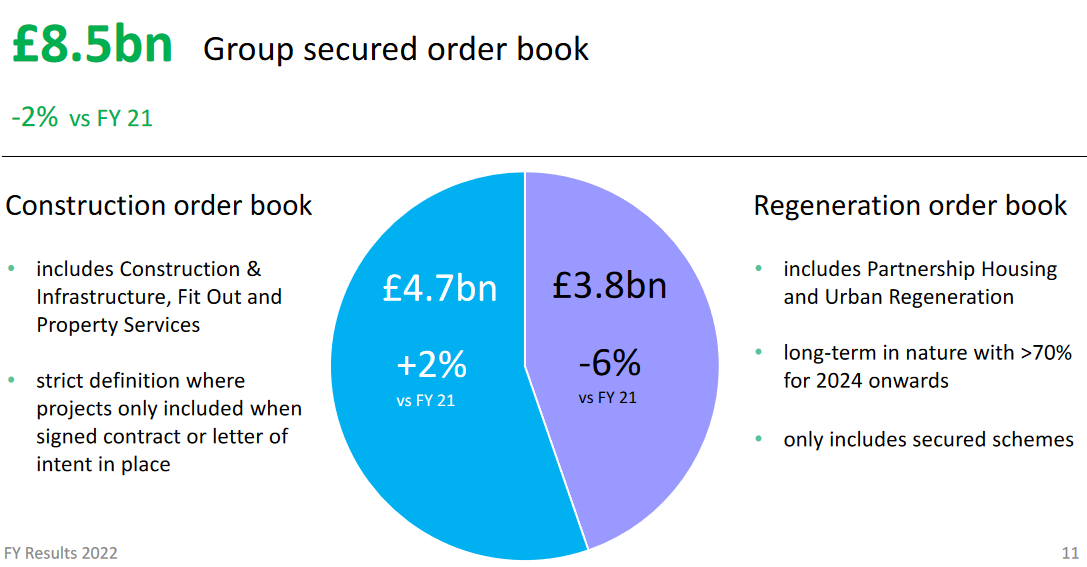

Trading remained strong last year. The group reported record revenue of £3.6bn and adjusted pre-tax profit of £136.2m. MGNS ended the year with an impressive secured workload of £8.5bn, albeit down by 2% on the prior year.

Average daily net cash was £256m (2021: £219m) and the dividend was increased by 10% to 101p per share, giving a trailing yield of 5.8%.

Although John Morgan admits that the economic outlook has become "more challenging", I wonder if the 35% share price drop since August 2021 has created a buying opportunity.

After all, this business has not needed to raise new equity for at least 20 years. It also maintained dividend payments throughout the 2008 financial crisis, albeit with a cut.

MGNS shares now offer a forecast yield approaching 6%. This payout is expected to remain twice covered by earnings this year.

Unless the outlook for the UK economy becomes very much worse, I think the shares might be attractively priced at current levels.

Morgan Sindall: crunching the numbers

Description: a construction and regeneration group operating in sectors including infrastructure, urban regeneration and housebuilding.

| Morgan Sindall Group (LON: MGNS) |

Quality Dividend score: 75/100 | Forecast yield: 5.8% |

| Share price: 1750p | Market cap: £837m | All data at 20 January 2023 |

Latest accounts: results for the year ended 31 December 2022

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain whether I think Morgan Sindall could be a suitable addition to my quality dividend portfolio .

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Dividend culture: excellent

I estimate that chief executive John Morgan received £3.6m in dividend payments last year – nearly double his total remuneration of £2.0m.

The presence of owner management may help explain why Morgan Sindall has been able to maintain a more reliable record of dividend payments than many of its peers.

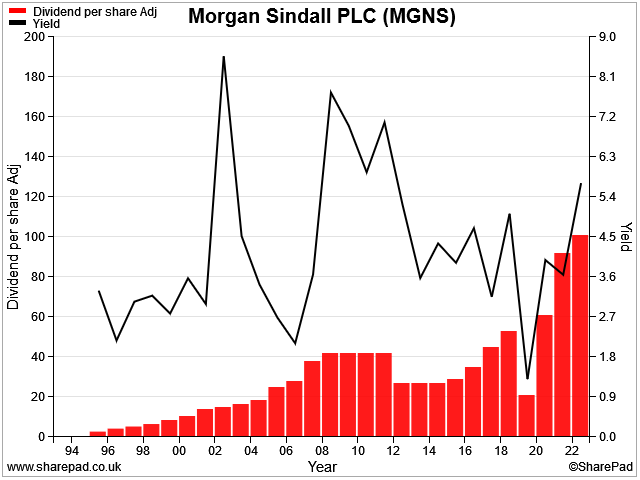

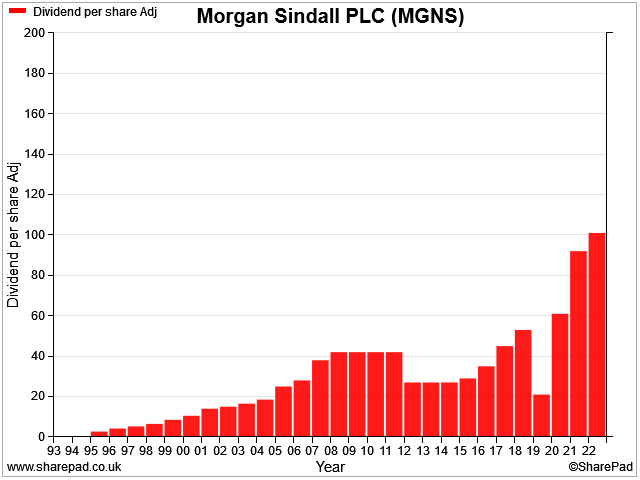

According to SharePad records, Morgan Sindall now has an unbroken 27-year record of continuous dividend payments:

In my view, it's clear that this company attaches significant importance to maintaining a sustainable dividend.

Morgan Sindall scores 5/5 for dividend culture in my screening system.

Dividend safety: very good

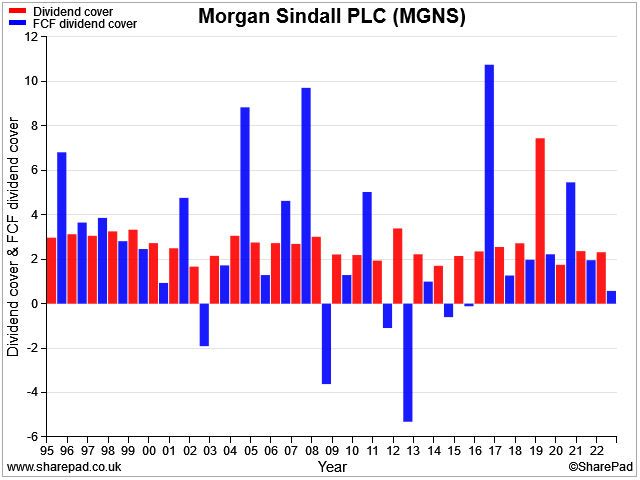

The main criteria I use to asses the safety of a dividend are earnings cover and free cash flow cover.

I this case we can see that dividend cover has remained in a range between 2x and 3x earnings for most of the last 25 years.

Free cash flow cover has been more variable, due to the nature of the business. But I think it's reasonable to say that in aggregate, payouts have been comfortably supported by surplus cash generation.

Looking ahead, broker forecasts suggest the 2023 and 2024 dividends should each be covered 2.2x by earnings. While there's no guarantee this will happen, it would be consistent with past performance.

I don't see much to be concerned about here.

Morgan Sindall scores 4/5 for dividend safety in my screening system.

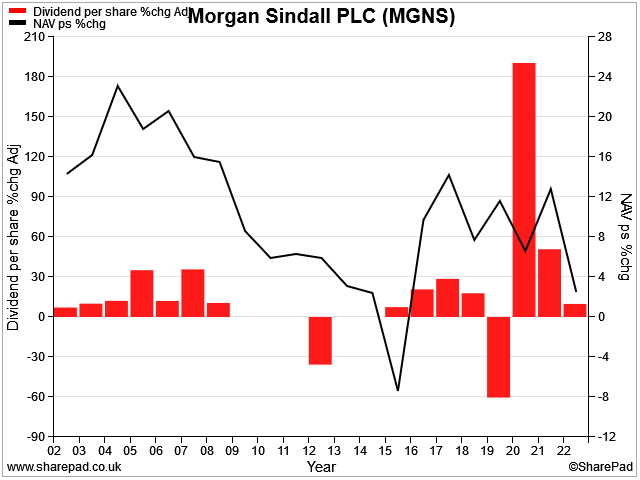

Dividend growth: lumpy cash flow

Rising dividend payments are of limited appeal to me if their growth means that they become less affordable. This is why my dividend growth score is intended to test the affordability of a company's dividend growth.

My approach to doing this is to compare dividend growth with changes in a company's net asset value (NAV) and free cash flow.

For this review I'm trying a new chart format that shows the annual percentage change in Morgan Sindall's dividend and NAV. I've excluded free cash flow because it's too volatile and makes the chart unreadable:

What we can see here is that Morgan Sindall's NAVps has grown by around 8% per year over the last five years. Not a bad result, in my view. Dividend growth has been more volatile, but the trend has been positive (except for 2020).

I don't think these numbers are bad for this business, given the events of recent years. But this chart doesn't show the smooth, progressive growth that I'm really looking for.

In short, I would say that the company's dividend growth has been sustainable but inconsistent. My dividend growth score is a reflects this, I think.

Morgan Sindall scores 2.7/5 for dividend growth in my screening system.

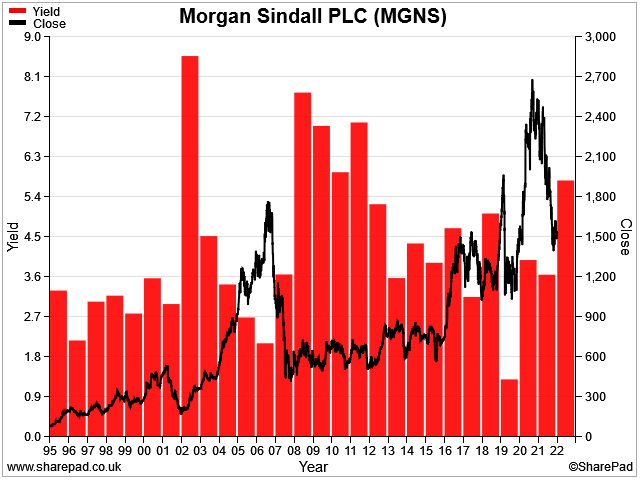

Dividend yield: improving

Morgan Sindall's dividend yield is above its historical average level at the moment. In general, the yield has only been this high previously at times when the UK construction sector was facing difficult conditions.

One reason for the current high yield is that as happened in 2008, the shares have fallen sharply from previous record highs:

Is this a buying opportunity, or a warning of a more difficult period ahead? It's not clear to me what is most likely to happen, but I think a measure of caution is probably prudent.

Purely in terms of dividend yield, MGNS earns a middling score in my screen.

The reason for this is that while the current yield is high, my score reflects five-year average dividend yield in addition to forecast yield. Morgan Sindall's buoyant share price in recent years has depressed the five-year average yield, hence the lower score.

Morgan Sindall scores 2.7/5 for dividend yield in my screening system.

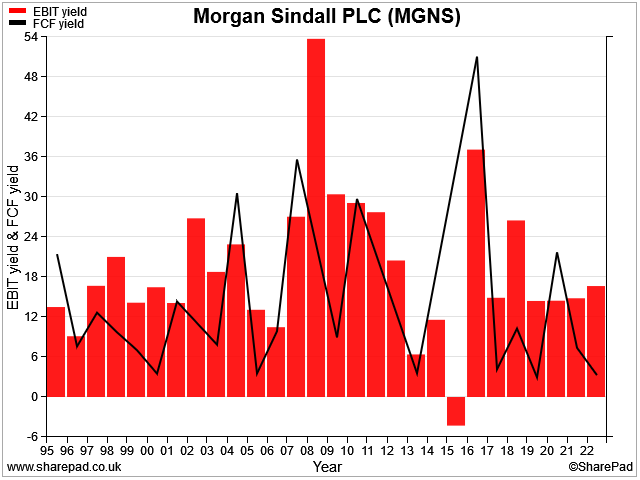

Valuation: affordable

I prefer to view valuation from a business or owner's perspective, rather than a per-share basis. So I don't use P/E in my screen (although I do use it more generally).

Instead, I use EBIT yield and free cash flow yield. Both metrics use enterprise value as their denominator, rather than market cap. This means that any any net debt or net cash position is factored into the valuation, rather than being ignored.

Using EBIT instead of earnings also neutralises the impact of different mixes of debt and equity, as it excludes finance and tax costs.

As a rule of thumb, I tend to think that an EBIT yield of 8% may be good value, assuming the underlying profits are sustainable.

Morgan Sindall's trailing EBIT yield of 16% is significantly above this level, and has been so since 2016.

One point that's worth making is that this calcution is based on statutory operating profit, which was £88m last year. This figure was depressed by a £48.9m exceptional charge for building safety remediation.

This provision should hopefully be final, in which case EBIT could rise to c.£130m this year if results are consistent with 2022. That would imply an EBIT yield of 24%.

That's either staggeringly cheap, or a warning that a cyclical downturn is looming. This depends on your macro view and whether Morgan Sindall can continue to replenish its order book.

The stock's overall score for valuation is held back by its more volatile free cash flow yield, which dipped last year.

However, using a base case assumption that profits should be broadly sustained, I'd have to conclude that Morgan Sindall shares look good value at current levels.

Morgan Sindall scores 3.5/5 for valuation in my screening system.

Profitability: good

I've always been impressed by the profitability of this business whenever I've looked at it.

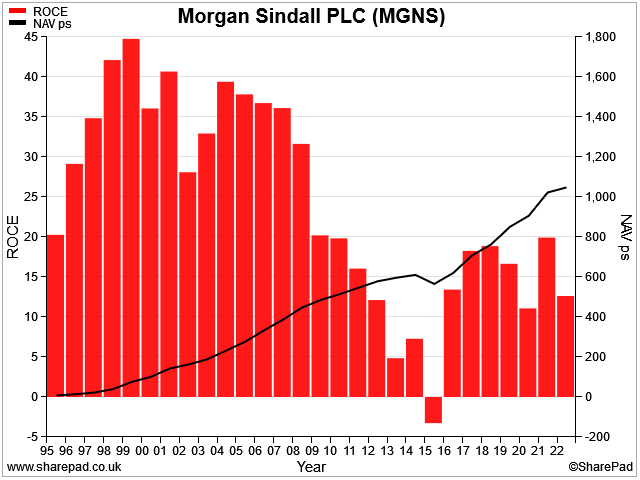

Morgan Sindall's return on capital employed was depressed last year due to the building safety charge. Without this, I estimate it would have been 22%, consistent with 2021:

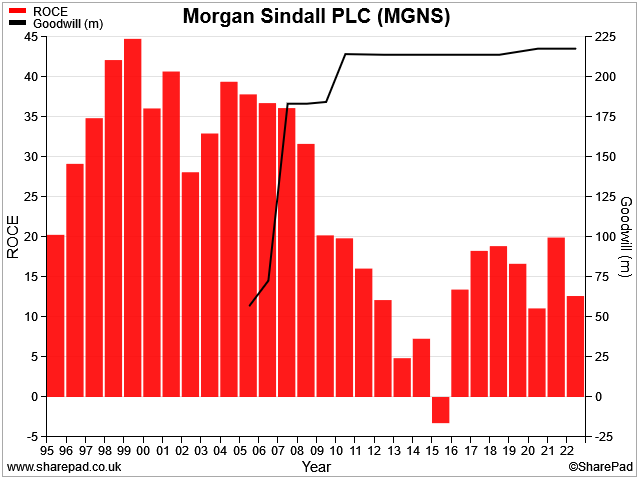

Happily, this is not what I'd call an acquisitive business. John Morgan prefers to focus on delivering organic growth. But the company did take advantage of the fallout from the financial crisis to pick up some distressed assets from rivals:

- 2007: acquired AMEC's construction division

- 2010: acquired Connaught's social housing maintenance division out of administration

I assume these deals explain the appearance of goodwill on the group's previously pristine balance sheet. This has had the effect of increasing balance sheet assets and hence reducing return on capital employed:

I don't have any concerns about the profitability of this business.

Morgan Sindall scores 3.4/5 for profitability in my screening system.

Fundamental Health: very strong

The main factors I'm interested in here are debt and leverage.

In my experience, there are a couple of things to watch out for here that seem to particularly affect companies in this sector:

- Net cash isn't surplus cash – very often a strong cash position is needed to win contracts. Clients need to be confident that their prime contractors can fund the start-up of new projects and complete them without running out of cash.

- Many construction companies report year-end net cash, but this annual snapshot can be window-dressed, masking use of debt during the year.

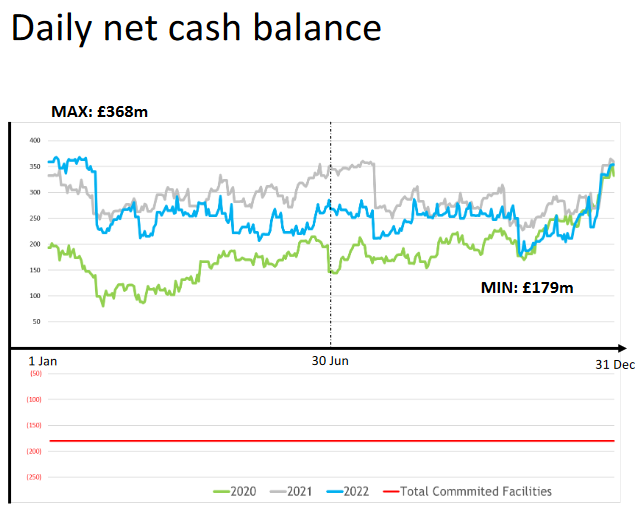

A growing number of companies are reporting average month-end net cash, but Morgan Sindall reports average daily net cash.

Management even included this wonderful chart in its 2022 results presentation, showing average daily net cash for the last three years.

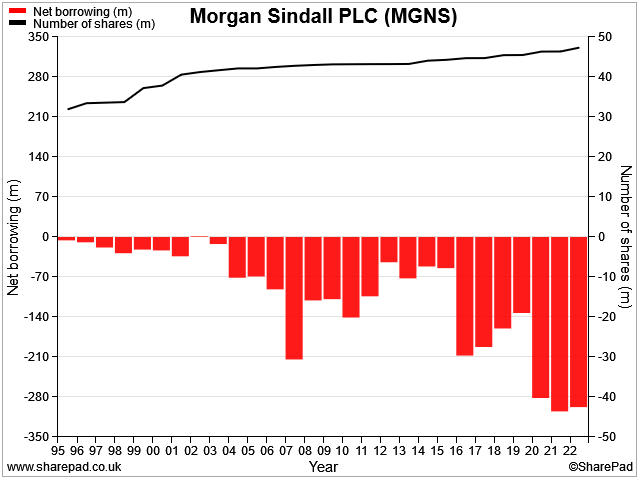

Let's wrap up this section with another lovely chart. This one shows the group's 27-year track record of year-end net cash and the number of shares in issue over the same period. While there have been some share issues, dilution has been pretty minimal over the last 20 years.

My view is that Morgan Sindall's fundamental health is as strong as we're likely to find in this sector of the market.

Morgan Sindall scores 5/5 for fundamental health in my screening system.

Conclusions: a good business

My quality dividend system awards Morgan Sindall an overall score of 75/100 at the time of writing (April 2023).

I'm confident Morgan Sindall is a well-run business, with strong finances and a reasonably stable outlook.

Broker consensus forecasts suggest that the group's earnings will continue to edge higher over the next couple of years, supporting a P/E of 8 and a dividend yield approaching 6%.

My view: Morgan Sindall's 27-year dividend track record and strong profitability suggest to me that this business does enjoy some enduring competitive advantages. I think these derive from its scale, diversification, and strong management.

This impression was supported by comments made by John Morgan in a recent interview with trade publication Construction News:

"We do the odd large job, but that’s not what gets us out of bed in the morning. We like repeat jobs and long-term workstreams."

"We don’t want a £200m job […] We don’t do mega jobs and don’t do jobs that lose mega money. We are fairly risk-averse and very selective.”

One example of this is the group's focus on partnership or social housing projects, rather than private housing. Partnership housing tends to have "very strong government support", according to the firm, with projects that can span several years.

I don't think we can rule out the risk that poor economic conditions will lead to a slowdown in new projects. But I think Morgan Sindall is probably better equipped to handle such risks than most of its rivals.

This sector wouldn't be my first choice for my quality dividend portfolio. But I have a favourable impression of Morgan Sindall and I would be comfortable enough buying the shares at current levels.

I'll leave Morgan Sindall on my short list for now. But it is a stock I could consider adding to my quality dividend portfolio.

Disclosure: At the time of publication, Roland did not own shares of Morgan Sindall.

Disclaimer: This is a personal blog and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.