Dividend notes: super returns - DOM, NXT (05/05/23)

I review the latest updates from UK dividend shares Domino's Pizza and Next.

Friday was a quiet day for company news, so I've caught up with a couple of items I missed from earlier in the week.

Enjoy the bank holiday weekend!

This is a review of the latest results from UK dividend shares that are in my investable universe and may appear in my screening results.

Dividend notes is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

Companies covered:

(click links to scroll to the relevant section)

- Domino's Pizza Group (LON:DOM) - this takeaway group appears to be performing well and is due to receive a £79m cash windfall shortly.

- Next (LON:NXT) - solid numbers and excellent reporting can't disguise falling sales volumes and an expected decline in earnings. A good business, but the price is up with events in my view.

Domino's Pizza Group (DOM)

Record Q1 orders and app customers driving growth in sales and continued market share gains

Domino's struck an upbeat tone in its first-quarter update. I've been optimistic that this business will remain a relatively affordable and popular treat despite the impact of inflation. I think the firm's latest numbers largely support this view:

- Like-for-like system sales up 10.7% (excluding VAT change)

- 18.0m orders, up 2.8%

- Active app users up 27% to 6.8m versus Q1 2022

- Collection orders up 23.0%, delivery orders down 4.9% (positive for DOM's labour costs)

- Strong start to Q2 with LFL orders up 10.9% and total orders up 5.9% during first four weeks of the quarter

The company has been waging a post-pandemic campaign to switch customers from delivery to collection. It looks like it's succeeding, which helps alleviate cost pressures and labour shortages.

Targeted offers such as the £8/£10/£12 deal are said to have helped drive new sales growth during the quarter.

New store openings are also accelerating, with both store openings and the new store pipeline running ahead of last year.

Share buyback: Domino's has launched a further £20m share buyback, citing its target leverage range of between 1.5x and 2.5x EBITDA.

The group's year-end net financial debt of £253m represented a multiple of 3.1x FY22 net profit. That's towards the upper end of my prefered range, but given the cash-generative nature of the business, I don't see too much risk at this time.

In any case, a significant cash windfall is due soon.

Germany sale should bring £79m cash inflow in Q2: the sale of the group's German business is expected to complete in June for £79m, or 18.8p per share. Cash from this deal will be "flowed through the capital allocation framework" at that point. We should get an update in the half-year results.

Outlook: full-year guidance is unchanged from the FY22 results. Broker forecasts suggest earnings of 16.7p per share with a 10p dividend. That's equivalent to a P/E of 18 and a 3.2% yield.

My view: given the cash due from the Germany disposal, I would hope for a modest increase to the ordinary dividend this year.

But management seem to prefer buybacks over extra dividends, perhaps because of the boost they can provide to earnings per share...

Apart from this niggle, I remain positive about Domino's. The group generated an operating margin of 18% in 2022, with an impressive return on capital employed of 28%. Both figures are typical for this business.

Free cash flow last year was £79m, with a similar figure expected this year. That gives the stock a free cash flow yield of around 6% – not unattractive, in my view, and comfortably covering the dividend.

Next (NXT)

We are maintaining our sales and profit guidance for the full year, with profit before tax forecast to be £795m and Earnings Per Share (EPS) of 501.9p.

Next's trading updates are always a pleasure to read for their clarity and educational value. I've learned quite a bit about retail over the years from the detail in this company's statements.

Management guidance is also typically very accurate, with a good seasoning of prudence. That's the case here:

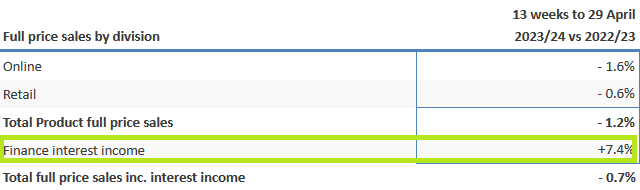

- Full price sales for the 13 weeks to 29 April were down 0.7% versus last year, compared to guidance of -2%

- Q2 sales forecast has been adjusted down to -5% to leave H1 forecast unchanged.

- The company justifies this caution by pointing out that Q2 last year benefited from pent-up demand (from the pandemic) and warm weather. We can't rely on a repeat this year.

Finance income: Next's customer credit business contributes about 20% of trading profits and is a big driver of earnings.

Higher interest rates appear to be having a beneficial effect so far. There's a risk that bad debt may increase, but that doesn't seem to be an issue yet. Finance income rose sharply during the quarter, partially offsetting lower sales:

Outlook: Full-year guidance is also unchanged at this point in the year, with pre-tax profit forecast at £795m (-8.6% vs FY22) and earnings per share of 501.9p (-12.5% vs FY22).

Shareholder returns: Next expects to end the year with £220m of surplus cash after the ordinary dividend and other costs. The company says it will use this to fund share buybacks or the acquisition of equity stakes in potential clients for its Total Platform online marketplace service.

My view: Next is a class act, with excellent profitability and wonderful reporting. Returns on capital employed have averaged 32% over the last five years and I expect this to continue.

But the reality appears to be that sales volumes are falling and that full-year earnings per share are expected to be more than 10% lower than last year.

The dividend yield is unremarkable, too, at 2.9%.

Given the growth challenges facing this business, I think the shares are up with events at current levels. A stock to buy in the next market sell-off, perhaps?

Disclaimer: This is a personal blog and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.