Dividend notes: underrated quality/full price - MACF, RECI, BEZ

I review the latest updates from packaging group Macfarlane, property lender RECI, and insurer Beazley.

Welcome back to my dividend notes. Here's what's on the menu at the end of another shortened week.

Thanks for reading - and enjoy the weekend.

Companies covered:

- Macfarlane (LON:MACF) - this small-cap packaging business appears to be making good progress and looks reasonably valued to me. I think it could be worth a closer look.

- Real Estate Credit Investments (LON:RECI) - this specialist lender has a good record of providing regular income and currently trades at a small discount to NAV, providing an impressive 9% yield. I'm tempted at this level.

- Beazley (LON:BEZ) - a solid Q1 update from this insurer, which is benefiting from strong rates in property and cyber insurance. I'm not convinced by the value on offer, though.

This is a condensed review of the latest results from UK dividend shares that are in my investable universe and may appear in my screening results.

Dividend notes is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

Macfarlane (MACF)

"Macfarlane has made a solid start to 2023, with Q1 sales and profits ahead of the same period in 2022."

This small cap packaging group has been churning out steady growth for a number of years now. This week's AGM update confirmed that progress continued during the first quarter of 2023.

Macfarlane said that sales and profit were ahead of the same period in 2022 during the quarter, helped by a contribution from acquisitions.

No revenue numbers were provided, but the company said that revenue in from packaging distribution business rose by 4%, while manufacturing revenue rose by 14%, "aided by good recovery in certain industrial markets".

The packaging distribution business contributed 80% of revenue and 90% of profit last year, so this drives the majority of earnings. The manufacturing business is smaller but serves an attractive niche, in my view, providing bespoke packaging for industrial customers in sectors such as aerospace and electronics.

Net bank debt fell from £3.4m to £0.1m during the first quarter, showing continued good cash generation.

Outlook: expectations for the full year are unchanged. Broker forecasts suggest earnings will rise by 20% to 11.8p per share this year, with a dividend of 3.6p.

That prices the stock on 10 times forecast earnings, with a 3.1% yield.

My view: Macfarlane appears to be performing well and quite reasonably priced, for a business that generates 15% return on capital and has minimal debt.

An economic slowdown in the UK could hit earnings later this year, but for now this business seems reasonably priced and in good health to me.

Although the dividend yield isn't especially high, Macfarlane's profitability and consistency mean that it also ranks quite well in my dividend screen, with a score of 69/100.

Real Estate Credit Investments (RECI)

"The company expects to deploy its currently available cash resources in near-term commitments and continues to see a growing pipeline of senior loans at attractive floating rates"

Real Estate Credit Investments has a £289m market cap and specialises in making senior bilateral (direct) loans to property developers. RECI is managed by Cheyne Capital, an asset manager that was setup in 2000 to focus on opportunies in credit and real estate.

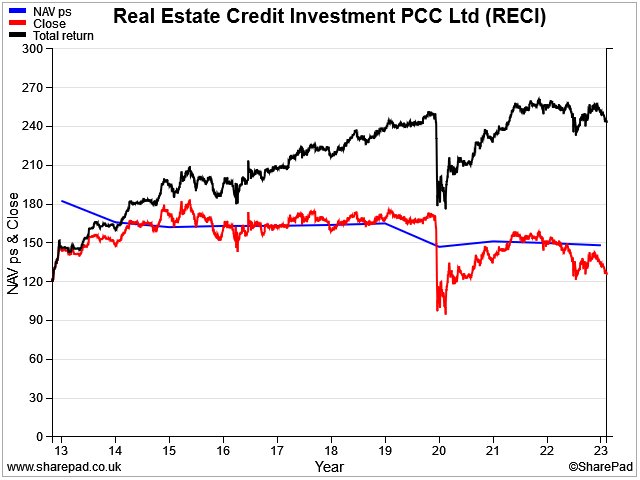

RECI's appeal for investors is its very high and (so far) stable dividend yield. The company targets a payout of 7% of NAV and has paid quarterly dividends without a cut since 2013.

However, the stock's current discount to NAV means that RECI offers a prospective yield of more than 9% at current levels. Based on the group's track record since the financial crisis, I think this could be a buying opportunity.

Quarterly update: RECI has just published a monthly factsheet and quarterly update from this specialist lender. I'm not going to attempt a detailed analysis here, but I would like to highlight some of the main points.

As this is a fairly specialist and perhaps higher-risk investment, I would recommend anyone interested should review the company's excellent and regular reporting for themselves.

- NAV per share on 30 April 2023 was 148p (31 Dec 22: 148.2p)

- RECI's loan portfolio has minimal or zero exposure to shopping centres, seconday offices and logistics - sectors where management expect further problems

- the company is continuing to rotate bond portfolio into "funding existing strong senior loans with attractive returns"

- Portfolio loan-to-value of c.59% - very high compared to a typical REIT, but RECI's senior bilateral loan model means it has a direct relationship with the borrower that can be used for "returns optimisation and financial flexibility".

- Company net leverage of 20% – there's a substantial equity buffer to absorb any losses

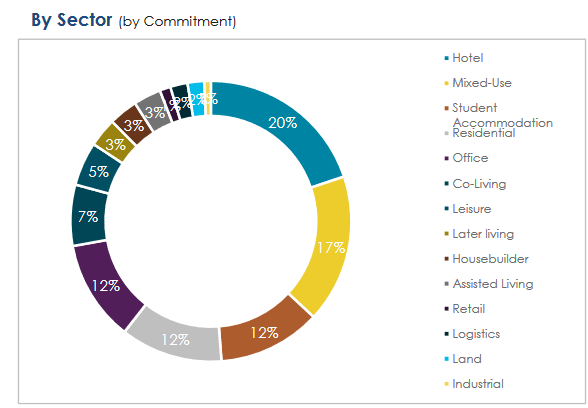

So where does RECI invest? The company's loan portfolio is heavily biased towards residential and short-term accommodation, plus mixed-use property.

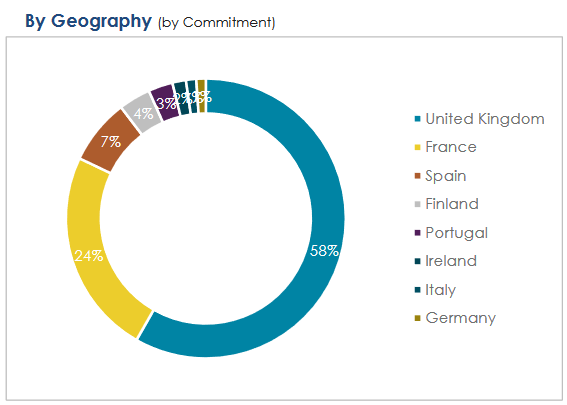

Geographically, more than half the firm's properties are in the UK, with the remainder in Western Europe:

Market opportunity: RECI believes that tighter conditions in credit markets will provide good lending opportunities:

"The present macroeconomic backdrop is set to continue through 2023, resulting in further constraints in bank lending and alternative sources of capital. The opportunity to provide senior loans at low risk points, for higher margins, is increasingly evident"

The company says that the current market environment is offering opportunities to make:

"low-risk senior loans yielding 12%+ (and of a floating rate nature)"

My view: I'm not an expert on this sector and have not done any detailed research into the company's property investments or the nature of its borrowers. But I have followed this business for several years and have been consistently impressed by the clarity and accuracy of its reporting and the reliability of its returns.

RECI's strategy is to pay out its total return in dividends to shareholders, so share price returns are likely to be minimal. But the dividend has provided a steady c.7% return on average since 2013.

With the yield now standing at more than 9%, I think RECI looks attractively valued – unless we're heading for a severe recession and 2008-style meltdown.

If this was to happen, then I'd expect to see the company's NAV rapidly eroded and – most likely – the dividend cut. With such high LTV lending, the risk for lenders is that their loans will be written down more quickly than in a lower-LTV scenario. Although RECI appears to have a sizeable equity buffer on its balance sheet, this would be required to absorb lending losses.

To a large extent, this investment depends on the continued expertise and good execution of RECI's investment managers.

I have bought RECI shares below book value in the past with good results. I can't be sure the firm's model will continue to work so well in a higher interest rate environment, but so far, I don't see any reason to doubt this.

I'm considering buying some shares again using some of the unallocated cash in my pension (not part of my main dividend portfolio).

Beazley (BEZ)

"We remain confident in our growth guidance of mid teens gross premium written and mid 20s net premium written for 2023 full year."

This is only a brief comment to lay down a marker on this well-established FTSE 250 insurer.

Beazley offers insurance for risks such as cyber attack, commercial property, and aircraft. It's a specialist business that can be quite cyclical.

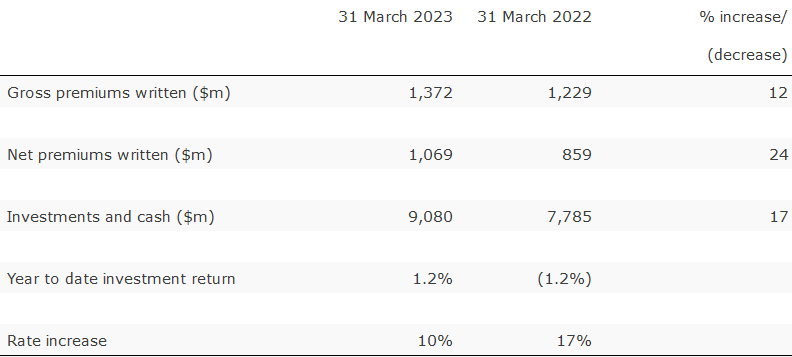

Trading appears to be in a strong upcycle at the moment, with premiums written, insurance rates, and investment returns all rising:

Management says a strong first-quarter was underpinned by growth in property, where gross premiums written rose by 56% to $347m during the period. The other strong performer was cyber insurance, where premiums rose by 24% to $280m, compared to the same period last year.

My view: I plan to leave a more detailed review of Beazley until its next accounts are published. I think this is probably a good business at the right price, but the shares have doubled from their 2020 lows and now offer a yield of just 2.4%.

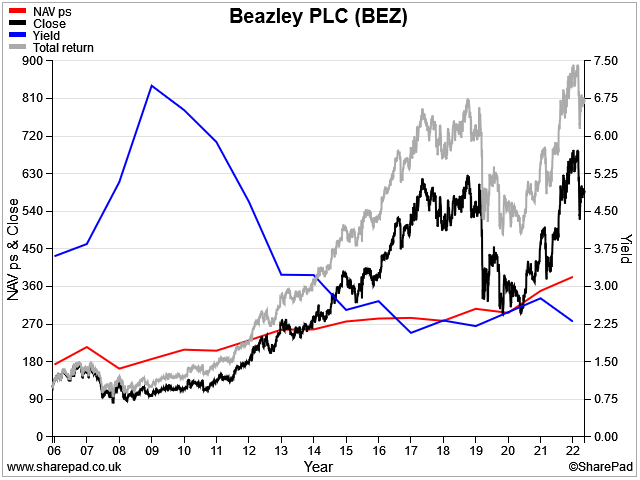

I'm not an expert on this sector and I don't know how the current cycle will pan out. But I can see that historically, the best time to buy Beazley shares has been when the stock has been trading close to NAV.

Right now, the shares are trading at almost twice their last-reported NAV of 326p per share:

The long-term average return on equity of this business is about 14%, according to SharePad. I'm not sure that's high enough to justify paying 2x NAV for the stock.

I may well be wrong, but I'm not sure there's much value on offer right now.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.