Dividend notes: warnings, upgrades and a 6% yield - VCT, CRDA, BNZL, VP

15/06/2023: I review recent trading updates and results from Victrex, Croda International, VP and Bunzl.

In today's dividend notes I'm catching up on on some items I've missed recently, including two profit warnings and a UK small cap offering a tempting 6% dividend yield.

Companies covered:

- Victrex (LON:VCT) - this plastics specialist warns on profits, as I predicted in May. I'm starting to see some potential value here, though.

- Croda International (LON:CRDA) - another profit warning triggered by destocking from big chemicals group. Bad news for now, but I wonder if an opportunity could be emerging for me to buy shares in this quality business at a more reasonable price.

- Bunzl (LON:BNZL) - this distributor bucks the trend with a (slight) upgrade to margin guidance for the year. I remain a fan of this well-run business.

- VP (LON:VP) - a solid set of results from this equipment hire group, albeit with some signs of worsening credit performance from construction customers. The 6% yield looks tempting to me and a trade sale remains a possibility.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my view only and are not advice or recommendations.

Victrex (VCT)

"latest indicators suggest these current headwinds will now continue over the summer and at least until the end of FY 2023 in September."

In May, I reviewed Victrex's half-year results and commented that the outlook relied on an improvement in H2 that might not materialise.

Less than a month later, we have a profit warning.

Victrex says that the "ongoing macro-economic weakness and industrial customer destocking" seen during H1 are now expected to continue until at least the end of September.

Although the group's medical business is making "good progress", industrial headwinds mean that group volumes are now tracking down in excess of 20%. For context, volumes fell by 14% during H1. Trading still appears to be worsening.

For Q3 alone, volumes are expected to be c.800 tonne, 40% below last year's level of 1,323 tonnes. I wonder if there's scope for another warning in Q4 if trading doesn't stabilise.

As a result of this weak start to H2, Victrex has cut its full-year guidance.

- Full-year revenue is expected to be down 6%-10% at the current run rate (previously consensus was broadly flat vs FY22 at c.£340m)

- Adjusted pre-tax profit for the year is expected to be £80m-£85m (previously flat vs FY22 result of £95.6m)

My view: I estimate Victrex shares may now be trading on c.16x FY23 forecast earnings, with a possible dividend yield of 4%. However, I'm unsure just how safe this outlook is at the moment – in particular, whether the risk of a dividend cut is mounting.

I'm still interested in learning more about this business, which has a record of good cash generation and high-teens returns on equity. But I'm not in a rush to invest at the moment and will await further results. The next scheduled update is the Q3 statement on 6 July.

Croda International (CRDA)

"customer destocking in consumer and industrial end-markets now expected to continue into the second half year"

Victrex isn't the only London-listed chemicals group issuing profit warnings.

I missed this last week due to time constraints, but FTSE 100 firm Croda issued a near-identical warning to Victrex just one week earlier, on 9 June.

Croda produces specialty chemicals used in a wide range of markets including life sciences, consumer care, agriculture and industry. The group is reporting destocking across the board:

- Consumer care: sales volumes are down a "double-digit percentage" compared with the same period last year as a result of customer destocking.

- Life sciences: crop protection started the year well but is "now experiencing rapid customer destocking" that was not expected until later in the year. Sales to pharmaceutical customers are also lower, due in part to lower sales for Covid-19 applications.

- Industrial markets: customer destocking is now expected to continue into the second half

Outlook: 2023 pre-tax profit is now expected to be between £370m and £400m. From what I can see, previous consensus estimates were c.£450m.

My view: I think Croda is a high-quality business and don't see any reason why this should change. But as with Victrex, I wonder if further downgrades may be likely later this year.

Profit warnings often come in threes and widespread destocking makes me think that demand in these companies end-user markets may be weakening.

Croda's share price was down more than 10% yesterday and the stock has now halved from its pandemic peak of over £10, when it was boosted by sales of vaccine ingredients.

With the shares now trading on c.24x earnings and offering a yield of c.2%, Croda is getting closer to the level where I might be interested. For now, it's another stock for my watch list.

Bunzl (BNZL)

"operating margin over the first six months of the year expected to remain well ahead of historical levels and driving an upgrade to our full year expectations"

When I saw a trading update from FTSE 100 distribution group Bunzl in the RNS feed this morning I wonder if it might be another warning. But it wasn't. According to CEO Frank van Zantern, it's an upgrade to full-year guidance.

Bunzl specialises in not-for-resale consumables such as cleaning products, PPE and disposable foodservice items. The group had a very good pandemic as demand for many of its products rocketed.

This means that current-year results are coming off these record highs, so I think it's reasonable to expect some moderation in revenue growth.

Outlook: However, today's update suggests an outright fall in revenue can be avoided. Half-year revenue is expected to increase by 4%-5% at actual exchange rates, or +1% constant currency.

This growth is being driven by acquisitions, but underlying revenue is still expected to be flat.

Operating margins are now expected to be slightly below last year's level, which appears to be a modest upgrade from previous guidance of "slightly higher than historical levels".

Consensus forecasts prior to this update suggested adjusted earnings for the year may still be marginally below last year's level, pricing the stock on 17x forecast earnings with a 2.2% yield.

My view: my feeling is that any actual upgrade here is marginal, but I'm not arguing. I think this is an excellent and very well-run business with some interesting characteristics.

One possible slight headwind for the group is that it uses a fair amount of debt – net debt excluding lease liabilities was £1,160m at the end of last year. While this isn't a problem in itself, rising borrowing costs could lead to a modest reduction in the profitability of acquisitions over time.

My dividend portfolio already includes one distributor and I probably wouldn't add Bunzl unless the shares became unusually cheap. But if the shares fell back to last summer's lows of c.£25, I think I might start to get tempted.

VP (VP)

"High quality of earnings highlighted by the return on average capital employed"

The quote above doesn't contain any numbers, but I think its very existence at the top of equipment hire group VP's recent results reflects well on the management of this business.

VP is controlled by founder and chairman Jeremy Pilkington, who owns just over 50% of its stock.

Its shares are currently trading at c.650p, which is a level seen previously during the 2020 crash, and prior to that, in 2016. Last week's final results suggest to me that the shares may have been oversold, barring a major recession.

These results cover the year to 31 March 2023. Let's take a look at the main highlights.

Revenue for the year rose by 6% to £371.5m, but operating profit fell by 8.7% to £39.3m due to the impact of £5m of exceptional (cash) costs.

Even so, VP generated a respectable operating margin of 10.6% and a return on capital employed of 10.4%.

Operating cash flow of £66.3m converted into free cash flow of £11.9m, according to my calculations. This is an improvement from last year but reflects the significant cash costs of fleet renewal and growth faced by businesses such as these:

- FY23 expenditure on equipment for hire: £59.9m

- Depreciation of rental equipment: £40.9m

- Cash proceeds from sale of property, plant and equipment: £24.9m

Cash flow was impacted by an increase in working capital last year, which the company says reflects revenue growth during the year and "a slight worsening of the external credit market, particularly in the construction sector".

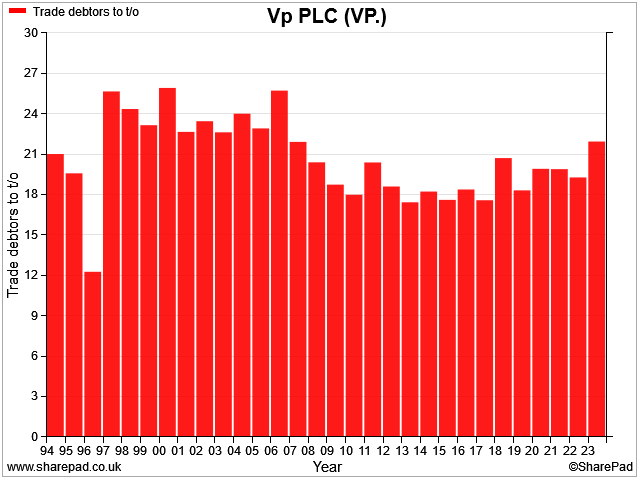

According to management, VP's customers took an average of 59 days to pay their bills last year, up from 55 in the previous year. I don't think this indicates a serious issue, but it's a metric that's worth monitoring.

SharePad data suggests that trade debtors as a percentage of turnover are now at the highest level seen since 2007 – possibly not a positive trend:

With this slight caveat, I don't see anything untoward in the group's financials. VP's profitability and balance sheet seem fine to me.

Broadly stable revenue and underlying profit is a reassuring result in the context of the last year, in my view.

Dividend: the full-year dividend has been lifted 4% to 37.5p per share. This represents 2x adjusted earnings cover, although my sums suggest the payout was not quite covered by free cash flow.

Outlook: VP says markets remain stable and the company continues to invest for future growth. A "supportive infrastructure market outlook in the UK" is expected after a flat 2022.

Broker forecasts suggest earnings of 80p per share and a dividend of 39.5p in 2023/24. That puts the stock on a P/E of 8 with a 6% yield.

My view: VP looks reasonably priced and in good health to me, with a slight caveat about the apparent worsening of market conditions in the construction market.

I would be comfortable owning the shares at current levels.

There's also some potential upside if the business is sold. VP tried to find a trade buyer last year but was unsuccessful. Presumably Mr Pilkington would like to retire, but only at the right price.

I'd guess a sale will be made eventually. In the meantime, I rate this as the best of the small-cap equipment hire companies on the UK market.

Disclaimer: This is a personal blog and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.