Dividend notes: warnings and uncertainty - VCT, DLG, MSLH (09/05/23)

I review the latest updates from UK dividend shares Victrex, Direct Line Insurance and Marshalls.

Another shortened week begins with a mixed bag of news, including poorly-received updated from three FTSE 250 dividend stocks in my coverage universe.

Companies covered:

(click links to scroll to the relevant section)

- Victrex (LON:VCT) - a good business that I've admired for a while. But falling volumes and elevated inventories suggest some risk of a cyclical slowdown. Victrex remains on my watch list for further research.

- Direct Line Insurance Group (LON:DLG) - a discouraging Q1 trading update that leaves me feeling relieved that I sold my DLG shares earlier this year.

- Marshalls (LON:MSLH) - today's profit warning was triggered by worsening trade forecasts, says the company. However, today's statement creates as many questions as it answers, in my view. I'm staying on the sidelines for now.

This is intended to be a condensed review of the latest results from UK dividend shares that are in my investable universe and may appear in my screening results.

Dividend notes is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

Victrex (VCT)

"Consequently, compared to a record FY 2022, full year volumes are still tracking to be down by a double-digit percentage."

FTSE 250 group Victrex produces a high-performance polymer (plastic) called PEEK. This business has many of the characteristics I look for in a quality dividend stock, such as strong profitability and good cash generation.

Recent years have seen the company investing in "mega-programmes" to develop new products made from PEEK and move higher up the value chain. This seems a logical strategy to me to help ward off growing competition. However, progress has been slow and the group's profits peaked in 2018.

Today's commentary suggests the company may now be facing a broader cyclical downturn. However, Victrex's balance sheet still looks healthy to me and the valuation looks more reasonable than it has done for several years.

I'm wondering whether a buying opportunity might be emerging here.

H1 2023 highlights: today's results cover the six months to 31 March 2023. They show a slump in volume and a slightly smaller reduction in profit:

- Group sales volumes down 14% to 1,941 tonnes (H1 2022: 2,264 tonnes)

- Revenue up 1% to £162.2m (down 5% in constant currency)

- H1 operating margin: 24.2% (H1 2022: 27.5%)

- Pre-tax profit down 10.3% to £39.1m

- TTM return on capital employed 15.3% (FY22: 15.9%)

- Diluted earnings down 11.1% to 38.5p per share

- Interim dividend unchanged at 13.42p per share

Profitability remains attractive, in my view, with a return on capital in excess of 15%.

However, margins do appear to be under pressure and the company reports contrasting trading conditions across its different customer markets:

Industrial: revenue down 2% to £129.7m (down 8% constant currency). The company says that performance in this division was split:

- Electronics, energy, industrial and value-added resellers: "macro weakness"

- Aerospace & automotive: "good growth"

Collectively, the outlook for the company's industrial markets (all of the above) is cautious, if not gloomy:

"Victrex typically sees a strong bounce back once end-markets improve and we remain well positioned for an upturn in the global economic environment. However, volumes continue to track down double-digit on a full year basis, compared to the record volumes of FY 2022."

Medical: the group's smaller but more perhaps less cyclical medical business appears to be trading well:

- Medical: "record half", revenue up 17% to £32.5m (+6% constant currency). Growth driven by new applications for PEEK.

Balance sheet/cash flow: Victrex has maintained a net cash balance for at least a decade, but this fell to just £5.4m over the last six months as the company spent £30.5m increasing its inventory to £117.3m (FY22: £86.8m).

The company says this stock build was done to "support security of supply for customers" and to offset the impact of planned engineering work in the UK.

However, many companies seem to be reporting that supply chain concerns are easing. I wonder if this is a case of shutting the stable door after the horse has bolted.

Management expects inventories to remain "elevated" at the end of the financial year. I'm a little concerned by this, as high inventories are sometimes an early sign of a cyclical downturn in industrial businesses.

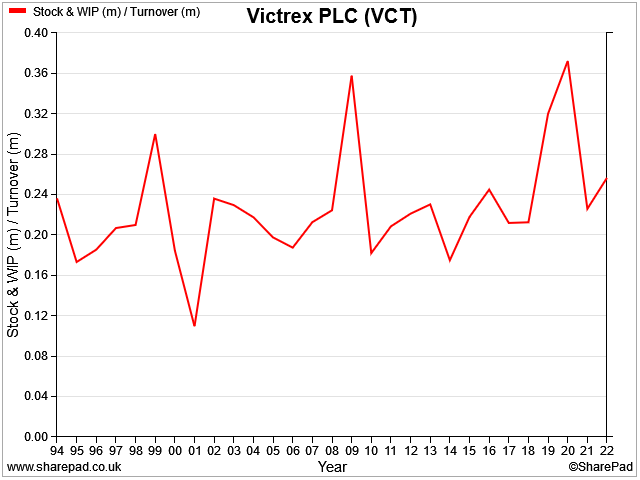

My sums sugest Victrex's inventories now represent 34% of trailing 12-month revenue. According to SharePad data, this level has only been seen twice before, in 2008/9 and during the market crash at the start of the pandemic:

Inventories aside, Victrex's balance sheet looks healthy enough to me. I don't see any serious cause for concern at this time.

Outlook: today's guidance suggests that profits will fall below expectations, unless demand improves during the second half of the year (my bold):

Delivering a PBT performance in line with FY 2022 and current expectations assumes a step up in demand during the latter part of the second half, driven by macro-economic conditions.

In other words, Victrex is relying on profits being weighted to the second half in order to meet current forecasts. In my experience, this if often an early sign that a profit warning is becoming more likely.

Broker forecasts prior to today suggested earnings of 93.9p per share and a dividend of 60.5p. After today's slump (-7% to 1,539p at pixel time), that prices Victrex shares on 16 times forecast earnings, with a dividend yield of 3.9%.

My view: I think there could be a little more bad news to come. But Victrex shares are trading close to 10-year lows. Is value starting to emerge?

On a trailing 12-month basis, my sums suggest the stock is now trading on a EBIT/EV yield of around 6%. For me, that's reasonable, but still a little way below the 8% I'd target for strong value.

Victrex's strong profitability and market leadership in PEEK are attractive to me. But falling volumes suggest to me that the second half may not be better than the first.

I'm also a little unsure how successful some of the company's product-based growth programmes are. The majority of revenue is still generated from selling commodified raw PEEK (pellets), for which there is more competition.

For now, Victrex is on my watch list for further research. I'll be following its progress with interest.

Direct Line Insurance (DLG)

"2023 earnings outlook continues to be challenging"

I sold Direct Line from my model dividend portfolio and my personal holdings at the end of March. I explained why in a detailed review of the group's results here.

In short, I thought there was a good chance earnings would disappoint this year, and I had lost confidence in management. I had also started to wonder if the group's direct business model is not as strong as it once was.

Direct Line's Q1 update did nothing to change my views.

Trading: a focus on margins resulted in a 19% increase in motor renewal premiums in Q1. Unsurprisingly, this had an impact on volumes – the number of in-force motor policies fell by 2.5% during the quarter.

Home and breakdown policy counts were stable, while commercial policy numbers rose slightly despite hefty price increased.

At a group level, gross written premium rose by 9.7% to £805.7m, but the number of own-brand in-force policies fell by 1.5% to 7.1m.

My conclusion from the numbers is that the motor business is continuing to lose market share. The group's other businesses are performing better, but aren't big enough to offset motor's decline.

Claims costs: once again (!), the company said it had been surprised by higher costs for motor and commercial damage claims during the first quarter. As I feared, these costs are expected "to put pressure on earnings in 2023".

Balance sheet: management say the insurer's capital solvency ratio was "broadly unchanged compared with year end", but do not provide an updated figure.

Expected capital tailwinds resulting from external market conditions are "now expected to be recognised over the remainder of 2023". My reading of this is that they didn't materialise in Q1.

Self-help measures are also being considered. I wonder if one of these might end up being a rights issue or equity placing.

Outlook: acting CEO Jon Greenwood's outlook statement seemed vague and cautious to me:

Whilst 2023 earnings outlook continues to be challenging, the Group has many strengths, and we continue to take the actions required to drive business performance. Our ambition over time to generate a net insurance margin of above 10% remains.

My view: I didn't find this update very reassuring. In my view, there's a good chance Direct Line may need to issue another profit warning this year.

If the hoped-for capital market tailwinds materialise, the group may be able to strengthen its capital buffer without needing to raise funds. But I think Direct Line is unlikely to pay a dividend this year.

I'm also a little surprised that the company still hasn't managed to appoint a new chief executive, nearly four months after Penny James departed. This also does not reassure me.

The only possible bright spot I can see is that a trade buyer might see value in the business at current levels, given its large market share and well-known brands. I don't know how likely this is – but for an industry expert it might be worth considering.

Marshalls (MSLH)

"the Board now expects to deliver a result that is lower than its original expectations"

Building materials supplier Marshalls says that a slowdown in new-build housing is the main reason for today's profit warning. In addition, the company also warns of a reduction in discretionary RMI (repair, maintenance and improvement) spending in areas such as landscaping.

Although revenue rose by 12% to £227m during the quarter, this reflects last year' £535m acquisition of Marley Roofing Products. Stripping out this deal, Marshall's revenue for the quarter was 14% below the same period last year.

What struck me about today's update was the contrast with recent commentary from the big housebuilders.

Marshalls says that today's profit warning is based on the latest construction output forecasts from the Construction Products Association (CPA).

Marshalls says that since January, the CPA has cut its forecasts for new-building housing by a further 6%, taking the total year-on-year reduction to 17%. This change is what's prompted today's warning, according to management.

In contrast to this, recent updates from Taylor Wimpey and Persimmon have pointed to a 30%-40% reduction in expected completions this year.

Obviously these big housebuilders are not necessarily a direct proxy for the whole new-build housing market. But I should think they're probably a reasonable indicator.

I'm not sure how to interpret the discrepancy between the CPA forecasts and the housebuilders' guidance.

My view: Marshalls' share price has now fallen by around 70% from its pre-pandemic highs of over 850p.

If things don't get too much worse, I suppose there could be some value here. However, the company didn't provide any specific financial guidance for the rest of the year in today's update, so we're left guessing about the likely fall in profits.

I'd also note that the Marley acquisition has left Marshalls with increased net debt of £220m, just as its core markets seem to be slowing.

Given the level of uncertainty here, my view is that it's probably sensible to stay on the sidelines until a clearer picture emerges – or the shares get cheaper.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.