The Dividend Note - what are the risks? NXT, MIDW, PGH, MPE (22/03/24)

I review the latest numbers from UK dividend shares that each carry quite different risks - Next, Midwich, Personal Group, and MP Evans.

This week's full-year results from FTSE 100 retailer Next propelled the stock to an all-time high and provided the usual masterclass in corporate reporting.

I always find that writing about investments help to clarify my thinking and highlight possible flaws. So it was interesting to see Next chief executive Simon Wolfson make a similar comment about the challenge of writing up these results:

"As is so often the case, the requirement to explain ourselves has been instructive"

Lord Wolfson's explanation of the evolution of the group's business model and its current startegy and operations made for a fascinating and educational read.

The company's accounts weren't bad, either, with revenue up 9% to £5.5bn and underlying pre-tax profit up by 5% to £918m. Guidance for the current year is similar, with group sales expected to rise by 6% and pre-tax profit by 5%.

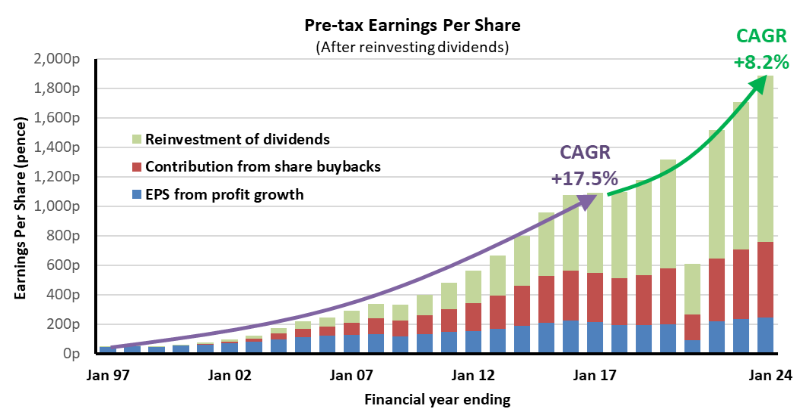

However, I was struck by one chart in the results which I don't think I've seen any other company use:

This shows pre-tax earnings per share and demonstrates the extent to which buybacks have supported earnings growth over the last 20 years. Next's earnings would be broadly unchanged from 2016 levels, except that buybacks have reduced the group's sharecount by about 15% since 2016.

However, I thought the most remarkable aspect of this chart was the way that the company had modelled the impact of reinvesting dividends. In my view, it's certainly a compelling illustration of why it's important to reinvest dividends if they're not needed for income.

Of course, the beauty of receiving dividends (rather than buybacks) is that you can choose which company you want to reinvest them in. They don't have to be reinvested at unattractive valuations, for example.

I don't hold Next, in part because I hold another high quality retailer in my dividend portfolio that pays more generous dividends. But I would consider Next, at the right price. (Type NXT into the search box at the top to see my previous coverage of Next.)

Moving on, in the remainder of this week's Dividend Note, I'm going to take a look at a mix of companies that I think offer quite different opportunities (and risks) for UK income investors.

Companies covered:

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- Midwich Group (LON:MIDW) - results from this distribution group look fairly good to me despite tough market conditions. I quite like the business model and I think the shares look reasonable value at current levels.

- Personal Group Holdings (LON:PGH) - this small-cap financial services group delivered a (mostly) strong performance in 2023, but I'm a little concerned about the seemingly high profitability and low payout ratio of its core insurance product. The shares could be cheap, but probably aren't for me.

- MP Evans (LON:MPE) - this palm oil producer does carry some commodity-type risks, but boasts a 30-year dividend record and could be attractively valued, I think. This review has left me interested to learn more.

Midwich Group (MIDW)

"Record financial performance and market share gains in FY23"

2023 full-year results / Mkt cap: £436m

FY24 forecast dividend yield: 4.1%

Last week I looked at a crop of 2017 IPOs that are starting to look appealing to me.

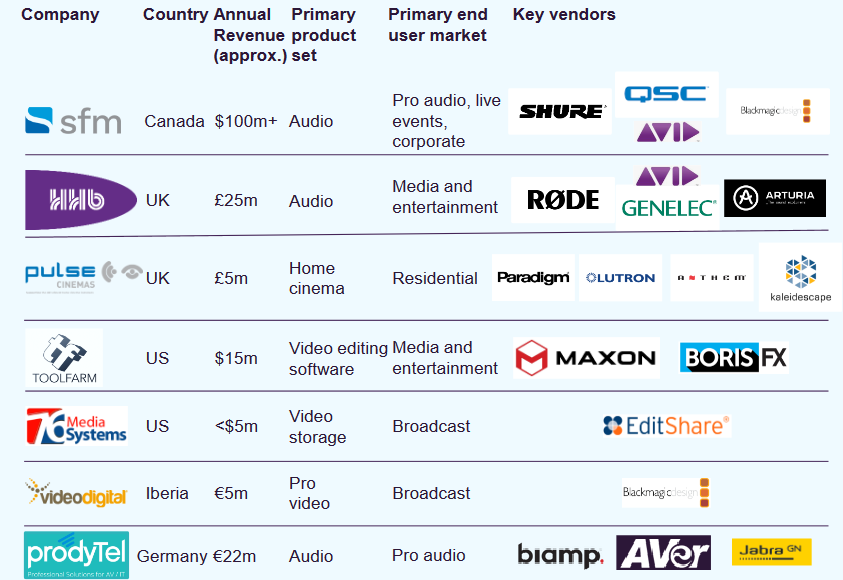

This week I'm starting with a look at Midwich Group. This AIM-listed firm is a leading distributor of specialist audio-visual equipment. The group floated in 2016 and operates in 22 countries, including the US.

One initial attraction here is that Midwich retains founder ownership, despite having been listed for eight years now. Managing Director Stephen Fenby holds 16.8% of the stock, according to Stockopedia:

Interestingly, Fenby has been a fairly active trader of the firm's stock since the IPO.

According to Stockopedia's director dealing data, he's has been a steady buyer at times when the shares have been between 350p and c.500p. When Midwich's stock has topped 600p, Fenby has been a big seller. I guess this may give us some idea of his view of fair value.

2023 results summary: Midwich reports another record year with "strong technical product growth" and "increasing specialisation in the audio market".

The group also entered the Canadian market through the acquisition of S.F. Marketing Inc and completed a total of seven acquisitions during the year.

This is something of a roll-up business, I think – Midwich has made 27 acquisitions since its 2016 IPO. This is a model that can work well, in my view, when it's well managed.

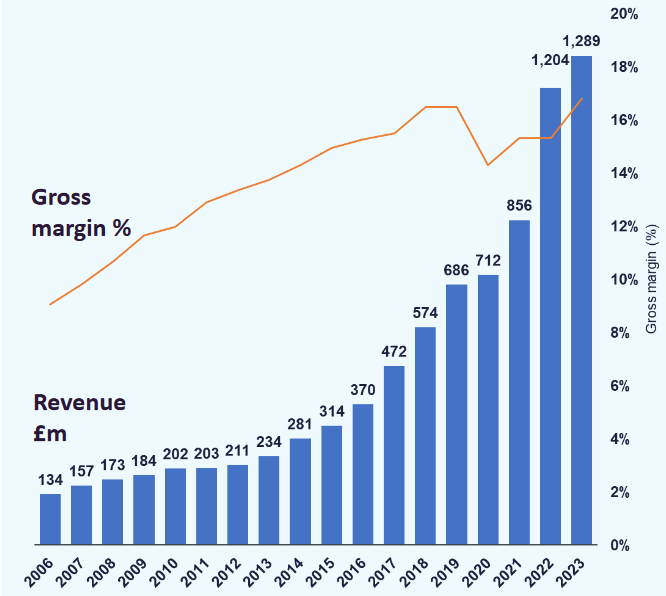

Group revenue rose by 7% go £1,289m in 2023, which the company says reflects "good organic growth" and a contribution from acquisitions. However, the numbers show revenue growth of 6.8% at constant exchange rates, with just +0.8% organic growth.

Given general levels of inflation last year, I would not describe this as strong organic growth.

The company says that margins were supported by greater specialisation, but seems to suggest that overall volumes may have fallen:

"Despite lower demand for mainstream products, stronger technical product sales led to our highest ever gross margin percentage."

The accounts show gross margin improving from 15.3% to 16.8% last year, while operating profit climbed 19% to £41.6m. Gross margin has improved steadily over the years:

Free cash flow: stripping out some big working capital movements gives me an underlying free cash flow estimate of £32m for 2023. This represents excellent cash conversion from a net profit of £28.9m.

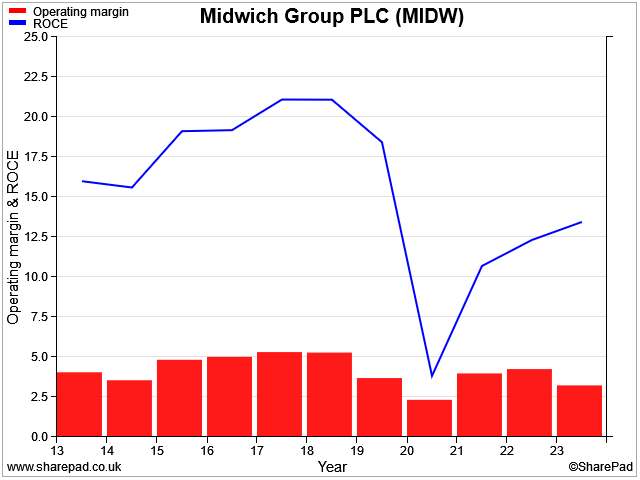

Profitability: although last year's operating profit is only equivalent to a 3.2% operating margin, my sums suggest the business delivered a return on capital employed of 14% in 2023. This is slightly below pre-pandemic levels, but the trend is favourable:

In my experience, well-run distributors are often able to generate attractive ROCE. From what I understand, the main reason for this is that they typically benefit from generous supplier credit terms (reflected in trade payables) that allow them to turnover stock before it needs to be paid for.

This is effectively free leverage and serves to reduce the overall level of capital required in the business, supporting attractive ROCE despite low margins.

In this case Midwich's 2023 accounts show payables (money owed by the firm to suppliers) equivalent to almost 22% of cost of sales, suggesting c.90-day trading terms.

In contrast, receivables are c.17% of annual revenue, suggesting c.60-day payment terms for Midwich customers.

The main risk with this model comes if the company suffers an unexpected shortfall in orders, or a change in trading terms. Either can result in a sudden need for additional cash as working capital unwinds.

Debt/placing/M&A: given the working capital risk, I would not want to see too much balance sheet debt in a business of this kind.

Midwich's 2023 balance sheet shows net debt excluding leases of £82.6m at the end of 2023, reduced from £96m at the end of 2022. Based on last year's profits, I would say this is probably high enough.

Management may agree with me. Midwich raised £50m in a placing last year to fund a £26.7m acquisition, with the remainder used for debt reduction and M&A activity.

Given that net debt only fell by £13.4m last year, we can infer that there would have been a substantial increase in net debt without last year's placing.

The cash flow statement for 2023 shows £42.3m of acquisition spending, plus £9.3m of deferred consideration for past acquisitions, totalling £51.6m.

Dividend: the full-year dividend has been increased by 10% to 16.5p per share, giving a yield of 3.9%. This £17m payout is covered comfortably by last year's free cash flow, if I exclude acquisition spend.

Outlook: the company says that challenging market conditions from 2023 have continued into 2024. Management don't expect an improvement in mainstream product sales, but say that demand for technical products has remained strong so far this year.

Broker forecasts suggest adjusted earnings could rise by around 5% to 39.4p per share this year, supporting a 17.3p per share dividend. That would price Midwich shares on a price-to-earnings ratio of about 11, with a 4.1% yield.

My view

I quite like this business and am inclined to think the shares are probably reasonably valued at current levels.

However, I already have two distribution specialists in my portfolio that I like even more. I'm not inclined to add a third distributor at this time, but this is a business I'll continue to follow.

Personal Group Holdings (PGH)

"This has been a year of positive change for Personal Group."

2023 full-year results / Mkt cap: £55m

FY24 forecast dividend yield: 7.0%

This small cap is a specialist provider of workplace benefits schemes and certain type of health/life insurance. The group's clients are generally corporates and other large employers - e.g. Royal Mail.

I last covered Personal Group here in January and promised to take another look when the full-year results were published.

This business has historically been cash-generative and quite profitable, offering attractive yields. With the shares trading at levels last seen 20 years ago and a turnaround seemingly underway, I've been wondering if there could be an opportunity here.

Personal Group's full-year numbers for 2023 seem positive at first glance, with revenue flat at £49.7m and operating profit up by 41% to £5.3m.

The group declared a full-year dividend of 11.7p per share, giving a useful 6.8% yield. The £3.7m cost of this payout appears to be covered by last year's free cash flow.

A net profit of £4.3m on net assets of £32.0m give a respectable return on equity of 13.5% for the full year.

However, these figures mask some interesting changes and trends across PGH's various operations.

Insurance: revenue rose by 13% to £28.7m. This supported segmental adjusted EBITDA of £11.3m, giving a useful 39% margin.

These profits effectively support the majority of group earnings and appear to be driven by a (remarkably low?) reported claims ratio of 27% – this reflects the amount paid out to policy holders from total premium income received.

If I've understood this correctly, this claims ratio means that PGH kept 73% of the insurance premium payments it received last year. For contrast, private healthcare provider BUPA reported a loss ratio (an equivalent measure) of c.70% in 2021 and 2022.

Benefits: PGH sells its digital benefits platform direct to customers but also offers it through accountancy software group Sage (disc: I hold).

External revenue rose by a healthy 28% to £6.7m last year, generating £3.8m of EBITDA at an impressive 57% margin (2022: 37%). This division appears to be benefiting from operating leverage as it scales up.

Pay & Reward: this seems to be an HR consultancy service, relating to remuneration. Revenue rose by 11.8% to £2.3m in 2023, generating £493k of adjusted EBITDA at a margin of 22%.

Let's Connect: this is a technology purchasing scheme employers can offer employees. This business appears to have lost (possibly) its largest client last year, causing revenue to fall by 34% to £11.1m. Adjusted EBITDA fell by 44% to £369k – a margin of just 3.3%.

Outlook: apart from Let's Connect, all of PGH's business lines seemed to perform reasonably well last year. The company's outlook statement for 2024 suggests management remain confident:

"... the Group is well-placed to deliver further growth with an increasing proportion of recurring revenue and a strong balance sheet."

Broker forecasts suggest earnings could rise by 12% to 16p per share in 2024, supporting a 12.3p dividend that gives the stock a potential yield of 7%.

My view

I'm attracted by the high-yield and potential growth on offer here, but I'm not sure I'm comfortable with the insurance business model.

I appreciate that this business has been around quite a long time, but I have to wonder whether PGH's insurance product may not offer very good value for money for its end users.

If I'm right, then my concern would be that it might a) attract tougher competition or b) earn the attention of the FCA at some point.

On balance, I think there could be an opportunity here. But it's probably not one I will pursue.

MP Evans (MPE)

"Results affected by lower CPO price environment when compared to exceptionally high prices during 2022"

2023 full-year results / Mkt cap: £398m

FY24 forecast dividend yield: 6.0%

This AIM-listed palm oil business can trace its roots back to the 1870s and has been listed since 1986. It's always been a SE Asia-based plantation business, but has evolved through various crops, including tea and rubber. Today, the business is focused solely on Indonesian palm oil plantations.

There's owner-management here, too. Executive chairman Peter Hadsley-Chaplin and a related family trust appear to control around 6.5% of the stock between them.

Palm oil attracts controversary because demand for new plantation space has led to deforestation of virgin rainforest in Asia and elsewhere. The problem is that palm oil itself is an excellent product – the fruits produce a high yield of oil and the oil itself is versatile and widely used.

I should point out that MP Evans' plantations are all described as sustainable and operate on land leased from the Indonesian government. This is a universal framework for agricultural land in the country that's been in place since the 1960s.

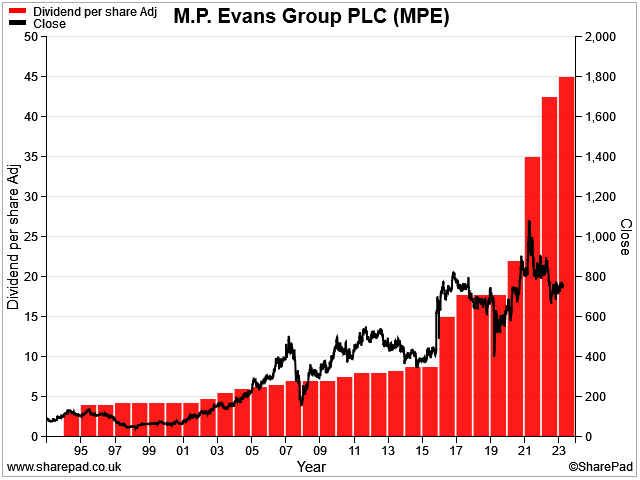

This business has proved a decent investment for investors who have bought at opportune times and does not appear to have cut its dividend for at least 30 years:

2023 results summary: last year's results showed an inevitable decline from 2022, when the group benefited from "exceptionally high prices" following Russia's invasion of Ukraine.

This SharePad chart showing Crude Palm Oil prices shows the magnitude of the change. Prices are down c.40% from their 2022 peaks, but remain substantially above pre-pandemic levels. I don't know if there's a structural reason for this or not:

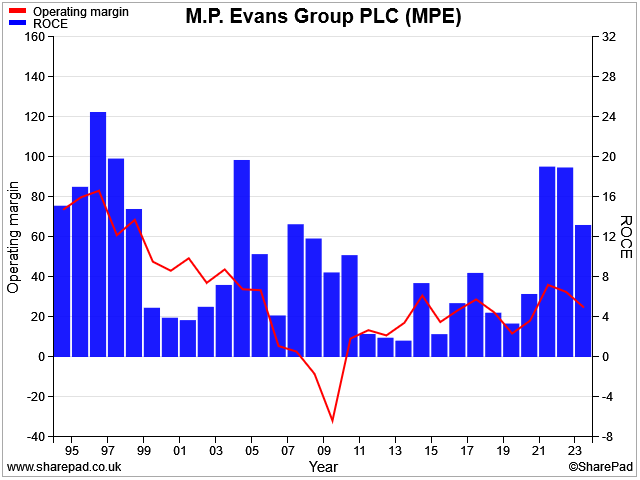

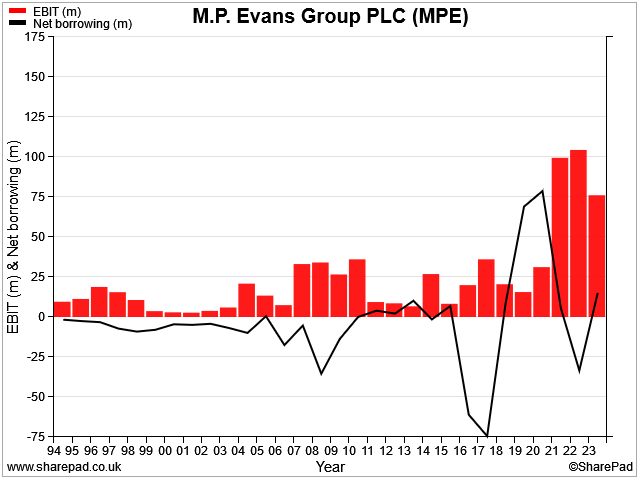

MP Evans' revenue fell by 6% to $307.4m, while the group's operating profit slid 26% to $75.3m, giving a margin of 24.5%. That seems to be broadly in line with the average in recent years, although margins (and ROCE) vary widely, depending on prices and crop yields :

Earnings/dividend: earnings per share of 96.2 cents (78.1p) provided solid cover for an increased dividend of 45p per share, which was a 6% increase from 2022. This payout gives the stock a yield of 5.8% at current levels.

Outlook: MP Evans aims to continuously expand its operations as opportunities arise.

The company opened a sixth mill last year, allowing it to process substantially all of its crop in house. A further 10,000 hectares of planted land was also acquired during the year.

This is expected to support future growth, while further acquisitions are possible:

"We have secured a substantial increase in planted hectarage during the year, which will support our continuing growth, and we remain focused on opportunities for further sustainable development, both at our existing estates and as we continue to review additional acquisition prospects."

At this early stage in the year, it's hard to forecast palm oil prices and other factors that might affect the result.

An updated note from broker Cavendish on Research Tree leaves mill-gate price assumptions unchanged and estimates that earnings could rise by 9% to 107.6 cents per share this year.

These estimates would price MP Evans on around nine times earnings, with a prospective dividend yield of c.6%.

My view

My initial impression of MP Evans is favourable, not least because of its very long and stable dividend history. This suggests it has been run with financial discipline and fairly consistent profitability.

However, I'd want to understand a litle more about the cyclicality of this business before considering an investment. Profits seem to have gone through periods of feast and famine in the past, although the trend has always been upwards:

In addition to palm oil pricing and market conditions for this commodity, one area I'd look at is the company's history of replanting cycles. Palm trees are said to have a productive life of around 25 years, with productivity peaking at about 10 years old.

The company's website describes its palms as "relatively young" on average. Does this mean crop yields could enter a multi-year period of decline at some point in the next five years or so? I don't know.

MP Evans scores highly in my dividend screen results at the moment. Although I'd view this business as slightly riskier than some others I consider, the 6% yield and strong track record mean this is a business I might look at in more depth.

Roland Head

Disclosure: At the time of publication, Roland owned shares in Sage.

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.