Should I buy dividend giant Shell for my portfolio?

Shell (LON:SHEL) is one of the most popular FTSE 100 dividend shares. How does this energy giant score in my screening system?

FTSE 100 energy giant Shell is the UK's second-largest listed company. It's one of the world's largest independent producers of oil, gas, and petrochemicals.

New CEO Wael Sawan appears to be focused on maintaining the group's current strong performance and closing the valuation gap with the big US oil giants. That could help to support more attractive shareholder returns.

Shell also currently earns a very respectable score in my quality dividend share screen. The company's gushing cash generation and reduced leverage has certainly caught my eye over the last year or so.

However, I think it's worth pointing out that Shell's shares have demonstrated an incredible ability to trade within a range over the last 30 years:

This has always been a very cyclical business. Will things really be different this time?

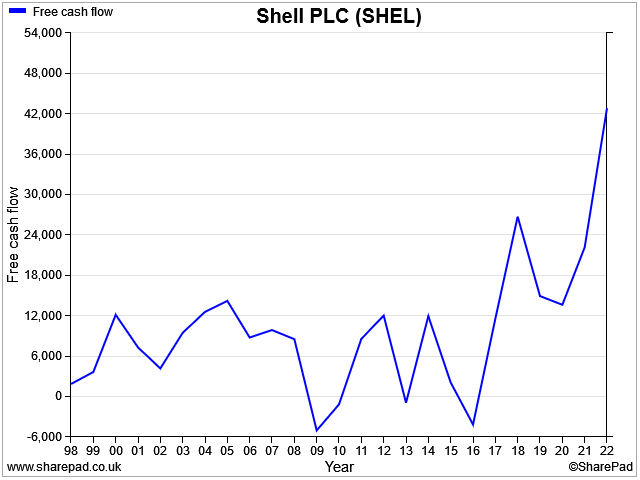

I'm not yet sure. But recent management guidance on free cash flow looks very appealing for an income-minded investor like me:

6% p.a. absolute free cash flow growth through 2030

Grow FCF/share >10% p.a. through 2025

My research also suggests that this business was considerably more profitable in the past than it has been in recent years. A return to these past levels of profitability might help to support a stronger and more stable valuation.

To find out more, I decided to run Shell through my dividend scoring system and take a more in-depth look at this business.

Could this energy giant be a suitable share for my model dividend portfolio?

Table of contents

- History - seashells to oil wells

- Shell today - a new look?

- Climate change and net zero - should investors be worried?

- Crunching the numbers - how does Shell score in my screening system?

- Dividend culture - exceptional

- Dividend safety - better than it seems?

- Dividend growth - recovering

- Dividend yield - varied

- Valuation - cheap right now?

- Profitability - underrated?

- Fundamental health - robust

- Conclusions - would I buy Shell shares today?

History: seashells to oil wells

Shell's history can be traced back to 1833, when Marcus Samuel expanded his London antiques business to start selling oriental seashells, which were imported from the Far East.

The business pivoted to oil after Samuel's sons took control in 1870 and became interested in opportunities to export oil – specifically, kerosene to Asia.

To solve handling poblems – barrels leaked and were unwieldy – they commissioned a fleet of purpose-designed tankers, including the Murex, which was the first oil tanker to pass through the Suez Canal.

The Shell logo and red branding provided a strong marketing visual to distinguish the company from its main rival at the time, Standard Oil.

The group fast became a leading player in oil refining and trading and was renamed the Shell Transport and Trading Company in 1897. In 1907, a partnership was formed with rival Royal Dutch to form the Royal Dutch Shell Group.

The rest is more or less history – Shell became a major oil and gas producer, one of the world's largest petrochemicals businesses, a major energy trader, and one of the first companies to invest in large-scale LNG.

Today, the group employees over 90,000 people generating turnover of c.$350bn per year.

Shell today: new look?

One of CEO Wael Sawan's first acts was to reorganise his top team, giving a smaller number of top execs broader responsibility. As a result, Shell's business today is divided into just two major commercial divisions:

Integrated Gas and Upstream: this included LNG, gas-to-liquids (GTL) and conventional offshore oil and gas production. This really is the cash cow of the group.

Collectively, these businesses generated adjusted earnings of $33bn last year, 78% of the group total.

Assets in this division have an average breakeven price of $30 per barrel and an average commercial life of more than 20 years. They're expensive to develop, but big and quite cheap to run when they're in production.

Shell's oil production is expected to stabilise at 1.4m barrels per day until c.2030. LNG production – where Shell is already the global market leader thanks – is expected to rise by 20-30% by 2030.

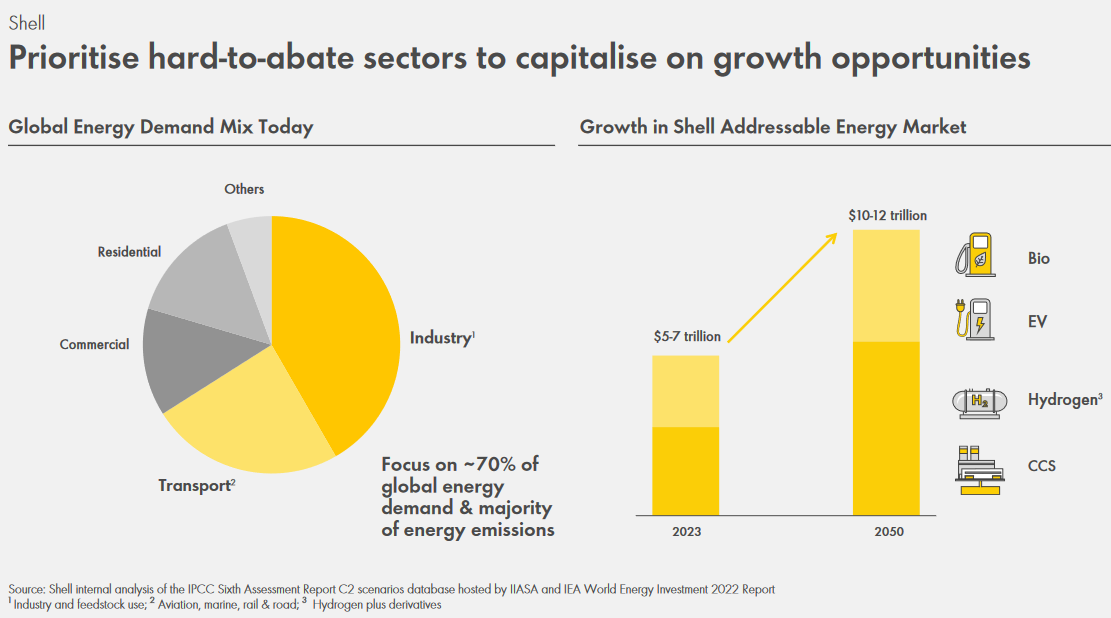

Sawan's strategy is to drive growth by priortising industrial and transport markets. He says these account for 70% of global energy demand and the majority of energy emissions:

I think it's fair to say that the strategy for this part of the business is to meet demand for fossil fuels while it exists.

It's worth remembering that oil and gas projects generally earn higher returns on capital employed than renewables such as wind farms. Commercially, there's not yet much incentive for Shell to try and force customers to decarbonise too quickly.

However, there is more of a focus on abatement and decarbonisation in the other half of the group.

Downstream, renewables and energy solutions: these operations generated $9.2bn of adjusted earnings last year, 22% of the group total.

Shell says that this side of its business is engaged in:

"Profitably decarbonising our customers"

There's some truth in this, but I think there's a fair amount of spin, too.

This division encompasses fuel refineries, chemical plants, filling stations and energy trading – in addition to renewable generation, lower-carbon energy solutions for industrial customers, and EV charging for motorists.

In Shell's financial reporting, these operations are described under slightly different headings. I think they make it easier to understand:

Marketing: Shell serves around 32m customers each day at 46,000 service stations worldwide. The group also serves 1m business customers in 160 countries. This business also includes Shell's lubricants business and its EV charging network.

Marketing is expected to generated adjusted earnings of $4-$5bn by 2025, although it only earned $2.8bn last year.

Chemicals and products: this includes Shell's global network of so-called energy parks – refineries and chemical plants. In addition to producing petrol and diesel, they also produce a wide range of other chemicals used by industrial customers.

I think it's fair to say that demand will remain strong for many of these chemicals, even if transport undergoes widespread electrification.

Renewable and energy solutions: this includes the sale of natural gas and electricity to end users, in addition to electricity generation, hydrogen, and activities aimed at carbon capture or avoidance (including tree planting).

Trading: Like its peers BP, Shell has a large commodity trading business.

Each year, this operation buys and sells quantities of commodities that are far in excess of the group's own production. I would guess that Shell's first-hand insight into both physical production and end-user market conditions may provide the firm with an edge over some rivals.

In terms of reporting, Shell's trading operations are absorbed into the results for its Marketing, Products and Renewables businesses.

Shell (and BP) are pretty cagey about disclosing their trading profits, but they are thought to be substantial, especially in volatile markets.

Climate change and net zero

I admit that I haven't devoted too much energy to considering risks such as stranded assets, climate change litigation, and other potentially existential threats to Shell and its peers.

This isn't because I don't think fossil fuels are causing serious problems. I do. But as an investor, my aim is to look at the situation objectively, in terms of what is happening now and what is likely to follow.

From this perspective, I believe that changes to the global energy system are already underway. I think these changes are likely to accelerate over time and will eventually reach a tipping point, as they have done in the past.

In the meantime, the reality is that the world is still largely powered by fossil fuels. Demand for 100m barrels of oil and over 350bn cubic feet of gas every day isn't going to disappear overnight, regardless of the impact its consumption may be having on the planet.

In my view, Shell has the opportunities and resources it will need to evolve successfully. A prolonged period of mismanagement or strategic misteps could cause problems. But my base assumption is that Shell will remain a viable, large business for the foreseeable future.

Shell: crunching the numbers

Description: an integrated energy company that's one of the world's largest producers of oil, gas and petrochemicals.

| Shell (LON:SHEL) |

Quality Dividend score: 69/100 | Forecast yield: 4.6% |

| Share price: 2,314p | Market cap: £155bn | All data at 16 July 2023 |

Latest accounts: results for the quarter ended 31 March 2023

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain whether I think Shell could be a suitable addition to my quality dividend portfolio .

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Dividend culture: exceptional

My dividend culture score is based on the number of consecutive years that a company has paid dividends. Cuts don't affect the score - this is just about continuity. Does the company have a strong culture of dividend payments?

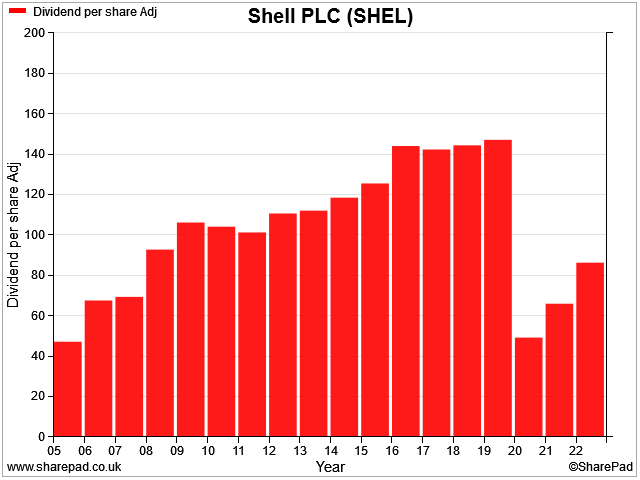

When Shell cut its dividend in 2020, it was widely and reliably reported as the first cut to the firm's payout since World War II.

However, Shell's corporate structure changed in 2005, when the partnership between Royal Dutch Petroleum and Shell Transport and Trading was dissolved to create a unified group, Royal Dutch Shell (now just Shell).

As a result, both SharePad and Stockopedia only have dividend data back to 2005:

I haven't been able to find a reliable record of Shell's pre-2005 dividend payments. As a result, my scoring spreadsheet awards Shell a score of just 3/5 for dividend culture, based on its 18-year available record.

However, I'm confident that Shell shareholders have received annual dividends each year since 1945. So I've taken the rare step of manually adjusted Shell's data in my spreadsheet.

As a result, the firm scores the maximum possible value for dividend culture – the only reasonable result for one of London's oldest dividend payers.

Shell scores 5/5 for dividend culture in my screening system.

Dividend safety: better than it seems?

I score stocks for dividend safety based on the level of earnings and free cash flow cover they generate for their payouts. My score also includes a measure of leverage, to try and highlight firms that should be diverting their surplus cash into debt reduction.

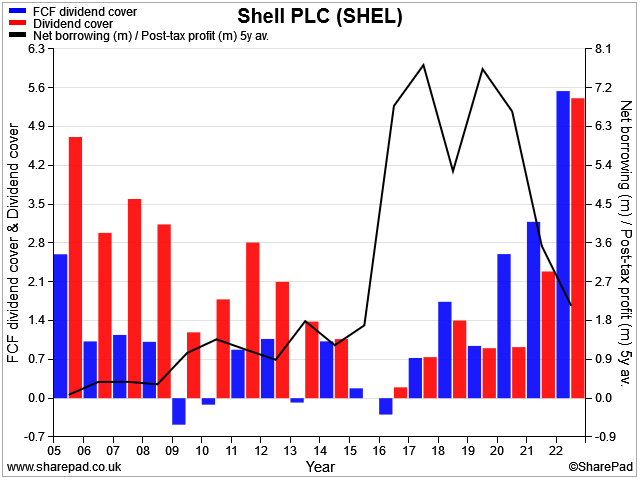

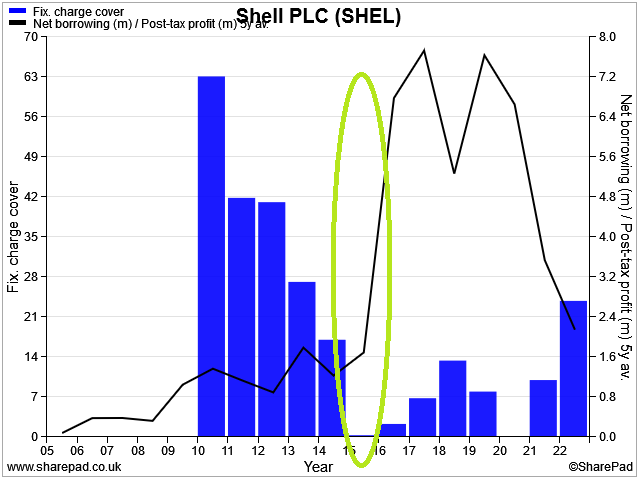

This historic chart shows Shell's historic dividend cover by earnings (red) and free cash flow (blue). The black line traces the group's leverage, using my preferred measure of net debt/5yr average profits.

It's an interesting story, I think. In the run-up to 2008, we can see that Shell was paying out pretty much all of its free cash flow as dividends. But the payout was comfortably covered by earnings and leverage was very low. So no real worries, in my view.

Things went downhill after that though, as Shell's leverage ballooned but its profits and cash flow remained relatively weak:

The rapid rise in Shell's leverage followed the $100+ oil years of 2010-2014. During this time, oil companies' costs and spending commitments surged.

When the boom came to an end in 2014 and oil prices crashed, Shell was left with a bloated cost base and big capex plans that no longer looked quite so attractive.

After taking charge in 2014, former CEO Ben van Beurden engineered a gradual turnaround. This improved Shell's performance and gave rise to a substantial improvement in cash generation.

Even so, when Covid hit in 2020, van Beurden's decision to cut the dividend was correct – and arguably overdue – in my view.

Of course, what Shell might not have predicted was that the pandemic would be followed by the Russian invasion of Ukraine, triggering a new energy price spike.

As a result, Shell's balance sheet has quickly been delevered and the group's cash flow look stronger than it has done for many years.

Analysts' expect Shell's profits to fall steadily over the next couple of years. This could reduce dividend cover to more typical levels.

Even so, I think Shell's dividend looks very safe at the moment.

Shell scores 3.5/5 for dividend safety in my screening system.

Dividend growth: recovering

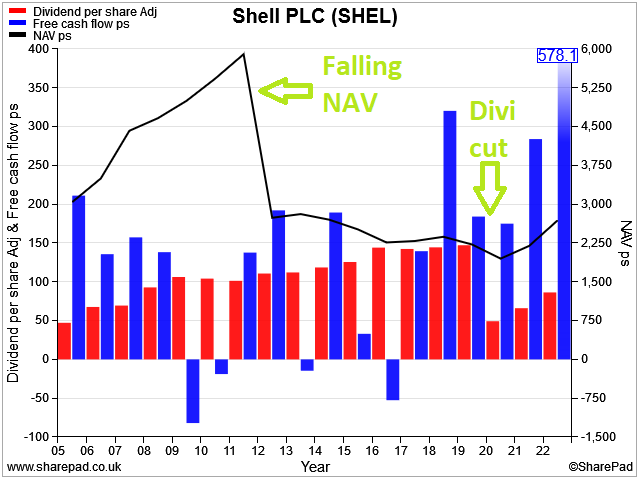

When I score a stock for dividend growth, the main thing I'm looking for is sustainability. I try to gauge this factor by comparing historic dividend growth with growth in free cash flow and net asset value per share.

My focus on free cash flow is fairly self explanatory, I hope. Net asset value (NAV) is perhaps less so, but I've come to believe it's a very useful indicator.

If NAV (or shareholder's equity) is falling, it's likely to mean one of three things, in my experience:

- the value of the company's assets are falling, hence their expected cash generation is probably declining

- debt levels are rising faster than asset values (i.e. leverage is increasing)

- the business is paying dividends that aren't covered by earnings or free cash flow

In the interest of balance, there's one other positive explanation I can think of, too:

- the business has so much surplus cash that it's simply returning it to shareholders (thus reducing net asset value)

If NAV per share is rising, it's more likely to indicate that companies are retaining a portion of their profits each year, while also investing in productive assets and not borrowing too much.

This is the profile I'm looking for in a long-term investment.

Ultimately, I think a rising dividend is unlikely to be sustainable if net asset value is continually falling. At some point, some kind of crunch point will occur. This is what I want to avoid.

Looking at these measures for Shell, we can see that this is exactly what did happen in the post-2008 period. Assets values were written down as oil prices crashed. Debt levels rose, cash flow worsened and – eventually – the dividend was cut:

Since 2020, this pattern has reversed. Dividend growth has been supported by rising free cash flow and an increase in net assets per share. Good news.

Shell's free cash flow cover of five times may seem excessive at the moment; the company could clearly support larger dividends right now. But I think it's right to be cautious.

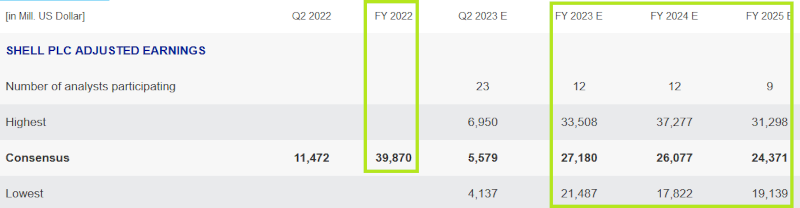

History suggests that profits will return to more normal levels at some point. Broker forecasts point to a 30% drop in profits this year, for example.

Oil prices are already back at around $80, after last year's foray above $100. Gas prices are down, too.

As I mentioned above, there's also the potential for the energy transition to have a growing impact on Shell's business model. I have little doubt that the company will adapt, but it might not be so large or profitable as in the past.

I think this is why Shell has been using so much cash to buy back its shares and repay debt, rather than funding huge dividends. In my view, shrinking the group's capital base in this way when times are good is a logical decision.

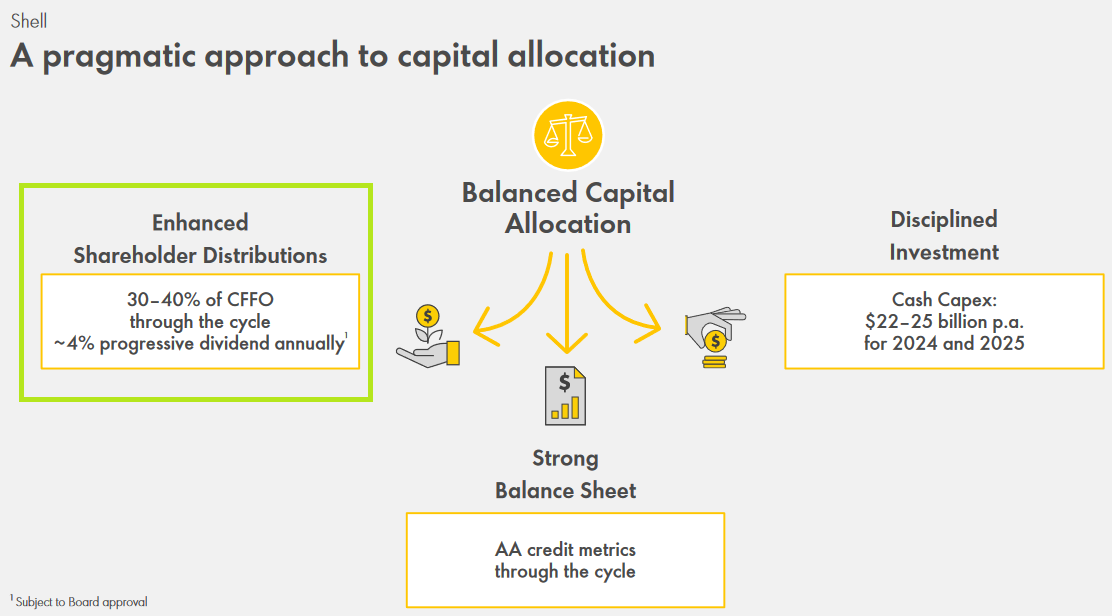

Although dividend growth has exceeded the company's 4% target over the last couple of years, I don't necessarily expect this to continue. The company's guidance remains for 4% growth, with additional shareholder returns as possible:

My dividend growth score reflects Shell's mixed recent history. But I think that post-2020 dividend growth is probably more sustainable than this lowly rating suggests.

Shell scores 1.7/5 for dividend growth in my screening system.

Dividend yield: varied

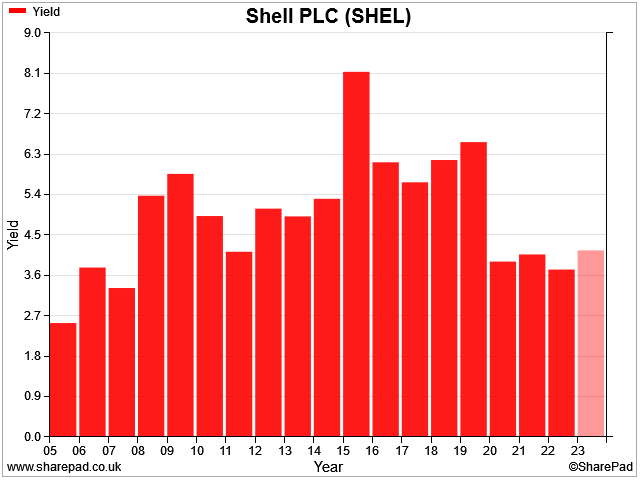

Shell has had a reputation as a high yielder. Over the last 20 years or so, that's been true for most of the time, although there have been some periods when the yield has been more average:

Note: I think SharePad's 2023 forecast is lower than current consensus – by my reckoning the forecast yield is c.4.6% at the time of writing.

When looking at the valuation of this business today, it's tempting to focus on the cheap-looking price/earnings ratio of six.

However, I think the dividend yield gives us a more nuanced idea of the valuation of the business, based on the board's view of likely future profits through the cycle.

Shell scores 3/5 for dividend yield in my screening system.

Valuation: cheap right now?

There's no escaping the fact that Shell looks very cheap based on its recent profits. Of course, I might also argue that this is a typical trait of cyclical businesses when they're close to peak profits.

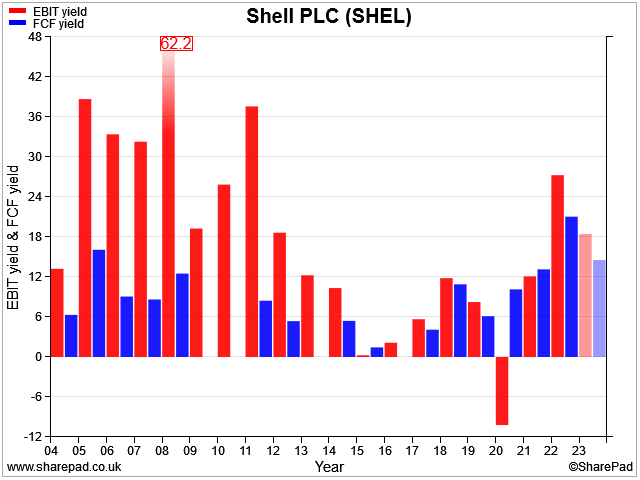

Using my preferred measures of EBIT yield and free cash flow yield, I think Shell looks cheap, but not unprecedentedly so:

Right now, I think it's very tempting to suggest that Shell is cheap and that the old boom-and-bust cycle has been banished. There's also a popular argument that cutbacks to industry capex in recent years will gradually lead to shortages of oil and gas supplies as older fields decline.

Perhaps things will be different this time. Personally, I don't think they will. I think the circumstances of last year were exceptional, but the market has now adjusted.

For my money, energy profits have probably peaked for now. For this reason, I suspect that Shell shares may not be quite as cheap as they seem...

Shell scores 5/5 for valuation in my screening system.

Profitability: underrated?

... but then again, perhaps I'm wrong. Looking at Shell's historic profitability has made me realise that in past decades, this business was consistently more profitable than it's been over the last decade.

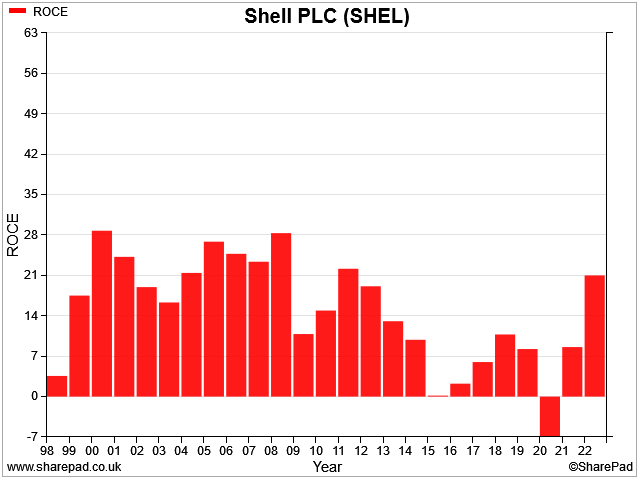

I use return on capital employed as my main measure of profitability for non-financial stocks, rather than operating margin.

Here's how Shell has performed on this measure since 1998:

My scoring system looks at ROCE over the last five years. This is designed to provide a smoothed view of a company's current performance, not its past glories or future potential. On this basis, Shell's profitability looks quite poor.

However, on a longer view, SharePad's data shows that Shell was once a business that generated reliable double-digit annual returns each year.

If Shell can return the business to this level of profitability, then I could be wrong to dismiss the shares at this level. They might be cheap.

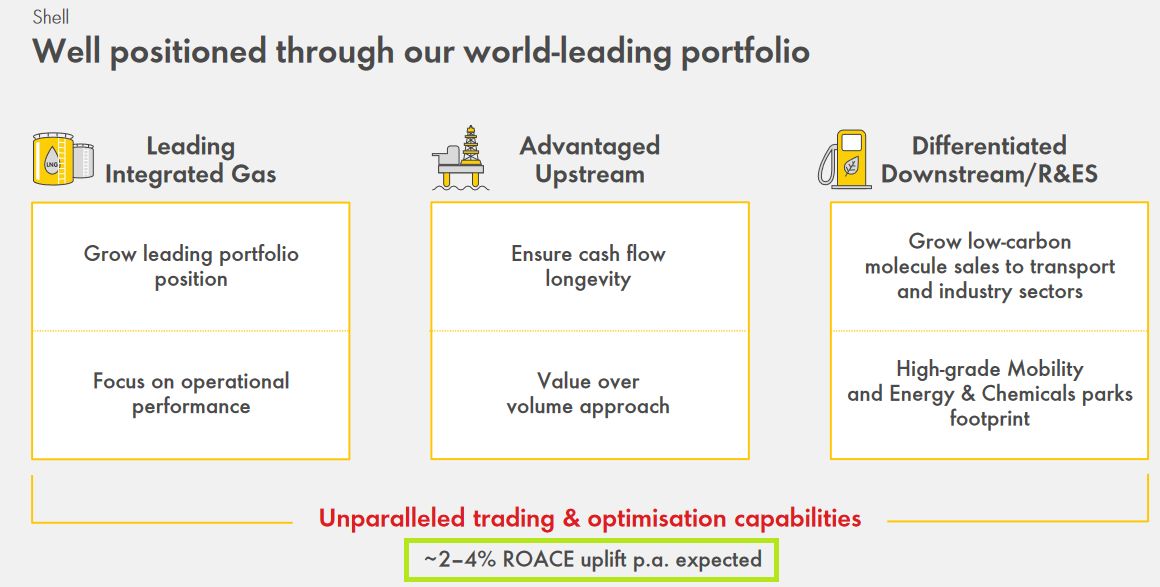

New boss Wael Sawan certainly expects to report improved profitability across the business over the coming years, according to this slide from the group's Capital Markets Day in June:

There are a lot of moving parts in this business. Attempting to forecast profits and ROCE is not easy. But there does seem to be some possibility of a sustained improvement in profitability.

Shell scores 2.2/5 for profitability in my screening system.

Fundamental health: robust

Shell has rapidly cut debt levels over the last two years, significantly strengthening its balance sheet. The company has a solid investment grade credit rating and can borrow money more cheaply than some European countries.

I suspect that something apocalyptic would have to happen for Shell to become financially distressed. But as shareholders have experienced over the last decade, this financial strength doesn't rule out periods of poor returns.

My fundamental health score looks at two simple measures of financial strength:

- fixed charge cover (essentially, operating profit divided by finance costs)

- leverage (which I measure as net debt/5yr average profits)

We've seen Shell's reduction in leverage once already. But by combining it with fixed charge cover, we can see how fixed charge cover collapsed when the firm faced a profit slump at the same time as debt was rising sharply.

This isn't really the kind of profile I look for in a quality dividend stock. But I don't have any concerns about Shell's fundamental health at the moment. I think the business is in good shape.

Shell scores 3.7/5 for fundamental health in my screening system.

Conclusions: should I buy Shell?

My quality dividend system awards Shell an overall score of 69/100 at the time of writing (July 2023).

My view: I think it's possible that I'm missing the bigger picture and that Shell really is going to become a more profitable and highly valued business over the next 5-10 years.

The last decade may just be a glitch in the history of this 190-year-old business.

If CEO Wael Sawan can maintain high-margin oil production and gas growth while maintaining strict discipline on lower-margin activities, the business could become a cash cow that justifies a higher valuation.

Even for a company of Shell's size, regular multi-billion dollar share buybacks are big enough to provide a lift to per-share performance.

On the other hand, I think there are still plenty of reasons to be cautious. The history of the last 30 years shows regular boom and bust cycles in oil prices. I'm not yet convinced this will change.

I could well be wrong, but I'm not convinced this is a great time to buy Shell.

My instincts as a relatively conservative and value-oriented investor are to stay on the sidelines for now and see how market conditions evolve over the next 6-12 months.

As always, please let me know what you think in the comments below. Am I missing the big picture? Would you buy Shell shares today?

Disclosure: At the time of publication, Roland did not own shares in Shell.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.