Should I sell my Direct Line Insurance shares?

Direct Line Insurance (LON:DLG) had a difficult time last year. Roland Head reviews the insurer's 2022 results and flags up his concerns.

In this piece I'm going to review the 2022 annual results from FTSE 250 insurer Direct Line Insurance (LON: DLG) and explain what I've decided to do with this problem stock in my model dividend portfolio.

I'd normally leave this review until my month-end roundup. But with shares in this business now trading below their 2012 IPO level, I think this holding warrants a more in-depth look.

- The story so far

- Dividend score & summary of my concerns

- 2022 financial review

- Dividend update

- DLG 2023 outlook commentary

- My concerns

- My decision

The story so far

To recap briefly, I added Direct Line shares to the model portfolio in late 2021 to benefit (I hoped) from the high dividend yield. My view was that this well-known business was well positioned to benefit from a cyclical uplift, following a tough period for insurers.

At the time, I saw Direct Line as a market-leading business with strong brands and a solid track record of profitability. Unfortunately, things haven't worked out that way.

In 2022, soaring inflation, supply chain problems and a series of "weather events" caused claims costs to soar.

In January 2023, Direct Line issued a major profit warning and cancelled its final dividend for 2022.

Although I think some pressure on profits was inevitable, not all of the company's rivals performed so badly. I think that some of Direct Line's problems could have been avoided with more better management.

Chief executive Penny James left with immediate effect shortly after January's profit warning, and the company is looking for a replacement.

In the meantime, acting chief executive Jon Greenwood fronted the release of the company's results on 13 March. I've now had time to review the numbers and watch the full management presentation.

In the remainder of this piece I'll review Direct Line's 2022 results and explain what I've decided to do with the shares.

Disclosure: Roland owned shares in Direct Line Insurance at the time of publication.

For an explanation of my Quality Dividend score, see here.

Direct Line Insurance Group

Description: A FTSE 250 company that's one of the UK's largest motor, home and commercial insurers. Click here for an archive of past posts.

| Direct Line Insurance (LON: DLG) |

Quality Dividend score: 42/100 | Forecast yield: uncl. |

| Share price: 141p | Market cap: £1.9bn | All data at 24 March 2023 |

RNS release: preliminary results for the year ended 31 December 2022

Direct Line does not appear to be in any danger of going bust. It's also avoided (so far) the need for an equity raise. I think this might now be avoided altogether, although we won't be certain until a new permanent chief executive is appointed.

However, the company's full-year results made it clear that 2022 was a very bad year indeed. It also became more clearly apparent how heavily Direct Line depends on motor insurance to drive profits, despite its diversification into home, commercial, and breakdown cover.

The conclusion I've come to is that a number of company-specific factors made last year's problems worse than they should have been. Unfortunately, I think these issues could continue to affect performance in 2023 – and perhaps beyond.

Should I keep hold of this stock for an eventual recovery, or is it time to cut my losses?

Financial review

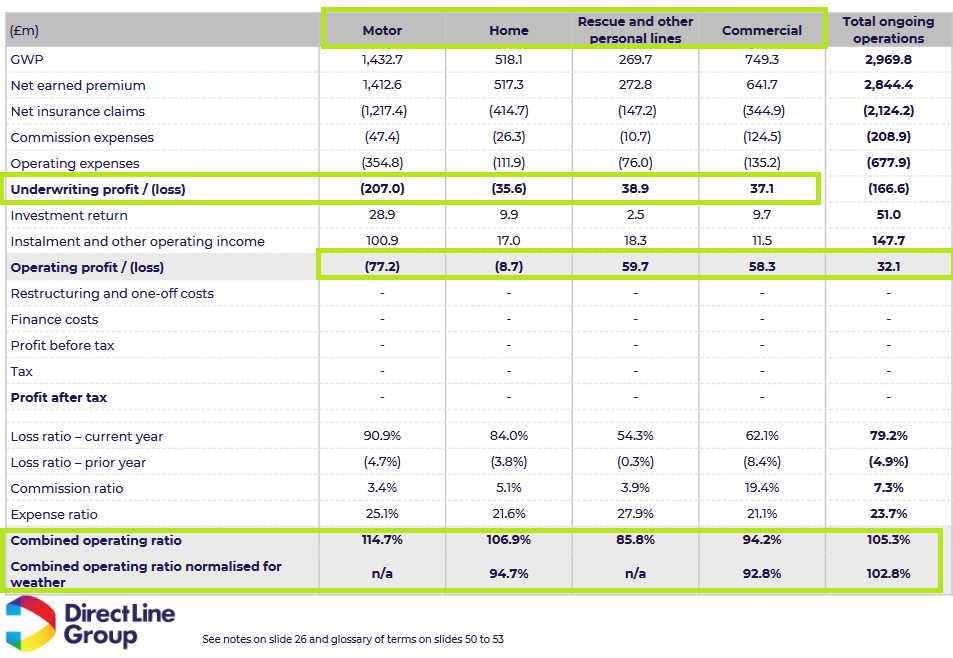

Direct Line's operating profit from continuing operations fell by 95% to £32m (2021: £590m) last year, as soaring claims costs led to underwriting losses in both home and motor insurance.

The situation was worsened by a slump in new business. This led to a fall in policy numbers and a reduction to gross written premium.

- In-force polices (own brands): -3.8% to 7.25m

- Gross written premium (own brands): -5.5% to £2,087m

A mixed bag of restructuring and finance costs added to the damage and the group reported an after-tax loss of £40m.

In addition to underwriting losses, impairments to the value of commercial property and loans held in the company's investment portfolio contributed to a sharp fall in surplus capital:

- Solvency capital ratio: 147% (Dec '21: 160% - adjusted for comparability)

- DLG target range 140% - 180%

It was this decline in the group's surplus capital that forced management to cancel the dividend – Direct Line simply didn't have enough spare cash for a payout.

To understand these results in a little more detail, I've included a segmental breakdown from the results presentation, with additional comment on each operating segment below it.

Combined operating ratio: this insurance industry metric shows insurance claims costs and operating expenses as a percentage of premiums written.

A combined ratio under 100% indicates profitable underwriting, whereas a figure over 100% indicates an underwriting loss. In other words, a figure of 100% means the company has used up all of its premium income and has needed to draw on its own funds to meet costs.

Motor insurance is Direct Line's largest business and contributed the majority of last year's underwriting loss. Let's start there.

Motor: Like all motor insurers, Direct Line faced rampant claims inflation last year. The cost of almost everything went up:

- used car prices

- parts costs

- labour and energy costs

There was a second problem, too – supply chain problems slowed down the repair process, clogging up repair shops with cars awaiting parts. Across the industry, repair times rose by 60%. In Direct Line's own DLG Auto Services business, repair times rose by 30%.

Perhaps more worrying for me was that Direct Line's multi-year IT investment programme did not appear to provide any benefit last year. The company has spent heavily on new systems intended to improve pricing and thus profitability.

In August 2022 we were told:

In Motor we have delivered significant pricing capability during H1 with the launch of our new risk pricing models which are materially more advanced than anything we have had before and critical in navigating a changing market.

Management said these new pricing models had delivered an encouraging early impact:

"an estimated 5 to 7 percentage point improvement in our written loss ratios".

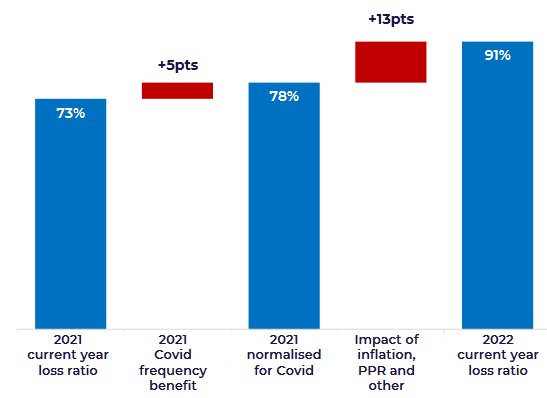

However, the full-year results showed that motor loss ratios worsened by 18% last year.

My suspicion is that Direct Line's IT investment has not worked as well as hoped.

In the 2022 results presentation, interim CEO Jon Greenwood said that the company is now:

"increasing resources deployed to build pricing models and enhance risk model sophistication".

This seems at odds with the company's comments last August, which suggested this work had already been done.

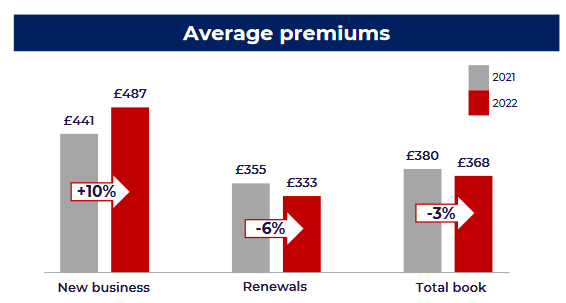

The reality is that Direct Line's pricing and inflation estimates were behind the curve for most of last year. Although new business pricing was increased by 29% over the full year, the majority of this came quite late in the year.

As a result, new business pricing only rose by an average of 10%.

Meanwhile, renewal premiums fell by 6% as Direct Line discounted its prices in an effort to retain customers and protect its market share.

Lower-than-expected volumes of new business meant that the higher premiums paid by new customers did not offset the impact of the fall in renewal premiums.

The overall result was that average motor premiums fell by 3% last year, despite the inflationary environment:

In fairness, it was a tough year for motor insurers. The combination of rapid inflation and regulatory pricing reforms created challenging conditions. But as one of the largest general insurers in the market, I think Direct Line should have managed better than it did.

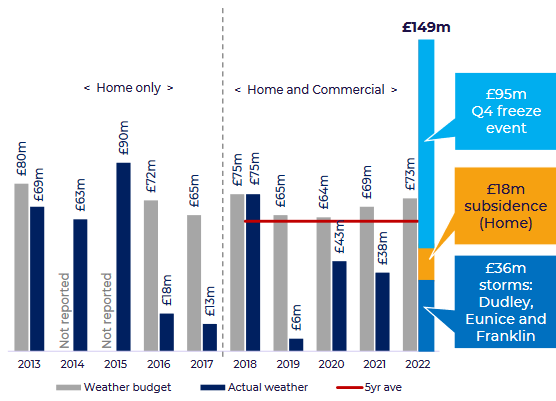

Home: the other loss-making division was Home insurance. Claims costs soared due to a succession of weather events, culminating in December's big freeze.

As a result, the company saw £149m of weather claims from home and commercial customers last year – the highest since its 2013 IPO.

Last year's claims do seem to be exceptional. It's probably unfortunate that this coincided with an exceptional year for motor claims - otherwise the home claims would have been more readily affordable.

Commercial & Rescue: Direct Line's other two business lines performed well enough last year, but they aren't large enough to have been able to offset the losses in motor and home.

Dividend

The 2022 final dividend was cancelled. Shareholders received an interim dividend of 7.6p per share last year, giving the stock a trailing yield of 5.6%.

Direct Line has promised an update on the outlook for dividend payments with its half-year results in August.

2023 outlook

The company's outlook statement for 2023 was brief and did not fill me with confidence. It contained three main points:

2023 earnings: many of last year's motor policies were effectively written too cheaply, at prices below expected claims inflation. This means that profits from motor insurance will remain under pressure in 2023.

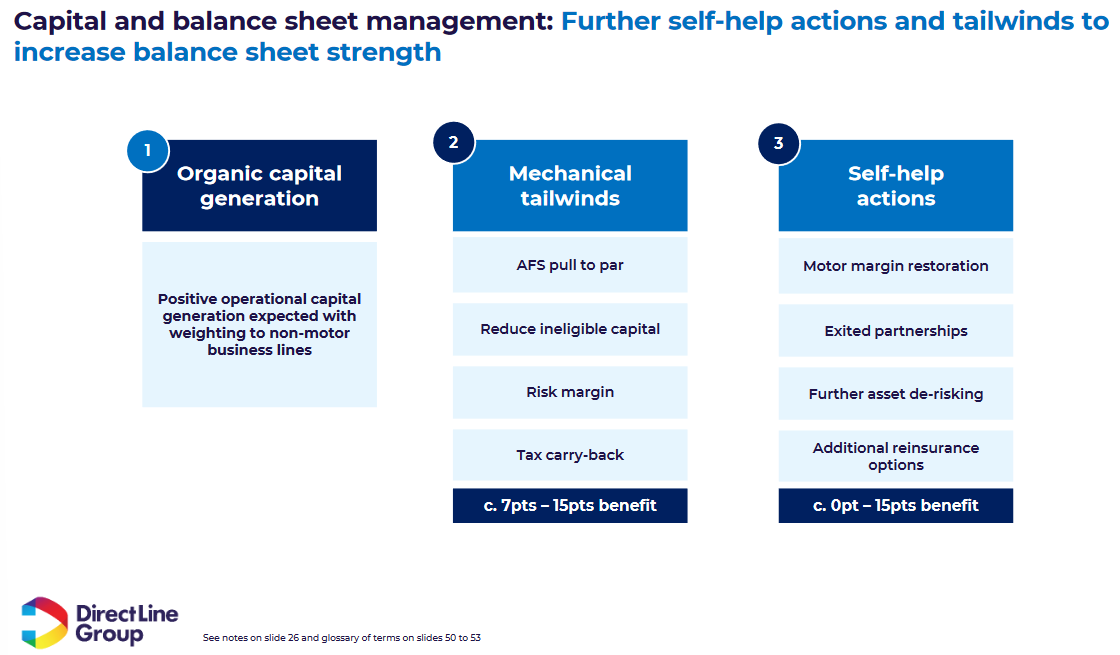

Balance sheet: the company expects to see an improvement in its solvency capital ratio due to management actions and various market effects. The range of guidance given in the presentation suggested a minimum increase of 7% this year, with remaining improvements uncertain:

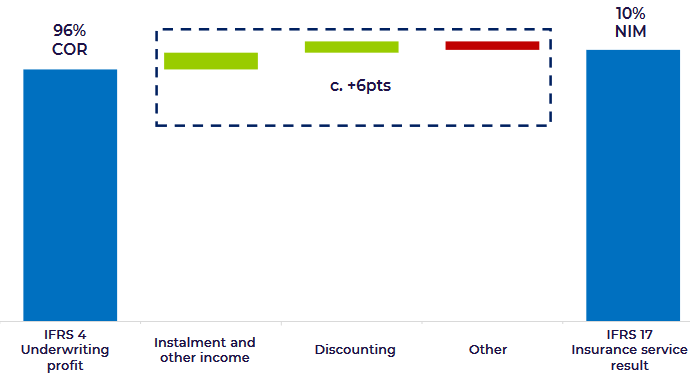

Lower profitability target? this year will see UK insurers switch to a new accounting standard, IFRS 17. This will result in a change in reporting metrics, including the replacement of the combined ratio (COR) with "net insurance margin" (NIM).

The company says it will target a weather-normalised NIM of 10% over the medium-term. In the results presentation, management indicated this was equivalent to a COR of 96%.

A higher NIM value is better, whereas a lower COR is better.

Previous guidance in January was for a medium-term COR target of 95%. This seems to suggest that the NIM target of 10% may be less ambitious than the previous profitability target.

CFO Neil Manser was questioned about this after the results presentation, but didn't give a very clear answer. My impression is that Direct Line's early emphasis on the new metric is possibly being used to gloss over a slight reduction in its profitability target.

My concerns

The company's recovery plans seem sensible enough to me, as far as they go. But I was concerned by some of the comments made during the results presentation – and by some of the topics management seemed keen to avoid.

New business shortfall: It wasn't made clear why new business fell short of expectations last year. I wonder if the explanation may be linked to the fact that (according to Direct Line) 90% of new business in motor insurance is sold through price comparison websites (PCW).

While Direct Line is active in PCW through its Churchill and Darwin brands, PCW is still secondary to the group's direct model. I wonder if the core Direct Line franchise is in danger of losing market share in this market. Management were asked about this in the Q&A, but I felt the answer was slightly evasive.

Target profitability: as I discussed above, my feeling is that profitability targets for the business has been cut since January.

2023 earnings warning: CFO Neil Manser repeatedly emphasised the risk to 2023 earnings from last year's underpriced motor insurance policies. This left me with the impression that there's a meaningful risk that profits could fall below expectations this year.

Pricing model/IT spend: the company is still having to direct extra spending into its new motor pricing models. These appear to have failed to deliver the hoped-for benefits last year. I'm a little concerned that this long-running and expensive project appears to have been unsuccessful, so far at least.

Investment portfolio: Like most insurers. Direct Line invests some of its premiums in bonds and other assets, in the hope of boosting overall returns. However, I wonder if the company may have taken on too much risk in so doing.

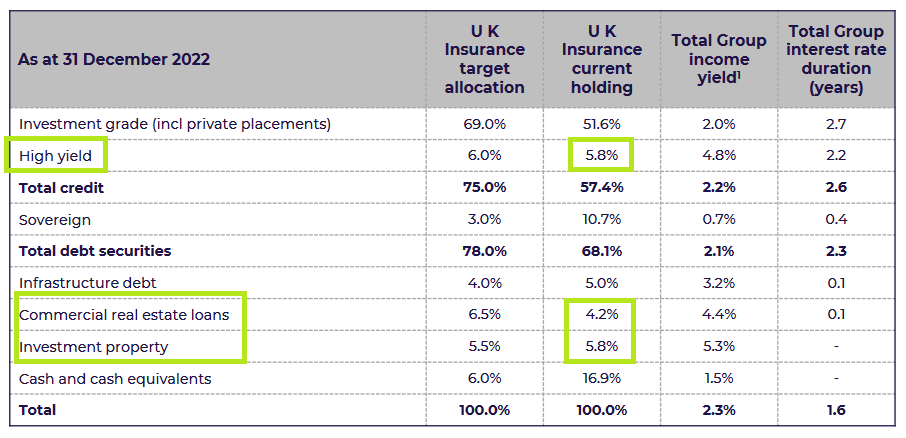

At the end of 2022, the investment portfolio included a 10% weighting to commercial property loans and direct property holdings, as well as 6% in high yield debt (presumably sub-investment grade, also known as junk bonds).

The value of many of these assets fell sharply last year as interest rates rose. As the group's bonds mature and are repaid, there should be some recovery in asset values due to the pull-to-par effect (they are repaid at face value, even if they're trading below face value).

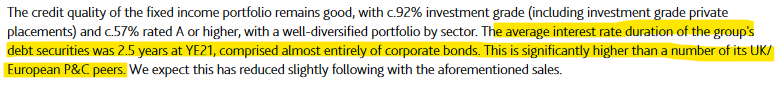

The risk is that interest rates coud rise further or that some of the group's investments could perform badly. I've no way of knowing how likely this is. But according to credit rating agency Moody's, Direct Line's investment portfolio is more exposed to longer-term debt than some of its main peers:

Longer duration can be a disadvantage when interest rates are rising, as asset values tend to fall further to discount the impact of higher rates.

Decision time

I don't think Direct Line is in any danger of becoming financial distressed. But I do think any dividend paid in 2023 is likely to be minimal.

I also think there's a risk that the company's franchise strength could be weakening, and that it might continue to lose market share.

In addition, wider economic conditions may mean that rebuilding a comfortable solvency capital ratio is harder or slower than expected.

On the other hand, I recognise that this business has historically generated attractive mid-teens returns on equity, together with plenty of surplus cash.

Direct Line remains one of the largest motor insurers in the UK and is expected to benefit from a 15% increase in motor premiums when its contract with Motability kicks in later this year.

The group's Commercial business also looks promising to me, although it's more capital intensive than some other types of insurance.

At current levels, Direct Line shares could certainly be cheap. My problem is that I'm not sure whether the company's historic business model is still working as well as it used to.

Holding on for a recovery might make sense, but I've decided to sell.

I'm concerned that more bad news will slip out as the year progresses – or when a new permanent CEO is appointed. On balance, I think there's a material risk that profits will be lower than expected this year.

Although I recognise the turnaround potential on offer, I think there are higher-quality choices elsewhere for dividend income.

I'll be selling Direct Line from the model portfolio in the next week. I'll also sell my own shares at the same time.

I'll confirm the total loss to the portfolio in my month-end report for subscribers and will reveal a new share to replace Direct Line in due course.

Please let me know what you think about Direct Line in the comments below. Am I underestimating the strength of the group's brand franchise?

Disclaimer: This is a personal blog and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.