Portfolio shares: Will my patience pay off at PZ Cussons?

There aren't many family-controlled businesses in the FTSE 250. But consumer goods group PZ Cussons (LON: PZC) will be the second such company I've looked at in two weeks.

(The first was homewares retailer Dunelm – check out that piece here if you missed it.)

This business can trace its roots back 135 years to Sierra Leone, where founders George Paterson and George Zochonis (PZ) began trading commodities with the UK.

In 1975 PZ acquired Cussons, creating the current business. Today the company operates in four main markets; the UK, Nigeria, Indonesia and Australia. Key brands include Imperial Leather, Carex, Cussons and Original Source.

The Zochonis family remain dominant shareholders and control approximately 30% of the stock, although a good chunk of this is held by the Zochonis Charitable Trust. According to the company, around 13% of PZ Cussons dividends go to the Trust each year.

In a similar vein, PZ Cussons is working to become a B-Corp, underwriting its commitment to sustainable principles.

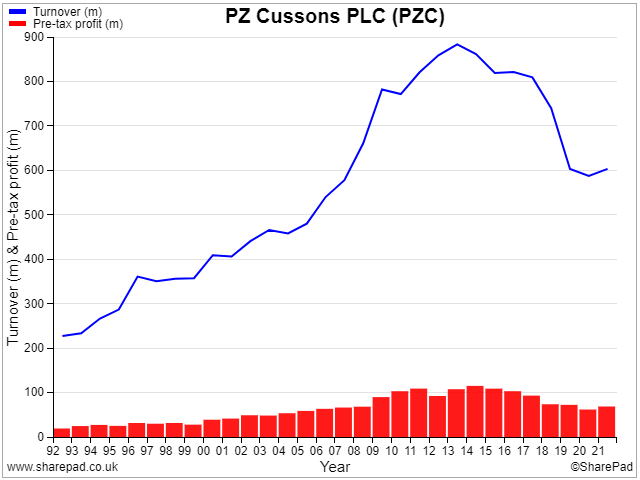

Unfortunately, PZ Cussons has not enjoyed the same run of success as Dunelm in recent years. Both sales and profits have fallen steadily since 2014, reversing a two-decade run of growth:

This venerable business has faced a range of problems over the last five years. These have included allegations of financial misconduct by a former chief executive, slowing sales in Nigeria and a lack of strategic focus that's led to a general decline.

Fortunately, newish chief executive Jonathan Myers is making good progress resolving these problems, in my view. Since taking charge in March 2020 he's refocused the business on a core portfolio of 'Must Win' brands in hygiene, baby and beauty segments, and has disposed of various non-core assets.

My impression is that the focus and performance of the business is already visibly improved. But this progress has yet to be reflected in the company's share price, which is still dominated by the impact of the pandemic: