Dividend notes: 8% yield, industrial headwinds - AV, RS1

Strong updates from two companies but one appears to face an uncertain near-term outlook. I review the latest numbers from Aviva and RS Group.

Welcome back to my dividend notes. In this update I'm looking at an unloved high yielder and an industrial business that performed very well last year but might be facing a slump in demand.

Companies covered:

- Aviva (LON:AV.) - a solid first-quarter update didn't generate much enthusiasm in the market, but I'm struggling to see any serious concerns. The 8% yield on offer here looks good value and fairly safe to me.

- RS Group (LON:RS1) - weak industrial markets could put a drag on earnings this year. But a strong set of FY23 numbers suggests to me that this stock could be worth watching as a possible long-term buying opportunity.

This is a review of the latest results from UK dividend shares that are in my investable universe and may appear in my screening results.

Dividend notes is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

Aviva (AV.)

"On track to meet or exceed Group targets"

FTSE 100 insurer Aviva just doesn't seem to get much love from UK investors. Despite chief executive Amanda Blanc delivering a successful turnaround and some attractive shareholder returns, the shares have remained stubbornly cheap, in my opinion.

I last reviewed this stock in January and concluded that it looked well run and potentially cheap. Has anything changed since then?

Wednesday's first-quarter update saw the shares fall 5% but did not contain any bad news, as far as I could see.

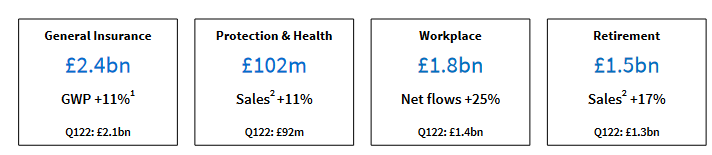

Trading highlights: The group reported a positive performance across all of its decisions:

Areas of strong growth highlighted in the commentary included bulk annuities, workplace pensions and private healthcare.

In general insurance, gross written premiums were up 11% at constant currency with a combined operating ratio of 94.5%. That sounds healthy enough to me, given inflationary pressures on claims costs. It's certainly a stronger performance than at my former holding Direct Line.

Financial summary: Aviva's balance sheet continues to look well supported, with a Solvency II cover ratio of 196% (FY22: 212%) and centre liquidity of £2.1bn (Feb '23: £2.2bn).

In both cases the reduction so far this year relates to dividend payments and buybacks. I don't see anything to be concerned about.

One area of concern for life insurance companies has been the falling value of long-dated bonds and commercial property.

Aviva says its bond portfolio is "performing well", with less than £20m of bond assets downgraded out of a portfolio valued at £20.8bn. No corporate bonds have been downgraded below investment grade.

In commercial property, the company says its mortgage portfolio has an average loan-to-value ratio of 54% based on the nominal value of the loan.

Outlook: the company is on track to meet its £750m cost saving target by 2024 and management expect to beat its guidance for cash remittance of £5.4bn between 2022 and 2024.

Dividend guidance for 2023 is £915m, suggesting a payout of 33p per share. That's equivalent to a yield of 8.3% at a share price of 400p.

My sums suggest the group could generate a return on equity of perhaps 12% this year. Not the best in the sector, but perfectly acceptable in my view.

My view: As I discussed in my in-depth review in January, Aviva shares continue to rank well in my dividend screening system. At present they boast a dividend quality score of 70/100.

It's possible that I'm underestimating the risks to Aviva's future profits from a slowing economy or the transition to higher interest rates. It's also true that Aviva lacks the consistent long-term record of some rivals.

But for my money, Aviva shares looks good value and could be an attractive choice for a high-yield income. I'd certainly consider owning the stock, I if I didn't already own shares in a direct rival.

RS Group (RS1)

"we are comfortable with current consensus profit expectations for 2023/24, albeit with performance more weighted to the second half."

This FTSE 100 company was previously known as Electrocomponents.

Electronics buffs may recognise the RS Components branding as one of the group's best-known operating businesses.

Once known as Radio Spares, today this group is a major distributor of electronic components in markets all around the world.

RS has often looked expensive to me, but I've often admired its strong quality metrics and cash generation. The shares are now down by nealy 40% from their pandemic highs and are starting to look more reasonably priced to me.

RS has also risen to become one of the highest-ranked shares in my quality dividend screen, with a score of 75/100.

This week the group published its final results for the year ended 31 March 2023 – the first set of numbers under brand-new chief executive Simon Pryce.

Financial highlights: the group's broad geographic reach and good stock availability helped to drive a strong performance last year. Margins were well supported, despite cost inflation and supply chain challenges.

Revenue for the year rose by 17%, or 10% on a like-forlike basis, excluding acquisitions (2%) and currency benefits (5%).

Operating profit for the year was 24% higher, at £383m (+17% LFL). Earnings for the year rose by 24% to 60.4p per share, while the dividend was lifted 16% to 20.9p per share.

Net debt was minimal at £113m, while cash generation and profitability remained strong. I've calculated the following numbers from the firm's accounts:

- Free cash flow exc. acquisitions: £241.7m

- Free cash flow conversion from net profit: 85%

- Free cash flow margin: 8.1%

- Operating margin: 12.8%

- Return on capital employed: 24.9%

Record stock levels could pose some risk: Free cash flow was held back by continued investment in inventory last year.

Inventories ended the period at a record £616m. This investment helped the company provide a good service to its customers last year, but it could pose some risk if industrial demand slows this year.

RS says it is actively managing its working capital position and will be restricting investment in inventory to products "which we know, from utilising data from our customers' website searches, will sell quickly".

I'd hope to see some evidence of inventory levels falling in the half-year numbers.

Outlook: the company says it is continuing to outperform in the industrial market, especially in EMEA. However, trading during the first weeks of the 23/24 financial year has reflected "a slowing in industrial growth" and "continued weakness and aggressive competition in electronics".

The company remains comfortable with consensus forecasts for 2023/24, but warns that performance will be "more weighted to the second half".

Helpfully, RS includes consensus estimates in its results, specifying revenue of £3,116m, adjusted operating profit of £390m and adjusted pre-tax profit of £379m.

In addition, the company's website specifies FY24 consensus forecast earnings of 59.6p per share. That prices the stock on 13.2 times forward earnings, with a possible dividend yield of c.2.7% by my estimate.

My view: based on last year's results, RS shares trade with a trailing free cash flow yield of 6.5% and an EBIT/EV yield of 10%.

I think this valuation could be attractive if a similar level of performance can be achieved this year.

However, a second-half profit weighting is very often an early warning sign that expectations could fall. The company's comments on slowing industrial demand seem to support this view.

I'm encouraged by these results and the group's high-quality financials. I think RS shares could be reasonably priced at current levels.

However, with elevated inventories and an uncertain outlook, I'm not sure there's any rush to invest.

The shares are now on my watch list. I may look into them in more depth over the coming weeks and months.

Disclosure: Roland owns General Accident preference shares (General Accident is a subsidiary of Aviva).

Disclaimer: This is a personal blog and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.