Dividend notes: big cap roundup - BP, GSK, NXT (01/11/23)

I review third-quarter updates from FTSE 100 dividend shares BP, GSK and Next.

Three big FTSE 100 dividend stocks have issued their third-quarter updates this week.

Two companies included upgrades to guidance, while one big name missed forecasts. I've been taking a look.

Companies covered:

- BP (LON:BP.) - the FTSE 100 energy giant's third-quarter numbers missed City expectations, but performance and cash flow looks pretty solid to me. I think BP shares may offer value if improved profitability can be sustained.

- GSK (LON:GSK) - another upgrade to 2023 guidance plus a strong showing from the pharma group's vaccine division suggest to me that value may be emerging here.

- Next (LON:NXT) - another profit upgrade from this well-run retailer, but I think the good news is probably already in the price.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

BP (BP.)

"Further $1.5bn share buyback announced"

BP's third-quarter numbers came in slightly below expectations, as more stable gas markets resulted in a sharp reduction in profits from the group's gas trading business.

This result triggered a sell-off that continued the slump seen over the last couple of weeks:

I don't see too much to worry about in BP's Q3 numbers, but I think they do highlight a return to normal after the exceptionally profits of the last 18 months.

Q3 highlights: BP reported an underlying profit of $3.3bn for the third quarter, 60% below the $8.2bn reported during the same period in 2022. Oil and gas production were both broadly stable during the period, but income from gas trading fell sharply due to more normal market conditions.

Underlying profit for the first nine months of the year was $10.9bn, 53% below the $22.9bn generated last year.

These are big falls, but last year's profits were exceptional. This year's numbers still look relatively high to me, in a historical context.

Cash generation has also fallen. Although Q3 cash flow was only down by 10% compared to Q3 last year, BP's measure of surplus cash flow for the year-to-date was down by over 60% to $5.1bn (9M 2022: $14.1bn).

Dividend: the quarterly payout was left unchanged at 7.27 cents per share, in line with consensus estimates for a payout of 28.1 cents per share this year. That gives BP shares a prospective yield of 4.7% at a share price of 493p.

The payout is expected to be covered around three times by earnings and free cash flow this year and looks very safe to me.

Share buyback: a further $1.5bn share buyback has been announced, adding to the $6.6bn of shares already repurchased this year.

BP's sharecount has fallen from 20.3bn in 2021 to around 18.8bn today. Buybacks on this scale should provide some support for future earnings per share, even in less favourable environments.

Outlook: BP expects oil prices to remain firm in the final part of the year, due to OPEC+ production cuts and rebounding demand.

The company says that LNG prices could be more volatile, depending on the weather and on demand in Europe and China.

Production is expected to be broadly flat versus Q3.

Consensus estimates appear to be largely unchanged, suggesting BP will report earnings of $0.92 per share this year, compared to a figure of $1.45 per share last year.

These estimates give BP shares a forecast P/E of around 6.5.

My view

As far as I can see, BP is performing well and benefiting from robust demand in most major markets, especially for oil.

The group's low-carbon energy strategy is continuing to unfold and develop.

Net debt has fallen to $22bn and does not look a serious concern to me, although given the impact of higher interest rates I might prefer to see more emphasis on debt reduction than buybacks.

Broker forecasts suggest free cash flow could range between c.$14bn and $16bn between now and 2025. Taking $15bn as a mid-point gives the shares a free cash flow yield of about 14%, which appears to be good value.

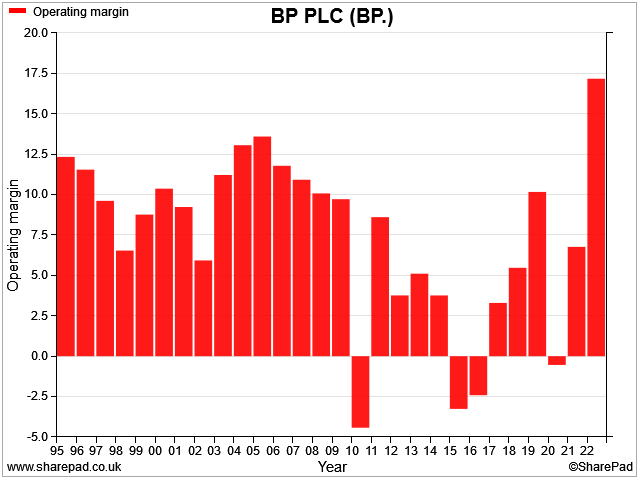

My concern is that these estimates seem to be based on a view that BP will maintain double-digit operating margins over the coming years. This may be possible, but BP has struggled to achieve this consistently over the last 30 years:

Oil and gas has always been cyclical, even without the periodic company-specific problems BP has suffered.

I am not yet convinced that the future will be different to the past, so I'd be looking for a lower valuation to buy BP shares.

GSK (GSK)

"Strong year-to-date and Q3 performance drives upgrade to full-year guidance"

Another quarter, another upgrade from GSK. I last looked at this FTSE 100 pharma group in July, when the company tweaked its guidance higher for the year.

The third-quarter results included another useful upgrade to guidance, alongside what appear to be solid operational results. Let's take a look.

Q3 highlights: GSK says that its third-quarter sales rose by 10% to £8,140m, at constant exchange rates.

Operating profit for the quarter rose by 64% to £1,949m, or by 6% to £2,772m on an adjusted basis.

The increase was driven by vaccine sales, which rose by 33% to £3,218m. This increase was mostly driven by GSK's shingles vaccine (+15%) and a £709m contribution from the US launch of Arexvy, which is the world's first RSV vaccine.

Like its peer AstraZeneca, GSK's profit adjustments are lengthy and complex. I prefer to focus on free cash flow, as this is the ultimate driver of R&D, dividends, and debt service capability.

My sums suggest free cash flow of £2,540m for the first nine months of the year, compared to a figure of £3,426m for the same period last year. However, GSK received a $1.25bn settlment from US pharma firm Gilead last year, so stripping this out suggests a more neutral picture.

This year also saw an increase in working capital, which appears to relate to stock build in vaccines in anticipation of continued strong demand.

Broker forecasts suggest free cash flow of £5,400m this year, which seems to be consistent with my nine-month calculation. This estimate prices GSK shares on a free cash flow yield of 9.1%, or 7.3% including debt. Both valuations look reasonable to me.

Updated 2023 guidance: continued strong trading was supported by the Arexvy launch and CEO Emma Walmsley has issued updated 2023 guidance that suggests both profits and margins will be stronger than previously expected:

- Turnover up by 12%-13% (previously 8%-10%)

- Adjusted operating profit growth of 13%-15% (previously 11%-13%)

- Adjusted earnings per share growth of 17%-20% (previously 14%-17%)

- Full-year dividend guidance unchanged at 56.5p per share

Outlook: Ms Walmsley says GSK has "clear momentum" and that the group's longer-term outlook also "continues to strengthen".

I don't have access to updated broker forecasts for GSK, but my sums suggest this guidance leaves the stock trading on something like 9.5x forecast earnings, with a 4% dividend yield.

My view

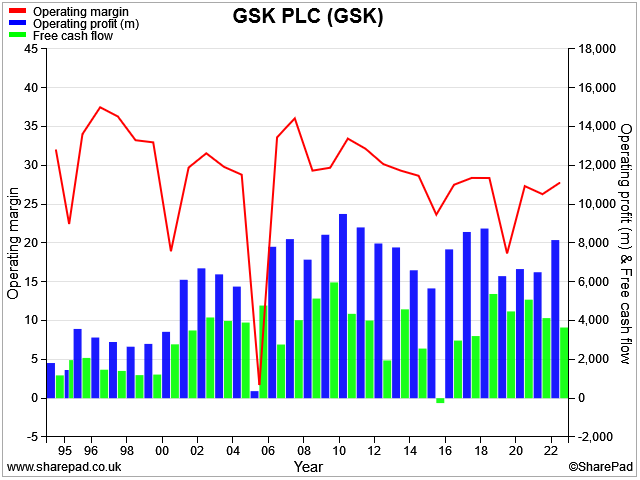

GSK has a somewhat different problem to BP. Unlike the oil giant, GSK has always been a high margin business. But as I've discussed previously, this business has struggled to grow over the last 15 years or so, with operating profit and free cash flow both rangebound since 2008:

This lack of growth – and the perennial patent cliff/innovation challenge faced by pharmaceutical firms – is the main reason why I don't own these shares.

I'm not sure yet whether GSK has broken this streak of stagnating growth, but on balance I'm gaining confidence and will continue to watch with interest.

Next (NXT)

"We are increasing our full year guidance for profit before tax"

Retailer Next's third-quarter trading statement included the company's fourth profit upgrade in six months. (See my previous coverage here.)

The company said that full price sales rose by 4% between August and October, ahead of the company's previous guidance for an increase of 2%.

As a result, Next has increased its pre-tax profit guidance for the current year by £10m to £885m.

The company says that stronger demand during the third quarter added £10m to profits during this period. This appears to mean that the outlook for the final quarter of the year is effectively unchanged. Management say they believe colder weather in October helped to lift sales.

As long as Q4 is not worse than expected, Next's forecasts should be reliable, I think. If Q4 is better than expected – which seems possible to me – then a further upgrade may be needed in January's Christmas trading statement.

My view

I think Next is a good quality and well-run business, but the underlying growth rate has been fairly pedestrian in recent years. The share price has also been rangebound for most of the last 10 years.

Although I have confidence in the company's ability to manage its store estate and develop its online offering, I think the shares look up with events on c.13x forecast earnings. I would prefer to buy Next shares during one of their periodic sell offs.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.