The Dividend Note - emerging opportunities? AZN, IOM, CHH (12/04/24)

I consider AstraZeneca's surprise dividend increase and review this week's updates from AIM dividend shares Iomart and Churchill China.

Welcome back to The Dividend Note, my weekly review of news and updates from UK dividend shares. I'm back after a week's hiatus for the Easter break and an exceptionally quiet week for corporate results here in the UK.

FTSE 100 pharmaceutical giant AstraZeneca has been in the news this week after announcing a 7% dividend increase for 2024 in a surprise standalone RNS update. Perhaps by chance, this news was issued just ahead of Thursday's shareholder vote on whether to increase CEO Pascal Soriot's pay by £1.8m to £18.7m this year.

Mr Soriot is apparently "massively underpaid", according to one shareholder (£), although this FT comparison (£) suggests that he's only really outpaid by the bosses of Eli Lilly and AbbVie. Mr Soriot's remuneration appears to have been similar to or greater than all the other big pharma CEOs last year.

I tend not to lose sleep about boardroom remuneration at big caps. Although it often seems excessive, it's generally pretty insignificant relative to profits. This isn't always true at some small caps, where I generally look for stronger management alignment with shareholder interests.

From a shareholder perspective, Soriot's time at AstraZeneca has certainly delivered results. The share price has risen by around 280% since he took charge in October 2012. Including dividends, shareholders have received a total return of around 360%, or around 11% annualised:

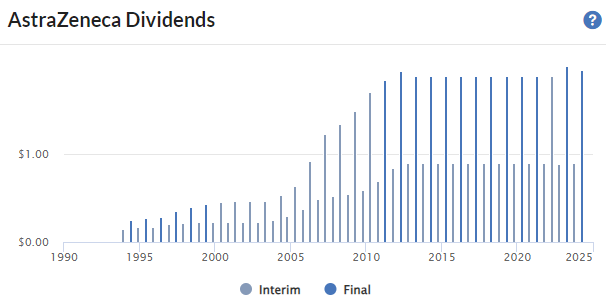

AstraZeneca has not cut its dividend for 30 years, as far as I can see, but the shareholder return has been pretty much flat for most of the last decade. The current payout offers a yield of just 2.3%, so an increase is likely to be popular with shareholders.

I commented on AstraZeneca's results here and found that last year's dividend was not quite covered by free cash flow, at least not by my calculations.

However, consensus estimates on SharePad suggest free cash flow could strengthen markedly over the next couple of years, so perhaps there might be an opportunity here for a return to sustainable dividend growth.

I'm not really sure – pharmaceuticals are a little outside my comfort zone, as I struggle to understand their growth prospects. As things stand, I would personally probably be more interested in GSK at the moment, as I discussed in February.

In the remainder of this note, I've taken a look at updates from two small-cap UK dividends shares that issued updates – and in one case a possible profit warning – last week.

Both companies are on my radar as businesses I'd like to learn more about and might consider owning at some point.

Companies covered:

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- Churchill China (LON:CHH) - a solid set of results show the benefit of a strong balance sheet and experienced management. While volumes fell by 12% last year, revenue was flat and profits rose. The valuation looks reasonable to me and Churchill stays on my watch list.

- Iomart (LON:IOM) - this week's full-year trading update looks like a profit warning to me, but I do think an opportunity may be emerging here. I'm looking forward to seeing the full-year results when I plan a more detailed assessment of the situation.

Churchill China (CHH)

"Improved profitability"

Results for the year ended 31 December 2023 / Mkt cap: £126m

FY24 forecast dividend yield: 3.3%

This 200-year old pottery business is one a UK market leader in supplying crockery to the catering trade.

It's had a tough time since the pandemic. Reopening was followed by a period of surging costs and recruitment problems that affected the company directly, but also had a big impact on its customers in the hospitality trade:

"Our end customer, the hospitality market, has been undergoing major upheaval, with significant input cost increases in labour, energy and food, leading to a reduction in capital expenditure by the major pub and restaurant groups."

However, my reading of this week's results – which I discuss below – suggests that good quality products, experienced management and a solid balance sheet have enabled Churchill to emerge from a difficult period in decent shape.

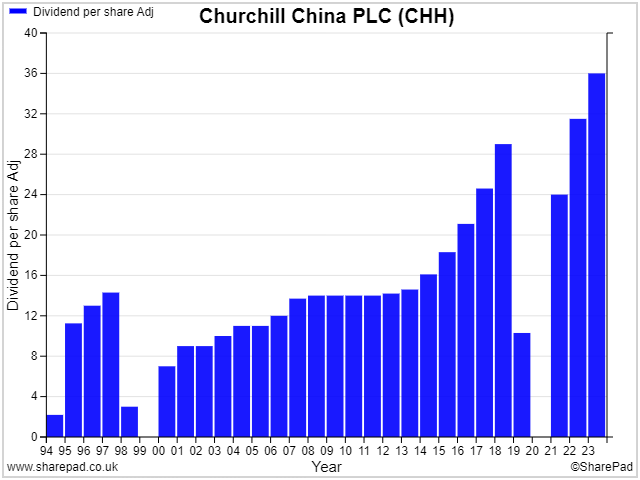

Churchill's (almost) unbroken 30-year dividend record has also caught my eye. I'm starting to wonder if this company might be a useful addition to my dividend portfolio.

2023 final results: Churchill says it achieved "flat revenues in a challenging environment" last year, with revenue down just 0.2% to £82.3m. However, sales volumes fell by 12%, reflecting the slowdown in UK hospitality.

Fortunately, "strong improvement in yields and productivity" helped to support a 12.4% increase in pre-tax profit to £10.8m. Adjusted earnings were 4.9% higher at 70.2p.

The company says this improvement in profitability was achieved by reducing use of expensive and less-skilled agency staff in its factories. This cut wastage and improved output.

To give an idea of the scale of the shift, the number of staff working in the factory fell by 136 last year, even though Churchill's full-time headcount increased.

Alongside this, the company has now completed the price rises needed to pass cost inflation through to its customers.

Churchill's 2023 results show an operating margin of 12.5% (FY22: 11.7%) and a return on capital employed of 15.5% (FY22: 15.7%), which seem respectable to me.

Net cash from operating activities doubled to £8.5m, but increased inventories and capex meant that cash free cash flow for the year was unusually weak at £2.8m, or just 36% of operating profit.

Fortunately, Churchill can afford to invest to meet future demand. The company had no bank debt and net cash of £13.9m at the end of 2023, (FY22: £14.7m), equivalent to around 10% of the market cap.

Dividend: Churchill's payout has rapidly been rebuilt since the pandemic and rose by 14.3% to a new high of 36p last year, giving a trailing yield of 3.2%.

Outlook: Churchill delivered a credible improvement in profits and margins last year, despite a sharp reduction in volumes.

Volumes are expected to remain soft in the first half of 2024, with Q1 demand said to have been "as expected".

However, management believes the company will be in a strong position to take advantage of a market recovery, which is expected to start in the second half of 2024.

Consensus forecasts suggest earnings could rise by 13% to 79.6p per share this year, before levelling out somewhat in 2025.

Dividend growth is expected to return to a more normal level of c.5% per year.

These estimates price Churchill on around 14 times FY24 forecast earnings, with a 3.3% yield. That seems reasonable value to me, if not absolutely cheap.

My view

Watching UK-listed companies negotiate the last few years has convinced me further of the benefits of long-term management paired with a strong balance sheet.

Companies with these benefit have both the skills and the resources they need to adapt to unexpected headwinds, while still investing in order to maintain or extend their competitive position.

Perhaps not coincidentally, Churchill still has significant family ownership and board representation by the Roper family, who have been involved in the business since 1922.

Although the shares have often looked expensive to me in the past, they look more reasonably priced to me today.

Last year's results give an EBIT/EV yield of 9.1% and I'm encouraged by the 15% return on capital employed.

Perhaps one concern is that the UK hospitality sector will take a little longer to recover than expected. This might delay the recovery in volumes that I suspect may be needed to support any further improvement in margins.

On balance though, I can see plenty to like here. Churchill will stay on my watch list.

Iomart (IOM)

"Recurring revenue remains high, at c.91% (FY23: 92%) of Group revenue."

Pre-close trading update y/e 31 March 2024 / Mkt cap: £153m

FY24 forecast dividend yield: 3.9%

Iomart owns 12 data centres around the UK and a provides a range of IT and hosting services to its (mostly) corporate clients.

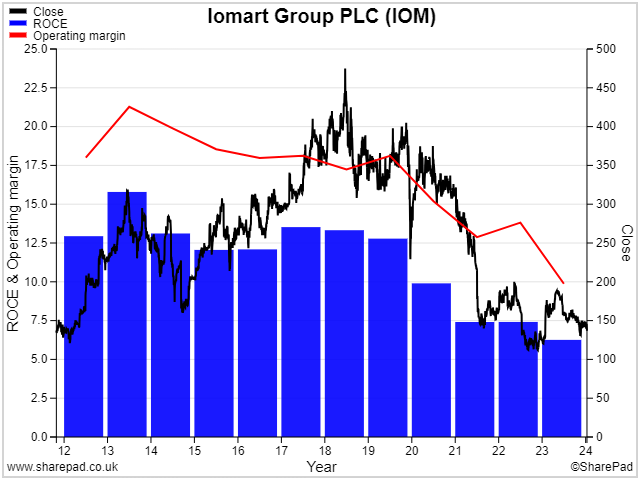

This business has been listed in London since 2000, but has struggled somewhat in recent years. Profitability has been in decline, and the share price is now back at levels first seen a decade ago:

Despite this weakness, I've started to pay closer attention to this business recently. I think Iomart could be approaching an inflection point, where the stock offers an attractive combination of value, improving quality and growth.

With over 90% recurring revenue and a dividend yield approaching 4%, this is a business I could imagine owning in the right circumstances.

Unfortunately, this week's full-year trading update looks like it may have been a profit warning. Let's take a look.

Pre-close update: Here's a summary of the results Iomart expects to report for the year ended 31 March 2024:

- Revenue +10% to £127.0m

- Adjusted EBITDA +4% to c.£37.5m

- Adjusted pre-tax profit broadly flat at c.£15.0m (FY23: £14.8m)

- Recurring revenue at c.91% of group revenue (FY23: 92%)

- The company says interest expense rose to £4.3m last year (FY23: £2.9m), contributing to the margin weakness indicated above

No direct mention is made of whether these results are in line with expectations, but the company does include a set of sell-side analyst estimates in the footnotes:

- Revenue of £128m-£131m

- Adjusted EBITDA of £37.4m-£38.7m

- Adjusted pre-tax profit of £14.3m-£16m.

Based on these estimates, my feeling is that results for the year just ended were a slight miss.

A note from broker Cavendish available on Research Tree supports this view. Cavendish analysts have cut their earnings per share forecasts by 6% to 10.5p for FY24, and by 23% to 10.6p for FY25.

Trading commentary: Newish CEO Lucy Dimes says that the company's acquisition strategy is continuing to expand Iomart's capabilities.

Acquisitions last year added additional Microsoft capabilities (Extrinsica, June 2023) and deepened Iomart's footprint in the legal sector (Accesspoint Technologies, Dec 2023).

Customers are also said to be responding well to the company's focus on managed services, with "good growth in order bookings" from existing customers and prospects.

However, Dimes notes that some smaller customers are not renewing, which resulted in H2 renewal rates that were lower than expected.

According to Iomart, these smaller customers have proved to be more sensitive to price rises pushed through at the end of last year to reflect higher energy prices.

I'm not sure if this means the company is deliberately pricing out lower-value customers in order to focus on larger customers, or if Iomart's more small-scale service offerings have become less competitive.

However, given that IT is pretty much a non-negotiable requirement for most companies, I assume that these smaller customers are now finding cheaper ways to meet their hosting requirements elsewhere.

My own experience is that the market for small-business hosting and IT services is very competitive, and is dominated by a handful of large players. I can imagine that Iomart might struggle to compete on price in this market.

Focusing on customers who are willing to pay for higher levels of service (and better customer service) may be sensible.

No updated outlook was provided for the current financial year, which started on 1 April.

My view

Iomart shares do not look particularly expensive to me at the moment, assuming the company can stabilise its margins and avoid any further downgrades.

The latest consensus estimates I can see price the stock on a P/E of 13 and suggest a dividend yield of c.4%.

I'd like to know more about cash generation and debt levels and plan to wait for the full-year results in June before forming a stronger view. But I remain interested in Iomart.

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.