The Dividend Note - good operators? AZN, RECI, RSW (09/02/24)

I drill down into this week's results from AstraZeneca, Renishaw and specialist lender Real Estate Credit Investments.

Welcome back to The Dividend Note. This is a weekly review of results from dividend stocks that look potentially interesting to me.

Try as I might, I'm not sure there's a common theme between this week's companies – except perhaps that all three of them seem to be quite good at what they do.

Companies covered:

- AstraZeneca (LON:AZN) - rising costs and capex appear to have put pressure on free cash flow last year, despite impressive growth in headline profits. There's not enough value here for me, but I could be wrong.

- Real Estate Credit Investments (LON:RECI) (disc: I hold) - this specialist lender impaired the fair value of some loans in Q3, but I think the underlying quality of the loan book remains good. With the shares trading at a discount to NAV and offering a 10% yield, I remain positive.

- Renishaw (LON:RSW) - half-year results show a drop in profits and continued high cash burn, but Renishaw is investing for the future and appears to be positioned for a gradual recovery. I remain interested.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

AstraZeneca (AZN)

"we are pleased to report another year of strong financial performance and scientific progress"

2023 final results / Market cap: £152bn

FY24 forecast dividend yield: 2.6%

I looked at FTSE 100 pharma GSK last week and concluded that there could still be some value on offer, if current momentum can be maintained.

This week it was the turn of AstraZeneca to report its 2023 results. When I covered the Anglo-Swedish group's half-year results in August last year, I noted improved cash generation but commented that the valuation seemed relatively full.

AstraZeneca's share price has dropped about 10% since then, in part because of a sell-off that followed this week's results, which showed earnings slightly below expectations:

I don't think the wheels are coming off here. But as I commented last week, developing major new drugs is an expensive and seems to be a somewhat hit-and-miss business.

I don't claim any knowledge of this sector, so I tend to restrict my focus to the financial performance of the big pharma firms. As a dividend investor, I want to know if these businesses are able to produce reliable supplies of surplus cash to support an appealing dividend.

AstraZeneca applies a mind-boggling level of adjustments to its profits. Last year's core earnings were $7.26 per share, while reported earnings were just $3.84 per share.

Cash flow: I prefer to focus on free cash flow. In November, I noted that AstraZeneca's third-quarter results showed an improvement in cash generation over the first nine months of the year, compared to 2022.

However, this increase doesn't seem to have been maintained over the full year. Based on the way that I've calculated free cash flow, the amount of surplus cash generated by the business fell by nearly 9% last year:

- 2022 FCF: $5.7bn

- 2023 FCF: $5.2bn

This gives AstraZeneca a trailing free cash flow yield of about 2.7%, which seems quite full to me.

For clarity, I've included various acquisiton-related payments in my calculation as these have become a regular part of AstraZeneca's business model and were comparable across both years.

The fall in free cash flow appears to have been driven by an increase in capital expenditure. Cash outflows on investing activities rose by around a third to $4.1bn last year (2022: $3.0bn).

This was mirrored by an increase in operating expenses – combined expenditure on R&D and general overheads rose by 7% to $30.2bn last year (2022: $28.2bn).

For me, this serves as a reminder that developing new medicines is a costly business.

Profitability: AstraZeneca's 2023 results do show a useful improvement in statutory profitability:

- Operating margin: 17.9% (2022: 8.5%)

- ROCE: 11.6% (2022: 5.4%)

However, both of these figures are lower than those achieved by GSK last year (22.2% and 17.8%, respectively).

Dividend: total dividends declared for the year were $2.90 per share.

While this was comfortably covered by reported earnings of $3.84 per share, my sums suggest the shareholder payout wasn't quite covered by free cash flow of c.$2.65 per share.

I don't see this as a major problem, but it's a little disappointing all the same.

My view

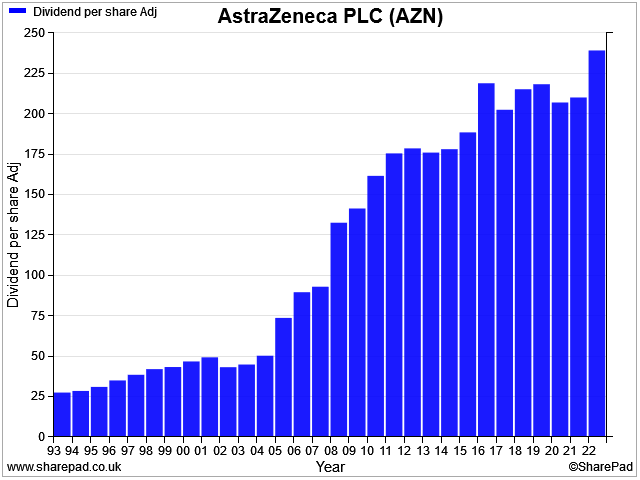

AstraZeneca does have a long and fairly respectable dividend history, hence my interest here:

Sales and profit growth have been strong in recent years and consensus forecasts suggest this will continue. It's possible that the stock will grow into its current valuation, but for me, the price is still a little too steep.

Based on 2023 results, I estimate AstraZeneca shares trade on an EBIT yield of 3.8% and a free cash flow yield of 2.7%. These numbers don't offer me the kind of safety margin I'd like.

I could be wrong – if profit growth is backed by stronger cash generation this year, AstraZeneca's valuation could become more attractive. But we all have to make our own choices on value, and I prefer not to pay too much upfront for growth.

Real Estate Credit Investments (RECI)

"The opportunity to provide senior loans at low risk points, for higher margins, is increasingly evident"

Q3 presentation / Mkt cap: £275m

FY24 forecast dividend yield: 10%

Disclosure: I hold shares in RECI.

RECI is a closed-end investment company that originates and invests in commercial real estate debt in Western Europe. It's managed by alternatives specialist Cheyne Capital.

The company's core activity is providing senior loans directly to property developers, with the aim of funding the dividend from interest income. It's a somewhat niche and specialist business, but RECI has been listed since 2005.

In my view, this business has established a fairly solid record since 2011, after it had recovered from the 2008 financial crisis.

The stock currently pays a quarterly dividend of 3p per share. That gives a generous yield of 10%, at the last-seen share price of 121p.

Q3 update: RECI says that its total NAV return for the three months ended 31 December 2023 was -0.6%. This was due to impairments on its loan portfolio. More on that shortly.

One UK loan was repaid during the quarter, realising net proceeds of £9.4m and providing improved headroom for new lending.

Cash reserves do appear to have run a little low – cash stood at £12.1m or 3.7% of NAV at the end of December, below the target range of 5%-10%. However, the January factsheet (also released this week) shows that cash recovered to £22.7m by the end of January, or 6.8% of NAV.

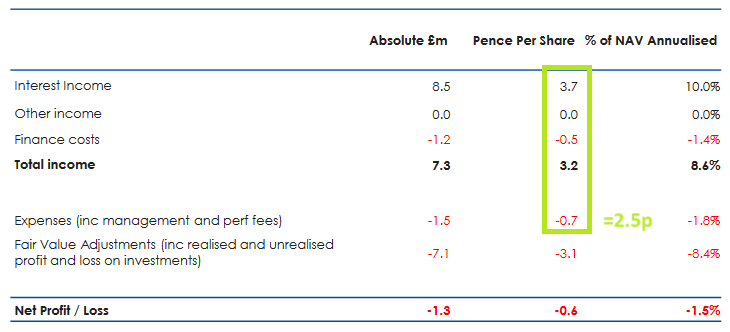

Profits: total income for the quarter was £7.3m or 3.2p per share. However, expenses and fair value adjustments reduced this to a net loss of £1.3m (-0.6p per share) for the quarter.

RECI's goal is for the dividend to be fully covered by net interest income, but this wasn't quite achieved during the quarter. As we can see from the table below, interest income less finance costs and expenses dropped out at 2.5p per share (before fair value adjustments):

Loan-to-value & leverage ratios: the weighted average loan-to-value (LTV) of the company's portfolio was 60.7% on 31 December 2023 (Sept '23: 60.9%).

The weighted average maturity of RECI's loans was unchanged at 1.5 years.

With a REIT, LTV serves as an indicator of the level of borrowing the REIT has undertaken to fund its assets. However, that's not true in this case.

RECI's 60% LTV represents the value of its loans as a proportion of the value of the properties on which they are secured. It's equivalent to the LTV on a residential mortgage.

RECI's own balance sheet leverage is much lower. Borrowings stood at £55.1m at the end of December, versus a net asset value of £330.6m. This gives a debt-to-equity ratio of 16.7%. That looks comfortable to me and is well below the company's limit of 40%.

Discount to NAV: the 121p share price at the time of writing represents a 16% discount to RECI's 31 January NAV of 145.5p per share.

I think this could offer value, but the risk of loan losses also appears to be increasing.

Are loan losses likely? RECI's loans are marked to fair value each month when NAV is calculated. The company's policy is to adjust the value of its loans based on the credit quality of the borrower and the market value of the underlying property.

This fair value policy gives an expected recovery figure from the loan, which may be below the original commitment. Clearly, that's useful information to have for a realistic NAV. I assume this approach is also in line with how RECI's auditors want the company to record loan values.

However, it seems to me that one side effect of this fair value policy is that it becomes harder for investors to gauge the true equity cushion on a loan that has been impaired.

In effect, the fair value adjustment appears to ensure that LTV remains broadly unchanged from entry LTV, even when the value of the property collateral may have fallen.

This seems relevant to me because my understanding is that in situations where RECI is the senior lender (87% of loans), the company will still hope to achieve a recovery of the original amount loaned, even if it has impaired the fair value of the loan.

This conclusion is based on my reading of the company's commentary on the Paris office loan whose fair value was impaired in Q3:

Cheyne’s loan basis is low in the asset, and hence, we can

afford to take a longer time to lease up the asset, which we

will do.

In the interim, Cheyne’s valuation policy is to reflect the

lower asset valuation.

Cheyne will continue to work actively with the borrower

and a selected asset manager to expedite leasing the

asset, to secure early repayment of the principal as well as

all accrued interest.

Apologies for this digression. I've been thinking about this because RECI's third-quarter update highlighted some expected (unrealised) loan losses that were not apparent when the company's half-year results were published in November:

"Following careful analysis of market conditions, RECI has in instances conservatively taken unrealised mark downs to its portfolio"

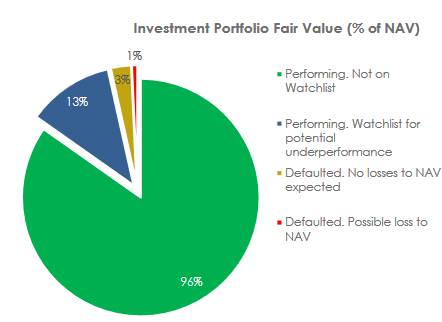

Loans that have defaulted now account for 4% of NAV, representing five positions

In total, these loans represented original lending commitments of £32.0m, but have now been marked down to a fair value of £13.0m. This is a non-cash impairment (so far), but the £13.0m represents the expected recovery value from these loans.

In fairness, I think the situation is not as bad as these figures might suggest.

Paris office property: The only loan issued under the company's current lending policy that has been impaired is a Paris office property which is struggling to let due to post-COVID demand changes.

RECI's loan has been written down from £14.5m to £10.3m to reflect its policy of valuing loans based on the credit quality of the borrower and the market value of the property. But as the senior, secured lender, RECI says it can remain patient and is working towards securing "early repayment of the principal and all accrued interest".

Legacy loans: the remaining four defaulted loans are described as legacy and are a mix of CMBS and junior (mezzanine) debt. I don't think RECI would consider either of these today. At least some of these defaulted loans date back to 2006/7!

Original commitments of £17.5m are now expected to yield a recovery of £2.7m. £10m of this shortfall is expected to come from a total loss on a loan relating to a UK retail property.

I have to admit that I didn't know these lower-quality legacy loans still existed on RECI's balance sheet, prior to the publication of the Q3 presentation. I don't know if there are any others, but if so I would hope that they are nearing redemption.

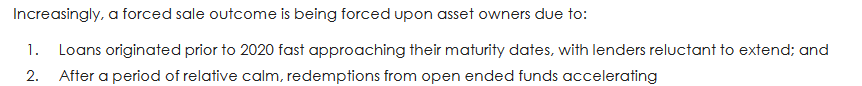

Are further impairments likely? I don't know. But the company's commentary about the increasing frequency of forced sales suggests to me that there is still some risk that property values could continue to fall:

Outlook: management says that RECI has "a strong pipeline of floating rate senior loans", derived from Cheyne's pipeline of deals, said to stand at £1.1bn.

My view

I find RECI's monthly factsheets and quarterly reporting to be relatively transparent and informative for shareholders.

I don't see any reason to doubt management's view that ongoing constraints in bank lending and an increase in forced sales are contributing to "a compelling emerging opportunity set in senior loans" seems reasonable to me.

But I wonder if the flipside of this market dynamic might be that further impairments are likely, even if RECI may eventually be able to achieve a full recovery.

In the meantime, I would like to see dividend cover restored. However, I'm reassured that January's factsheet did not highlight any further loan impairments.

RECI shares currently trade c.15% below net asset value and offer a 10% dividend yield. While they're not without risk, on balance I think there's probably some value here. I remain happy to hold.

Renishaw (RSW)

"We expect an improvement in our trading performance in the second half of the financial year as market conditions improve"

2023/24 half-year report / Mkt cap: £3.0bn

Forecast dividend yield: 1.9%

Renishaw specialises in precision measurement and process control products for manufacturers. I reviewed last year's results from this specialist engineer here.

This year's H1 results triggered a sharp share price rise, despite a big drop in profit compared to H1 last year:

Is this new optimism justified? I'm not entirely sure. Let's take a look at the numbers.

H1 results summary: Renishaw says that weak demand from semiconductor manufacturers offset strength in healthcare and industrial metrology. The net result was a 5% reduction in H1 revenue, which fell to £330.5m.

Pre-tax profit for the half-year fell by 27% to £56.5m, while earnings were down 26% to 62.1p per share.

Reductions in inventory contributed to a significant increase in cash flow from operating activities, which rose to £55.6m (H1 FY23: £21.6m).

However, my sums suggest free cash flow for the half year was just £13.1m, reflecting £40.4m of capex and £4.5m of capitalised development costs during the period.

The capex relates to the expansion of the company's factory in Wales. Full-year spend is expected to be similar to last year's figure of £74m.

Renishaw ended the half year with net cash of £164m, down from £193m at the end of June 2023.

The interim dividend was left unchanged at 16.8p per share.

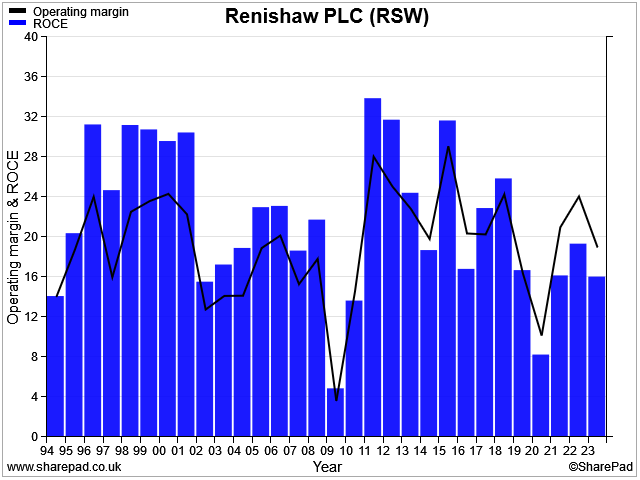

Profitability: Renishaw's operating margin for the half year fell to 14.3%, giving a trailing 12-month figure of 16.4%. That's down from 19.5% in the prior year and slightly below the long-term average for this business:

However, I don't see too much to dislike here – this still appears to be an above-averagely profitable business with a very strong balance sheet.

Outlook: management expects a stronger performance during the second half of the year.

Updated guidance is for an adjusted pre-tax profit of between £122m and £147m for the full year.

Last year's adjusted PBT figure was £141m, so Renishaw will need to hit the top end of this range in order to make any progress this year.

Consensus forecasts suggest FY24 earnings of 145p per share (FY23: 155.1p), putting the stock on a forecast P/E of 28.

A stronger showing in FY25 is expected to reduce the forward P/E to 24.

The full-year dividend is expected to rise by 2.6% to 78.2p per share, giving a prospective yield of 1.9%.

My view

When I looked at Renishaw last year, I liked the business and commented that the valuation look "far more reasonable than it's been for a number of years".

These half-year results give me an EBIT yield of 6.2%, which is within the range I'd consider for a quality business.

While free cash flow and the dividend yield are both lower than I'd like to see, I can see a case for suggesting that Renishaw is fairly valued on a long-term view.

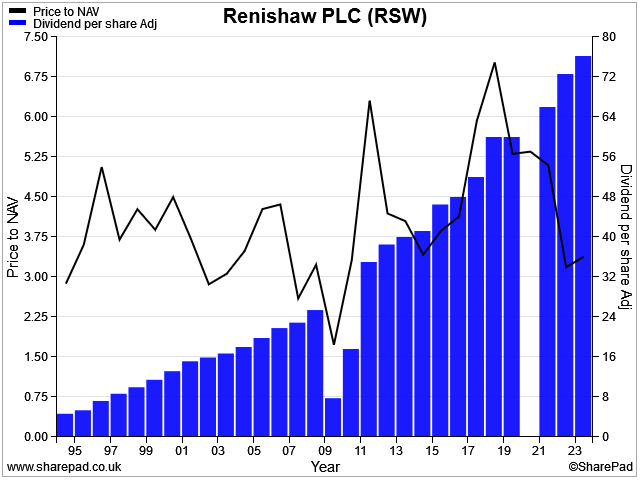

The company has a 29-year track record of (almost) unbroken dividend growth. I think it's also interesting to note that the stock's current P/NAV of c.3x has historically been at the bottom end of its valuation range:

Renishaw remains on my watch list as a possible buy.

I'm not quite on board with the valuation, but I can see that if the company can resume its past record of growth and profitability, then the shares might be reasonably valued at current levels.

Disclosure: at the time of publication, Roland owned shares in Real Estate Credit Investments.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.