Dividend notes: farms, fashion & forex - ABF, REC

30/06/23: I review Q3 trading at Associated British Foods and solid FY results from currency management specialist Record.

Welcome back to my dividend notes. Two companies are on the menu today, a family-controlled FTSE 100 stalwart and an interesting small-cap financial with 30% profit margins and a 5% yield.

Companies covered:

- Associated British Foods (LON:ABF) - a solid third-quarter update with group revenue up 16% and an upgrade to full-year profit guidance. I think the shares could be a good long-term investment.

- Record (LON:REC) - I admire this currency management's specialist expertise and impressive profitability. But I'm less sure about its diversification into asset management. I'll continue to watch with interest.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Associated British Foods (ABF)

"Based on current trading conditions,we now expect the Group's adjusted operating profit for the full year to be moderately ahead of last year."

Food and fast fashion conglomerate ABF has issued a third-quarter trading statement confirming solid progress across the business.

Group revenue rose by 16% to £4,726 during the three months to 27 May, compared to the same period last year.

The group's food businesses include British Sugar and grocery brands such as Kingsmill, Twinings and Ovaltine. Revenue in these businesses rose by 18% to £2,728m during the third quarter.

ABF also owns budget fashion retailer Primark. This business continues to recover from the pandemic (it doesn't sell online) and saw revenue rise by 13% to £1,998m during the quarter.

Outlook: management now expect adjusted operating profit to be "moderately ahead of last year". The company's previous guidance with its interim results was for flat profits this year.

My view: I think this is a good business that benefits from family ownership and a strong, conservative balance sheet.

My sums suggest the shares trade on a trailing EBIT/EV yield of about 6.5% at the moment, which seems reasonable to me, if not obviously cheap.

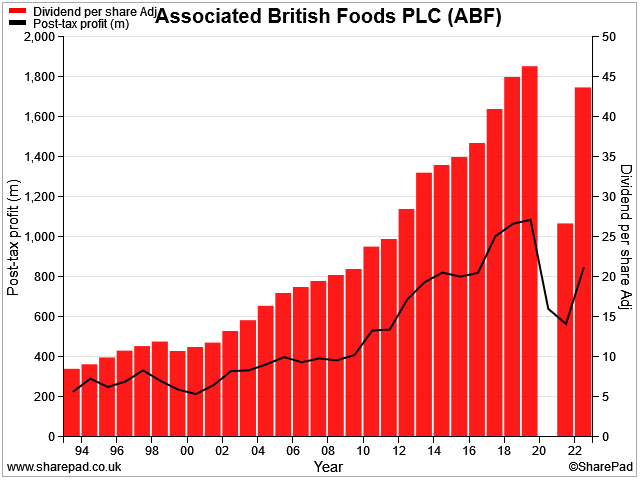

ABF has been a reliable performer for many years and has an excellent dividend record.

I suspect it will remain a rewarding long-term investment.

Record (REC)

"Strong momentum in AUME growth (+6%) driven by net inflows of $9.1bn to close the year at $87.7bn, the highest ever level of AUME to date."

Currency management specialist Record reported a strong set of full-year results on Friday.

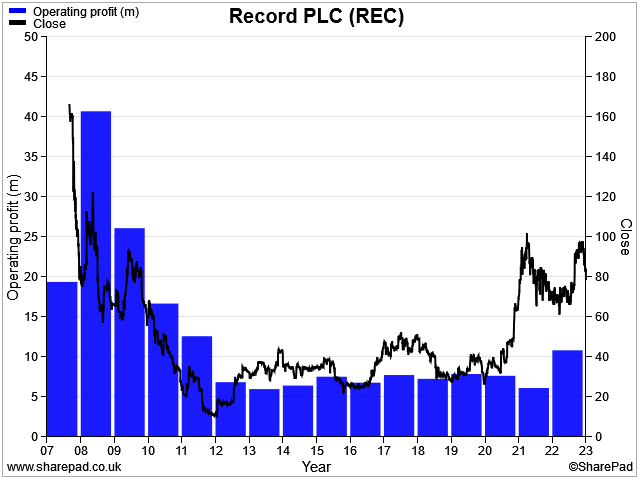

Results summary: revenue rose by 27% to £44.7m, while pre-tax profit was up by 34% to £14.6m. Profitability was excellent, too. Record's operating margin rose to 32% (FY22: 31%) and my sums suggest a return on equity of 42%.

The group's assets under management equivalent, a measure of the total value of client assets hedged by the group, rose by 6% to a record $87.7bn.

Management fees are charged as a percentage of AUME and rose by 12% to £38.3m. Performance fees rose to £5.3m £5.8m (correction), from just £0.5m the previous year. My sums suggest fee margins were stable last year, although it's hard to be sure given the currency translation involved.

However, comments from departing chairman (and founder) Neil Record suggest that fee margins have indeed stabilised, after a long period of compression:

"While these mandates can sometimes be large (>$10 billion), we have experienced steady fee compression over the past decade, only now levelling out at very low levels."

Record had cash and short-term money market securities totalling £14.5m at the end of March, down from £17.3m one year earlier. The group has no debt.

Dividend: shareholders will see the ordinary dividend increase by 25% to 4.5p per share and will also receive a special divided of 0.68p per share. That gives a total of 5.2p, implying a yield of 5.3% at current levels.

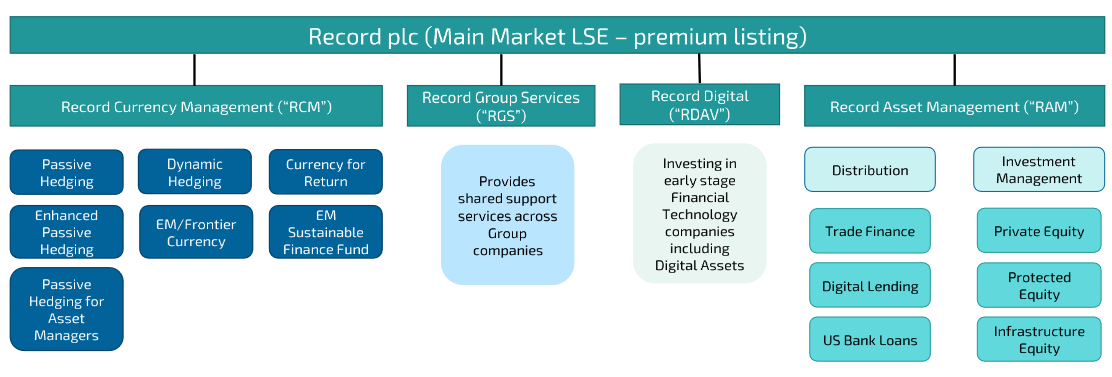

Trading commentary: historically, Record's core business has been providing passive currency hedging to institutional investors such as pension funds. This is a large scale business, but fee margins have fallen steadily over the last decade. While they may now be stabilising, I would guess they are unlikely to rise again.

To address this problem, Record has been diversifying since CEO Leslie Hill took charge three years ago. The company says it's now seeing attractive growth in providing currency hedging for "large, international asset managers". This work is said to be technically challenging, but attracts "much better fee rates" then are earned from pension funds.

Alongside this, the group is also developing its own asset management business. This hasn't yet generated a reportable amount of revenue, but is now starting to manage funds. Sectors being targeted appear to include fintech, debt, and infrastructure:

Outlook: CEO Leslie Hill (who is also an 8% shareholder) believes she has now laid the groundwork for the next phase of Record's development. Hill expects to start seeing revenue from the group's new asset management and digital asset businesses.

No specific financial guidance is provided, but the company says its confidence in the future is reflected by the 25% increase in the ordinary dividend – the payout has not been cut since 2012 and "targets progressive and sustainable dividend growth" with a target payout of 70%-90%.

Broker forecasts for the current financial year (y/e 31 March '24) suggest that both profits and revenues will be broadly flat compared to FY23. After recent share price gains, that leaves the stock trading on about 16x earnings, with a 5.3% dividend yield.

My view: I think it's clear that Record has specialist currency management skills that are of value to large institutional clients. My impression is that the company has some degree of competitive advantage in this market, despite its relatively small size (market cap £185m).

However, I'm less convinced by the company's efforts at diversification into asset management. I'm not sure why Record is likely to have any particular edge when investing in areas such as trade finance, digital assets or infrastructure.

I don't have much understanding of currency markets, but I also wonder if it's possible that Record's recent strong growth has been aided by external tailwinds that might ease.

Record's profit growth has been inconsistent and often disappointing, historically. The group's profits have never returned to the peak levels seen at the time of its IPO in late 2007:

Record shares currently trading at 10-year highs despite cautious growth forecasts. I'm inclined to continue watching this interesting business while remaining on the sidelines.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.