The Dividend Note - impressive profitability - PETS, IPX (31/05/24)

This week I've reviewed the latest results from Impax Asset Management and Pets at Home - two distinctive UK dividend shares.

Welcome back to The Dividend Note, my weekly look at UK dividend shares I might be interested in adding to my portfolio.

This week I've taken a look at two well-known UK small/mid caps with impressive profitability – although in one case, this is somewhat hidden behind a quirky accounting entry.

Companies covered:

These notes contain a review of my thoughts on recent results from UK dividend-paying companies that are of interest to me. In general, these are stocks that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- Pets at Home (LON:PETS) - I dig down into the profitability of this business and am favourably impressed. However, profits depend heavily on the vet business which is currently exposed to a CMA review into this sector. With this caveat, I think there could be value here.

- Impax Asset Management (LON:IPX) - a shift towards more direct distribution and a revision to the dividend policy are perhaps growing pains. Even so, I remain a big fan of this sustainability specialist and believe the shares are likely to offer value at this level.

Pets at Home (PETS)

"No change to FY25 underlying PBT guidance"

Results for year ended 31 March 2024 / Mkt cap: £1.4bn

24/25 forecast dividend yield: 4.4%

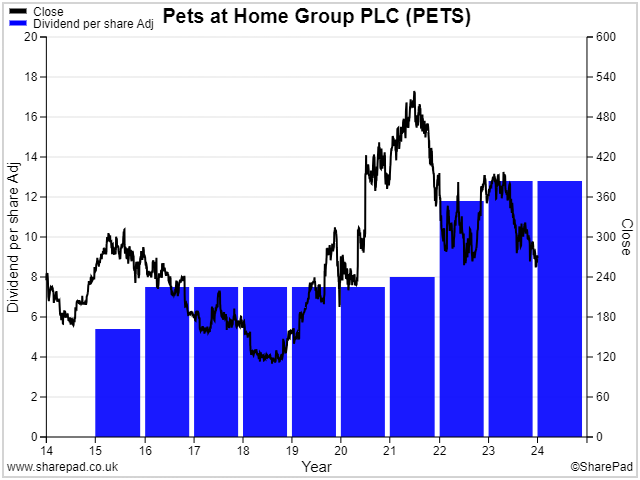

Pets at Home floated on the London market in 2014. Over the last decade this integrated pet superstore and vet business has provided somewhat volatile ride for shareholders, but has also produced a useful stream of dividends.

I last looked at Pets at Home a year ago when I commented that the "outlook looks a little weak to me and the valuation seems up with events".

Profits were indeed lower last year and the share price has also fallen sharply since then. Investor sentiment towards this business has probably not been helped by the Competition and Markets Authority's (CMA) decision to launch an investigation into the UK veterinary sector.

The company sounds confident about the CMA review, but at this stage I would argue some risk remains:

"We believe that our vets growth strategy is not threatened by the CMA's review into the vet sector. Our key building blocks for growth support competition and deliver better outcomes for consumers."

However, this week's full-year results suggested to me that Pets at Home is in relatively good shape and could be a more attractive investment prospect than it was a year ago.

Let's take a look.

23/24 results summary: Pets at Home is nearing the end of an investment programme that saw the company launch a new app and website last year and open a new distribution centre that now serves all of its stores.

CEO says last year was "a pivotal year for the business", but the consumer backdrop appears to have been a little softer.

The company mentions "continued caution among consumers" and the "normalisation" of new puppy and kitten numbers. I assume this means a post-pandemic slowdown to more normal numbers of new pets.

The company says that membership of its Pets Club loyalty scheme rose by just 1.6% last year, albeit it now has 7.8m active members.

Against this backdrop, PETS' 23/24 financial performance looks acceptable to me, if not spectacular:

- Revenue up 5.2% to £1.5bn (+5.1% like-for-like, so not driven by new store openings)

- Underlying pre-tax profit down 3.2% to £132m

- Reported pre-tax profit down 13.7% to £105.7m

- Underlying earnings down 9% to 20.7p per share

- Dividend held flat at 12.8p per share

Profit analysis: the fall in underlying profits is blamed on temporary supply problems during the distribution centre changeover and a slowdown in discretionary accessory sales.

Pet food sales rose by 9.3% to £814.2m last year, but accessory sales fell 4.3% to £466m. Against this backdrop, total retail profit fell by 22% to £77.9m (FY23: £99.8m). That's equivalent to a segmental margin of 5.9%.

I don't know what the impact of supply chain problems was. But these numbers suggest to me that retail profits depend heavily on higher-margin accessory sales to offset lower-margin food sales (pet food is a competitive market, after all). The company says it has a plan to return accessories to growth this year.

Fortunately, the vet business continues to expand and provide a higher-margin revenue stream. The company's owned and hosted vet practices generated total revenue of £576m last year, of which £146.5m accrued to Pets at Home (FY23: £125.5m).

From this, PETS generated £58.1m of vet segment operating profit (FY23: £52.1m). This implies an impressive segmental margin of 39.7%.

I think this super profitability can be explained by the franchise-like structure of the vet business. Around two-thirds of PETS' vet revenue is fee income from joint venture practices. The structure of these JVs entitles the company to a fee income, rather than a share of profits. In that sense, it's a bit like a franchise – very profitable for the parent.

The remaining vet revenue comes from company-managed practices. Sadly, I can't see any way to determine how profitable these are.

One final comment profits – the larger fall in reported profits is attributed to £26m of exceptional costs related to the new distribution centre and other restructuring activities. I'm normally sceptical of adjusted profits, but in this case the explanation and adjustments do seem reasonable to me as genuine one offs.

Cash flow & balance sheet: cash generation also worsened last year but remained reasonable, in my view. I calculate FY24 free cash flow of £66m. That's down from a comparable figure of £75.8m last year, but is still enough to cover the dividend.

Free cash flow of £66m is also equivalent to 83% cash conversion from net profit, which is not a terrible result.

Pets at Home ended the year with net cash of £8.8m excluding leases and gross debt of under £50m. That looks fine to me.

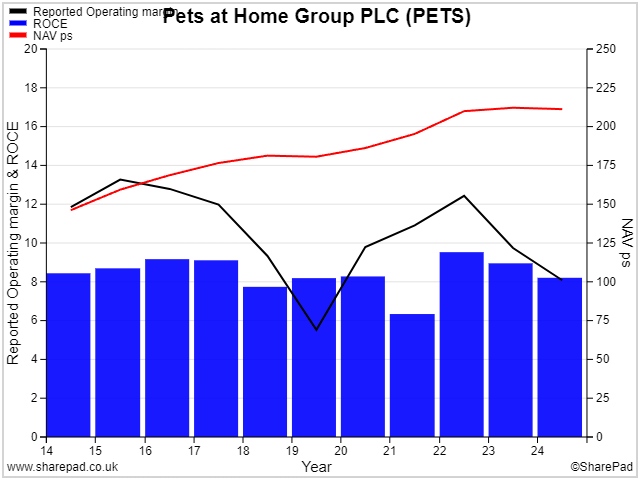

Hidden profitability? Pets at Home's vet business provides a useful boost to profitability, but margins have historically been quite variable. Last year's operating margin of 8.1% is at the bottom end of the historic range, but still quite respectable:

ROCE: at first glance, return on capital employed doesn't seem spectacular. My standard calculation gives a ROCE of just under 9% for last year. The chart above suggests this is fairly typical.

Given this, I was surprised to see Pets at Home's FY24 results specify a far more impressive-sounding underlying cash return on invested capital (CROIC) of 19.4% for last year. So what's the difference?

The company's underlying CROIC calculation has a number of moving parts and is a little too bespoke and complex for me. But the breakdown of the CROIC calculation did reveal an interesting quirk to the balance sheet.

When PETS was floated by its former private equity owner KKR in 2014, KKR added £906.5m of goodwill to the balance sheet. This is listed within intangible assets.

This goodwill is presumably an accounting construct that wouldn't have existed with the flotation. So what would PETS' ROCE be like without it, I wondered?

It turns out that stripping out the goodwill from my ROCE calculation gives a FY24 ROCE of 27.4%. This highlights the relatively capital light business model and the way in which the vet business juices the group's profitability.

However, in the interest of objectivity, I felt I should make a further tweak to my calculation.

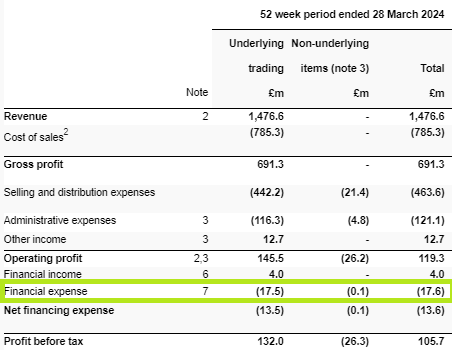

One problem with the IFRS 16 lease accounting rules are that rental payments are no longer included in operating expenses. Instead, they are listed as a finance cost, together with loan interest, below operating profit in the income statement.

A quick look at the footnotes revealed that Pets at Home paid £13.3m in so-called interest expense on lease liabilities last year. Deducting this from operating profit gives me a lease-adjusted operating profit of £106m.

Applying this figure to my return on capital calculation gives me an adjusted ROCE of 24.3%. A very impressive result, I think, and not a million miles from the company's underlying CROIC figure of 19.4%.

(I'm aware of the contradiction of dismissing a company's own adjusted figure and then creating my own. But the point here is that my figure can be calculated from the standard accounts, without needing any extra insight. PETS' CROIC figure relies on an extra level of detail that's not easy/possible to extract from the accounts. More broadly, as investors we are all free to interpret accounts as we wish. In this case, I think my adjustments have helped me gain a better understanding of this business.)

Outlook: full marks to Pets at Home for providing clear guidance on FY25 expectations and a summary of current consensus estimates.

"No change to FY25 underlying PBT guidance. Whilst the external trading environment has been subdued, overall pet care spend has proven resilient, and in the year ahead, we should begin to benefit from previous investments and key productivity programs."

The company specifies an analyst consensus for underlying pre-tax profit of c.£144m as the basis for this guidance. SharePad data suggests this could translate into earnings of 22p per share, a 6% increase from the year just ended.

These broker estimates put Pets at Home shares on a forecast P/E of 13.8, with a prospective yield of 4.5%.

My view

Pets at Home's USP is that it combines a full range of clinical, pet care and retail services. These are all available in an integrated offering under one roof and online – 10% of revenue now comes from subscriptions for repeat purchase products such as pet food and worming tablets.

This model allows the company to boost the profitability of big stores by offering high-margin services within an affordable large format retail space.

However, I was struck by how low the average spend per consumer is – the average Pets Club member only spent £178 with Pets at Home last year. Clearly many customers are not spending across the full range of services.

The growth opportunity here is for Pets at Home to continue expanding its share of customers' annual pet spend.

I would say the main risk is that the high returns on capital I discussed earlier are dependent to some extent on the vet segment. This division generated more than 40% of operating profit from just 10% of revenue last year.

If the profitability of the vet business is reduced for any reason following the CMA review, then I don't think the company will be able to make up for this by selling more low-margin pet food (where it must compete with supermarkets and Amazon, among others).

With this caveat, I have to admit that I am more impressed by this business than I expected to be. Pets at Home has good scale and as far as I know, no direct competitors in the UK.

I think PETS shares are potentially quite reasonably priced at current levels.

Impax Asset Management (IPX)

"AUM growth of 5.9% to £39.6 billion, driven by investment performance"

Half-year results for six months to 31 March 2024 / Mkt cap: £554m

FY24 forecast dividend yield: 6.1%

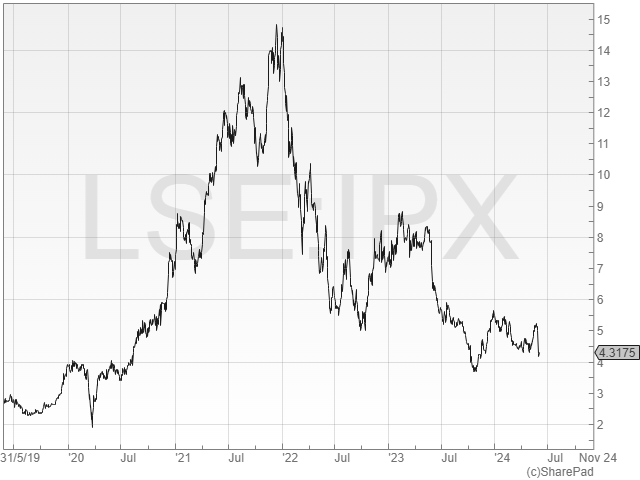

When I last looked at specialist sustainability asset manager Impax following its 2022/23 results one year ago, I commented that the shares had already de-rated sharply. When I wrote the review the shares were trading at 657p. As I write now, they are changing hands for 432p – another 34% lower.

I see this business as one of the most differentiated asset managers out there, with a strong track record. I've been bullish for a while, albeit prematurely. Interestingly (for me), Impax has also been one of the top-scoring shares in my dividend screen results for a while now.

Given this, I was interested to see this week's half-year results.

HY24 results summary: in this recent piece on asset managers I noted the pattern that seemed to be emerging of positive market performance and continued net outflows. I wondered if it could signify a turning point for asset manager shares and perhaps the wider UK market.

Impax 's assets under management (AUM) rose by 5.9% to £36.9bn between 30 September 2023 and 31 March 2024. Market gains of £4.9bn outweighed net outflows of £2.7bn to deliver a positive overall result.

Revenue fell by 2% to £86.8m compared to H1 2023, while adjusted operating profit for the period fell 5.5% to £25.8m.

Impax generated adjusted H1 earnings of 16.0p per share (H1 2023: 17.3p) and the interim dividend held unchanged at 4.7p per share.

On a reported basis, I estimate Impax has a trailing 12-month (TTM) operating margin of 30% and TTM return on equity of 34% – both are excellent figures towards the top of the company's historic range.

Trading commentary & fund flows: movements in AUM often correlate to revenue, as a large proportion of asset managers' income comes from fees charged as a percentage of AUM.

In this case, the increase in AUM didn't result in an increase in revenue. This may have been because most of the market gains didn't take place until the latter part of the half year, or because outflows occurred earlier in the period.

However, Impax's revenue margin remained stable at 0.45% which means that its annualised run-rate revenue improved to £177.1m (Sept 23: £169m).

Operating costs appear to have flattened out. So assuming AUM is flat or better over the remainder of the current financial year, I'd expect revenue and profits to rise in H2.

I don't have too many concerns about Impax's ability to allocate its assets well. My bigger worry is that the substantial outflows seen in H1 may continue.

ESG funds in general have suffered above-average outflows as this sector of the market has fallen out of favour somewhat. But I've tended to see Impax as more differentiated and not simply a box-ticking ESG operation. For me, that's key to the appeal of the shares as a potential investment.

The company says the outflows were predominantly through its wholesale channel. My understanding is that the main wholesale customer for the group is BNP Paribas.

The French bank is Impax's largest shareholder and a longstanding partner, but Impax says it is now making more effort to develop its own direct distribution capabilities. Assuming this effort is successful, then Impax should become less dependent on BNP Paribas over time.

However, I don't know how much of a challenge it might be to become less dependent on wholesale distribution. I have sometimes wondered if Impax's arrangement with BNP Paribas was the secret to its (previously) strong and consistent growth.

Dividend policy change: one other change that caught my eye is that Impax has revised its dividend policy.

The company previously targeted a payout of 55%-80% of adjusted profit after tax.

This has now been reduced to "at least 55% of adjusted profit after tax". There's a new emphasis on "ensuring that we retain sufficient capital to invest in our future growth".

This doesn't necessarily mean the payout will be cut, but it seems to lean in that direction, I feel.

Consensus forecasts suggest earnings of 32.5p per share for the 23/24 financial year. That implies a minimum dividend of 17.9p per share under the new policy.

This would imply a 35% cut from last year's 27.6p per share payout.

Personally, I think a smaller cut is more likely. Impax is just coming to the end of a period of investment in staff and infrastructure. Unless AUM falls again, I think a modest recovery in profits should help to support a payout that's closer to last year's total.

Outlook: consensus forecasts currently only reflect a very modest dividend cut to 25.6p per share. That gives a prospective yield of 6.1% at the time of writing.

Interestingly, I note that sector specialist Paul Bryant at Equity Development has not pencilled in a cut at all – forecasts in his latest note are for the 27.6p to be maintained this year.

Bryant notes Impax has £60m of regulatory surplus capital and has just completed a successful €459m private markets infrastructure fund raise. He argues this highlights the group's strong financial position and a potential improvement in flows.

My view

I remain a fan of Impax, which I think benefits from clear differentiation and a well-defined and proven approach to selecting potential investments.

However, the business does now appear to have reached a size where further growth will be more dependent on its own direct distribution capabilities than in the past.

Expansion into fixed income and private markets also offers the potential for missteps, although I think both are logical extensions to the group's equity investment model.

On balance, I think Impax looks attractive at this level. The group's share price has now almost returned to pre-pandemic levels, but assets under management are now more than twice what they were at the end of March 2020.

A P/E of 13 and a prospective dividend yield of 6% seem cheap to me for a well-established fund manager generating a 30% return on equity.

If I was looking to add another financial to my portfolio at the moment, Impax would be on the short list of contenders.

Let me know what you think – and thanks for reading!

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.