The Dividend Note - turning point? Asset managers, RTO, LTG (19/04/24)

I consider the income opportunities among UK asset managers and take a look at this week's updates from dividend shares Rentokil Initial and Learning Technologies.

Welcome back to The Dividend Note. This week I start with a look at the asset management landscape in the UK and explain why I think we may be nearing a turning point.

I then take a look at two fallen high flyers that are starting to look interesting to me.

Are asset managers returning to growth?

This week's updates from investment platforms AJ Bell (AJB) and IntegraFin (IHP) seemed broadly reassuring, with both reporting record assets under management at the end of March 2024.

Net inflows to both firms remained positive, too and both companies left full-year guidance unchanged. I last discussed these companies here in December and my favourable view also remains unchanged.

Perhaps more interesting are the recent quarterly updates from some of the UK's smaller asset managers, which I've listed below with their forecast dividend yields:

| Ticker | Company | Div yield (FY24 fc) |

| LIO | Liontrust Asset Mgt | 10.4% |

| PMI | Premier Miton | 9.8% |

| POLR | Polar Capital | 8.7% |

| IPX | Impax Asset Mgt | 5.7% |

All four reported an increase in assets under management during the first quarter of this year, thanks to positive market and investment performance.

While Liontrust, Premier, and Impax continued to see net outflows, Polar Capital broke the trend by reporting a small net inflow for the 12 months to 31 March 2024.

It's easy to see turning points where none exist. But I wonder if this combination of slowing outflows and positive investment performance could be a sign that asset managers (and the UK market) have reached a turning point.

From a dividend perspective, my view is that these firms' high yields are still largely supported by a combination of net cash and earnings. If market performance remains positive, these managers could see a return to net inflows, boosting fee income.

In this scenario, I can imagine these stocks re-rating. Given the high yields on offer, this could be an interesting total return opportunity.

Of course, inflows and earnings may not recover. Even if they do, some of these companies may underperform. It's possible that some of these dividends may still be cut, so please DYOR before considering any trades in this sector.

For previous comment, I last covered Liontrust here (Nov '23) and Impax and Premier Miton here (Jun '23).

Companies covered

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- Rentokil Initial (LON:RTO) - the pest control market leader is suffering integration pains after the acquisition of Terminix. But the stock has de-rated and I'm starting to get interested in the long-term potential here. One to watch.

- Learning Technologies Group (LON:LTG) - this AIM-listed software group specialises in training and employee development. Revenue is under pressure from slower customer spending, but cash generation is good and I think the shares could be cheap. Unfortunately, management commentary suggests to me that the dividend yield is likely to remain too low to be of interest to me.

Rentokil Initial (RTO)

North America growth performance has stabilised with Organic Revenue up 1.5%

Q1 trading update / Mkt cap: £10.4bn

FY24 forecast dividend yield: 2.2%

This business describes itself as a global leader in pest control and hygiene and wellbeing services. It seems like just the kind of business that should be well positioned to generate plenty of cash and pay reliable, rising dividends.

Pest control cannot easily be deferred and is often carried out on a contract basis, especially for corporate customers. More broadly, longer, hotter summers are expected to result in an increase in pest problems.

Historically, I've always felt priced out of Rentokil shares, which traded as high as 30 times earnings until 2021. However, a sharp de-rating since last year has brough the stock down to a level where I could be interested.

About the business: Rentokil was founded in the 1920s and is said to be the global market leader in pest control. The group has grown through many bolt-on acquisitions over the years, a model I like.

However, there have also been a few much larger deals. The Initial business was acquired in 1996, adding washrooms and workwear.

More recently, Rentokil paid £4.5bn to acquire US residential pest control group Terminix. This transaction completed in October 2022 and has increased the group's US pest control exposure to more than 60% of group revenue.

Unfortunately, this acquisition (priced at 26x Terminix profits) was completed just before a period of softer demand in the North American pest control market. October's third-quarter update included a rare profit warning, sending the stock tumbling.

Alongside this, Rentokil is having to spend significant amounts to integrate Terminix into its business – last year's results included £81m of integration costs, from an expected total of $250m.

Interest costs have also surged higher, as rising interest rates have coincided with a sharp increase in debt levels. Rentokil's interest costs trebled to £141m in 2023, on net debt of £3.2bn.

Synergies from combining the two businesses are expected to total $325m. I estimate this should effectively double the profitability of Terminix, based on the profits reported when it was acquired. However, Rentokil has now pushed back the completion date for the integration from 2025 to 2026.

Integration activities so far seem to have concentrated on IT and accounting systems. The unification of the two companies' physical branches is scheduled to start later this year. Management say that this process will include wage harmonisation. This is expected to help address current high levels of staff turnover, especially among Terminix staff.

March's full-year results seemed to be in line with October's revised guidance. But this week's first-quarter update has put renewed further pressure on Rentokil's share price.

Q1 trading update: Rentokil claimed a "positive overall start" to the year, but first-quarter revenue growth of 4.9% (3.1% organic) looked relatively weak to me.

Drilling down, North American revenue rose by just 1.5% on an organic basis, compared to the same period last year. This suggests a decline in volumes to me, given the general level of cost and wage inflation seen over the last 12 months.

Performance in regions not directly affected by the Terminix acquisition was stronger:

"Good momentum in Organic Revenue growth was sustained in all other regions: +6.2% in Europe inc. LATAM, the Group's second largest region; +4.1% in UK & Sub Saharan Africa; +4.3% in Asia & MENAT; and +7.3% in Pacific."

Further bolt-on acquisitions were made, with eight deals during the period delivering annualised revenue of £45m.

Outlook: full-year expectations were unchanged, with guidance for 2-4% organic revenue growth in North America and "modest margin progression", albeit weighted towards the second half of the year.

Such H2 weightings are often a sign that further disappointment is possible, in my experience.

My view

My core thesis for this business is that it should be able to generate reliable free cash flow and attractive profit margins.

To try and get a view of underlying performance and valuation, I've taken a look at the 2023 accounts.

My sums suggest free cash flow excluding acquisitions of £406m. While this figure is lower than the company's adjusted FCF figure of £500m, my estimate is much closer to Rentokil's reported net profit of £381m for last year.

Free cash flow of £406m gives the stock a free cash flow yield of 4%, which seems quite full to me.

What about profitability? This business generally has reasonable margins. Even with the acquisition spend on Terminix, statutory operating margin last year was 11.6%. On a company-adjusted basis this figure rises to 16.7%.

However, the lofty price tag paid for Terminix (and the impact of past acquisitions) means that Rentokil's balance sheet carries more than £7bn of goodwill and other intangibles.

My sums suggest a return on capital employed of 7.3% for 2023, or 10.5% if we use company-adjusted operating profit. Free cash flow return on capital employed was just 4.8%.

Looking ahead, consensus forecasts on SharePad suggest that Rentokil's free cash flow will rise to £463m in 2024 and to £628m in 2025. Those figures give an FY24e FCF yield of 4.4%, rising to 6.0% in 2025.

That could be attractive, I think, based on my assumption that this business is relatively defensive and has can grow steadily over the long term.

Net debt is expected to start falling from this year. Forecasts suggest it will drop below my preferred level of 4x net profits in 2025.

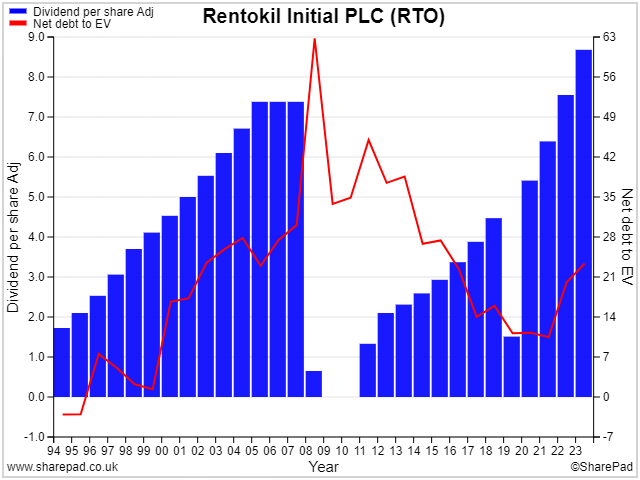

It's worth pointing out that Rentokil appears to have debt-related problems before. According to SharePad, net debt accounted for more than 60% of enterprise value at the height of the 2009 financial crisis, prompting a suspension of the dividend:

I don't think we're heading for a repeat of this wilderness period. But I do suspect that the Terminix acquisition will drag on the group's performance for a little longer yet.

As with Diageo, which I wrote about here, my feeling is that Rentokil's valuation may now be coming down to a level where it could be attractive.

Rentokil shares currently trade on around 17.5 times 2024 forecast earnings, falling to 15.4 for FY25.

The stock's forecast yield of 2.2% is still below the level I'd look for, but not necessarily a million miles away for a business I view as a possible long-term compounder.

I plan to keep an eye on Rentokil and will take a look at the interim result in July.

Learning Technologies Group (LTG)

"Continued margin progression and record operating cash flow generation"

2023 full-year results / Mkt cap: £612m

FY24 forecast dividend yield: 2.0%

This AIM-listed software firm is an Andrew Brode stock – the 82-year-old serial entrepreneur remains chairman and has a near-15% shareholding.

(Mr Brode is also the largest shareholder in RWS Holdings (RWS), which I hold in my dividend portfolio. However, he recently stood down as chairman at RWS.)

Learning Technologies is a "global market leader in digital learning and talent management". As far as I understand it, the company offers a portfolio of software products to manage digital training and employee development.

The business has grown by acquisitions and has previously attracted a tech-style rating.

The stock has de-rated sharply since 2021, but the business now appears to be consolidating into a more cohesive and cash-generative unit. Although the current dividend yield of 2% is too low for me to consider, the group's 2023 results suggest to me that a more generous payout could be affordable.

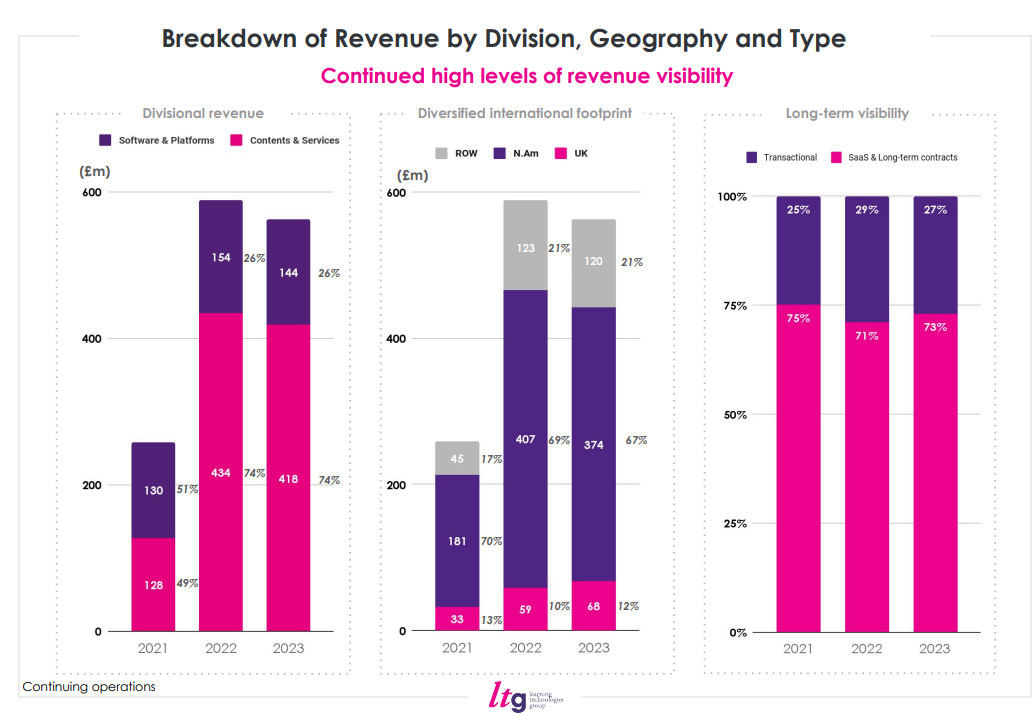

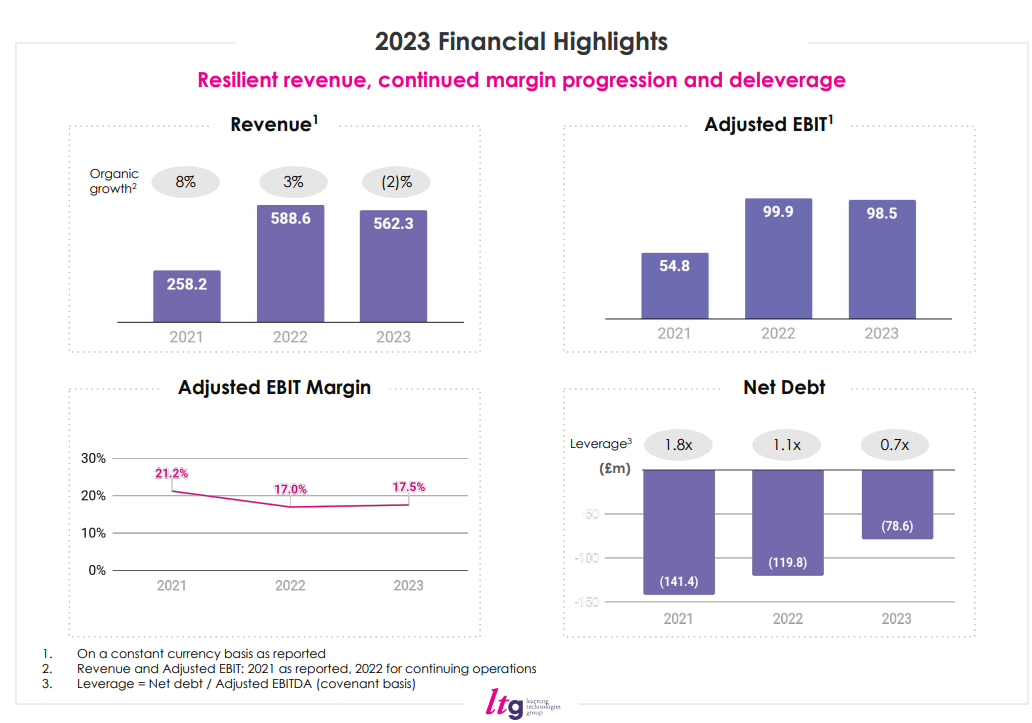

2023 results summary: LTG saw revenue fall by 4% to £562.3m last year. The company describes this as "resilient in the context of the macroeconomic climate". Management says that 73% of revenue is now underpinned by service-based or long-term contracts.

The company's customer base includes a large number of consumer facing and cyclical businesses, so blaming a slowdown on external pressures seem plausible, in my view.

This revenue breakdown shows the pullback last year and highlights the group's increased dependence on the US market, presumably since the acquisition of GP Strategies:

Profit performance last year was broadly flat, with adjusted operating profit down by 1.4% to £98.5m. LTG's adjusted operating margin rose by 0.5% to 17.5%.

Adjusted earnings fell by 2.5% to 7.8p per share and the full-year dividend was increased by 4% to 1.66p per share.

Despite the fall in profits, strong cash generation supported continued debt reduction:

Free cash flow & debt: Net interest costs for the year rose from £4.3m to £15.7m, despite the reduction in net debt from £119.8m to £78.6m.

This increase in finance charges put pressure on free cash flow, which fell to £44.4m last year, according to my sums (2022: £51.1m).

Although the reduction in free cash flow is disappointing, £44.4m gives the stock a free cash flow yield of 7.3% – potentially decent value. With debt now under control, LTG's cash generation suggests to me that a larger dividend might be affordable, given the current yield of 2.0%.

Trading commentary: the company says it renewed "all major client contracts" over $10m last year and grew revenue in Latin America and the Middle East.

Profits at from the flagship GP Strategies business are now said to have doubled since its 2021 acquisition for £284m. At the time, we were told that GP Strategies was expected to generate an adjusted operating profit of $26m in 2021, so the purchase price was pretty punchy.

The slide pack accompany the results reveals that GP Strategies generated $418m of revenue last year, with an adjusted EBIT margin of 13.5%. That implies adjusted EBIT of $56m, or around £45m. The purchase price is starting to look more reasonable, I think.

However, it's worth noting that GP Strategies revenue fell slightly last year. The company blames this on macro conditions and integration challenges, but surely integration should largely have been accomplished by now?

Outlook: 2024 revenue is expected to be in line with 2023, excluding the impact of disposals. The company says it's targeting an increase in adjusted operating profit this year, as margins continue to improve.

Broker forecasts suggest adjusted earnings of 8.3p per share. This prices the stock on less than 10 times earnings and would represent an increase of 6.4% on last year's figure of 7.8p per share.

However, more generous dividend payouts seem unlikely – chief executive Jonathan Satchell says the company will resume acquisition activity from this year, now that debt levels have been reduced.

My view

After a period of major acquisitions, LTG is consolidating and working to include margins and cash generation. On balance, I think it's reasonable to expect a return to top line growth when economic conditions improve.

However, I have a couple of concerns around this business as a potential investment.

First of all, I can't completely ignore the possibility that revenue is flat because some of the companies LTG has previously acquired are simply not performing as well as expected.

Secondly, I would rather see a focus on organic growth than the planned resumption of acquisitions from this year. This would provide clearer evidence of the underlying quality of the business and allow for more generous dividend payments, funded by free cash flow.

For these reasons, I don't think Learning Technologies is likely to end up in my portfolio in the near future.

As always, please let me know what you think of the topics and companies I've covered in this note. Drop a comment below, or contact me directly.

Roland Head

Disclosure: Roland owned shares in RWS Holdings at the time of publication.

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.