Dividend notes: looking for cyclical buys - CCH, VCT, RWA (11/07/23)

In my dividend notes today I cover recent updates from FTSE 100 firm Coca-Cola HBC, FTSE 250 plastics specialist Victrex, and recruiter Robert Walters.

Welcome back to my dividend notes. Today I'm covering some backlog items from last week. These include a cash-rich small cap share and a FTSE 100 drinks business I think could be interesting.

Companies covered:

- Coca-Cola HBC (LON:CCH) - I think this soft drink bottling and distribution business has some of the hallmarks of a quality consumer defensive business. I do have a few niggling concerns, though. For now, it's on my radar for further research.

- Victrex (LON:VCT) - the plastic firm's Q3 update confirms full-year guidance, following June's profit warning. However, a 38% slump in volumes during the quarter suggests to me that there's still some risk of another profit warning. I remain interested, but on the sidelines.

- Robert Walters (RWA) - this cash-rich and profitable recruiter looks good value to me on a cyclical view. It's definitely on my radar as a possible dividend share.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Coca-Cola HBC (CCH)

"Coca-Cola HBC announces that, after a stronger than anticipated finish to the first six months of the year, it is upgrading its 2023 earnings expectations."

FTSE 100 member Coca-Cola HBC (also known as Coca-Cola Hellenic Bottling Company) is one of the main bottling and distribution partners for US drinks group The Coca-Cola Company (NYSE:KO).

I just want to create a brief placeholder for this company covering some initial notes I've made. I'm interested because I think this is probably a good quality business and could potentially be an interesting quality dividend stock.

CCH operates in 29 countries across western and eastern Europe, plus Russia, and some African states. It was Greece's largest listed company until 2013, when the group transferred its listing to the UK in the midst of the eurozone financial crisis. CCH is now a FTSE 100 member.

Trading update: in a half-year trading update on 7 July, CCH said that performance in June – a key month – had been better than expected. Management now expects to report "strong" growth in adjusted operating profit for the first half of the year, driven by "double-digit" sales growth and operating leverage.

The company reports good improvements in price/mix - in other words, increasing prices and selling more higher-margin products.

Outlook: 2023 full-year adjusted operating profit is now expected to rise by 9%-12%, compared to previous guidance of up to 3%.

Broker consensus forecasts have been twitched higher and now suggest earnings of €1.80 per share for 2023, giving a forecast P/E of about 15. An 8% dividend increase is expected, giving CCH shares a prospective yield of 3%.

My view

The Coca-Cola business is much broader than just Coke. It also includes a huge range of soft drinks, tea, coffee and alcoholic beverages. The affordable, everyday nature of many of these purchases should make this a good defensive investment, in my view.

I don't think the shares look too expensive, either, on c.15x earnings.

However, when compared to UK-listed alternatives such as Britvic, AG Barr, or Diageo, I think there are a couple of points about the group's ownership and business that might be worth noting:

Brands: CCH has huge expertise in local manufacturing and regional distribution. But it doesn't own many of the brands it sells – the vast majority are produced under licence from Coca-Cola.

I don't expect this long-term relationship to change. But it could change and I think it does mean that shareholders don't have any claim on the value of these brands and products.

Location: CCH is incorporated in Switzerland, not the UK.

Ownership: The group is effectively controlled by two dominant shareholders that control more than 23% each - The Coca-Cola Co and Luxembourg-based vehicle Kar-Tess Holdings SA.

My impression is that Kar-Tess Holdings SA represents the interests of the Levantis-David Group, who previously owned CCH before its flotation. Certainly, the board contains a number of non-executive directors with the surname Levantis.

As a potential investor, I would assume that this ownership structure gives external shareholders, including institutions, very little influence over how the company is run.

On the other hand, I'm generally in favour of family ownership. I think it often provides a welcome long-term perspective.

Russia: CCH still operates in Russia. Following Coca-Cola's exit from this market, CCH restructured its (sizeable) Russian operations to a "self-sufficient business model focusing on local brands". Arguably, this could yet give rise to reputational and financial risk, although I don't see this as a huge concern.

Final thoughts: for now, Coca-Cola HBC is one I'll keep watching. I plan to take a closer look at the group's half-year results in August to expand my knowledge of this business and take a closer look at its financial qualities.

Victrex (VCT)

"Overall, our Outlook is unchanged from what we recently communicated"

Updates are coming thick and fast from this specialist plastics manufacturer, which has a £1.3bn market cap and is a FTSE 250 member.

I previously commented on Victrex in May (half-year results) and June (profit warning).

The most recent update came on 6 July and covers trading for the three months to 30 June. Group revenue fell by 23% to £72m, with volumes of PEEK plastic down by 38% to 818 tonnes.

Although this is a big drop, it does appear to confirm an improvement in average selling prices, which have now recovered to £85/kg on a year-to-date basis. Full-year guidance is for ASP to be above £84/kg.

Management say that weaker demand and destocking are continuing across multiple markets, particularly electronics, energy/industrial and value-added resellers.

Aerospace is said to be seeing good growth, while automotive demand is "stable".

Revenue fell by 8% during the first nine months of the year, with volumes down 23%. This run rate is in line with June's guidance for revenue to fall by 6%-10% across the year to 30 September.

However, given the 23% revenue decline in the third quarter, I wonder if full-year performance could still miss guidance. My sums suggest that if Q4 revenue falls by more than 20% compared to the same period last year, then full-year revenue would fall by more than 10% from last year's figure of £338m.

Hitting guidance appears to depend on market demand and pricing stabilising over the summer. I don't know how likely this is.

Outlook: chief executive Jakob Sigurdsson says that full-year guidance is unchanged since June's profit warning.

Adjusted pre-tax profit is expected to be between £80m and £85m.

Consensus forecasts suggest earnings of 83p per share, putting the stock on a forecast P/E of 17.

My view

I remain interested in this business as a potential member of my dividend portfolio.

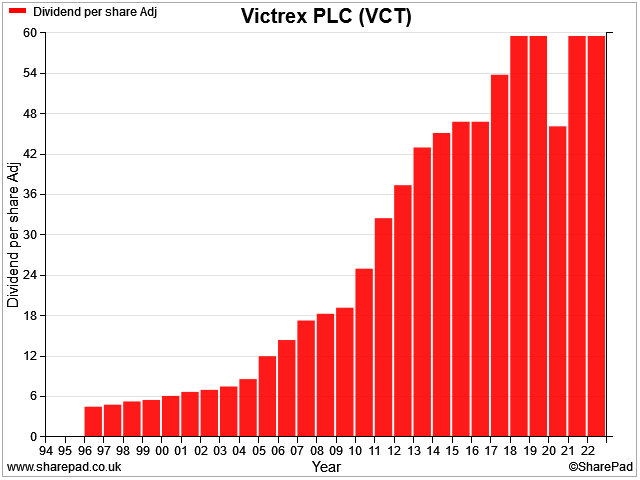

Except during the pandemic, Victrex's dividend has never been cut since its 1995 listing – 27 years. With the yield now approaching 4%, I think the valuation could be starting to look quite reasonable.

However, I wonder if we could still see another profit warning this year. From what I can see, meeting full-year guidance could still be challenging in such weak markets.

More generally, I think Victrex is a good quality business with some attractive assets. But I wonder if growing competitive pressures means that its growth potential and pricing power aren't quite as strong as they once were.

In the midst of a broader downturn, it's sometimes hard to separate out the macro and the micro influences on a company's performance. But I expect the picture to become clearer over the coming months and will continue to follow this story with interest.

Robert Walters (RWA)

"candidate confidence and time to hire are not yet showing the anticipated signs of sustained improvement"

Recruiter Robert Walters issued a profit warning in June and reiterated its cautious outlook in last week's Q2 trading update.

However, this stock has been steadily rising up my dividend screening results in recent months. At the time of writing, this £300m market cap business is ranked among the top 10% of UK stocks by my scoring system.

You may wonder why this is, given the economic headwinds facing the business. Put simply, when I'm buying cyclical stocks for income, I'm looking for a combination of quality metrics and a cyclically-low valuation. In other words, I want the shares to look cheap based on average earnings through the cycle.

Robert Walters appear to fit this bill. The stock has a long-term average return on capital employed of around 18%, remains profitable, and has ample net cash to support the dividend. I'm confident its performance should improve when market conditions recover.

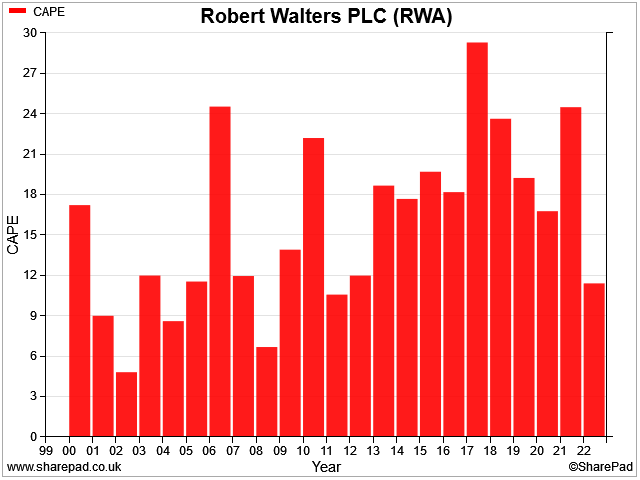

In terms of valuation, RWA shares currently trade on just seven times 10-year average earnings (the cyclically-adjusted P/E, or CAPE). According to SharePad, this is the cheapest they've been since 2011 and only slightly more expensive than in 2008.

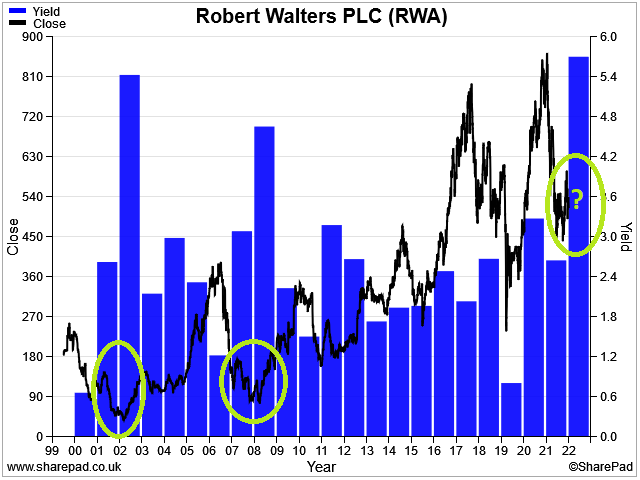

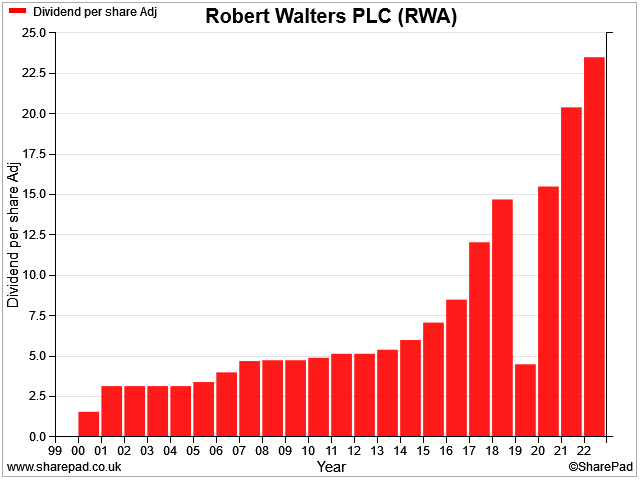

In addition, Robert Walters' dividend yield is currently at a level only seen during previous recessions of 2001/2 and 2008/9.

Although past performance is no guarantee of future returns, on both of these previous occasions, buying RWA shares would have been a profitable cyclical trade:

Trading update: let's take a look at the main points from last week's update.

The company reported net fee income down by 11% during the second quarter. This represents a reversal of the 4% growth seen in Q1, but it's worth remembering that these figures are comparisons with the same period last year, which was a record year for the business.

The US and China were the biggest fallers:

- China: net fee income down 37% year-on-year, "economic bounceback from Covid-related disruption is yet to materialise".

- USA: net fee income down 47% due to "significant disruption to hiring" in the finance and technology sectors. No surprise really, given the big layoffs that have been taking place.

Headcount has been cut by 3% as the company controls costs and net cash at the end of the quarter was almost unchanged at £69.9m – equivalent to more than three years' dividends at current levels.

Outlook: new chief executive Toby Fowlston believes that underlying demand in the employment market remains sound and that hiring activity will recover when market confidence improves.

Although last week's quarterly update didn't provide any fresh financial guidance, analysts covering the stock have trimmed back their estimates again since the numbers were published.

The latest consensus estimates I can see suggest earnings of about 30p per share this year, down from 50p before June's profit warning.

That prices RWA shares on about 14 times forecast earnings, with a still-covered prospective dividend yield of 5.8%.

My view

I'm not calling the bottom, but the combination of a double-digit P/E and an attractive yield looks like a possible cyclical buying opportunity to me. The company's £70m cash pile means that a dividend cut seems unlikely to me, even if earnings remain weak for a time yet.

The payout was not cut in 2002 or 2008, either:

I've been a fan of this business for some time and it's certainly on my radar at the moment.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.