Dividend notes: no recession here - CREI, CPG, HAT (10/05/23)

I review the latest updates from UK dividend shares Custodian REIT, Compass Group and H&T Group.

Welcome back to my dividend notes. Today I'm looking at three very different businesses, all of which claim to be trading very well.

Companies covered:

(click on the link to scroll to the relevant section)

- Custodian Property Income REIT (LON:CREI) - a very solid Q4 and full-year update, in my view. I think this regional commecial property specialist looks well-run and fairly valued.

- Compass Group (LON:CPG) - a strong update from this FTSE 100 catering outsourcer. I remain a fan, but it's just too expensive for me.

- H&T Group (LON:HAT) - this pawnbroking and high-end watch retail business continues to perform well and is trading in line expectations. The shares look reasonably valued relative to forecast profit growth.

This is a review of the latest results from UK dividend shares that are in my investable universe and may appear in my screening results.

Dividend notes is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

Custodian REIT (CREI)

"strong leasing momentum driving income and supporting fully covered dividend"

This £400m REIT specialises in regional commercial property and was founded by Ian Mattioli, the founder and CEO of AIM-listed wealth manager Mattioli Woods. Both Mattioli and MTW are significant shareholders in CREI.

The trust promises to provide NAV growth and "high and stable dividends". Let's take a look.

Q4 update: today's trading update covers the three months ended 31 March 2023, which is the end of Custodian's financial year.

The numbers seem fairly positive to me, given wider market conditions. Here are the main financial highlights:

- EPRA earnings per share of 1.4p (Q3: 1.5p) and 5.6p for FY23 (FY22: 5.9p).

- Q4 dividend of 1.375p giving a full-year dividend of 5.5p per share, 102% covered by EPRA earnings

- £2.5m of new rental income secured during the quarter, 5% ahead of ERV (estimated rental value)

- NAV of £437.6m, orr 99.3p per share (31 Dec 2022: £440.0m/99.8p)

- 24.7% loan-to-value (31 Dec 22: 27.1%), with weighted cost of debt of 3.4%

- Occupancy: 90.3% (31 Dec 22: 89.9%)

- 84% of vacant property is being refurbished or under offer to let

According to the REIT's investment manager, "property pricing has reacted quickly to the new interest rate environment" and "valuations have largely stabilised during the quarter".

Custodian says it is continuing to invest in refurbishing its properties to improve energy efficiency ahead of new regulations, a theme also mentioned by Derwent London last week.

The trust says that the value of its portfolio fell by 11.8% over the 12 months to 31 December, outperforming a 17% decline in the wider UK commercial property sector. Management say this is due to a focus on diverse regional property and income returns.

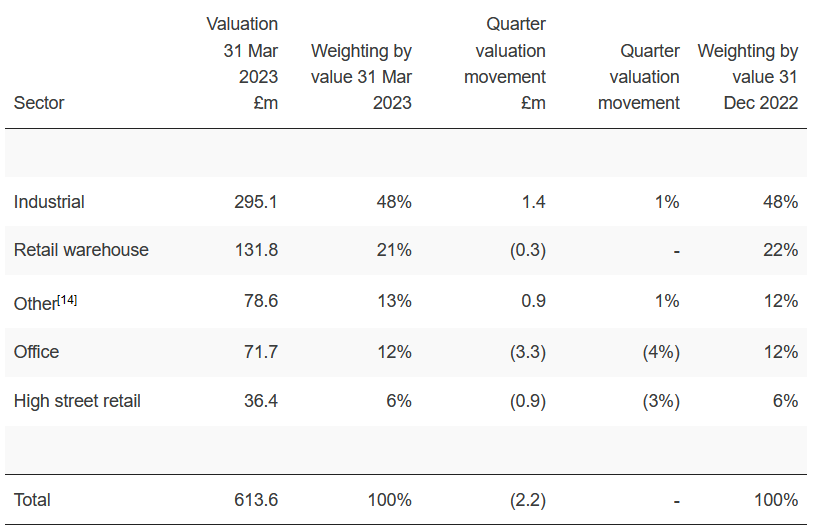

The latest portfolio breakdown shows around half of assets are industrial units, with the remainder split across classes.

The portfolio's current rental yield is 5.8%, but management says that this has the potential to rise to 7.3% if the portfolio can be fully let at estimated rental values.

I'm not sure how realistic this state of letting nirvana might be, but I think it's fair to say there is room for some uplift as leases are renewed and vacant properties let.

(There's a useful glossary to property jargon on the British Land website)

Outlook: sounds confident:

“We remain confident that our ongoing intensive asset management of the portfolio, which still offers a number of wide-ranging opportunities to add value, will maintain cash flow and support consistent returns. Coupled with the strength of the Company’s balance sheet, this will continue to support our high income return strategy.”

Broker consensus forecasts ahead of today suggested FY24 earnings of 5.9p per share and a dividend of 5.6p, giving a yield of 5.9%.

The market appears to remain confident in the value and profitability of this REIT – the shares trade at a discount to NAV of just 7% as I write.

My view: I looked at Custodian REIT elsewhere last year and was impressed. I remain very positive after reviewing this update. As far as I can see, the trust has a coherent strategy, a sound balance sheet and decent management.

The main risk I can see is that the UK economy takes a turn for the worse and suffers a more severe slowdown than expected. That could have a knock-on impact some of CREI's tenants.

However, at current levels, I would say these shares look fairly valued and potentially attractive as an income play. This is a REIT I would consider owning.

Compass Group (CPG)

"Strong half-year results, raising FY 2023 guidance and announcing

a further share buyback of up to £750m"

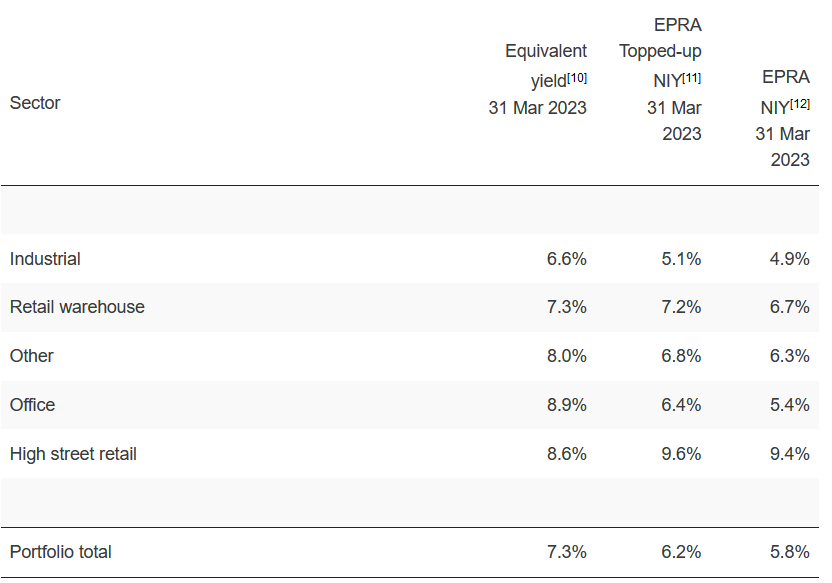

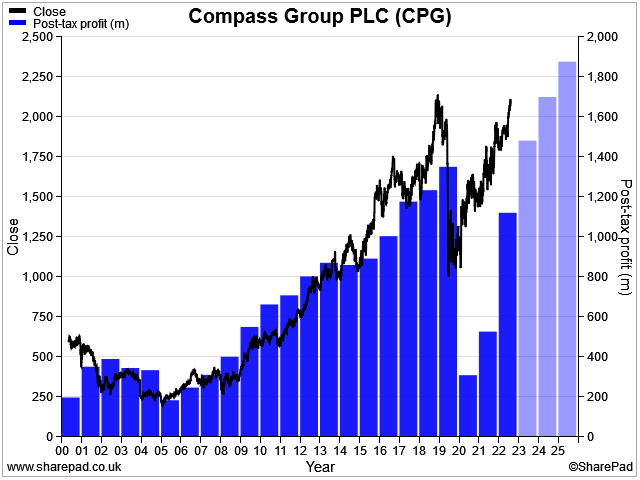

The FTSE 100 catering outsourcer had a torrid pandemic, but has bounced back very strongly. Profits are now back at pre-Covid levels, as is the group's share price:

Today's half-year results included details of strong trading so far this year:

- Revenue up 36% to £15.8bn

- Operating profit up 37.6% to £878m

- Operating margin: 5.6% (H1 2022: 5.5%)

- Earnings per share up 36.3% to 36.4p

- Underlying free cash flow up by 63.9% to £590m

- Net debt/EBITDA reduced to 1.1x

- Interim dividend up 59.6% to 15.0p per share

Management says that market conditions remain positive:

- 5% of revenue from net new business

- First-time outsourcers contributed c.45% of new business, driven by big savings available on food costs due to Compass's economies of scale

- "strong client retention rate"

Segmental results: Compass operates in a wide range of sectors, serving meals in offices, factories, schools, hospitals, leisure venue, defence installations and remote mining camps.

There's no breakdown of these sectors in today's results, but what's clear is that Compass's success is driven by its operations in North America. These are larger and more profitable than any other region and generated 80% of underlying profit during H1:

Perhaps unsurprisingly, the company plans to change its reporting currency from pounds to US dollars next year. FTSE 100 investors should probably be thankful the company is not thinking of moving its listing to the US as well.

Upgraded FY23 outlook: Compass has upgraded its guidance for the year to 30 September 2023:

- Underlying operating profit growth "towards 30%" (previously "over 20%")

- Organic revenue growth of "around 18%" (previously "around 15%")

- Underlying operating margin of 6.7%-6.8% (previously "above 6.5%")

Compass shares have hardly moved today despite this news, which suggests to me that a rosy outlook was already priced into the stock.

I estimate a forecast P/E of c.22x earnings and a 2.1% dividend yield.

My view: prior to the pandemic, I'd admired Compass's progress for many years, without owning the stock.

This high-achieving business always looked too expensive to me and it still does, with an EBIT/EV yield of under 4%.

In my view, Compass shares are already priced for good news and could slip on any disappointment. I'd look to buy these shares in a market sell-off.

However, I could be missing out. Compass's capital-light business model generates high returns on equity despite its low margins. If the company can maintain a decent rate of growth, the shares could continue to perform well.

H & T Group (HAT)

"The Board confirms that it expects trading and performance to continue in line with market expectations."

H&T is the UK's largest pawnbroker and is also an established retailer of new and secondhand jewellery/high-end watches.

I might not normally cover this small cap, but H&T currently appears in my dividend screen results with a respectable score and a near-5% yield. So I'm keen to keep tabs on performance in case it becomes a portfolio candidate.

Today's AGM update confirms performance in-line with expectations and reports strong trading:

- strong demand for pawnbroking, January and March were record months for lending

- Pledge book was £106.5m at the end of April, up from £100.7m at the end of last year

- Retail sales (jewellery and watches) to the end of April were up by 13% year-on-year

- However, the retail business is seeing some margin pressure and also notes "change of sentiment of some customers towards value". This is apparently affecting demand for "certain higher value watch brands".

- Gold purchase volumes as expected, with scrap margins benefiting from rising gold price

Outlook: the board confirms that the business is trading in line with expectations.

According to broker consensus forecasts, this suggest 2023 earnings of 55p per share, a 48% increase from last year.

Analysts expect a dividend of 20.9p per share, an increase of 40% from last year.

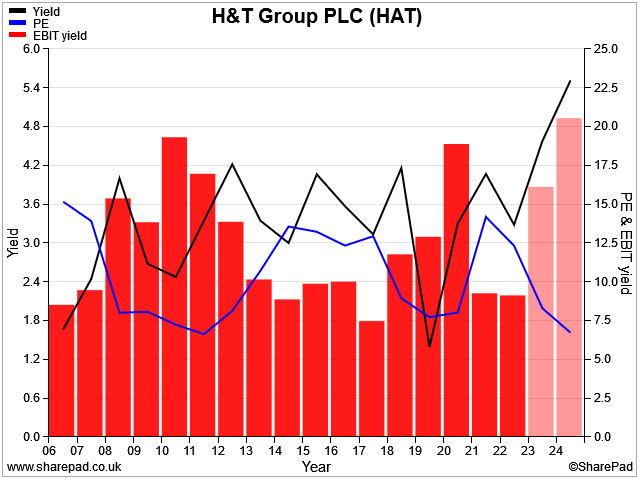

These estimates price H&T shares on a 2023 forecast P/E of 8.0, with a 4.7% dividend yield.

My view: H&T is a market-leading business in its sector and appears to be performing well.

Inflation and cost-of-living pressures are likely to be positive for the pawnbroking business, although perhaps more mixed for H&T's retail operation.

Although the shares are trading close to record highs, this is a larger business than it once was. Based on broker forecasts, the stock's valuation could be at the lower end of its historic range:

If H&T can continue to deliver on expectations, I think the shares could still offer value at current levels.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.