Dividend notes: classy contenders despite uncertainty - DLN, MGNS, SPT (04/05/23)

I review the latest updates from UK dividend shares Derwent London, Morgan Sindall and Spirent Communications.

A busy day on the RNS feed today, so I've just picked a few more interesting/less frequently covered stocks to look at, rather than trying to look at everything.

This is a review of the latest results from UK dividend shares that I don't own but which are in my investable universe and may appear in my screening results.

Dividend notes is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

Companies covered:

(click links to scroll to the relevant section)

- Derwent London (LON:DLN) - this London office REIT has a good quality portfolio and trades at a big discount to NAV. I think the shares could offer value.

- Morgan Sindall Group (LON:MGNS) - today's update reveals a stable order book and strong cash position. I remain a fan of this well-run business.

- Spirent Communications (LON:SPT) - Q1 in line, but "continued to see customer order delays". H2 profit weighting is a risk, but the shares have already de-rated heavily. I'm interested.

Derwent London (DLN)

London, particularly the West End, is busy and people are back in the office.

This FTSE 250 REIT owns 5.5m square feet of commercial property in central London. The company's portfolio was valued at £5.4bn at the end of 2022, which it says makes it the largest office-focused REIT in London.

Derwent specialises in buying run-down buildings in impoving locations and then carrying out comprehensive redevelopment or refurbishment.

Most of the firm's properties are in the West End of London and the Tech Belt area (e.g. Shoreditch/Whitechapel/Clerkenwell).

Today's Q1 business update seems quite positive to me:

New lettings: Q1 letting activity totalled £17.1m at an average of 6.6% above December 2022 ERV (estimated rental values). New tenants included Uniqlo (flagship retail unit on Oxford street), asset manager PIMCO (pre-let, under development) and engineering consultancy Buro Happold.

Occupancy: management says that the EPRA vacancy rate in the portfolio was 4.9% at the end of March, improved from 6.4% at the end of 2022.

Leverage: Derwent's EPRA loan-to-value ratio (LTV) fell by 0.8% to 23.1% during the first quarter (Dec 2022: 23.9%).

Disposal proceeds of £53.6m offset capital expenditure of £29.1m. Net debt fell to £1,225.1m (Dec 2022: £1,257.2m).

My view: office property prices are under pressure at the moment, due to investor concerns about reduced demand (WFH) and new environmental rating requirements.

However, I think Derwent London is better-positioned than most rivals to succeed in this environment. The firm's properties are carefully chosen and its strategy of redevelopment means that it can add value and ensure properties meet current sustainability standards.

Management say that the portfolio is already 85.7% compliant with 2027 MEES legislation (EPC C or above) and 65.3% compliant with expected 2030 rules requiring EPC B or above.

At a last-seen price of 2,322p, Derwent London trades at a 36% discount to its December 2022 EPRA NTAV of 3,632p per share.

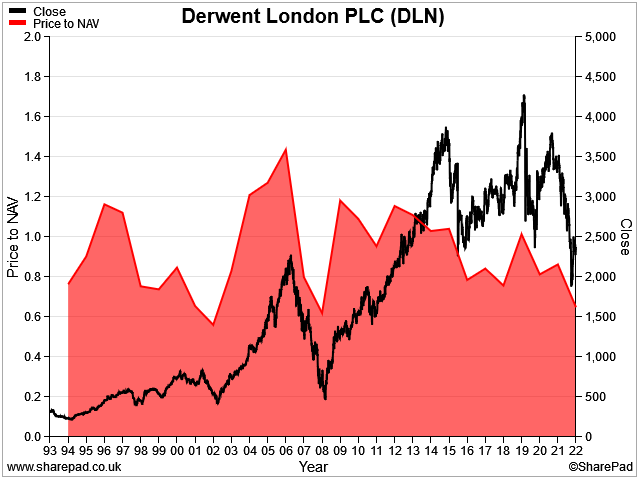

This NAV figure fell by 8% last year and it's possible that it will fall further this year. But this is the stock's biggest discount to NAV since 2008, according to SharePad data:

My feeling is that Derwent London shares are probably good value at this level, on a medium-term view.

The dividend yield is quite low, at 3.5%. But if the shares return to trade at book value over the coming years – as they have in the past – then they could offer 50% upside from current levels.

Morgan Sindall Group (MGNS)

Trading since the start of the year has been as expected and the general market conditions coming into 2023 have continued to ease, with inflation falling in certain areas.

I recently covered construction and regeneration group Morgan Sindall in an in-depth stock review. Although this is a sector I normally avoid, I can't help but be impressed by this company's strong record.

Today's update is only an AGM statement, but I think it's interesting for what it reveals about trading conditions and the company's outlook.

Inflation: rising material and labour costs have hit construction groups, but the company says they are now starting to ease.

Order book: Morgan Sindall's secured workload was £8.8bn at the end of March, 2% higher than at the same point last year.

Construction orders are up 9% versus the prior year (£4.9bn), while regeneration work is down 6% versus the prior year (£3.9bn).

Divisional performance: the construction business appears to be performing well and is expected to deliver revenue growth at target margins.

Fit Out (office space) is seeing "very strong" trading, with encourgaging enquiry levels.

Housing seems to be the weak spot. In partnership housing, sales activity remains well below prior-year levels but has improved since the start of the year. This reflects recent updates from housebuilders that I've covered here (PSN, TW, BDEV).

The property services business also appears to have run into problems relating to "disappointing contract delivery". Profit margins are expected to be lower, despite rising revenue.

This kind of problem is a perennial risk with low-margin contractors and outsourcers, hence why I tend to avoid them. However, in this case I think it's unlikely to have a big impact at group level – property services only contributed 3% of adjusted profit last year.

Balance sheet/cash: Morgan Sindall's reporting (and balance sheet) are second-to-none in this sector, in my opinion. Today we learn that average daily net cash from 1 January to 2 May was £281m – almost unchanged from £278m during the same period last year.

My view: I'm a long-term fan of this business, which has a track record of generating high returns on capital employed (and plenty of cash).

At current levels, the stock offers a 6% dividend yield covered twice by forecast earnings and free cash flow.

Given the stable outlook and the group's long record, I think Morgan Sindall is worth considering.

Spirent Communications (SPT)

Full year expectations unchanged

FTSE 250 firm Spirent Communications provides "automated test and assurance solutions for next-generation devices and networks". The rollout of 5G mobile and Low Earth Orbit satellite networks are key growth markets for the group.

This business isn't immune to cyclical spending patterns and depends on major telcos for much of its growth.

The shares hit record highs during the pandemic. But after management struck a cautious note in a January update, the stock has re-rated to pre-pandemic levels:

I've been watching this de-rating with interest, as I think this business could be the kind of long-term compounder that might fit well in my portfolio.

Q1 trading: Today's first-quarter update confirms "important 5G and Positioning wins in the period".

However, revenue for the quarter was 20% below a "very strong comparator period" last year.

The orderbook also "declined slightly" from the year-end position of $288m, although frustratingly no value was provided.

Spirent says it continues to secure "many large 5G contract wins" and that this remains a structural driver for growth.

Buyback: the company also reminds us of the £56m share buyback plan announced in April. Spirent reported a 2022 year-end net cash position of $210m, so this doesn't seem unreasonable to me.

Outlook: it's clear there are still some potential headwinds (my bold):

As expected, and consistent with wider industry dynamics, we have continued to see customer order delays but remain confident that customer momentum will pick up later in the year.

While the company has left full-year guidance unchanged at this point, management expect a "materially heavier weighting to second half".

I'm not sure how much visibility the company has of customer spending plans, but I think it's sensible to assume there's a material risk that full-year performance will miss current forecasts.

My view: Spirent has plenty of cash and doesn't appear to be in any danger of losing money. I think the company can afford to continue investing and hopefully stay aligned with customer needs, in preparation for future spending rounds.

My guess is that we could see a mild profit warning later this year, but I think some of the risk is already priced into the shares.

Spirent shares offer an 8% free cash flow yield based on last year's results, with similar cash generation expected this year.

The stock's forecast P/E of 14 and 3.4% dividend yield seem reasonable to me, for a debt-free company that's historically generated a 20% return on equity.

My main concern is that the business could lose share to key rivals, or perhaps fail to keep pace with network operators' requirements. But as things stand, I'm interested in Spirent and am considering the stock as a possible investment.

Disclaimer: This is a personal blog and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.