Dividend notes (27/04/23): optimism vs uncertainty - TW, SBRY, BARC, SXS

I review the latest results and updates from UK dividend shares Taylor Wimpey, Sainsbury's, Barclays, and Spectris.

Results and trading updates are continuing to flow from the dividend-paying companies I follow. In today's update there's mostly good news – albeit with some caveats.

This is intended to be a brief review of the latest results from UK dividend shares that are in my investable universe and are likely to appear in my screening results at some point.

This is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

Companies covered:

(click to scroll to the relevant section)

- Taylor Wimpey (LON:TW) - this housebuilder appears to be performing a little better than Persimmon, which I covered yesterday.

- J Sainsbury (LON:SBRY) - a solid set of results, but low profitability suggests to me that the shares are fully priced at current levels.

- Barclays (LON:BARC) - good progress with few signs of problem. Good value at current levels, in my view.

- Spectris (LON:SXS) - good but a little pricey for me right now

Taylor Wimpey (TW)

"We have seen continued recovery in demand from the low levels experienced towards the end of 2022"

In yesterday's report I looked Q1 figures from housebuilder Persimmon. Today we have an AGM update from rival group Taylor Wimpey covering the year to 23 April.

I thought it might be interesting to compare the two firms' performance so far this year.

Sales rate: Taylor Wimpey's management says that net private sales have fallen by 23% to 0.75 per outlet per week so far this year, including bulk deals.

Sales rates appear to have improved steadily through March and April – TW's full-year results reported net private sales rate of 0.62 for the year to 26 February.

Taylor Wimpey also appears to be outselling Persimmon, which reported a net private sales rate of 0.52 for the year to 26 February, and a rate of 0.62 for the first quarter.

However, the improving trend reported by both firms could mean that Persimmon's performance in April will have lifted its sales rate closer to that of Taylor Wimpey. We don't know.

Target completions: this week's guidance from each company makes it clear that Persimmon is expecting a bigger fall in new home completions this year than Taylor Wimpey:

| Company | 2022 completions | 2023 target | % fall (mid) |

|---|---|---|---|

| Taylor Wimpey | 14,154 | 9,000-10,500 | -31% |

| Persimmon | 14,868 | 8,000-9,000 | -43% |

Of course, we don't yet know how market conditions will develop later this year. Persimmon's greater caution may prove justified.

So far, though, the combination of lower sales rates and a bigger fall in targeted completions leads me to conclude that Persimmon is not performing as well as Taylor Wimpey in the current environment.

One reason for this could be TW's higher average selling price (ASP) and a slightly different customer demographic:

- Persimmon 2022 ASP: £248,616

- Taylor Wimpey 2022 ASP: £313,000

Build cost inflation: both companies have seen costs rise by a similar amount, but TW appears to be more optimistic:

- Taylor Wimpey: 9-10%, "beginning to moderate"

- Persimmon: 8-9%, "limited signs of easing"

Dividend: Like most of the big housebuilders, Taylor Wimpey's financial position remains strong. The company's dividend guidance is for an annual payout of 7.5% of net assets, or a minimum of £250m.

Management say this policy has been stress tested against a 20% fall in house prices and a 30% fall in volumes. The volume decline is in line with expectations for this year, but thus far house prices have been more resilient.

We'll have to see how market conditions evolve, but this payout does seem reasonable to me given the group's 2022 year-end cash balance of £863m.

Based on last year's balance sheet, my sums suggest a dividend yield of between 5.5% and 7.5% this year, based on a 125p share price.

Broker forecasts show a payout of 8.9p per share, equivalent to a yield of 7.1%.

Outlook: Taylor Wimpey strikes a cautiously optimistic tone. But the company doesn't seem to expect sales rates to improve, and suggests they could fall from current levels (my bold):

Customer interest has continued to recover from the weak conditions experienced in the final quarter of 2022. We continue to expect 2023 completions to be in the range of9,000 to 10,500, broadly equivalent to an annual net sales rate assumption of 0.5 to 0.7, with completions more weighted to the second half.

An H2 profit weighting is sometimes the forerunner of a downgrade. I think that's a risk here, as with many other businesses at the moment.

However, both Taylor Wimpey and Persimmon have healthy balance sheets that should withstand a crash, in my opinion. I don't expect any serious financial problems.

As I've said previously, I believe UK housebuilders offer value at the moment, with many trading at or below their tangible net asset values.

I would choose Taylor Wimpey in preference to Persimmon, but neither of these is the housebuilder I've bought for my dividend portfolio.

J Sainsbury (SBRY)

... delivering results at the top end of expectations

Sainsbury's shares are a perennial favourite with investors for their high dividend yield and strong cash generation.

Today's results cover the both confirm these attractions, but also highlight one reason why I don't hold this stock.

Let's start with a look at the financial summary for the 52 weeks ended 4 March 2023.

Financial highlights:

- Retail sales: (inc. VAT, excl. fuel): up 2% to £28,644m

- Underlying pre-tax profit: down 5% to £690m

- Retail free cash flow: up 28% to £645m

- Dividend: 13.1p (unchanged)

- Net cash excl. leases: £144m (2022: net debt of £285m)

- Retail underlying operating margin: 2.99% (2022: 3.4%)

- Company-adjusted ROCE: 7.6% (2022: 8.4%)

With retail sales up by just 2% and underlying pre-tax profit down by 5%, we can immediately deduce that Sainsbury's has either absorbed some cost inflation or lost market share.

The answer appears to be the former. Chief executive Simon Roberts tells us that Sainsbury's has "spent over £560 million keeping our prices low over the last two years". The company doesn't say how much it's absorbed over the last year alone, though.

According to the latest data from market research specialist Kantar, Sainsbury's market share fell by 0.3% to 14.8% over the period covered by today's results. I don't think that's too bad, in the circumstances, given the pressure on consumer incomes.

Cash generation: as Sainsbury's also includes a bank, I think the company's own measure of retail free cash flow is a useful guide to the free cash flow produced by the grocery business.

Retail free cash flow rose to £645m last year, from £503m in 2021/22. This increase was largely driven by a £174m reduction in working capital as the impact of Covid-19 dropped out of the numbers.

Management expect retail free cash flow to fall back to "at least £500m" during the current year. It looks to me like £500m is more of a baseline figure we can rely on. At the current share price, this gives a free cash flow yield of 7.5% – potentially attractive.

Profitability: Sainsbury's cash generation may be attractive relative to its share price, but the business requires £30bn of turnover and £14bn of capital employed to achieve this. As a result, profitability is slim.

- Retail free cash flow margin: 2.3%

Even the company's own adjusted profitability metrics are fairly unexciting. Both worsened last year:

- Retail underlying operating margin: 2.99% (2022: 3.4%)

- Company-adjusted ROCE: 7.6% (2022: 8.4%)

On a statutory basis, I estimate ROCE at 4.0% using statutory operating profit, or 6.9% using adjusted operating profit.

Sainsbury's specifies a pre-tax cost of capital of 9.1% in today's results. So these ROCE figures tell me that the business is unlikely to be covering its cost of capital. In other words, it's not creating any equity value for shareholders and may be destroying it.

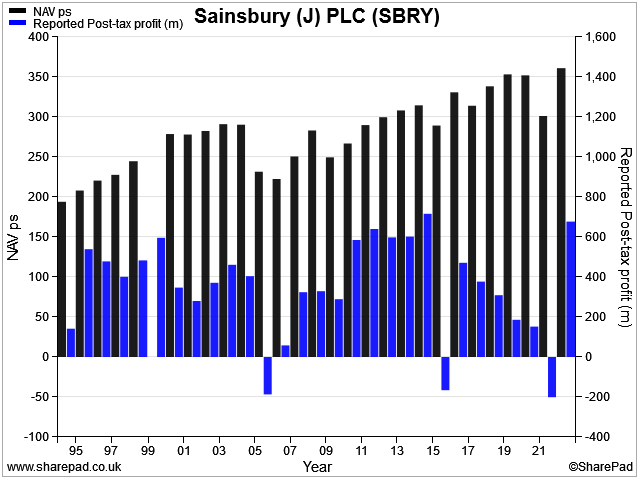

The company says it's more profitable than before the pandemic and I'm sure that's true. But taking a longer view, we can see that the group has needed to continually add more assets over the last 30 years to generate the same level of profit:

This might explain why the share price trend over the same period has been downards:

Balance sheet: Sainsbury's balance sheet equity value is distorted slightly by the impact of a large and ever-changing pension surplus.

Stripping this out (it will never be available to shareholders), I can see that the group's book value rose from £6,140m to £6,264m last year, or 266p per share.

That's a better results than I was expecting, given that the company booked a £281m impairment charge against its store estate during the year to reflect higher financing costs.

The pension situation looks under control to me, but I think a couple of points are worth emphasising.

- despite the surplus, cash pension contributions are running at c.£45m/year

- the group's final salary pension scheme had £6.9bn in assets and £5.9bn in liabilities at the end of the year. The scheme's large size means that a small change in valuations can lead to a big swing in the surplus/deficit. Future funding requirements could remain significant.

Outlook: at this early stage of the year, the company expects underlying pre-tax profit of between £640m and £700m in 2023/24. To me, this suggests a modest fall from last year's level of £690m.

As I mentioned, retail free cash flow is expected to fall to "at least £500 million".

Consensus forecasts ahead of today's results suggested adjusted earnings per share could fall by around 10 % this year. That might put the dividend under pressure, based on the 60% payout ratio policy – broker consensus is for the payout to fall to 12.1p, although I guess Sainsbury's might be able to hold it.

My view: Sainsbury's appears to be performing well, but the shares look fully valued to me on 14 times forecast earnings, with a 4.6% yield.

The company's low profitability mean that – as far as I can see – it will continue to struggle to create any lasting value for shareholders.

If I was going to invest in Sainsbury's, I would want to buy the shares at a discount to their book value. All else being equal, this would increase my dividend yield and boost my effective return on equity*.

I calculate a book value of 266p per share from today's accounts. The shares have often traded below this level in recent years – I suspect they may do again at some point:

For now, my view is that Sainsbury's offers its customers a better deal than its shareholders.

*(Accounting return on equity is based on a company's balance sheet equity. Buying shares at a discount to this book value effectively increases an investor's personal return on equity.)

Barclays (BARC)

Barclays ... remains on track to deliver its 2023 targets

My comment above about return on equity also applies to many UK banks at the moment. Barclays' Q1 results gave the shares a 5% lift, but the bank's share price of 162p still offers a 45% discount to its tangible net asset value of 301p per share.

In theory, buying the shares at this level would transform last year's 10% return on tangible equity into a more appealing return of 19%.

While the macro and sector outlook for banks isn't without risk, today's Q1 results do not suggest any fresh concerns to me.

- Pre-tax profit up 16% to £2.6bn (Q122: £2.2bn)

- Q1 return on tangible equity (RoTE) of 15.0% (Q122: 11.5%)

- Cost: income ratio 57% (Q122: 63%)

- Tangible net asset value per share: 301p (FY22: 295p)

- CET1 ratio: 13.6% (FY22: 13.9%)

- Credit impairment charges: £524m (Q122: £141m)

In the retail bank and credit card divisions, gains linked to higher interest rates appear to be offsetting a modest rise in bad debt and a reduction in consumer lending.

Barclays' corporate and investment banking division is also benefiting from higher interest rates, both on corporate deposits and through increased credit activity.

Outlook: Barclays' expects to achieve a RoTE of greater than 10% this year, which suggests the bank doesn't expect much improvement from last year's figure of 10.4%.

Credit losses are expected to remain modest.

My view: Barclays stock currently trades at a 45% discount to book value despite being on track to deliver double-digit RoTE this year. The forecast dividend yield of 5.8% looks easily affordable to me and is a further attraction.

One risk I can see is that net interest income will peak and perhaps fall as market pressure forces banks to improve deposit rates. There's also the broader risk that a recession in the US or UK will put more pressure on borrowers than is currently the case.

Even so, I think it's fair to say that Barclays shares are probably cheap at current levels.

Spectris (SXS)

Continued strong trading momentum in the first quarter

This FTSE 250 precision measurement specialist is a stock I've wanted to own but missed out on buying on a few occasions – most recently last year:

Today's first-quarter update suggests the business is performing well and clearing its order backlog as supply chains return to normal:

- 24% organic sales growth

- Book-to-bill ratio of 1.03x (i.e. new orders are slightly outpacing completed orders)

- Net cash of £278.4m at 31 March 2023

- "Investing for growth through elevated R&D and targeted M&A"

Outlook: management remain confident of delivering 6-7% organic sales growth this year, with improved profit margins.

Clearly this is well below the 24% organic sales growth figure posted in Q1. This reflects the way the group is clearing its order backlog – the second half is expected to see a more normalised performance.

As a result, profit weighting to the first half of the year is expected to be "higher than normal".

My view: I remain a fan of this business and have no serious concerns. But the outlook guidance does suggest to me that there's some risk of disappointment in H2, if the economic outlook weakens.

Spectris's H1 results are likely to benefit from the clearance of last year's backlog. But once this is gone, the group will be more exposed to the normal economic cycle.

Broker forecasts I can see suggest that adjusted operating profit this year will be broadly flat on 2022. That gives the stock an EBIT/EV yield of around 6%, by my calculation.

Consensus estimates suggest a forward P/E of 20 with a 2.2% dividend yield.

Spectris looks fairly valued to me at current levels. On a long-term view the shares might not disappoint, but I'm hoping to find a cheaper entry point.

Disclaimer: This is a personal blog and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.