Dividend notes: packaging, property, and a 9% dividend yield - WTB, SMDS, RECI

22/06/23: I review results from FTSE 100 packaging group DS Smith and Premier Inn owner Whitbread. Plus the latest from property investor Real Estate Credit Investments.

Welcome back to my dividend notes.

Today's companies include two stocks with high dividend yields that are operating in unloved sectors, and a business that's hoping to replicate its long-running UK success in Germany.

Companies covered:

- DS Smith (LON:SMDS) - this packaging group saw a big jump in profits last year as pandemic-era price rises dropped through and boosted margins. I'd like to see debt fall, but I think the shares look affordable at this level.

- Whitbread (LON:WTB) - a strong update suggests the Premier Inn model is firing on all cylinders. I like the business, but the share price looks up with events to me at the moment.

- Real Estate Credit Investments (LON:RECI) - reassuring results show stable net asset value and regular loan repayments. This isn't without risk, but I believe the 9% dividend yield looks safe (disc: I hold).

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my view only and are not advice or recommendations.

DS Smith (SMDS)

"Current trading in line with our expectations"

I've thought that the big packaging companies have offered value for some time now, so today's results from FTSE 100 packaging group DS Smith caught my eye.

Financial summary: DS Smith saw revenue rise by 11% to £8,221m last year, while operating profit rose by 65% to £733m. This big increase reflects the delayed benefit of price increases the company has secured to reflect cost increases seen in 2021/22.

Shareholders will receive a final dividend of 12p per share, giving a total payout for the year of 18p per share – an increase of 20%. While I'm sure shareholders will welcome the yield, as with Halfords, yesterday, I'm not sure these results justify such a generous increase.

My sums suggest that DS Smith's free cash flow fell by 35% to £244m last year, due to the impact of a sharp fall in energy and paper prices at the end of the company's financial year. I think the company paid for inventory it then had to sell at lower-than-expected prices.

This chart shows the price of wood pulp over the last year, from which paper and cardboard are made. Prices appear to have fallen by about 30% during the final quarter of DS Smith's financial year (y/e 30 April).

Net debt also rose, due to weaker cash flow and an increase in capital expenditure. I calculate that net financial debt rose by £122m to £1,448m last year. That seems high enough to me, for a business whose annual profits have (probably) peaked for now, at just over £500m.

The increased dividend will require 100% of free cash flow, so any deleveraging will rely on reduced spending or improved cash generation this year.

One positive from the results was that the tailwind from price increase supported a notable improvement in profitability. Operating margin for the year improved to 8.9% (FY22: 6.1%), while return on capital employed rose to 11.5% (FY22: 7.0%).

I reckon last year was the first time since 2016/17 that DS Smith's ROCE topped 10%, based on my unadjusted calculation.

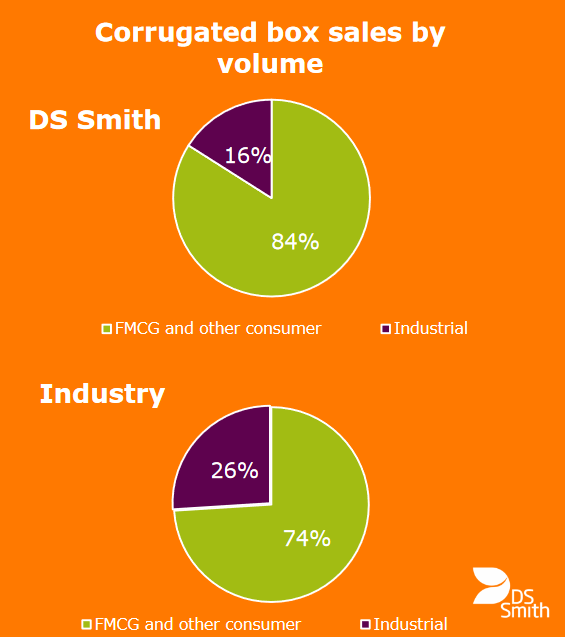

Operating summary: box volumes fell last year and the company says that overall market demand was "worse than we originally expected". Destocking and weak consumer demand are blamed – DS Smith has a greater exposure to consumer markets than the sector average.

However, the company remains confident that trends such as online retail and sustainability will continue to drive medium-term growth.

Outlook: trading so far this year is said to be in line with expectations, although box volumes are still "lower than normal".

Consensus forecasts on SharePad suggest earnings could fall by 12% to 37.7p per share this year, with the dividend unchanged at 18p.

Those estimates put the stock on a forecast P/E of 8 with a dividend yield of 6.3%.

My view: I'd like to see a reduction in leverage in this business, but fundamentally I don't see too much to worry about here.

While DS Smith isn't my top choice in this sector, I think the big packaging firms probably offer good value at the moment and could be a profitable contrarian choice.

Whitbread (WTB)

"With strong trading momentum across the Group, we remain confident in the full year outlook."

Premier Inn owner Whitbread says it's benefiting from the steady decline of the independent hotel sector and a lack of growth from branded rivals.

I reviewed this company's 2022/23 results in April and concluded that it was a good business, but probably fully priced for now. Does today's Q1 statement alter this view?

Today's first-quarter update covers March through May and shows the group making a strong start to the year. UK sales were 16% ahead of the same period last year, or 14% on a like-for-like basis.

Revenue per available room (RevPAR) was also 16% higher than last year, with the company seeing strong demand in the regions and London.

Whitbread is continuing to roll out the Premier Inn brand in Germany, which management believe offers the same attractions as the UK market in the past; lots of independent operators and a high degree of fragmentation.

The group now has 56 hotels in Germany, with a core of 18 more established sites that are said to be performing in line with expectations. Sales in Germany have more than doubled over the last year, as the group has opened new hotels and increased average RevPAR from €35 to €55.

Outlook: there is no change to financial guidance today. CEO Dominic Paul says is confident about the full-year outlook and expects to report "a strong first half result".

Broker forecasts put the shares on 20 times forecast earnings, with a 2.3% dividend yield.

My view: there's no change to my view that this is a very good business, but I still think the share price is up with events.

Real Estate Credit Investments (RECI)

"RECI continued to deliver a stable NAV and attractive annual dividend of 12 pence per share, amid challenging times and volatile markets"

I covered this specialist property investment company in May, so for more background on this high yielder please take a look at my previous update.

Following RECI's Q4 update in May, I bought some shares using some of the unallocated cash in my pension (not part of my main dividend portfolio). So I was interested to see if today's results contain any surprises.

First impressions are reassuring. The company ended the year with net assets of £337m (FY22: £344m), giving a net asset value of 147p per share (FY22: 150p).

The dividend for the year was unchanged at 12p per share, giving a yield of 9.5% at the last-seen share price of 126p.

According to the company's figures, RECI shares provided a total NAV return of 6.2% last year – that's the combination of dividends paid and changes to NAVps.

This stability is sharp contrast to the big NAV declines many REITs have reported in recent months. It suggests to me that RECI's policy of investing directly in carefully-chosen development projects is continuing to work well in more challenging markets.

Indeed, the company agreed to £155m of new lending during the year, while receiving £159m of repayments and interest. Shareholders received £27.5m of dividend payments.

8%+ interest rates: Interest payments totalled £32m on average assets of just under £400m, suggesting RECI's loans carried an average interest rate of about 8%.

May's Q4 update mentioned opportunities for issuing senior floating-rate loans at 12%+. I expect to see interest income rise over the coming year to reflect higher market rates.

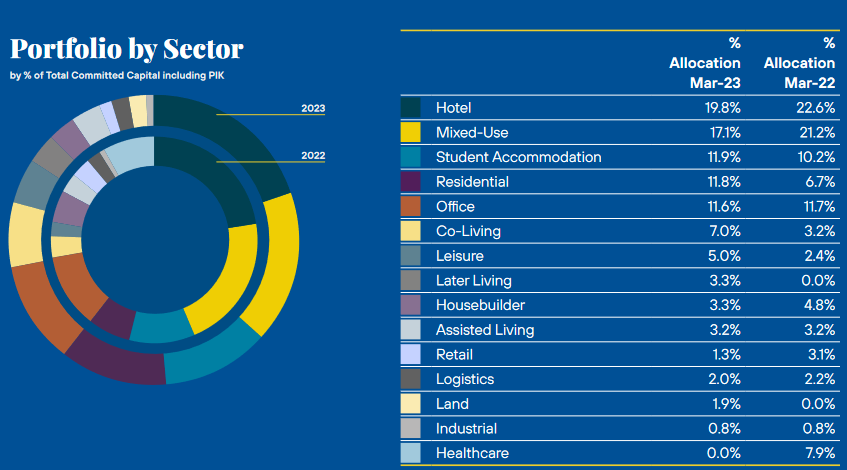

Diversified property: RECI's portfolio contained 53 positions at the end of the year. These are mainly property development projects where the company is the senior, secured lender and has a direct relationship with the borrower.

The largest exposures are in sectors relating to accommodation, but there is quite broad diversification.

Last year saw a big increase in the allocation towards residential and co-living property, presumably reflecting rental market conditions:

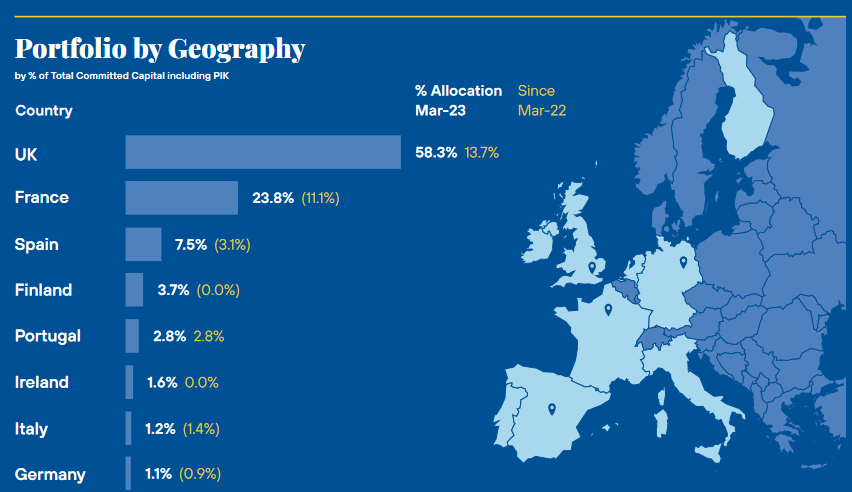

Geographically, the majority of the portfolio is located in the UK and France, with the remainder spread across Europe:

The average loan-to-value (LTV) ratio on RECI's developer loans is 59%. This is high relative to most REIT LTVs, but RECI is normally the senior secured lender in these projects. This gives it substantial influence in case of problems.

To fund these loans, the company uses about £20 of debt financing for each £100 it invests. Said differently, RECI's balance sheet has gearing of 24%. This leaves a substantial equity buffer to absorb any impairments.

However, the company's track record shows that it's usually able to persuade borrowers to inject more equity into projects that are struggling, reducing the risk that RECI will suffer loan losses.

Outlook: Last year's performance suggests to me that the company is continuing to deliver on its mandate in more difficult market conditions.

There's no specific financial guidance, but comments in the firm's Q4 update in May suggested that RECI is benefiting from tighter lending markets and is able to continue lending at attractive margins, despite rising interest rates.

The dividend is expected to remain unchanged at 12p per share, giving a yield of 9.5% at the time of writing.

My view: it's relatively unusual for RECI shares to trade below their book value – apart from the 2020 crash, this hasn't really happened since the aftermath of the financial crisis.

While this business is not without risk, my feeling is that RECI's results suggests that its model of investing directly in carefully-selected projects is continuing to work well.

I remain happy to hold the shares and collect a 9% yield, although I may sell at some point if the valuation recovers or I need the cash for something else.

Disclosure: Roland owned shares in Real Estate Credit Investments at the time of publication.

Disclaimer: This is a personal blog and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.