Dividend notes: patience could be rewarded - BAG, MAB1, JHD (27/10/23)

I review recent results from UK dividend shares AG Barr, Mortgage Advice Bureau, and James Halstead.

In this update I'm catching up with some companies that interest me and have published results over the last month or so.

Companies covered:

- AG Barr (LON:BAG) - a solid set of half-year results show sales growth in the core soft drinks business and continued investment for the future. Margin weakness remains a potential concern, but can see plenty to like here.

- Mortgage Advice Bureau (LON:MAB1) - this intermediary has been gaining market share in subdued conditions and could be well positioned for a recovery.

- James Halstead (LON:JHD) - a record set of results from this vinyl flooring specialist highlight its quality credentials and strong balance sheet, in my view. A watch list share for me.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

AG Barr (BAG)

"confident of delivering full year profit in line with recently increased market expectations"

This FTSE 250 soft drink firm owns Irn-Bru and range of other brands. I think it's a quality business. While Barr has faced some challenges around growth in recent years, I think these are starting to ease as management make selective acquisitions and continue to develop in-house brands.

This is a business I could imagine owning, so let's take a look at September's interim results, which cover the 26 weeks to 30 July 2023.

H1 results summary: sales rose by 33% to £210.4m during the half year thanks to a contribution from Boost Drinks, which was acquired in December 2022.

On a like-for-like basis, revenue rose by 10.4%. The company says this reflects market share gains and volume growth, as well as some price increases.

Pre-tax profit for the period rose by 12.6% to £27.8m, but earnings remained flat at 18.9p per share due to the increase in corporation tax rate from 19% to 25%.

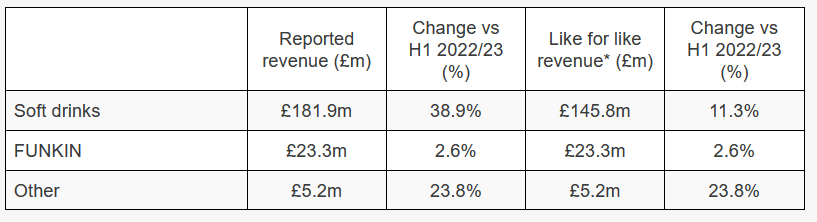

Segmental results show revenue growth across the business, with particular strength in the core soft drinks business:

Free cash flow for the half year was just £8.7m, due to higher levels of working capital relating to the Boost acquisition and seasonality. I expect cash conversion from profits to improve over the full year, as these factors normalise.

Barr ended the period with net cash of £47.3m (H1 2022/23: £61.3m), reflecting last year's Boost and MOMA acquisitions and the working capital movements mentioned above. With net cash representing nearly 10% of the market cap, the balance sheet looks very strong to me.

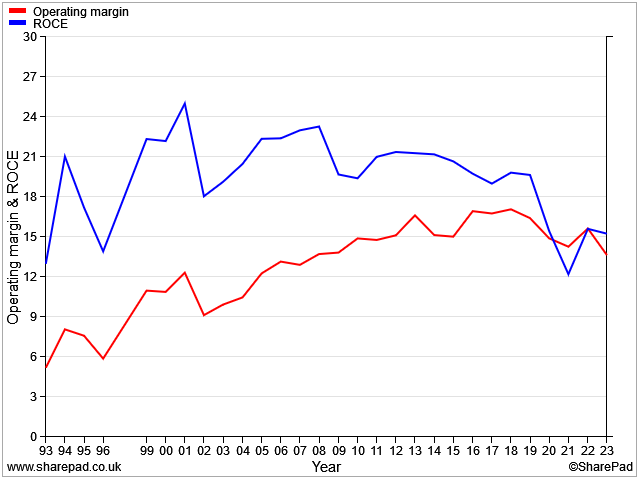

Perhaps my main concern with this business is the trend of weaker profitability seen over the last five years or so. The H1 operating margin of 12.9% is well below the 17% figure achieved in 2018.

Management says plans to rebuild operating margin over the "medium term" are "progressing well, supported by brand and portfolio development, Group manufacturing optimisation and disciplined cost control."

Dividend: the interim dividend was lifted 6% to 2.65p per share, which seems consistent with full-year forecasts for a payout of 14.5p per share. That would give a 2.9% yield at the current £5 share price.

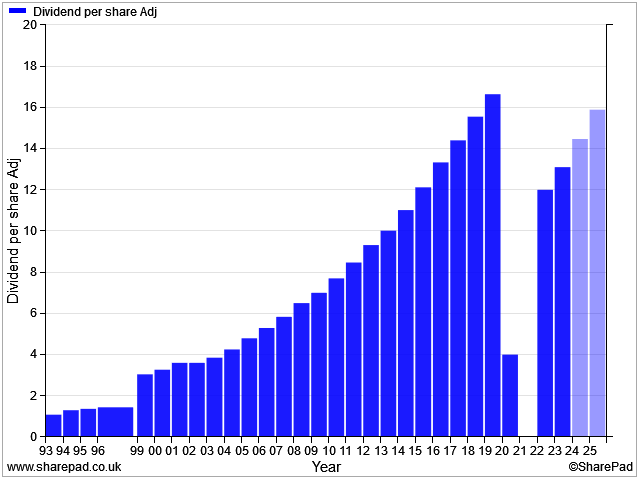

AG Barr's dividend has not been cut for at least 27 years, prior to the pandemic. The payout is being rebuilt and is expected to return to pre-pandemic levels in the next couple of years:

Although the yield isn't high, I see this as a good quality dividend stock with an excellent track record of cash-backed payouts.

Outlook: guidance in the half-year results is unchanged from the August trading update, when Barr said that full-year profit performance was expected to be "marginally above the top end of analyst expectations".

The latest consensus forecasts I can see suggest FY23/24 earnings of 32p per share, giving a forecast P/E of 15.6.

My view: I remain a fan of this business. Results over the last 12 months give a trailing EBIT yield of 9%, which is above the 8% level I use as a rule of thumb for value.

Although investment and acquisitions have held back free cash flow, I expect this to start improving from next year.

Based on the limited growth of recent years, I think the shares could be fairly priced. But if the company can deliver on forecasts for stronger growth over the next couple of years, then I think Barr could offer some value at current levels.

Mortgage Advice Bureau (MAB1)

"Market share of new lending up 19% to 8.1%"

This mortgage advisory business floated on AIM in 2014. It has more than 2,100 advisers on its books and recently reported an 8% share of new lending in the UK mortgage market.

MAB published its half-year results on 26 September 2023.

The shares have fallen by 60% from their pandemic highs and now trade substantially below pre-pandemic levels. This strikes me as potentially interesting, especially as this business has a good record of cash generation and is led by 23-year CEO and 18% shareholder, Peter Brodnicki.

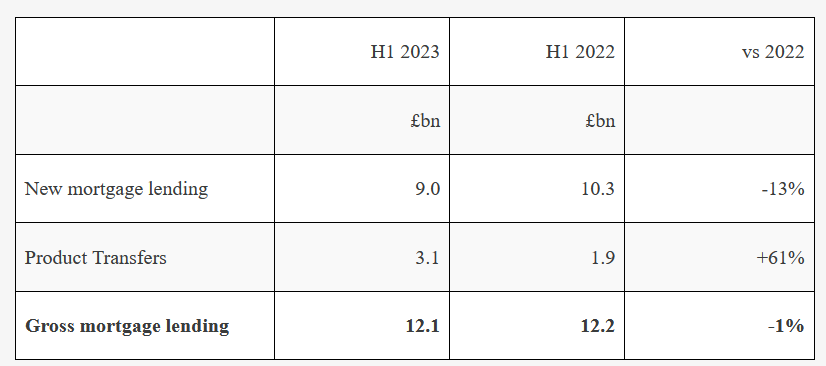

H1 results summary: it's obviously a tougher market for housing-related businesses at the moment, but MAB's half-year results suggest to me that it's doing the right things, benefiting from demand for product transfers and gaining overall market share.

- Market share of new lending up 19% to 8.1%

- Total revenue up 22% to £117.5m, including acquisitions

- Organic revenue up 1%

- Pre-tax profit down 25% to £7.6m

- Earnings down 19% to 11.3p per share

- Pre-tax margin of 6.4% (H1 2022: 10.5%)

- Gross mortgage completions -1% at £12.1bn

- Revenue per adviser up 17%

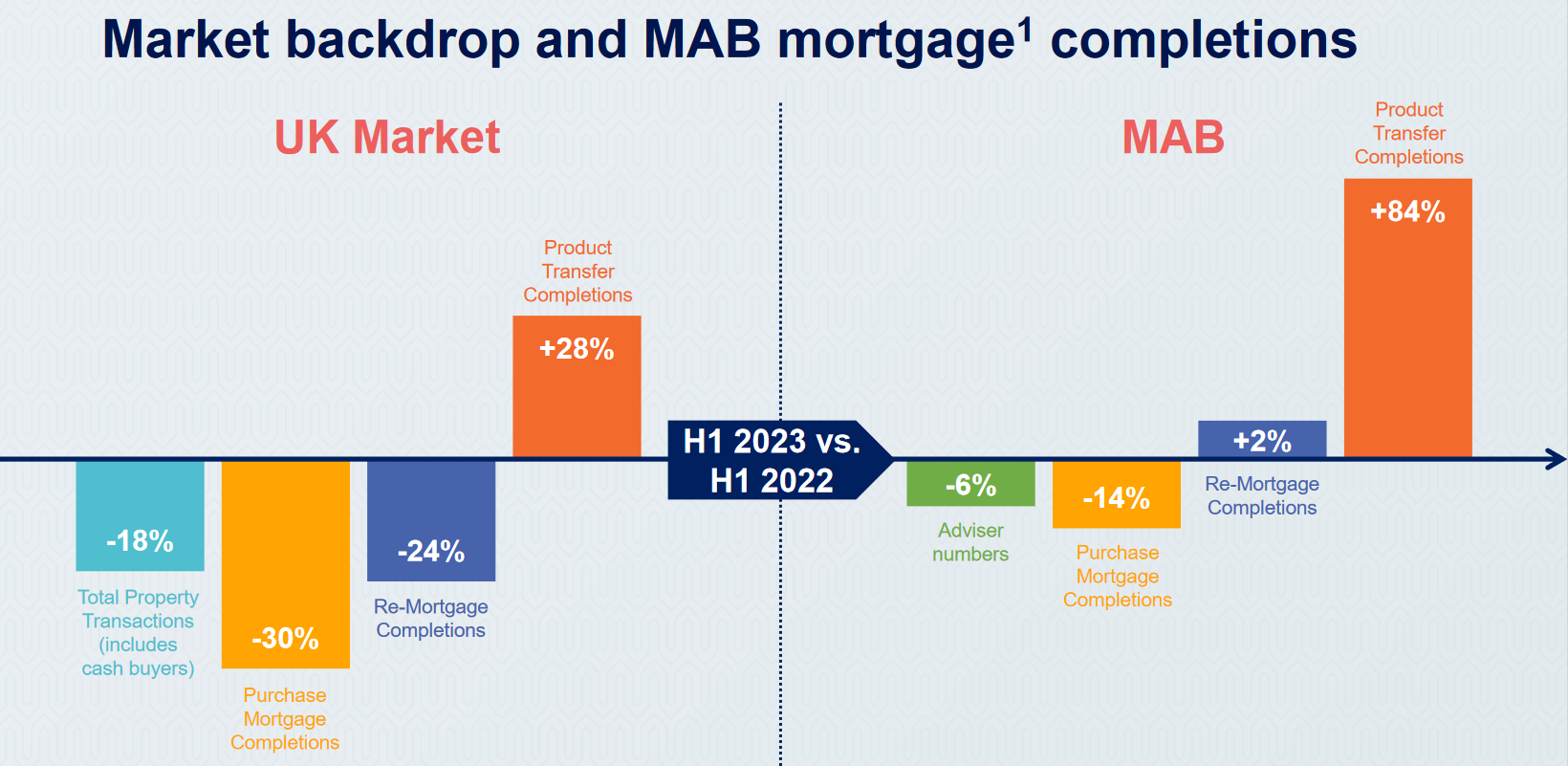

This chart shows how MAB has outperformed the wider market in these more difficult conditions, gaining market share:

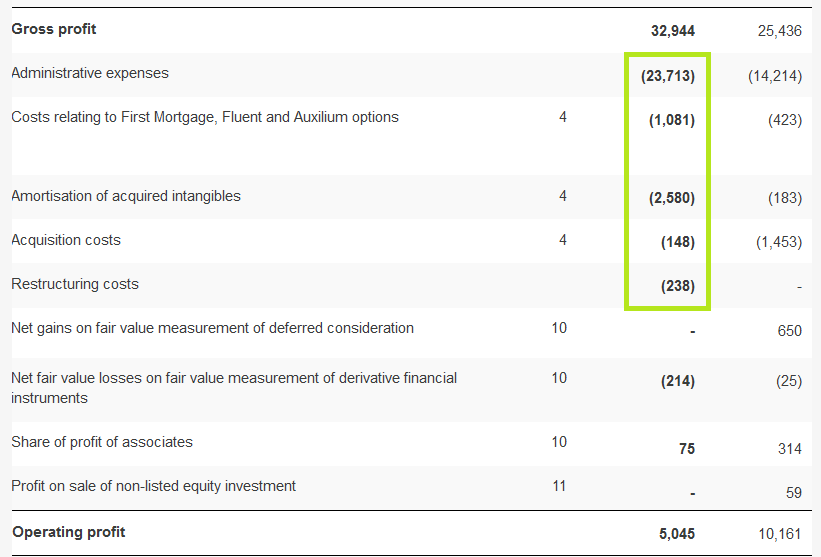

This looks like a strong result to me, but I think it's worth taking a look at the reasons for the sharp fall in profits.

One factor appears to be the switch from purchase mortgages (-14%) to product transfer mortgages (+84%), as homeowners have hunted out new fixed-rate deals.

Transfers carry lower fees, and typically also result in lower levels of protection product sales (e.g. life insurance, serious illness cover).

Reported profits have also been hit by an increase in overheads and substantial additional costs relating to acquisitions:

Fluent acquisition: MAB has been on something of an acquisition spree over the last couple of years. The largest of these deals was the £73m purchase of a controlling stake in online/telephone mortgage advice service Fluent in early 2022.

Fluent was said to have a very strong growth trajectory at that time and was expected to generate £38m of revenue/£4.2m of EBITDA in the year ending March 2022.

However, management say that Fluent has been harder hit by the housing market slowdown than its main in-person advisory business. Unfortunately, Fluent seems to have been ramping up its operations just as the market peaked:

"Fluent experienced significant growth in lead flow from price comparison websites and other national lead sources right through to the point of the mini-budget. Accordingly, the business had continued to scale up its adviser base and fulfilment capabilities in anticipation of a consistent and sustained growth path.

The significant market downturn has hit Fluent hard across all product lines, and unlike more mature first charge mortgage businesses, they have not had the benefit of a significant client bank to counter this effect.

Fluent's existing major lead sources have also been adversely affected in the short term both in terms of lead numbers and conversion potential."

Fluent contributed £19m of revenue in H1, but given the statement below, I'm not sure it's currently making any meaningful profit:

"Our acquisition of Fluent will bring significant earnings enhancement to the Group when market conditions improve."

MAB remains confident that Fluent will recover its previous profitability and growth potential when market conditions improve. I hope so. For now, I'm putting a question mark against the success of this £73m deal, which looks relatively large for a company that reported an annual profit of £12m last year.

Balance sheet: the acquisition of Fluent also had one other undesirable side effect – debt. MAB reported net cash in every year following its 2014 IPO, but took on new borrowing to fund the purchase of Fluent (in addition to a £40m share placing).

Net debt was said to be £19.4m at the end of H1. This doesn't look problematic to me in itself, but could be a further drag on cash generation and profits.

Dividend: the interim dividend was left unchanged at 13.4p per share.

Broker forecasts suggest a full-year payout of 28.1p, giving a prospective yield of 5%.

Based on the net debt position and forecast earnings of 28.7p per share, the dividend looks tight to me, but not necessarily unaffordable for a short period.

Outlook: my reading of the outlook statement is that it – almost – includes a slight profit warning, due to the underperformance of Fluent (my bold):

"Although the Board still expects the MAB Group excluding Fluent to be at least in line with its original expectations for the year, it now expects the Group to report an adjusted profit before tax of not less than £22m for the 2023 financial year, with some upside likely to materialise should market conditions normalise."

Broker consensus forecasts have edged lower since these results were published, falling from 30.6p to 28.7p per share, according to Stockopedia.

These forecasts put the shares on a forecast P/E of 20, which appears to price in some recovery in earnings in 2024.

My view: I think this is a fairly decent business and I'm encouraged by the CEO's long tenure and sizeable shareholding.

On the other hand, I think it's too soon to be sure of the timing of any housing market recovery. Against this backdrop, I am not yet entirely convinced by the Fluent acquisition.

However, it's probably fair to say that mortgage activity and MAB's profits could both recover quite quickly when housing market conditions do improve.

The shares aren't quite cheap enough to tempt me at the moment, but I'll be watching progress with interest.

James Halstead (JHD)

"I am pleased to announce a very respectable performance across the Group and another record sales performance."

I thought I'd wrap up with a quick look at the latest results from flooring manufacturer James Halstead, whose main brand is Polyflor vinyl flooring. This family-controlled AIM firm published its accounts for the year to 30 June 2023 on 2 October.

Maynard Paton and I took an in-depth look at this company in a podcast earlier this year (free to listen).

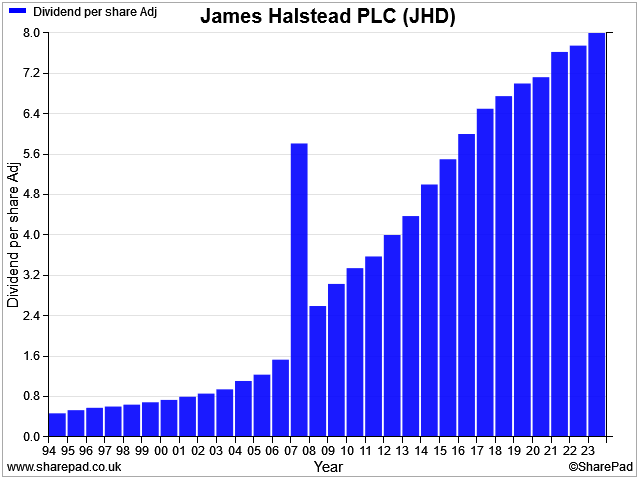

It's fair to say I'm a fan of this high-margin and cash generative business, which has an unbroken dividend growth record stretching back more than 30 years.

Halstead shares have come down somewhat recently and currently offer a 4.2% yield, so I was interested to see if the latest results highlight any potential concerns. After all, the company is exposed to the building and construction sectors.

Full-year highlights: James Halstead's results statement is refreshingly free of adjustments and simply starts by presenting statutory profits, the dividend, and the group's cash position.

- Revenue up 4% to £303.6m

- Pre-tax profit flat at £52.1m

- Earnings per share up 5.2% to 10.2p

- Full-year dividend up 3.2% to 8.0p per share

- Net cash up 21% to £63.2m (vs a market cap of £835m)

The cash position benefited from a £23m reduction in stock levels as supply chain conditions eased. This partially reverses a massive £50m investment in inventory in 2022 that was undertaken to ensure stock availability for customers.

Halstead's focuses on providing a quality product and a quality service, rather than being the cheapest. The group's strong balance sheet meant it had the cash to backup this promise when supply chain issues arose last year, without needing to borrow money.

A focus on quality has long supported high margins, which were largely maintained in FY23, despite some impact from cost inflation:

- Operating margin: 17.0% (FY22: 17.9%)

- Return on capital employed: 28.4% (FY22: 29.0%)

Dividend: as mentioned above, the full-year dividend was increased by 3.2% to 8p per share, a new record payout.

Although earnings of 10p per share suggest a low level of cover for this payout, the group's cash generation and sizeable cash position mean that the dividend continues to look very safe to me.

Based on the 8p payout/190p share price, Halstead's offers a 4.2% yield.

Outlook: one strength of this business is that it sells internationally, not just in the UK. Flagship projects last year include "the best hospital in Mexico" and accounting group Deloitte's new headquarters in Milan.

Overseas sales now account for 60%-65% of turnover and are said to be growing.

Although demand in Halstead's UK home market is now reported to be "slightly less buoyant", the company says that it remains "confident in the prospects of the year ahead and progress across the Group".

Broker coverage is minimal, but forecasts I can see suggest earnings will be broadly flat at c.10p per share this year, with a further modest dividend increase to 8.1p per share.

Those estimates price Halstead shares on 20 times forecast earnings, with a 4.2% yield.

My view: the stock's recent fall below 200p has left James Halstead trading at a level first seen in 2015. Although a P/E of 20 isn't obviously cheap, I think the company's long track record, bulletproof balance sheet and strong profitability probably do deserve a certain premium.

The flipside of this is that the prospects for growth over the next 12-18 months seem limited, based on current expectations.

Using last year's profits as a guide, Halstead's current valuation gives an EBIT/EV yield of 6.7%. That's more expensive than AG Barr (above), but is within the range I'd consider for a business of this quality.

As things stand, James Halstead is on my watch list and is a potential purchase for my dividend portfolio.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.