Dividend notes: quality choices? BVIC, DPLM, CWK (24/11/23)

I review recent results from three mid-cap dividend shares with strong track records - Britvic, Diploma, and Cranswick.

Welcome back to my dividend notes.

In this review I'm looking at two FTSE 250 food/drink companies with solid track records and a FTSE 100 industrial group that I'd like to own – but can't bring myself to pay for.

Companies covered:

- Britvic (LON:BVIC) - I can see plenty to like about this business, as a possible long-term holding. But I have some niggles over capital allocation and debt levels. The shares aren't cheap enough to tempt me at this time.

- Diploma (LON:DPLM) - a quick look at FY results from this distribution group, which I admire greatly, but am currently priced out of.

- Cranswick (LON:CWK) - this meat and food producer has an impressive track record but looks fully valued to me at the moment.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Britvic (BVIC)

"Excellent progress in a challenging market"

Final results y/e 30 September 2023

I've covered FTSE 250 soft drinks group Britvic once before, when I looked at its interim results in May this year. At the time I was broadly positive, but thought the share price was up with events.

Britvic's share price has fallen back a little since then and the company has just published its full-year results. It seems a good time to take a fresh look at a business whose brand portfolio means that it should be a nicely defensive and reliable performer.

FY23 results highlights: Britvic's headline numbers don't look too bad, if you accept the adjusted picture. But I think they look a little more humdrum when you scroll further down, as I'll explain.

- Revenue up 6.6% to £1,748.6m at constant exchange rates

- Adjusted EBIT up 5.9% to £218.4m

- Adjusted operating margin: 12.5% (FY22: 12.7%)

- Reported operating profit down 5.6% to £181.5m

- Reported operating margin: 10.4% (FY22: 11.9%)

- Dividend up 6.2% to 30.8p per share

Profitability: adjusted earnings of 61p per share price the stock on a fairly modest 14 times earnings. But reported earnings of 48.3p per share price Britvic on a more demanding 17x multiple. Which should I rely on?

As always, the devil is in the adjustments, which totalled £38.4m last year (21% of operating profit!).

Having looked at the list of adjusting items, my view is that most of them are part of the normal cost of doing business for Britvic. But I would exclude the single largest adjustment, which is a £20.5m pension scheme cost. This appears to have been a genuine one-off payment related to a change in the pension scheme rules.

Excluding this item gives me an adjusted operating profit of £202m. In turn, this gives me an operating margin of 11.6% (FY22: 11.9%) and a return on capital employed of 17.1% – a pretty decent result.

Cash flow/debt: in my half-year review I suggested that Britvic's H1 cash outflow might reverse in H2. This hasn't happened.

The final results show a £38m increase in inventories. The company says this is due to both cost inflation and "an increased level of both raw materials and finished goods stock". This is attributed to precautionary stockbuilding to protect customer service levels but also "softer quarter four volumes".

I'm not sure why Britivic would be building stock to protect customer service when supply chain conditions have largely normalised. I suspect that falling volumes are to blame – see below.

The end result is that operating cash flow for the year was broadly flat at £238.4m, while free cash flow was also largely unchanged from last year at £130m, excluding acquisitions. That's equivalent to a free cash flow yield of just over 6%.

This valuation seems reasonable to me. But as I predicted in my H1 review, Britvic's cash generation last year wasn't enough to cover both the £75m cost of the dividend and the £74m of share buybacks carried out last year. Nor was it enough to cover the £25m spent on acquisitions during the year.

As a result of this shortfall, the group's adjusted net debt rose by £63m to £538m last year. This represents 1.9x trailing EBITDA or around five times 5yr-average net profits – slightly higher than I'd like, although unlikely to be problematic.

Personally, I don't like to see companies using borrowed money to buyback shares, especially now that the cost of debt has risen. Britvic's interest bill rose by 42% to £21.1m last year – I think the buyback cash would have been better spent on debt reduction.

Trading summary: revenue growth last year appears to have been entirely driven by price increases. Britvic's segmental reporting shows that volumes fell in all of the group's markets during the period, due mainly to a softer Q4 (UK summer):

- Great Britain: volumes down 2.3% to 1,750.2m litres, with average price per litre up 10.6% to 67.9p

- Brazil: volumes down 0.9% to 296.5m litres, with average price per litre up 10.3% to 52.7p

- Other international: volumes down 2.7% to 416.5m litres, with average price per litre up 11% to 97.2p

The cost increases do appear to have been justified – Britvic's fixed cost base rose by 10.4% to £397.0m during the period. We've already seen that margins were flat, at best, last year.

Outlook: there was no explicit outlook statement in Britvic's results, other than a confident statement from chief executive Simon Litherland:

"I am confident Britvic will continue to make excellent progress next year and beyond, delivering growth and creating value for all our stakeholders."

For what they're worth, broker consensus forecasts on Stockopedia suggest adjusted earnings will rise by around 3% to 62.7p this year, pricing the stock on 13.5 times forecast earnings.

A modest dividend increase to c.32p per share is expected, giving a prospective yield of 3.7%.

My view

Britvic is a business that I could see in my dividend portfolio at some point. Profitability is quite decent and cash generation is fairly strong.

The valuation looks reasonable to me at the moment, with an EBIT/EV yield of 7.3%, using my adjusted version of operating profit.

However, I'm not a fan of the group's use of debt-funded buybacks and would like to see net debt a little lower.

I would also like to secure a dividend yield closer to 4%, given the risk of sluggish growth over the coming year.

On balance, Britvic isn't quite cheap enough for me right now. But it's a business I'll continue to watch with interest.

Diploma (DPLM)

"we are confident of continuing to deliver sustainable quality compounding"

Full-year results y/e 30 September 2023

I've covered this distribution group a couple of times before and been impressed with its quality and long history of compound growth.

Diploma operates with a buy-and-build model that focuses on regular, smallish acquisitions that operate within a decentralised group. Within this, there are three operating segments – controls, seals and life sciences.

To give an idea of scale, Diploma has a market cap of £4.5bn and spent £280m on 12 acquisitions last year.

FY23 results highlights: Diploma's latest results do nothing to change my view on the business.

Revenue rose by 19% to £1,200.3m, driven by organic growth of 8% and a contribution from acquisitions. Operating profit for the year rose by 27% to £183.3m, giving a useful 15.3% operating margin.

My sums suggest a return on capital employed of 14.9%, also a respectable figure.

Cash conversion was excellent, too. Free cash flow of £163m (excluding acquisitions) represents 100% conversion from adjusted net profit, or 138% of statutory post-tax profit. However, the free cash flow yield remains modest, at just 3.6%.

Dividend: the full-year payout has been lifted 5% to 56.6p per share, giving a rather modest dividend yield of 1.7%.

Outlook: chief executive Johnny Thomson expects to report organic revenue growth of c.5% next year, with a 6% contribution from acquisitions announced to date. Margins are expected to improve slightly.

Broker forecasts suggest adjusted earnings will rise by 7.5% to 136p per share, pricing the stock on around 25 times forecast earnings.

My view

My view on Diploma hasn't changed. Here's what I said in July:

"A business that earns 15%-20% returns on equity and has a 20+ year record of dividend growth probably deserves some kind of valuation premium, but for me, this is still a stretch."

True quality compounders are always expensive and perhaps I should buy at any price. I'm not going to, though, for a couple of reasons:

- I'm a dividend investor, not a pure quality investor. I need my holdings to generate a meaningful level of income

- The outlook seems relatively muted, but this business is still valued on an EBIT/EV of under 4%. That seems quite full to me, unless earnings rise much faster than expected.

Diploma shares traded below £25 on a number of occasions last year. I might be interested at that level, but as things stand today, this business just isn't a good fit for my dividend portfolio.

Cranswick (CWK)

"the outlook for the current financial year ending 30 March 2024 is now expected to be at the upper end of current market consensus"

Interim results for the 26 weeks ended 23 September 2023

This FTSE 250 business is a large-scale, vertically integrated food producer, specialising in chicken and pork products. It's the kind of business I'd expect to deliver average results, but it's actually been a reliable and high quality performer for many years.

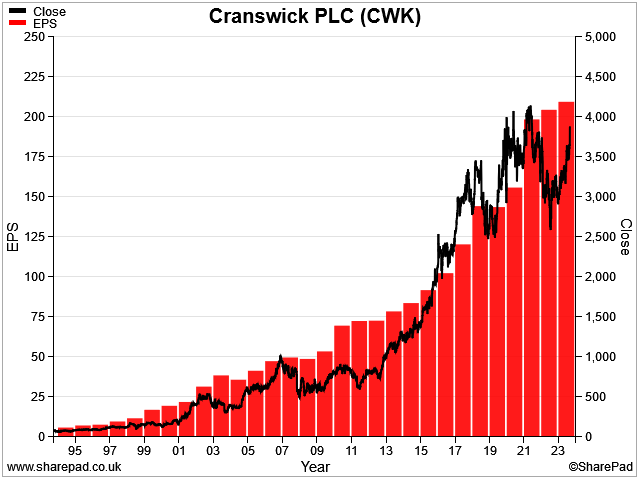

The shares have 10-bagged over the last 30 years as Cranswick's earnings have steadily motored higher:

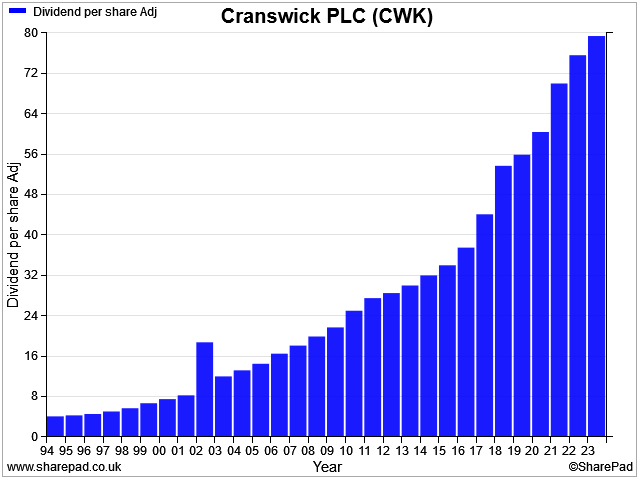

There's also a rather impressive dividend record to admire – my sums suggest the payout has grown at a CAGR of 10.5% for 30 years. That's an impressive record:

Cranswick scores a respectable 66/100 in my dividend screen and I'm wondering whether I should consider this share as a possible buy for my dividend portfolio. To start learning a little more about it, I've taken a look at the latest results.

Half-year results summary: full-year results are now expected to be at the top end of consensus forecasts, after a solid start to the year.

Cranswick's revenue rose by 12% to £1,253.7m during the first half, while pre-tax profit rose by 41% to £86.9m. On an adjusted basis, pre-tax profit was 25% higher at £81.6m, so perhaps this is a more meaningful guide to underlying performance.

Adjusted earnings were 13.8% higher at 112.2p per share, while the interim dividend was lifted 10.2% to 22.7p per share.

Net debt remained reassuringly low at £51m, excluding lease liabilities and Cranswick says its £250m bank facility provides plenty of headroom.

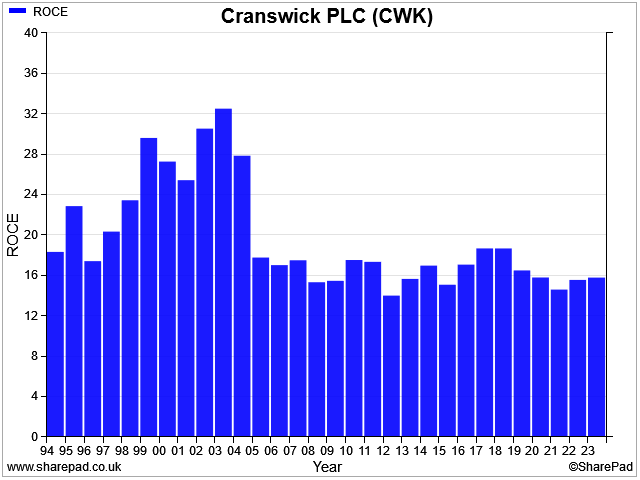

Profitability: operating margin for the half year was 6.8% on an adjusted basis, supporting a trailing 12-month return on capital employed of 16.2%. That's consistent with performance over the last 20 years or so:

Free cash flow: cash flow tends to fluctuate from year-to-year, as Cranswick goes through capex cycles to invest in new capacity. But my impression is that cash conversion is generally quite good.

My sums suggest trailing 12-month free cash flow (exc. acquisitions) of £78m, which gives Cranswick a 3.7% free cash flow yield.

Outlook: management expects results for the year ending 30 March 2024 to be "at the upper end of current market consensus". This is helpfully specified as being for an adjusted pre-tax profit between £153.2m and £160.8m.

So I guess we can expect a figure towards £160m, which would represent a 14% increase on last year.

In terms of earnings, consensus estimates are for c.219p per share, pricing Cranswick on about 18 times forecast earnings.

My view

Somewhat against my expectations for this sector, this does seem a good business. Given Cranswick's multi-decade history of consistent growth, I'd have to conclude that it's well run as well.

However, a free cash flow yield of 3.7% does not suggest obvious value to me and the 2.1% dividend yield is also a little too low for my purposes.

In addition, I have to confess that I'm not a big fan of this sector, either.

Even so, the apparent quality of this business is attractive to me. If the valuation became more compelling, then I might consider Cranswick. For now, I remain an interested observer.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.