The Dividend Note - three market leaders - GAW, TSCO, SVS (13/01/24)

I review last week's updates from Tesco, Savills and Games Workshop, and outline plans for a new publishing schedule in 2024.

Welcome back to my dividend notes, which will be taking on a slightly altered format for 2024.

I'll now be publishing a weekly piece on Friday afternoons, covering a selection of the most interesting UK dividend share news from the previous five days.

Content relating to my dividend portfolio will be unchanged, but will now be published on Sunday morning. This will include:

- Monthly portfolio stock reviews for subscribers

- Quarterly portfolio reviews

- Occasional in-depth reviews of dividend shares I might be interested in buying

These changes are aimed at creating a more sustainable publishing schedule that's focused on finding my ideas for the best UK dividend shares, without trying to cover everything.

I hope this will provide an improved experience for readers – but as always, please let me know what you think.

Last week saw the early stirrings of earnings season, with several big names publishing trading updates. I've picked out three contrasting and – I think – interesting businesses to look at below.

Companies covered:

Games Workshop (LON:GAW) - the appeal of this fantasy miniature gaming business remains an enigma to me, but its financial performance is outstanding and improved during the first half of its current financial year.

I share my views on this business and flag up a couple of possible risks. I also explain why I'm not a shareholder, but possibly should be.

Tesco (LON:TSCO) - a strong trading update for Q3/Christmas from the UK's largest supermarket. Management have nudged profit guidance higher and report strong cash generation.

I'm positive on Tesco as an investment and explain why I prefer this business to J Sainsbury, which also updated last week.

Savills (LON:SVS) - interesting market commentary from this leading global real estate business suggests that the dust is beginning to settle in commercial property sectors. Profits will be down sharply for 2023 but should start to recover in 2024, I think.

Savills is not as cheap as it was a few months ago, but this FTSE 250 share still looks reasonably valued to me.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Games Workshop (GAW)

"We continue to perform well during challenging economic times, delivering record group revenue, profit and dividends in the period."

I have hesitated to write about fantasy miniature business Games Workshop previously because it is so widely covered elsewhere in the private investor community, often by writers who are far more knowledgeable about the company and its products than I am.

It's also fair to say that I'm not a target customer for this business.

However, Games Workshop scores highly in my dividend screen and has become a hard business to ignore for an investor like me, who favours firms with excellent cash generation, strong quality metrics and clean accounts.

The last few years have seen strong growth from the core business, which operates through a network of shops and online.

This has been supplemented by growing licensing revenue, as Games Workshop has started to monetise its intellectual property through gaming and television deals.

Most recently, the company confirmed an agreement to grant exclusive rights to Amazon to create films and television series set within the Warhammer 40,000 universe. This was first announced in December 2022, but has evidently taken a while to finalise.

The two companies now plan a further 12-month period of work to "agree creative guidelines". Only then will the agreement proceed.

No financial terms have been revealed, but I would imagine the licensing revenue could be lucrative for Games Workshop and the exposure could drive additional interest in the core retail business. However, this potentially large project looks like it will be a slow burner, at least to start with.

Half-year results: with this backdrop in mind, I've taken a look at the company's latest half-year figures, which cover the 26 weeks to 26 November 2023.

- Revenue up 9.3% to £247.7m

- Operating profit up 13% to £94.5m, comprising:

- Core operating profit up 18% to £83.4m

- Licensing operating profit down 14% to £11.1m

- H1 earnings per share up 7.2% to 216.9p

- Dividends declared and paid in the period up 18.2% to 195p per share

Trading performance during the first half of the current year appears to have been fairly strong. Revenue from the core retail business is said to have grown "in all channels and in all major countries".

Profitability improved during the period, primarily because of a reduction in shipping costs and inventory provisions. Games Workshop's gross margin rose from 64.2% to 69.4% in H1, while operating margin for the half year improved from 39.4% to 40.1%.

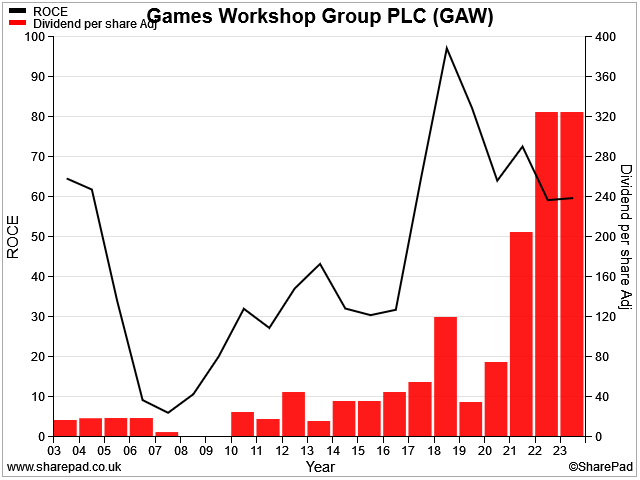

My sums suggest a trailing 12-month return on capital employed of over 60%; an exceptional figure that supports strong cash generation.

Dividends of £64.2m (195p/share) paid during the half year were covered comfortably by free cash flow of £82.9m (251p/share). This illustrates the company's policy of only using "truly surplus cash" to fund dividends.

Games Workshop's balance sheet also remained strong, with statutory net cash position of £62.7m at the end of November. CEO Kevin Rountree say this reflects a prudent policy towards rainy days:

"It's worth noting that we have increased our cash buffer in the period to £75 million in line with the current three month cash cost of running Games Workshop - on a rainy day we'd prefer to be able to look after ourselves. Our job is to run the business under all scenarios."

Personnel changes: one section that caught my eye was on personnel changes. Two long-serving and senior people are leaving the business:

- Art Director John Blanche has retired after nearly 40 years. CEO Rountree describes him as "a creative genius" but is keen to emphasise that Blanche leaves behind him "a well invested and talented Warhammer Studio".

- CFO Rachel Tongue plans to step down at the AGM in September 2024. Tongue has been CFO for nine years but has been at Games Workshop since 1996, two years prior to Rountree joining. She was promoted to CFO when Rountree moved from that role to become CEO in 2008.

I am sure that succession will be handled successfully in both cases, but it does seem like Kevin Rountree is losing two trusted lieutenants and senior leaders within a short space of time.

Outlook: Games Workshop doesn't provide conventional outlook guidance, but Rountree does sign off with a positive statement:

"We continue to perform well during challenging economic times, delivering record group revenue, profit and dividends in the period. Morale is good at Games Workshop and our hobbyists are having fun too."

Consensus forecasts suggest earnings will rise by about 10% to 440p per share this year, with a possible dividend payout of 423p per share. That gives a forecast P/E of 22, with a prospective yield of 4.3%.

My view

Like many UK investors in recent years, I've admired Games Workshop's progress without managing to buy the shares!

I can't see anything serious to dislike about this business, except perhaps a degree of key person risk (Kevin Rountree), especially given the departure of the two key personnel discussed above.

My other reservation is that I have no idea if this will still be a popular hobby in 10 years or more. History suggests that it could be, though.

The original Warhammer was released in 1983 and the game's appeal appears to have successfully survived the transition to Warhammer Age of Sigmar, which was launched by Games Workshop as a replacement in 2015.

For a cash-rich business that's generating 50%+ returns on equity, I don't think Games Workshop's current valuation is necessarily excessive.

On the other hand, it may be worth remembering that the share price has gone through long periods of stagnation before – a high of £8 was first seen in 1998 but not surpassed until 2016:

There are times in my investing career when I would have made more money if I'd been willing to pay up for high-quality businesses instead of looking for value.

This may be one of them, but I can't bring myself to take the plunge at c.£100. If Games Workshop's share price should fall back closer to the sub-£60 level seen in 2022, I could be tempted.

For now, I'll continue to follow this distinctive business with interest.

Tesco (TSCO)

"we are upgrading our guidance for the current financial year"

Q3 and Christmas Trading Statement 2023/24

Tesco has upgraded its profit guidance for the second time in six months, following a strong Christmas and third quarter.

The UK's largest supermarket said that like-for-like (LFL) sales in its core UK business rose by 6.8% over the six week Christmas period. Group sales for the third quarter, which covered the 13 weeks to 25 November, rose by 6.4% on a LFL basis.

Management say that the supermarket remains the cheapest of the the full-line supermarkets, offering a Christmas dinner for £2.09 per head. Sainsbury's quoted a figure of "under £3".

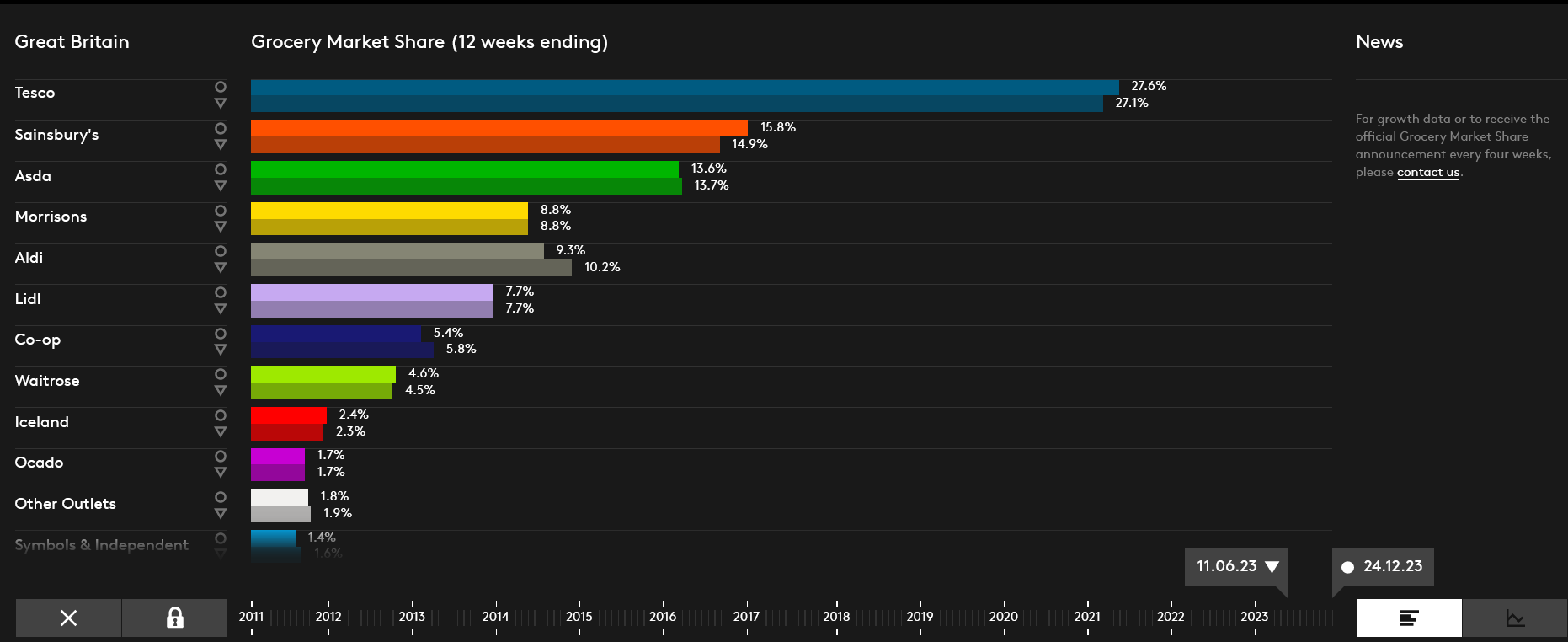

More broadly, the company says it saw consistent volume growth through the third quarter and gained an additional 0.15% of market share in the run-up to Christmas, taking its total share to 27.9%.

Playing with the timeframes on Kantar's grocery market share tool suggests that Tesco and Sainsbury took market share from Aldi, Asda and the Co-Op during the second half of last year:

Outlook: Tesco now expects retail adjusted operating profit of £2.75bn for the year ending Februaruy 2024, up from previous guidance of £2.6bn - £2.7bn.

Guidance for retail free cash flow, which reflects cash generated by the retail business and excludes Tesco bank, has also been nudged higher. Management now expect retail free cash flow to be "around £2.0bn", up from previous guidance of "between £1.8bn and £2.0bn".

This implies an underlying free cash flow yield of 6.5%. That seems a reasonably attractive valuation to me, and covers the 4% dividend yield 1.5 times.

One slight caveat is that this level of free cash flow is somewhat above the company's medium-term guidance range of £1.4bn-£1.8bn, so perhaps isn't entirely sustainable?

My view

From an investment perspective, I think Tesco continues to look well run and reasonably priced. Cash generation is good and the group's market-leading scale is a particular attraction for me in this sector, where margins are low and economies of scale are key.

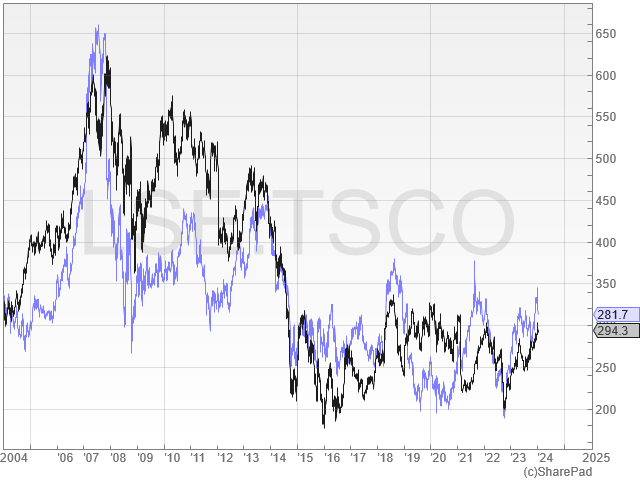

In my view, Tesco looks a better investment than J Sainsbury, whose shares fell last week after its Christmas statement revealed a slump in sales at the ultra-low margin Argos business.

Sainsbury's grocery business seems to be performing well, but as a group it has consistently been (even) less profitable than Tesco in recent years. I don't see this changing.

Having said that, the two companies' relative performance over the last 20 years suggests that there may be less differentiation than I'm imagining:

Savills (SVS)

"underlying market improvements ... should lead to substantive overall improvement in performance in 2024"

Savills is a global real estate business that offers transactional (estate agency) services and a range of less transactional services, such as consultancy, property management and investment management.

The company's market reach and long history means that its market updates are often an interesting source of commentary on commercial property market conditions.

2023 was a difficult year due to the impact of rising interest rates and the continued uncertainty about future demand for office property in major western markets.

This led to sharp drop in transactions and uncertainty over valuations. This continued for "longer than originally anticipated at the start of 2023" and led to a "significant reduction in profits" from the group's transactional business.

However, Savills' latest commentary suggests that the dust is beginning to settle on both issues.

Management say that while market liquidity remains poor, lenders are now starting to force borrowers to crystallise reduced valuations by refinancing (or selling) their properties.

This is expected to be the first step towards a normalisation of market conditions:

"we are now starting to see lenders beginning to exercise their security rights. This began to have a positive effect on market activity towards the year end and should be a catalyst for improved volumes in H1 2024."

Geographically, Savills says that the UK has recalibrated relatively quickly and now "represents value". There is said to be "significant occupier demand" for properties with strong sustainability credentials.

North America, France, and Germany are said to have been slower to adjust.

Interestingly, there seems to be some read-across from Savills' comments to a statement this week from Real Estate Credit Investments (LON:RECI), in which I have a long position.

RECI says it has impaired the value of a recently developed office property in France and is now acting to expedite leasing the asset and achieve early repayment of the loan.

Outlook: Savills' less transactional business are said provided "a resilient earnings stream" in 2023, underpinning the group's profits.

Full-year results are expected to be in line "with the expected range of outcomes". This wording suggests to me that numbers could be at the low end of forecasts.

Consensus estimates on SharePad are for earnings of 52.8p per share in 2023, down 44% from an underlying eps figure of 94.9p per share in 2022.

Forecasts for 2024 suggest a recovery in earnings to c.70p per share.

Those numbers give a 2023 forecast P/E of 19, falling to 14x for 2024.

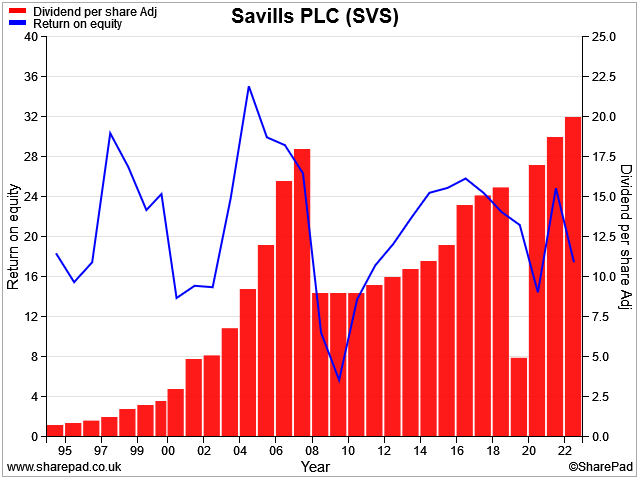

Dividend: Savills' dividend policy is complicated slightly by the company's practice of paying an interim and final ordinary dividend and an additional supplemental interim dividend that's based on the performance of its transactional business.

In 2022, the interim and final payouts totalled 20p per share. The company also paid a 15.6p per share supplemental dividend. So the total ordinary dividend for 2022 was 35.6p (2021: 34.35p).

Consensus numbers suggest a total payout of 30.5p per share for 2023, which I would guess reflects expectations of a much smaller supplemental dividend from the transactional business. This gives a prospective yield of 3.1%.

My view

Savills has generated an average return on equity of c.20% over the last 30 years, according to SharePad. During that time, its dividend has grown steadily, if we exclude the boom years of 2005-2007.

I've covered Savills several times before and have also written up the shares in an in-depth stock review at the end of 2022, in which I explained its history.

My view is that this 168-year-old firm is a good play on the long-term growth of the global property sector, with a bias towards commercial and prime residential.

It remains to be seen just how long it will really take the commercial property sector to recover from the impact of higher interest rates.

As with housebuilders, the main threat to a business of this kind is a lack of liquidity, rather than falling prices per se. Savills' commentary seems to suggest that this threat is now seems gradually receding, or at least no longer worsening.

Consensus forecasts for 2023 imply an EBIT yield of 6.1%, rising to 8% in 2024. A return to positive free cash flow is also expected in 2024, after an outflow last year.

Savills looked very cheap to me when the shares were close to 800p a few months ago. At c.1,000p as I write, I think the shares remain reasonably priced and likely to deliver decent long-term returns.

Disclosure: at the time of publication, Roland owned shares of Real Estate Credit Investment.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.