Dividend notes: a contrarian bargain? RWS, RESI, WHR

I review results from dividend share RWS Holdings and property stocks Warehouse REIT and Residential Secure Income.

Today I'm looking at three companies that are all facing headwinds of various kinds.

Despite this, I reckon one of them could be worth further research and might even be a genuine contrarian bargain.

Companies covered:

- RWS Holdings (LON:RWS) - this patent translation specialist scores well in my screening, but these half-year results do little to address growth concerns. Despite this, I feel RWS could offer value at current levels.

- Residential Secure Income (LON:RESI) - high occupancy and stable rental income isn't necessarily enough to offset a high LTV and rising debt costs. I think a dividend cut is likely.

- Warehouse REIT (WHR) - this urban logistics specialist reports a similar story of uncovered dividends. Leverage is lower, but I can see additional risk from near-term refinancing needs and shorter lease durations.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my view only and are not advice or recommendations.

RWS Holdings (RWS)

"... full year outlook is expected to be in line with latest guidance and current market expectations"

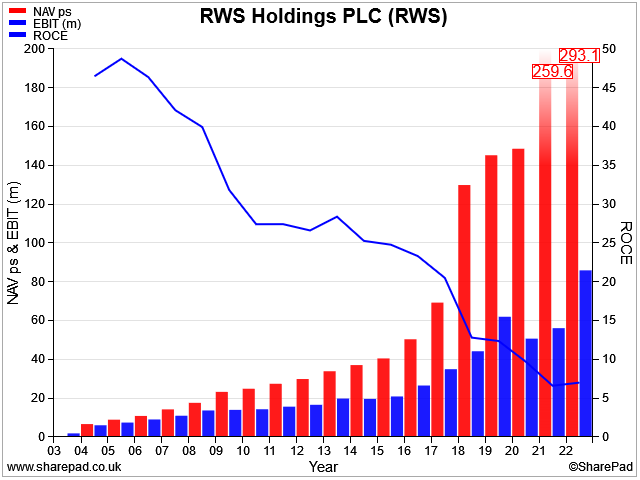

AIM-listed RWS Holdings specialises in providing translation services for patent owners and other related services. The group has an enviable 19-year record of unbroken dividend growth.

Results summary: these half-year results cover the six months to 31 March 2023. The numbers don't seem that impressive, although the share price rise on the day suggests the market may have been expecting worse.

- Revenue up 2.5% to £366.3m

- Pre-tax profit down 13% to £28.7m

- Earnings per share down 11% to 5.4p per share

- Cash conversion of 85% (H1 22: 104%)

- Net cash: £57.8m (FY22: £71.9m)

- Operating cash flow was unchanged at £60m, but an increase in spending and a small acquisition resulted in a c.£15m reduction in free cash flow, reflected in the net cash balance.

- H1 operating margin fell to 8.4% (H1 22: 9.6%)

Trading commentary: new business wins and retention were said to be strong across all divisions. However, given the stagnant revenue and falling profits I'm not sure how to read this. Is competition heating up? Is demand weak?

A new AI Data Services service, TrainAI, was launched and achieved some early wins. Development also continued in the targeted growth areas of eLeaning and Linguistic Validation.

Dividend: the interim dividend is increased by 7% to 2.4p per share.

Outlook: Full-year results are expected to be in line with expectations, albeit with profits weighted to the second half of the year. One reason for this might be the unitary patent – see below – but an atypical H2 weighting could also increase the risk of a profit warning.

For now, broker forecasts suggest adjusted earnings of 24.6p per share this year, a slight reduction from 26.6p per share last year. A full-year dividend of 11.9p per share is expected.

These estimates price RWS shares on 10 times forecast earnings, with a yield of 4.8%.

Possible headwinds

RWS shares have fallen by more than 50% over the last couple of years.

In addition to the earnings slowdown, I can see several structural factors investors might want to consider as possible headwinds to growth:

EU Unitary Patent: this is a new system that came into force on 1 June. It allows patent applicants to secure a single patent that's valid throughout the EU, rather than one in each country.

This has obvious attractions for RWS clients but will surely mean a significant drop in the amount of intra-EU translation work for RWS.

However, in the short term, RWS believes there's a backlog of work that's been held back until 1 June that could now be released. I assume this is one factor behind the company's guidance for an H2 weighting to profit.

Russia: the war has meant the closure of the group's Russian office and the loss of most Russian translation work. Operations in Ukraine have also been disrupted.

AI: RWS is already a big user of specialised AI systems.

The company says that generalised systems like ChatGPT will not provide the sophistication and accountability patent clients need. I can believe this. But I have to wonder whether more affordable AI services will make inroads into some of RWS's business.

My view

I think this is a good business with a pretty solid track record. However, the group appears to have suffered a long-running decline in profitability over the last 20 years.

Management hope to find further acquisitions to bolster future growth and have also announced a £50m share buyback.

I think the valuation is firmly in contrarian territory and could be attractive. But I'd need to do further research into this business to understand its operations in more depth before adopting a firm stance on this stock.

For now, I'd file RWS under interesting and worth a closer look.

Residential Secure Income (RESI)

"and will then revisit the appropriate level for a fully covered and progressive dividend."

A lot of property stocks and REITs are holding onto generous dividends at the moment. I think some of these will have to go. I've previously written (mostly) favourably about British Land, Tritax Big Box and Derwent London.

Today I want to take a quick look recent numbers from two property stocks where I think dividend cuts are far more likely, starting with Residential Secure Income.

RESI: Residential Secure Income owns a portfolio of social housing and retirement accomodation. The name suggests an ultra-reliable dividend, but I'm not sure that's true anymore.

This week's half-year results from RESI included the following comment in the chairman's statement:

"We are considering selective disposal of certain non-core assets, to reduce floating rate debt levels, and will then revisit the appropriate level for a fully covered and progressive dividend."

I think shareholders should be prepared for the possibility of a dividend cut.

Although RESI's net rental income rose by 8% to £8.8m and collection rates stayed at 99%, adjusted earnings fell 8% to 2.2p. This was due to higher energy costs in communal areas of retirement housing, plus higher interest costs on the company's floating rate debt.

As a result, dividend cover by earnings fell to 86% (H1 2022: 96%).

At the same time, RESI's loan-to-value ratio rose to 52% (FY22: 47%) to reflect a 16% fall in EPRA net asset value to 89p per share.

RESI's floating rate debt is only about £20m (10%) of its total borrowing of c.£200m, the remainder of which has long-term fixed rates. But this expensive short-term debt appears to be putting pressure on cash flows.

Falling property prices mean that one of these floating rate facilities is also now close to its covenant LTV limit.

Management hope to sell some properties to repay RESI's floating rate debt and rebuild dividend cover. This would reduce the company's earnings base, but should also reduce total borrowing costs and improve earnings visibility.

My view

Management are keen to stress the reversionary potential of RESI's portfolio – in other words, rents would be higher today if the properties became vacant and were re-let. However, my impression is that many of RESI's tenants stay put for a long time. Realising this reversionary value could be a slow process.

I don't know exactly how the numbers will work out, but I think it would be prudent to expect a dividend cut from RESI.

For buyers at today's prices, that might not be too painful. At 69p, a 20% dividend cut would give a yield of 6%, with scope for future growth.

Personally, I'm going to wait and see how the situation evolves. But if there are no further cuts to property valuations, then I think the shares could be fairly priced at current levels.

Warehouse REIT (WHR)

"We were not immune from the rapid rise in interest costs, which impacted both our valuation and our earnings"

This industrial property REIT has a portfolio of urban logistics warehouses, located close to major towns and cities.

Like RESI, WHR boasts strong occupancy numbers and 99% rent collection rates. Like-for-like rents also rose by 5.3% last year, with rents on new lettings running 29% ahead of previous contracted rents.

Although WHR's loan-to-value ratio of 33.9% is well below RESI's 52% figure, WHR is still being hit by the rising cost of variable rate debt. As a result of higher interest costs, last year's dividend of 6.4p per share was uncovered by adjusted earnings of 4.7p.

To address this shortfall, management have been selling properties in the hope of repaying the most expensive debt. They're also focused on "continuing to capture the reversion embedded in the portfolio". This might be quicker here – the weighted average remaining lease term is relatively short, at 5.5 years.

My view

As with RESI, I think there's a risk that a dividend cut will be needed at WHR to find a sustainable balance between borrowing costs and rental income.

Valuers cut the value of WHR's portfolio by 18% last year, resulting in a 29% drop in NAV per share, which fell to 122.6p.

The shares are trading at about 90p as I write, providing a further 25% discount to this reduced book value. As with RESI, even a 20% dividend cut would still produce an attractive 6% yield from this level.

However, WHR needs to refinance the majority of its loans (c.£330m) in the next two years. Its shorter lease lengths also carry risk as well as opportunity – if the economy slows, rental rates could soften again.

As with RESI, my plan is to stay on the sidelines here and watch how things unfold.

If I wanted to invest in logistics property today, I'd choose a larger and more conservatively financed REIT, such as BBOX or perhaps Segro. Personally, I don't think there's any rush to buy into this sector right now. The pandemic party is over and it's not quite clear to me how bad the hangover will be.

Disclaimer: This is a personal blog and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.